In the US Department of Agriculture’s October World Agricultural Supply and Demand Estimates Report, the USDA told the corn market that US and worldwide corn inventories declined compared to the September report. Global supplies fell more than the demand, tightening corn’s balance sheet in 2022.

Nearby CBOT corn futures traded to a high of $8.27 per bushel in April 2022 before correcting. The high was only 16.75 below the all-time $8.4375 2012 record peak. Meanwhile, at above the $6.80 level on November 3, corn futures remain at the highest price in November in a decade. The Teucrium Corn ETF product (CORN) moves higher and lower with a portfolio of CBOT corn futures prices.

A volatile year in corn

Nearby CBOT corn futures have traded in a $2.655 per bushel range over the first ten months of 2022.

The long-term chart highlights the broad trading range this year, with corn rallying close to the 2012 record high. At over the $6.80 per bushel level on November 2, corn futures were trading near the midpoint of the 2022 range. Meanwhile, the price in early November was at the highest level since 2013 for the end of the North American harvest season.

The war in Europe impacts corn in two ways

Russia’s invasion of Ukraine turned Europe’s fertile breadbasket into a battlefield. Moreover, the Black Sea Ports, a crucial logistical hub, have been a warzone.

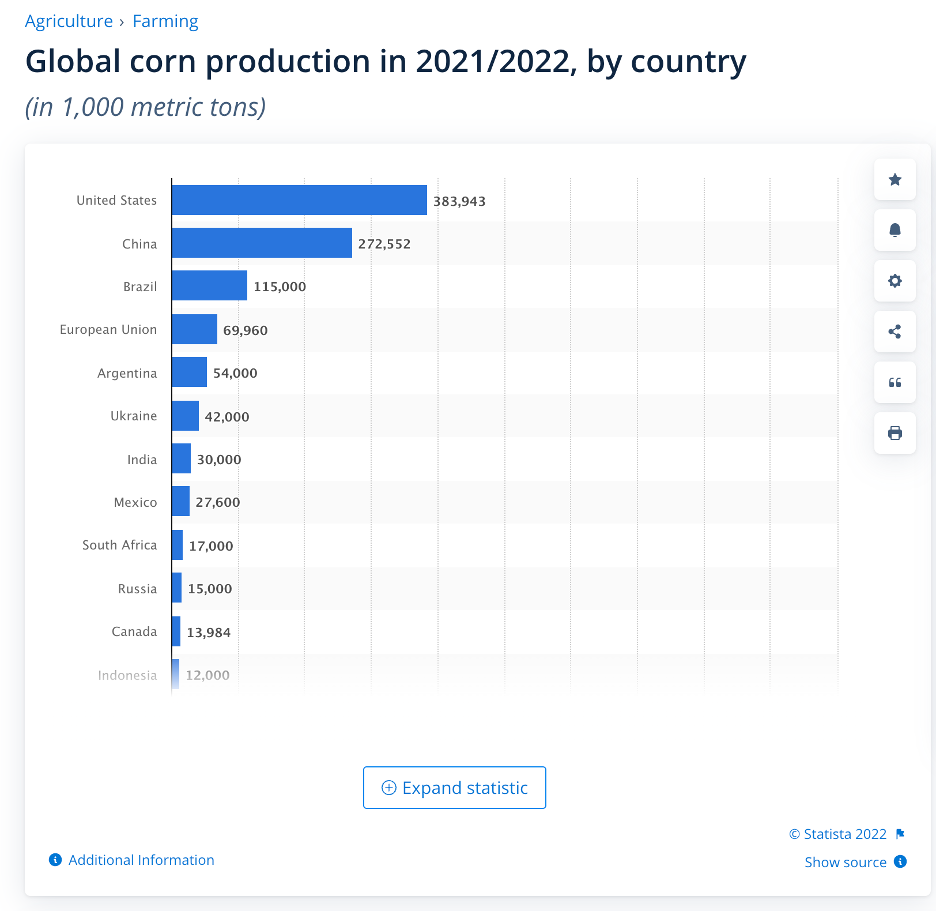

Source: Statista

The chart shows that while the US is the world’s leading corn-producing country, Ukraine is sixth, and Russia is tenth. The most recent USDA October World Agricultural Supply and Demand Estimates Report said that the US and global corn stockpiles had declined from the previous month. The tightening worldwide corn balance sheet is suffering from the war in two of the top ten corn-producing countries.

Meanwhile, rising gasoline and fuel prices put additional upside pressure on corn as coarse grain is the primary ingredient in US ethanol production. The US government mandates a blend of biofuel and gasoline. Russia and OPEC have been squeezing the US and other western countries with crude oil production cuts. While crude oil remained below the 2008 all-time high in 2022, gasoline futures reached a record peak in June and remain elevated. The bottom line is rising traditional energy prices, and the war in Ukraine has put upward pressure on corn prices in 2022.

Ethanol prices remain high on the back of gasoline

Since the US processes corn into ethanol, biofuel prices are highly sensitive to corn prices and vice versa.

The nearby Chicago ethanol swaps chart shows that prices reached a record high of $3.45 per gallon wholesale in November 2021. At the $2.6150 level on November 3, 2022, ethanol remains at a multi-year high. December ethanol prices were at the $2.4925 per gallon level, with December RBOB gasoline futures at around $2.67 per gallon. Elevated gasoline prices have lifted ethanol prices, putting additional upward pressure on corn futures prices.

Expect a continuation of high corn prices in 2023

Three factors suggest that corn prices will remain high in 2023 and could rise to a record peak above the 2012 record high:

- The war in Ukraine continues to rage, limiting corn and other agricultural production in Europe’s breadbasket.

- Inflation at a four-decade high is causing all input prices to rise. Energy, labor, farm equipment, and other production costs have exploded higher, putting upward pressure on corn prices. If corn and other agricultural product prices do not keep pace with production costs, the output becomes uneconomic, and farmers will curtain production.

- Russia is a leading fertilizer producer and exporter. Russia has limited fertilizer exports to “unfriendly” countries supporting Ukraine. Fertilizer scarcity and high prices only increase corn’s production cost.

Meanwhile, Russia has stepped away from a Black Sea corridor agreement, putting Ukrainian exports at risk. Moscow recently suspended its participation in the Black Sea deal after what it called a “major Ukrainian drone attack on its fleet in Russian-annexed Crimea.” Russia has used energy and food supplies as weapons in its battle against Ukraine and the Western countries supporting Ukraine. While ending the war would likely push corn prices lower, it will take years for Europe’s breadbasket and NATO-Russian relations to get back on track. A continuation of hostilities could only worsen the situation, with corn prices in the crosshairs of the conflict.

CORN is the ETF product that tracks the CBOT corn futures

The most direct route for a risk position in corn is via the futures and futures options trading on the CME’s CBOT division. The Teucrium Corn ETF product (CORN) provides an alternative for corn exposure without venturing into the futures arena.

At $27.28 per share on November 3, CORN had $216.2 million in assets under management. The ETF trades an average of 186,677 shares daily and charges a 1.14% management fee.

The last significant rally in the corn futures market took the December contract from $5.6175 on July 22 to $7.0650 on October 10, a 25.8% rise.

Over the same period, the CORN ETF rose from $22.87 to $28.05 per share or 22.6%. CORN holds a portfolio of active CBOT futures contracts to minimize roll risks. Since most price volatility occurs in the nearby contract, the ETF often underperforms nearby corn futures on the upside but outperforms during downside price corrections.

I am bullish on corn and the CORN ETF for the coming months and 2023. However, I would only purchase futures or the ETF on price weakness, leaving plenty of room to add if the price corrects. The higher corn futures rise, the greater the chances of vicious bull market corrections.

More Grain News from Barchart

- Red Follow Through for Thursday Wheat

- Red Soybean Prices Into Thursday

- Thursday Corn Starting Red

- Hard Losses for Midweek Wheat

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)