NRG Energy (NRG), the Houston-based electric power generation and distribution company, reports its Q3 earnings early Monday Investors expect huge buybacks during both Q3 and Q4. Moreover, a potential coming dividend hike along with its low valuation, and good options income plays make NRG stock look attractive to value investors.

Huge Buyback Yield

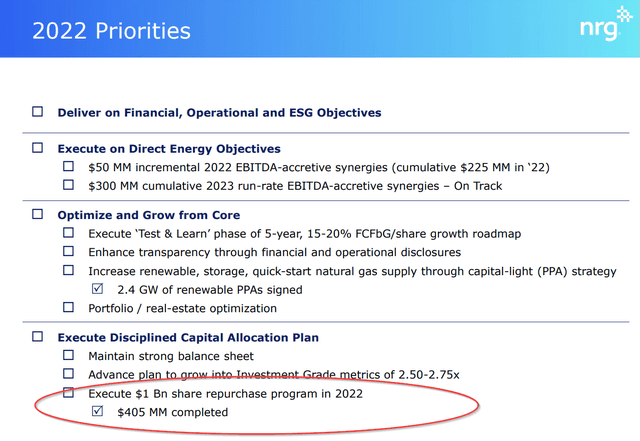

The key thing investors should look at on Monday is how many shares the company has bought back during the quarter. This is because last quarter the company made a very specific promise. They authorized $1 billion in share repurchases, and in the Q2 earnings release the company said this:

"... the balance of $595 million under the current program is expected to be executed by the end of 2022."

It bought back $405 million of stock by the end of Q2 and made a commitment to finish the $1 billion buyback during Q3 and Q4 2022. Since NRG stock now has a market value of $10.26 billion, that means that in six months or less it will have reduced its share capital by 5.80%.

This works out to annualized buyback yield of 11.6%, assuming it keeps this pace of buybacks over the next 12 months. That will likely involve another $1 billion share buyback authorization. This might even be announced sometime this quarter or even with this earnings announcement.

Why This Matters

I have pointed out many times that high buyback yields have the immediate effect of allowing a company to sustainably increase its dividends. This is because the company has fewer shares outstanding for the same dividend cost.

For example, in the last three years, NRG has been hiking its dividend annually. Its latest announcement on Oct. 31, has been the fourth payment of 35 cents per share. Therefore, investors could expect to see a dividend hike sometime next quarter.

Right now the $1.40 annual dividend represents 3.16% of its price as of Friday, Nov. 4, of $44.35. If the next quarterly dividend rises 8% to $1.51, as it was last time, the new implied yield is 3.40%. You can see that the 11.6% buyback yield more than covers the potential 8% dividend hike.

In addition, the buybacks increase earnings per share ("EPS"). Right now the stock is very cheap at just 12.7x, as analysts forecast $3.43 EPS this year. But next year they forecast a huge 48% gain to $5.08 EPS, lowering the multiple to just 8.6x.

Option Income Plays

Enterprising investors can also make extra income by shorting out-of-the-money (OTM) covered calls and OTM cash-secured puts.

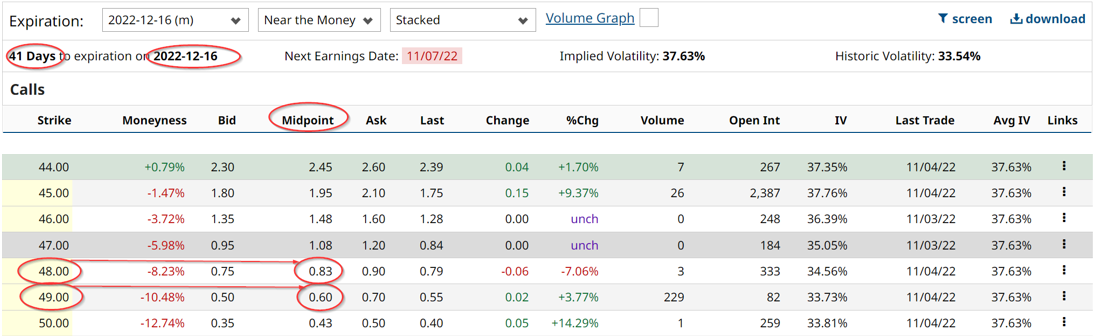

For example, right now the Dec. 16 calls offer a premium of 60 cents at the midpoint for the $49 strike price. That means that even if NRG stock rises over 10.48% by Dec. 16, the covered call investor can keep that gain, plus also pocket the 1.35% option income. This can be seen in the Barchart option chain below from Friday, Nov. 4:

This is seen by dividing 60 cents by the $44.35 stock price. That works out to a potential gain of 11.73% in one month. More can be made with lower strike prices. For example, the $48 strike price, 8.23% higher than today's price, offers a premium of 83 cents, or a yield of 1.87% (i.e., $0.83/$44.35).

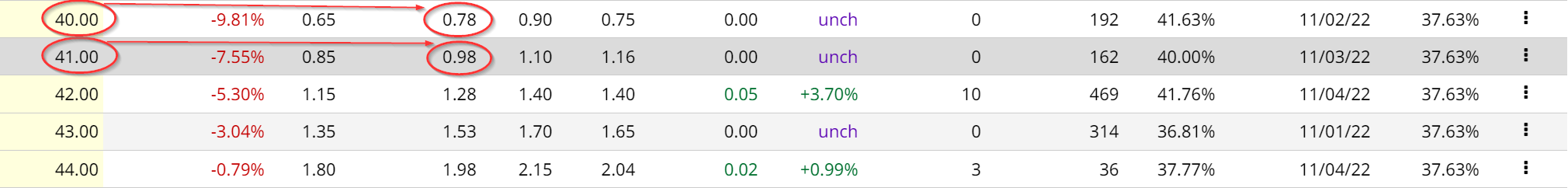

In addition, cash-secured puts are even more lucrative for Dec. 16, although there is no way to make a capital gain as with covered calls.

For example, the $40 put strike price on Dec. 16, 10% below today's price, offers a premium of 78 cents at the midpoint. That represents a yield of almost 2% (i.e., $0.78/$40.00 = 1.95%). Moreover, the $41 strike price has a 98 cents premium or 2.39%.

Massive Free Cash Flow

NRG's huge dividends and buybacks are a direct result of its massive free cash flow. For example, last quarter the company reported that it generated $3.189 billion in cash flow from operations (CFFO). After deducting $150 million in capex spending, it still had over $3 billion to spend on buybacks and dividends (i.e., $3.039 billion) during the first six months. That is what is called free cash flow ("FCF").

But it spent just $168 million on dividends and $366 million in buybacks, or $534 million in total. That represents just 17.6% of its total free cash flow. In other words, NRG is generating huge amounts of FCF and has plenty of room to increase its buybacks and dividends.

Where This Leaves Investors in NRG Stock

So far this year, the power company has risen just 3.24%. But with the stock's 3.16% dividend yield, and the 11.6% buyback yield, the total yield to shareholders is almost 15% (i.e., 3.16% + 11.6% = 14.76%). In fact, if the dividend yield rises to 3.40% next quarter, the total yield will be 15.0%.

The proof of this concept is simple. In the past year, NRG stock has risen 24.72%. Therefore, if the company reports substantial progress on buybacks on Monday during Q3 and indicates what it intends to do next year, expect to see NRG stock make a further move upward.

Meanwhile, investors can make additional income with their holdings in NRG stock by shorting OTM calls and puts, as I have shown.

More Stock Market News from Barchart

- Stocks Rally on China Optimism and Strength in Chip Stocks

- Stock Indexes, Jobs Data, and Algorithms

- Chinese Stocks Soar on Hopes Covid-Zero Policy Will Be Rolled Back

- Stocks Climb on China Optimism and Strength in Chip Stocks

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)