A broken wing butterfly with puts is a butterfly spread with long put strikes that are not at the same distance from the short put strike.

They have more risk on one side of the spread than on the other.

You can also think of it as a butterfly with a “skipped strike”.

The trade is usually set up as a slightly bullish trade.

A broken wing butterfly with puts is usually created buying a put, selling two lower puts and buying one further out-of-the-money put.

An ideal setup of the trade is to create the broken wing butterfly for a net credit, in this way, there is no risk on the upside.

The main risk with the trade is a sharp move lower early in the trade.

Let’s look at an example using the S&P 500 SPDR ETF (SPY).

SPY Broken Wing Butterfly Example

On SPY, a November expiry broken wing butterfly could be set up through buying the 360 put, selling two of the 350 puts and buying the 330 put.

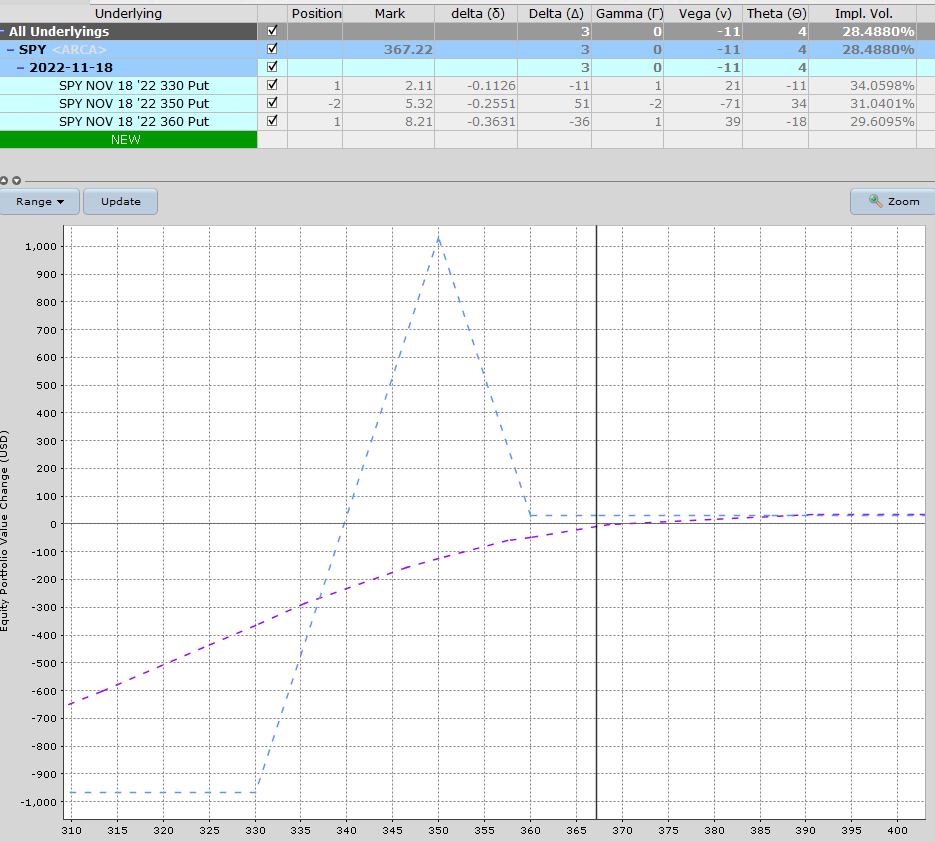

Here are the details of the trade as of yesterday’s close:

Buy 1 November 18, 330 put @ 2.10

Sell 2 November 18, 350 put @ 5.30

Buy 1 November 18, 360 put @ 8.20

Notice that the upper strike put is 10 points away from the middle put and the lower put is 20 points away.

This broken wing butterfly trade will result in a net credit of $30, which means there is no risk on the upside.

The worst that can happen is all the puts expire worthless leaving the trader with a $30 return which is 3.09% on capital at risk .

On the downside, the maximum loss can be calculated by taking the width between the upper two strikes (10) multiplied by 100, less the premium received.

That gives us 10 x 100 - 30 = $970

The maximum gain can be calculated as 10 x 100 + 30 = $1,030

The ideal scenario for the trade is that SPY stays flat initially and then slowly drifts lower to close around 350 at expiration. The main expiration profit zone is between 340 and 360.

As the trade starts with delta of 3, so has a slight bullish bias to start, but that will flip to negative delta closer to expiry if SPY is still above 360.

In terms of risk management, I would set a stop loss of 10% of the capital at risk, or if SPY broke below 340.

This is what the trade looks like as of today:

You can see the main risk in the trade is a drop in price early on. The blue line is the profit and loss at expiration and the purple line is the T+0 line. T+0 just means “today”.

So, we don’t want the stock to get into the profit tent too early.

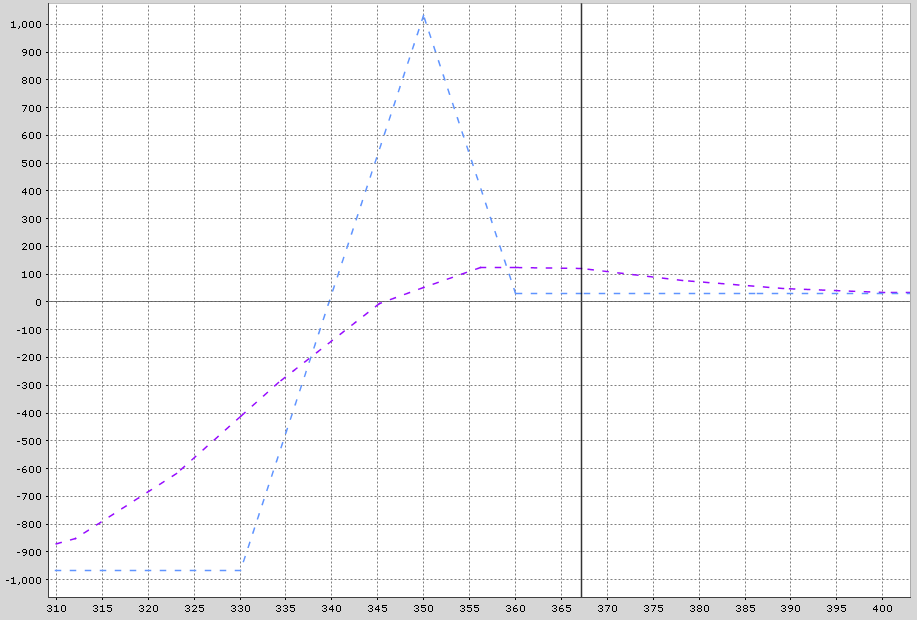

What about in three weeks’ time? How does the trade look then?

Looking a pretty good between say 350 and 390.

Summary

This strategy should move fairly slowly, unless there is a sharp drop in the stock price.

You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Broken Wing Butterflies have a similar structure to put ratio spreads, but they have the extra protection from the lower put, making it a risk defined trade.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

A stop loss of 10% might make sense in this scenario. If SPY is below 350 near expiry, there will be assignment risk

If you have questions on this strategy, please let me know.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Slip on Higher Bond Yields

- Kimbell Royalty Partner's 11.8% Dividend Yield Looks Sustainable

- Lam Research and KLA Hope to Remain Insulated from Chip Slump

- Should Investors Bite Into Dan Loeb’s Latest Target?

/AI%20(artificial%20intelligence)/Ai%20chip%20by%20Quality%20Stock%20Arts%20via%20Shutterstock.jpg)

/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)