Bullish investors in Devon Energy (DVN) stock are shorting out-of-the-money (OTM) puts as their premiums are very high now. The recent sell-off in DVN stock is overdone if the U.S. avoids a recession. But the fear that oil and gas prices will fall is leading to high put prices. Many bearish investors are pushing up put prices hoping to outsmart the market.

However, the stock's ample dividend yield will limit the downside risk of DVN stock. This article will explain why shorting DVN puts is the best way to take advantage of this situation.

Shorting Puts Is the Contrarian Play

To make money with options you more or less have to be a contrarian. You have to go against the grain. You sell to those eagerly trying to buy. That means shorting OTM puts to those who are eager to pay a premium price as they believe DVN stock will fall.

The fallacy here is that DVN stock has not only dropped 10% in the last month, but it's now very cheap as a result.

For example, analysts forecast earnings in 2023 will be $9.28 per share, up by 5.52% over the $8.82 earnings per share (EPS) projected for the year ending Dec. 2022. That puts the stock on a forward price multiple (P/E) of just under 7.0x, which is very cheap.

An ample Dividend Yield Will Limit Its Downside

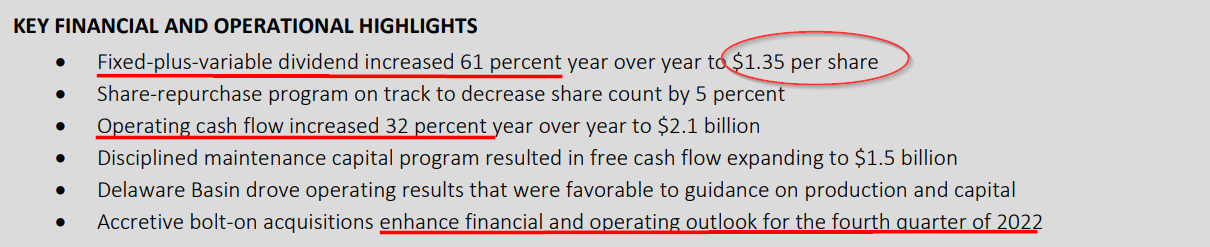

Devon Energy pays both a fixed and variable dividend every quarter. The variable dividend is the largest portion and works out to 50% of its excess adjusted free cash flow (FCF). The Q3 2022 quarterly fixed dividend was declared as 18 cents and the variable dividend of $1.15 (total $1.35 per share) on Nov. 1. But we are now at the ex-dividend date of Dec. 9. So, even though DVN stock might fall by $1.35 today as it is ex-dividend, this will give DVN stock a very high yield. This could push the stock higher again.

For example, Devon stock has an implied annualized dividend of $5.40 per share (i.e., $1.35 x 4). This gives it a dividend yield of 8.50% of the Dec. 8 price of $63.50. Therefore, if DVN stock falls by $1.35 on Dec. 9 or thereafter, reflecting the fact that new buyers don't get the $1.35 quarterly dividend, that will raise its yield to 8.69%. And any further deterioration in the price could push it closer to 9.0%. At $60.00 DVN stock will have a 9.0% yield (i.e., $5.40/0.09=$60.00).

That high yield is unsustainable in the long run, given how much FCF Devon Energy is producing, at least in the near term. I wrote about this last quarter, but the same applies to Q3.

For example, even if Devon's FCF fell by 20%, its variable dividend would still be 94 cents per share, and combined with the 18 cents fixed dividend, the total quarterly dividend would be $1.12. That works out to $4.48 annually, and at today's price that gives it a dividend yield that is still very high at 7.0%. The reason is that only 50% of the FCF decline hits the dividend and there is also a fixed dividend which softens the drop.

The bottom line is that today's 8.50% is very high, the implied ex-dividend yield is 8.69%, and even a 20% FCF hit gives DVN a 7.0% yield. In fact, even with a 20% FCF decline, the stock would only fall to $52.71 per share if it were to maintain the present 8.50% yield (i.e., $4.48 per share, as mentioned above, divided by 8.50% = $52.71).

We can use that worst-case situation to look at DVN puts, with a view to shorting them to make additional income.

Shorting OTM DVN Puts As an Income Play

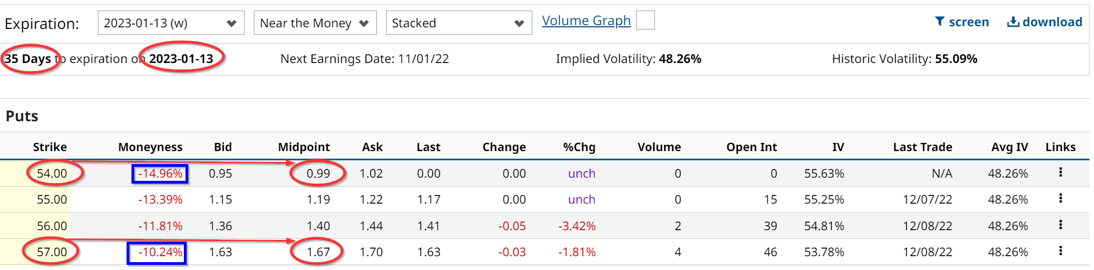

Look at the Barchart option chain below for the Jan. 13 expiration puts.

It shows that at the $57.00 strike price trade for $1.67 per contract. The $57 strike price implies the stock price, at $63.50 today, will fall over 10% to $57 in 35 days or before that. That also implies that an investor who shorts the $57.00 puts gets an immediate yield of 2.93% (i.e., $1.67 / $57.00 = 2.929%). This is also equal to an incredible annualized yield of 35%. In other words, that is a very high yield.

In fact, even the $54.00 strike price trades at the midpoint for $0.99 per contract. This is an immediate yield of 1.833% and 22% annualized. But DVN stock would have to fall 15% from the price on Dec. 8 of $63.50 to $54.00 by Jan. 13 before that short put would be exercised.

Even If DVN stock falls to $52.00, as we pointed out above, it also implies a very good entry point for the bullish investor who shorted the $54.00 puts. And for now, at least, it does not seem very likely that in a little over one month, DVN stock will crater by 15%, especially given its high yield. Therefore these two short income plays look very attractive now to bullish investors in DVN stock.

More Stock Market News from Barchart

- Stocks Close Moderately Higher Ahead of Friday’s PPI Report

- Tighter Fed Policy Deflates Asset Bubbles

- Stocks Climb on Signs the U.S. Labor Market May be Cooling

- Markets Today: Stock Indexes Moderately Higher as Short Covering Emerges

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)