A bear put spread is a vertical spread that aims to profit from a stock declining in price. It has a bearish directional bias as hinted in the name. Unlike the bear call spread, it suffers from time decay so traders need to be correct on the direction of the underlying and also the timing.

A bear put spread is created through buying an out-of-the-money put and selling a further out-of-the-money put.

The maximum profit is equal to the distance between the strikes, less the premium paid. The loss is limited to the premium paid.

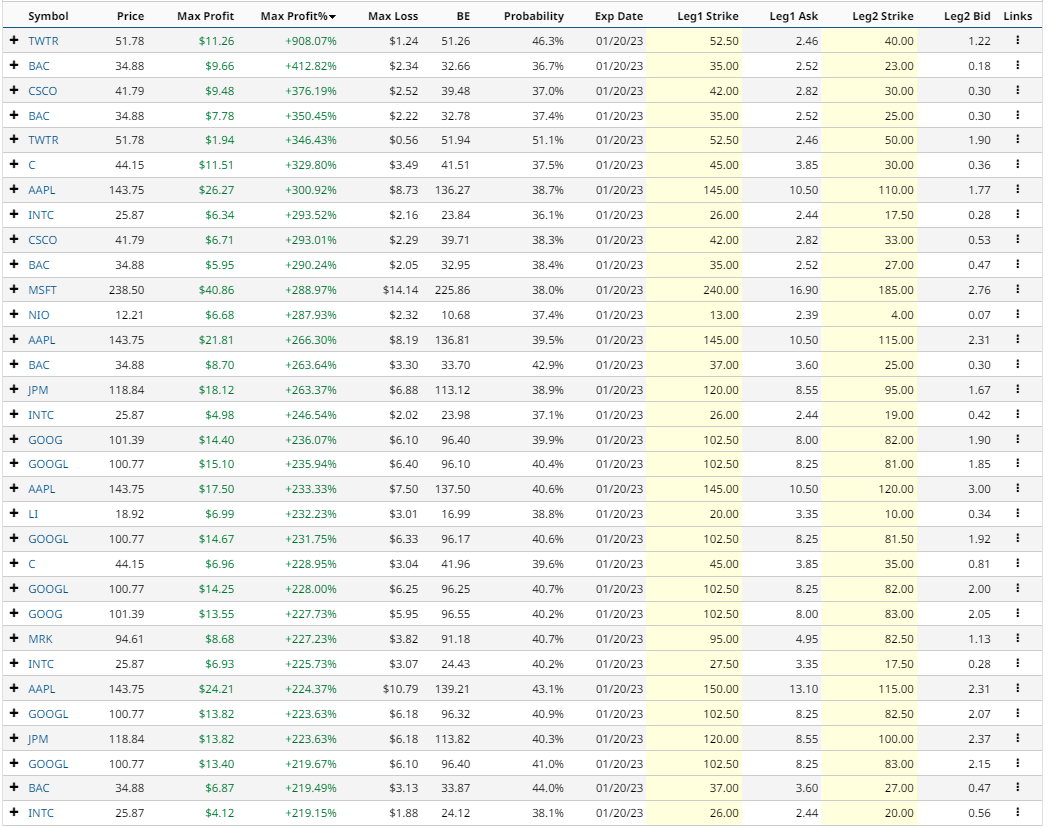

Let’s take a look at Barchart’s Short Bear Put Spread Screener for today:

Some interesting trades here with impressive Max Profit Percentage. Let’s take a look at the second item in the table – a bear put spread on Bank of America (BAC).

Bank of America Bear Put Spread Example

The BAC example above is using the January 20 expiry and involves buying the 35 strike put and selling the 23 strike put.

The cost of the trade is $234 which is also the maximum loss with the maximum possible gain being $966. The maximum gain would occur if Bank of America (BAC) stock fell below 23 on the expiration date.

The Barchart Technical Opinion rating is a 24% Sell with a Weakening short term outlook on maintaining the current direction.

BAC is showing an IV Percentile of 75% and an IV Rank of 60%. The current level of implied volatility is 37.62% compared to a 52-week high of 48.25% and a low of 21.71%.

Of the 14 Analysts following BAC there are 9 Strong Buy, 1 Moderate Buy and 4 Hold recommendations.

Let’s look at another example, this time on Cisco Systems (CSCO)

Cisco Bear Put Spread Example

The third example in the table is also using the January 20 expiry and involves buying the 42 strike put and selling the 30 strike put.

The cost of the trade is $252 which is also the maximum loss with the maximum possible gain being $948 The maximum gain would occur if CSCO stock fell below 30 on the expiration date.

The Barchart Technical Opinion rating is an 88% Sell with a Weakening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

CSCO is showing an IV Percentile of 99% and an IV Rank of 93%. The current level of implied volatility is 39.69% compared to a 52-week high of 41.35% and a low of 18.61%.

Of the 20 Analysts following CSCO there are 7 Strong Buy, 1 Moderate Buy, 11 Hold and 1 Strong recommendations.

Let’s look at one last example, this time on Citigroup (C)

Citigroup Bear Put Spread Example

The sixth line item in the table is also using the January 20 expiry and involves buying the 45 strike put and selling the 30 strike put.

The cost of the trade is $349 which is also the maximum loss with the maximum possible gain being $1,151 The maximum gain would occur if C stock fell below 30 on the expiration date.

The Barchart Technical Opinion rating is an 88% Sell with a Strengthening short term outlook on maintaining the current direction. Long term indicators fully support a continuation of the trend.

C is showing an IV Percentile of 79% and an IV Rank of 59%. The current level of implied volatility is 39.14% compared to a 52-week high of 51.57% and a low of 21.51%.

Of the 15 Analysts following C there are 4 Strong Buy, 1 Moderate Buy, 9 Hold and 1 Strong recommendations.

Mitigating Risk

Thankfully, bear put spreads are risk defined trades, so they have some build in risk management. The most the BAC example can lose is $234, while the CSCO and C trades have risk of $252 and 349 respectively.

For each trade consider setting a stop loss of 30% of the max loss.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

More Stock Market News from Barchart

- Stocks Rally for a Second Day on Strong Q3 Earnings Results

- US Stock Indexes, Economic Cycles, and I-gor

- Investors Find Safety in IBM

- Stocks Rally on Positive Corporate Earnings Results and Lower Bond Yields

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)