The S&P 500 index is the most diversified US stock market barometer. The index measures the performance of 500 large companies listed on stock exchanges in the United States. The S&P Dow Jones website says, “ The S&P 500 is widely regarded as the best single gauge of the large-cap U.S. equity market and is the world’s most tracked index by AUM. The index includes 500 leading companies and covers approximately 80% of the U.S. equity market’s available market cap.”

The S&P 500 reached a record high of 4,818.62 on January 3, the first trading day of 2022. Since then, the trend has been bearish, with the index making lower highs and lower lows. The S&P 500 SPDR (SPY) is a highly liquid ETF product that follows the diversified index. The VIX reflects the implied volatility of S&P 500 stocks.

An ugly decline in 2022 after a substantial gain in 2021

In 2021, the S&P 500 index gained 26.9% from the closing price at the end of December 2020. 2022 has been another story.

As the chart highlights, at the 3,912.05 level on November 17, the leading stock market index is 17.9% lower since December 31, 2021. Meanwhile, the index remains 78.5% higher than the March 2020 pandemic low and 12% above the 2022 bottom at 3,491.58.

Interest rates and the dollar have weighed on stocks

In March 2022, the short-term Fed Funds Rate stood at zero percent, on November 17, it was between 3.75% and 4.00%. Financing costs have skyrocketed in 2022 as the central bank has taken a hawkish monetary policy stance. A conventional thirty-year fixed-rate mortgage below 3% in late 2021 now stands at over 7%. On a $400,000 conventional loan, the difference is over $1,300 per month.

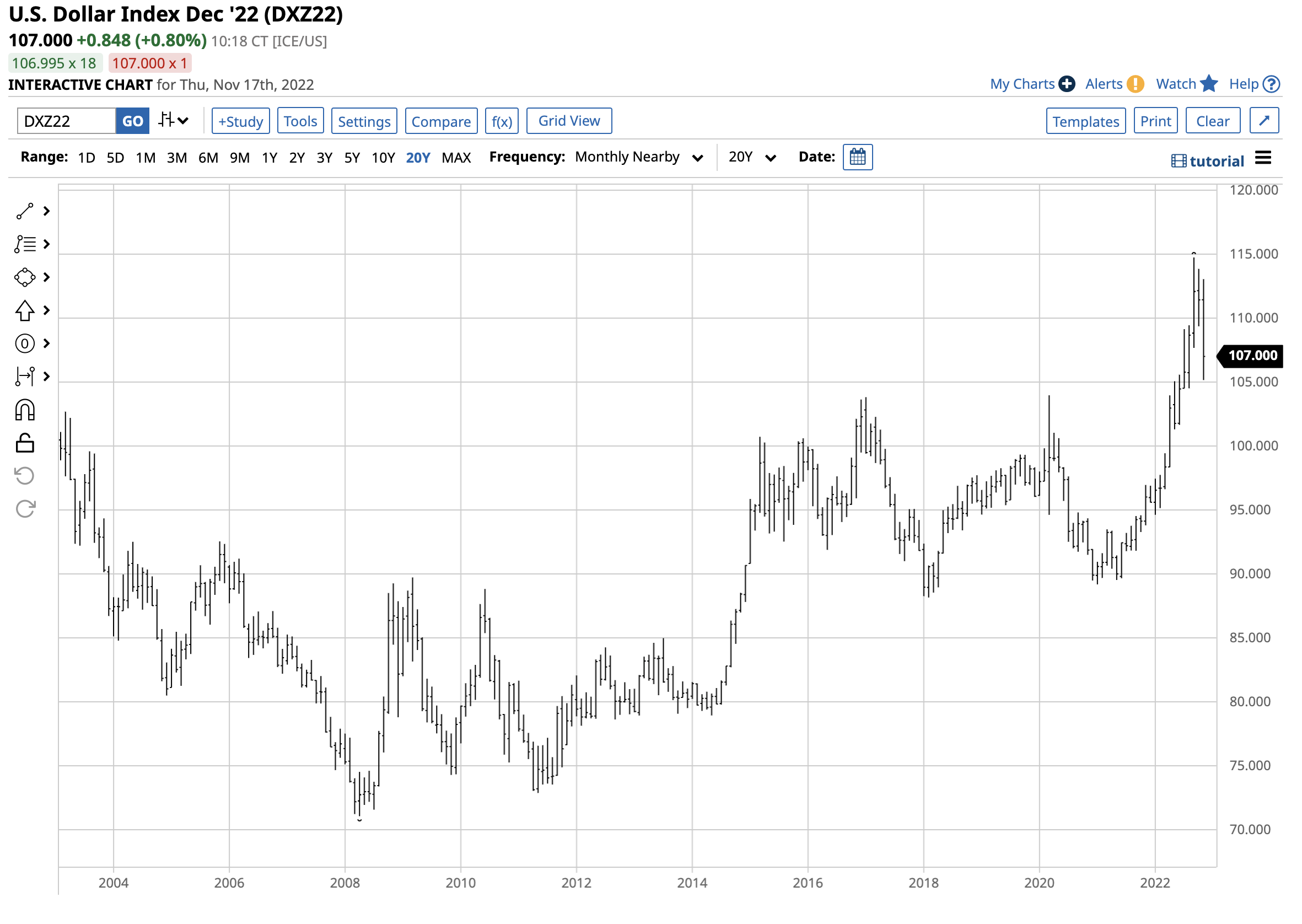

The chart of the nearby US 30-Year Treasury bond futures shows the decline from 160-14 on December 31, 2021, to the 124-03 level on November 17. Rising interest rates weigh on the stock market as they increase financing costs, putting pressure on earnings. Moreover, capital flows from stocks to bonds as the yields on fixed-income assets rise. Higher interest rates have also put upward pressure on the US dollar index, which measures the US dollar against the other worldwide reserve currencies.

The US dollar index chart illustrates the rise from 95.593 at the end of 2021 to the 106.995 level on November 17, an 11.9% increase. A rising dollar makes US companies less competitive against foreign companies, further weighing on earnings.

Inflationary pressures that have caused the Fed to tighten monetary policy with interest rate increases and quantitative tightening to reduce its swollen balance sheet have been the culprits that have weighed on the S&P 500 and all the leading US stock market indices in 2022.

The latest inflation data has caused a rebound

At the most recent November FOMC meeting, the US central bank increased the Fed Funds Rate by 75 basis points for the fourth consecutive time. While the Fed’s official statement acknowledged the lag between rate hikes and the impact on inflation, Chairman Powell’s tone at his press conference was particularly bearish, reiterating that monetary policy continues to be “sufficiently restrictive” to return inflation to the Fed’s 2% inflation rate.

Meanwhile, the latest October consumer and producer price index data came in below the market’s expectations, signifying that inflationary pressures could be starting to diminish.

At the 8% level on PPI and 7.7% on CPI, with core readings above 6%, inflation remains three times higher than the Fed’s target. However, the S&P 500 and other leading stock market indices responded to the latest inflation data with rallies as market participants believe it could cause the central bank to curb its enthusiasm for 75 basis point rate hikes. After four straight three-quarter of one-percent rate hikes, a 50-basis point increase in December may be bullish for the stock market.

As the short-term chart shows, after reaching a low on October 13, the S&P 500 has made higher lows and higher highs. The recent CPI and PPI data turbocharged the stock market gains.

Tax-loss selling could accelerate toward the end of this year

As we head into the 2022 holiday season and the end of a highly tumultuous year, the potential for end-of-the-year tax loss selling is rising. We could see this activity increase over the coming weeks as investors and traders prepare for the end of the year and 2023.

Meanwhile, markets reflect the economic and geopolitical landscapes, which remain uncertain in mid-November 2022. The war in Ukraine remains a clear and present danger to the global economy and worldwide peace. China remains a threat with its reunification plans for Taiwan, COVID lockdowns, and tensions with the US. There are more than a few geopolitical factors that could cause surprises that derail the stock market’s recent rally. News that Russian missile hit a target in Poland on November 15, a NATO member, is an example of issues that could ignite wild market volatility in the blink of an eye. Moreover, there is no guarantee that the US Fed will pivot away from its hawkish monetary policy stance at the December FOMC meeting as inflation remains three times its target rate level.

Lots of volatility ahead- The VIX could be inexpensive at below 25

The VIX index measures the implied volatility of S&P 500 stocks. Volatility tends to rise when stock prices fall and vice versa.

Implied volatility is the primary input in put and call option prices, and the VIX reflects the level of these option values on S&P 500 stocks. Options are price insurance, and premiums tend to rise during selloffs as market participants scramble to purchase insurance during uncertain times. In 2022, the VIX under the 25 level has been in the buying zone.

The chart shows that VIX purchases below 25 have led to profits throughout 2022. The VIX traded as low as 16.34 in early January 2022 when the S&P 500 was at a record high. The peak was in late January at nearly 39, but the VIX has spent most of this year above the 25 level.

On November 17, the VIX was just below the 25 level. If the trading pattern in 2022 continues, the VIX offers value with so many issues facing the stock market over the coming weeks.

The US stock market continues to face a rollercoaster of uncertainty on the economic and geopolitical landscapes. Buying the VIX or VIX-related products on dips with tight stops and selling for profits on rallies has been the optimal approach in 2022, which will likely continue.

More Stock Market News from Barchart

- Stocks Slump on Hawkish Fed Official’s Comment

- Unusual Activity in Tesla Put Options Signals Bullish Institutional Investors

- Markets Today: Stocks Slump as Bond Yields Rise on Hawkish Comments from Bullard

- Why Alphabet (GOOG) May Soon Join the Cost-Cutting Club

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)