- The changing headlines of Russia first backing out of the Black Sea grain shipping agreement Sunday before rejoining Wednesday has caused more chaos than usual in the Chicago wheat market.

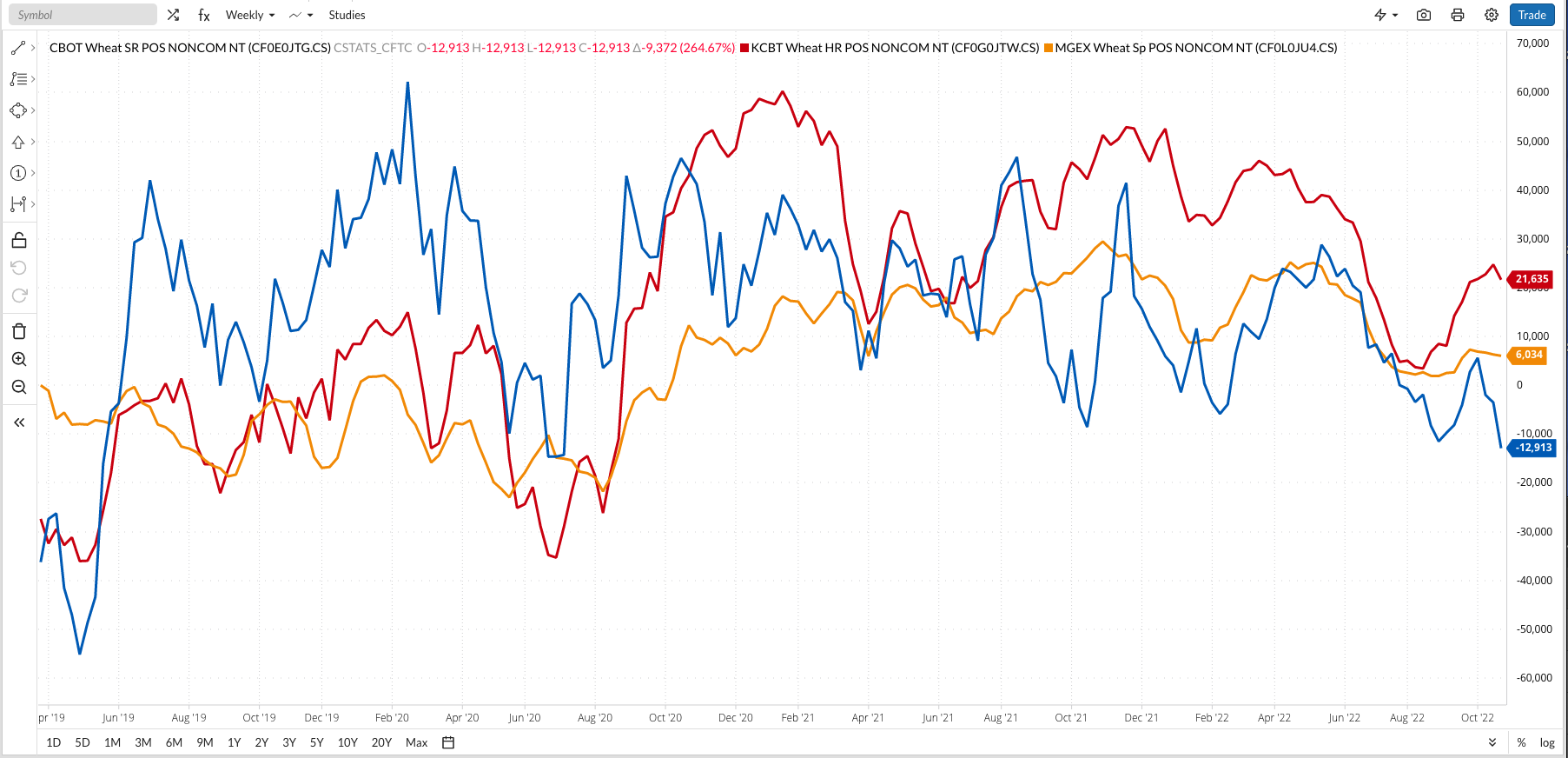

- Chicago is the most heavily traded wheat futures market in the world, opening the door to large noncommercial and commercial traders.

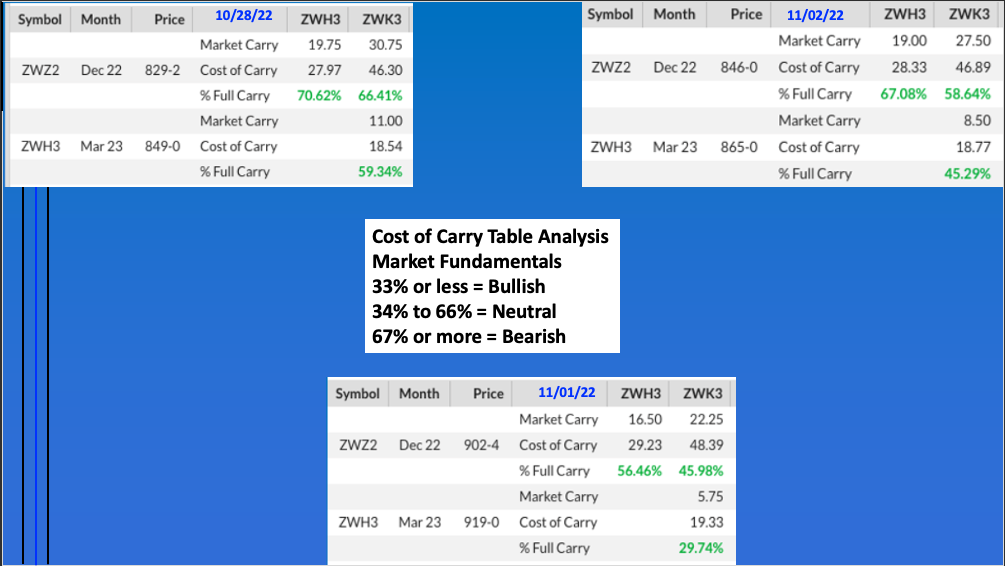

- Fundamentally, Chicago's futures spreads are more bearish than what is seen in Kansas City or Minneapolis, indicating the market should follow its long-term downtrend.

If you are fan of chaos, then this week’s wheat market is for you. We’ve only reached Wednesday afternoon, the second day of a new month, and all three markets have seen a month’s worth of activity. Having spent much of my life associated with wheat (recall I got my start brokering and merchandising in Kansas), I can say with confidence what we’ve seen the last few days is unusual for the Cockroach of the Grain World, Pork Bellies sowed kindred spirit.

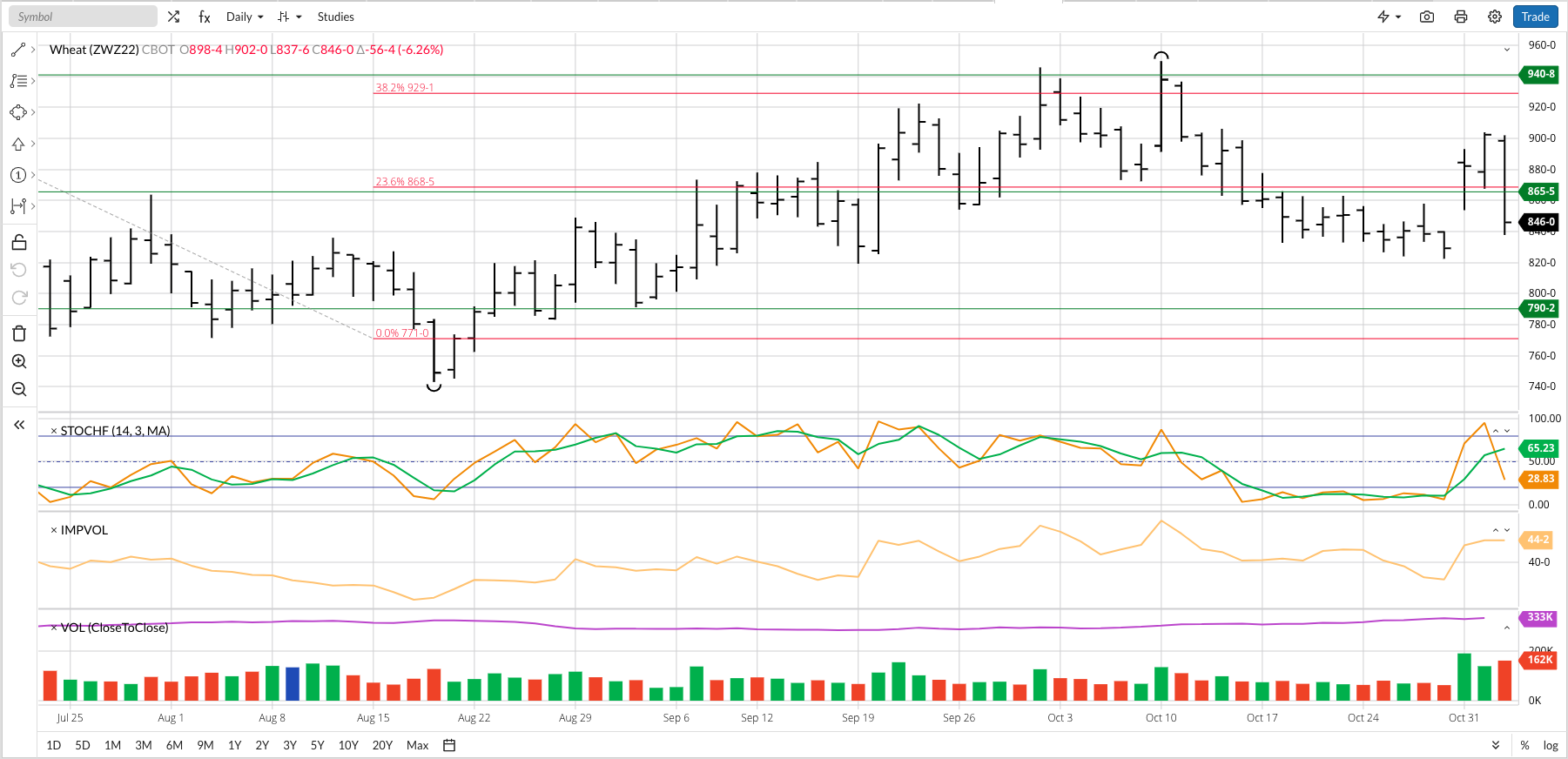

For now, let’s focus on the December Chicago (SRW) futures contract ((ZWZ22). While the US SRW crop is generally the third largest grown each year, Chicago futures are the most widely traded in the world. Additionally, the December issue is at this time the mostly heavily traded by both noncommercial (funds, speculators, etc.) and commercial (those involved in the underlying cash market) interests. A look at the Dec Chicago daily chart shows the contract posted a new short-term low last Friday of $8.2250, its lowest price since September 19, before gapping higher at Sunday evening’s open. The buying was tied to news Russia was backing out of the agreement allowing grain to be shipped from Ukraine through a safe corridor in the Black Sea. Monday’s session saw the contract gain as much as 63 cents before adding another 10.75 cents Tuesday. Then Wednesday rolled around and headlines were bleating about Russia’s change of mind, and the December issue fell as much as 64.75 cents.

Usually when wide price swings are seen it’s due to the flow of noncommercial money abruptly changing directions. The most recent CFTC Commitments of Traders report (legacy, futures only) showed this group adding to their net-short futures position, pushing it to 12,913 contracts as of Tuesday, October 25 (blue line on chart). A sidenote, this Friday’s report showing data pulled at Tuesday’s close should be interesting given the rally seen early this week. Given noncommercial traders were already holding the largest net-short since July 2020, the idea was they could start covering shorts. They likely did, only to put them back on Wednesday.

The commercial side has also been busy. As recently as last Friday’s close (October 28) the December-March futures spread was covering 71% calculated full commercial carry (cfcc), with 67% or more considered bearish. Strong buying tied to headlines of Russia’s move had the same spread covering only 56% cfcc at Tuesday’s close. Fast forward to Wednesday afternoon and the spread is back into bearish territory at 67% cfcc. Again, this type of movement in spreads isn’t normal, but so little about wheat is at this time.

How do we handle a red-hot market like Chicago wheat? One way is to look at the market’s long-term trend, and in this case the Barchart National SRW Wheat Price Index (ZWPAUS.CM), weighted national average cash price, is showing a 3-wave downtrend. This means the SWPI should eventually take out its August low near $6.6750, with the index just short of $7.78 Wednesday afternoon. The key to the market is fundamentals have been leaning bearish for at least a year, unlike both Kansas City (HRW) and Minneapolis (HRS), meaning if we apply Newsom’s Market Rule #6 (Fundamentals win in the end) SRW wheat should trend lower.

But wheat is wheat, making anything possible at any time. Just like pork bellies back in the day.

More Grain News from Barchart

- Cocoa Moderately Higher as Dollar Weakness Fuels Technical Buying

- Sugar Moves Higher on Brazil Production Concerns

- Coffee Prices Jump on Dollar Weakness and Smaller Central American Exports

- This Margin-Starved Beverage Stock Is on Sale Heading Into 2023

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)