/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Marvell Technology (MRVL) is a leading semiconductor firm powering data infrastructure for artificial intelligence (AI), cloud computing, 5G networks, enterprise storage, and automotive tech. The company designs high-performance chips like Ethernet adapters, custom ASICs, processors, and storage controllers that enable faster data centers, smarter networks, and connected vehicles. They supply hyperscalers like Amazon's (AMZN) AWS and Microsoft's (MSFT) Azure, telecom giants, and car makers, focusing on energy-efficient solutions amid booming AI demand.

Founded in 1995, Marvell is headquartered in Santa Clara, California with operations in over 10 countries. Marvell has a market capitalization of roughly $68 billion.

Marvell Technology Stock Struggles

Marvell Technology stock has experienced volatility, gaining 2% over the past five days but dropping almost 4% in the last month and 12% over three months. Year-to-date (YTD), MRVL stock is down 6%, with 27% decrease over the past 52 weeks. At present, shares are 29% off the 52-week high of $113.54, reflecting AI chip demand amid broader sector pressures.

Compared to the Nasdaq Composite ($NASX), Marvell has underperformed in the short term, with its one-month loss lagging behind the index's nearly 3% loss, and its six-month gain of almost 4% trailing the index's more than 7% rise. Over the past 52 weeks, MRVL stock's dip further shows the underperformance against the Nasdaq Composite's gains of approximately 18%.

Marvell Technology Results Beat Analysts

Marvell Technology released robust third-quarter fiscal 2026 results on Dec. 2, 2025. Revenue hit a record $2.075 billion, up 37% year-over-year (YOY) and $15 million above its own guidance midpoint, beating analyst estimates of $2.07 billion. Non-GAAP diluted EPS was $0.76, topping forecasts of $0.74.

Data center revenue, which was 73% of total sales, drove growth with strong AI demand. GAAP gross margin was 51.6% while non-GAAP gross margin was 59.7% (up 30 basis points sequentially). Operating cash flow reached a record $582 million. GAAP net income per share was $2.20, reflecting solid profitability.

For Q4 fiscal 2026, Marvell guided for revenue of $2.2 billion, non-GAAP gross margin of 58.5% to 59.5%, and non-GAAP EPS of $0.74 to $0.84. Full-year fiscal 2026 revenue growth is on track to exceed 40%.

Marvell Benefits from Amazon

Amazon stunned Wall Street by announcing $200 billion in capital spending for 2026, far above the $150 billion expected. CEO Andy Jassy cited booming demand for AI, semiconductors, robotics, and satellite tech, promising strong long-term returns despite an 8% premarket stock drop.

Marvell Technology stands out as a prime beneficiary. The company manufactures Amazon's custom Trainium AI processors. Jassy also highlighted Project Rainier for Anthropic, with 500,000 Trainium chips deployed and plans to ramp up. Marvell shares jumped 3% premarket on the Amazon spending news.

Others like Nvidia (NVDA), AMD (AMD), and AT&T (T) also gained 2%-plus, tied to Amazon's chip and satellite partnerships. Amazon's massive outlay signals sustained AI infrastructure growth, with Marvell positioned for key custom silicon wins.

Should You Buy MRVL Stock?

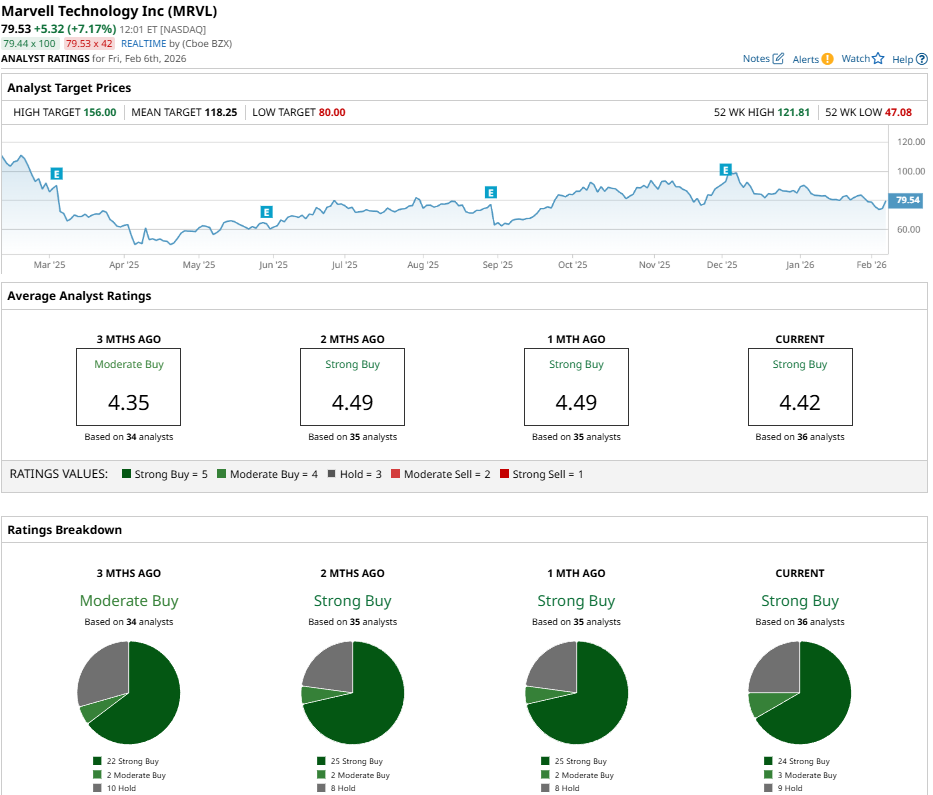

Marvell Technology has experienced some bearish sentiment recently, but analysts still give MRVL stock a consensus “Strong Buy” rating and a mean price target of $118.25, reflecting potential upside of roughly 45% from market levels.

MRVL stock has been reviewed by 36 analysts, receiving 24 “Strong Buy” ratings, three “Moderate Buy” ratings, and nine “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.