/Tesla%20Charging%20Station%20Plugged%20In.jpg)

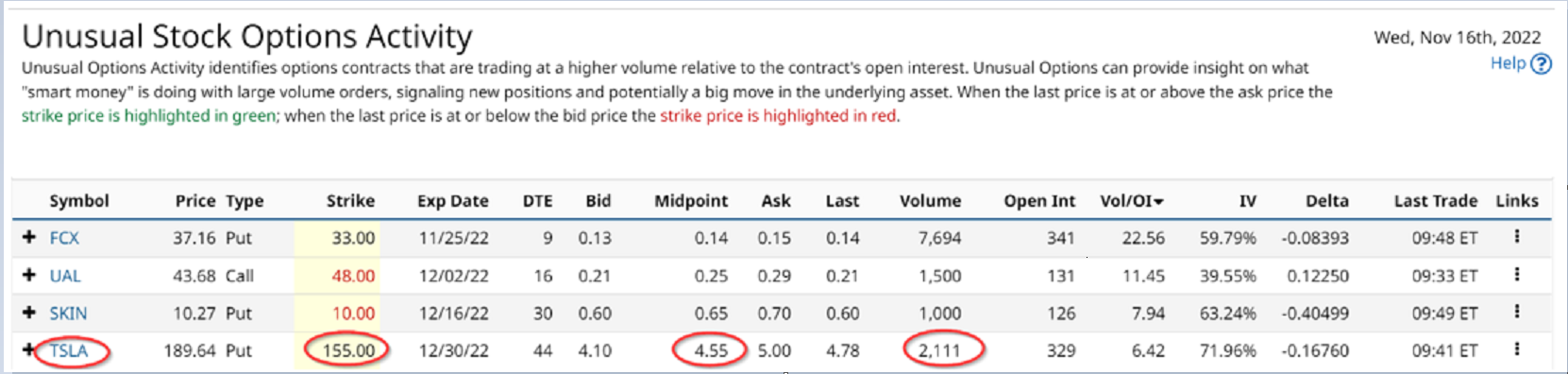

The Unusual Stock Options Activity Report by Barchart today shows some institutional buyer has sold a large volume of Tesla puts well below today's price. This signals they that have a very bullish outlook on TSLA (TSLA) stock as they are willing to buy large amounts of it if the stock were to fall further.

The report shows that over 2,000 put contracts were sold at the $155 strike price, which is 18.2% below today's price of $189.64. These put contracts are to expire on Dec. 30, which indicates that the institutional investor is very confident that the stock will likely be well over $155 before the end of the year. And even if it falls to that price by Dec. 30, they would be happy to buy the stock at $155 per share.

This contract cost the investor a lot of money. There were 2,111 put contracts sold at the $155 strike price, so the investor had to put up $32.72 million with the brokerage firm (i.e., 100 x 2,111 x $155) to secure the put contract short activity. In return, the investor received $4.55 per put contract at the midpoint, or $960K (i.e., $4.55 x 100 x 2,111).

That works out to an immediate ROI of 2.935% on the potential cost of $155 (which, again, is 18% below today's price. Or compared to today's price of $189.64, that return works out to an ROI of 2.40% (i.e., $4.55/189.64). Either way, this is a very adequate return for the institutional investor.

The reason is that there is very little chance that TSLA is going to fall over 18% in the next 44 days by Dec. 30. So far all intents and purposes, the investor will not likely have to buy TSLA stock at $155 on or before Dec. 30. Even if that happens, the investor would not even have a loss unless the stock fell to just over $150 per share (i.e., $155-$4.55 received, or $150.45).

That implies that TSLA has to fall by over 20.6% from today's price. That is simply not going to happen from a probability standpoint, by Dec. 30.

In other words, the investor has made a clean 2.935% ROI, or an annualized rate of 17.6%, assuming it can redo the same investment over the next year every two months.

TSLA Stock Looks Cheap Here

The fact is TSLA stock has fallen over 53% year-to-date, including a drop of 12.6% in the last month alone. So even if it fell another 13% this month, this short put income investment would still work out for the institutional investor.

Moreover, at today's price, the stock looks cheap. It now trades for just 33x earnings forecast for Dec. 2023, according to analysts. That is after their estimate of $5.76 per share next year in earnings, or 38.5% over this year's estimate of $4.16 per share in earnings.

Even if analysts lower their estimates going forward, they are not likely to lower them by anywhere near 20%. That is how much they would have to cut earnings estimates for the short-put investor to lose money in this trade highlighted above.

The bottom line here is to look for trades like this to capitalize on fears of Tesla's stock underperformance.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)