Ford Motor Co. (F) will report its Q3 earnings on Wednesday, Oct. 26, after the market close. Ford stock looks very cheap here, trading well below its historical price-to-earnings (P/E) multiple and dividend yield metrics.

In the past six months, Ford is down over 21% and YTD it's off 43%. This is attracting value buyers ahead of the Q3 release.

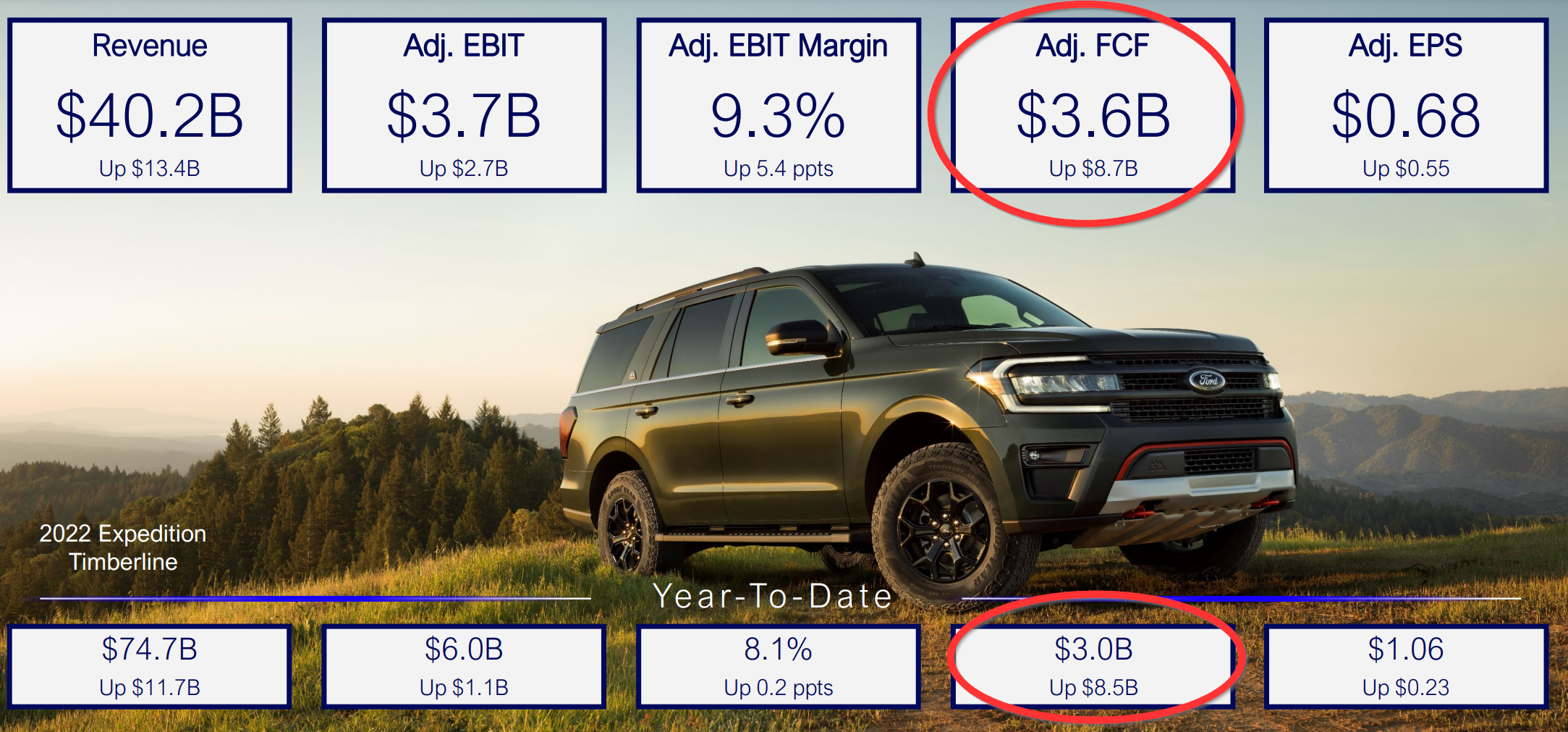

Earnings and Cash Flow

Moreover, analysts are projecting similar revenue levels or slightly lower compared to Q2. But the company has said it is very confident that it will make $6.5 billion in free cash flow (FCF) by the end of the year.

This may be low-balling the number if the FCF margins from Q2 hold up for Q3 and Q4. Analysts are forecasting $37.11 billion in revenue for Q3, which is close to the $37.9 billion it made last quarter.

Its China sales have already been announced, showing a 12.1% gain over the past quarter.

In Q2 the company made $2.9 billion in operating cash flow and adjusted free cash flow ("FCF") of $3.6 billion. This implies that its FCF margin was 9.49% in Q2. Moreover, the company now says that its adj. FCF will be $6.5 billion in 2022.

This implies that its adj. FCF will rise from $3.039 in the first half of 2022 to $6.5 billion, or by $3.461 over both Q3 and Q4.

This could be too low since it already made $3.6 billion in adj. FCF in Q2. It's possible then that the Q3 adj. FCF number could be quite significant.

Historical Metrics for Ford Stock

At $12.31 on Monday, Oct. 24, Ford stock now has a 4.87% dividend yield, given its annual 60 cents dividend payment (i.e., $0.60/$12.31). But this is still significantly higher than its average dividend yield of 4.06% over the past 4 years, according to Seeking Alpha.

If F stock were to rise to this average yield it would hit $14.78 (i.e., $0.60/0.0406 = $14.78). That implies an upside of over 20% for F stock.

Moreover, Ford's forward P/E multiple is 6.31x based on analysts' estimates of $1.95 for next year. This is also well below its historical average of 7.45x in the last 5 years. Morningstar reports that the historical forward P/E average is 8.0x.

Ford stock could rise $14.53 per share at 7.45x earnings (i.e., $1.95 x 7.45x). That is close to the $14.78 forecast using historical dividend yield analysis.

The bottom line here is that Ford stock looks cheap ahead of its earnings release. If Ford Motor produces positive FCF and it's on track to reach $6.5 billion, Ford stock could move significantly higher.

More Stock Market News from Barchart

- Stocks Mixed Ahead of Mega-Cap Tech Earnings

- Markets Today: Stocks Mixed Ahead of Big-Tech Earnings

- Unusual Options Activity for Twitter (TWTR) Underscores Political Sensitivities

- 2 Inflation Busting Stocks To Hold Forever

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)