Many market participants consider the USDA’s monthly World Agricultural Supply and Demand Estimates Report (WASDE) the gold standard for fundamental data on the wheat, corn, and soybean markets. Meanwhile, WASDE provides a snapshot of the US and global supply and demand metrics constantly changing along with the macroeconomic landscape. By the time the USDA releases the report, it is already stale.

The report’s most significant impact on market prices is how it can deviate from market expectations. After all, sentiment is the primary driver of the path of least resistance of prices. When buyers are more aggressive than sellers, prices move higher. When sellers overwhelm buyers, they decline.

CBOT soft red winter wheat prices reached a record high in March 2022 and retreated. Over the past weeks, wheat prices have been trading with an upward bias. Corn and soybean prices rose just shy of their 2012 record peaks and corrected. Like wheat, the corn and soybean futures markets have been trending higher as the market goes into the September WASDE report at comes as the fall harvest season is underway in producing countries in the northern hemisphere.

Teucrium’s take on the upcoming WASDE report

I reached out to Teucrium, the company that the CORN, SOYB, and WEAT ETF products. Sal Gilberte is the founder, and Jake Hanley is the Managing Direction and Senior Portfolio Strategist. Jake told me:

As evidenced by the performance of wheat futures yesterday (September 7), grain markets remain susceptible to bouts of extreme volatility. Global balance sheets remain tight. The uncertainties surrounding Black Sea grain shipments is adding pressure to an already fragile situation.

What the world needs now is record production of corn, wheat, and soybeans. What we don’t need is War and geopolitical tensions calling into question the commercial availability of food and the inputs required to produce food. Unfortunately, production is struggling in many key producing areas, and of course the Black Sea is plagued by war and global geo-political tensions are on the rise.

When it comes to wheat, it’s worth noting that the globe has consumed more wheat than it has produced for three consecutive years. It’s also worth noting that this year the world will produce a record amount of wheat, yet it still isn’t expected to be enough to keep up with demand. The wheat balance sheet continues to tighten.

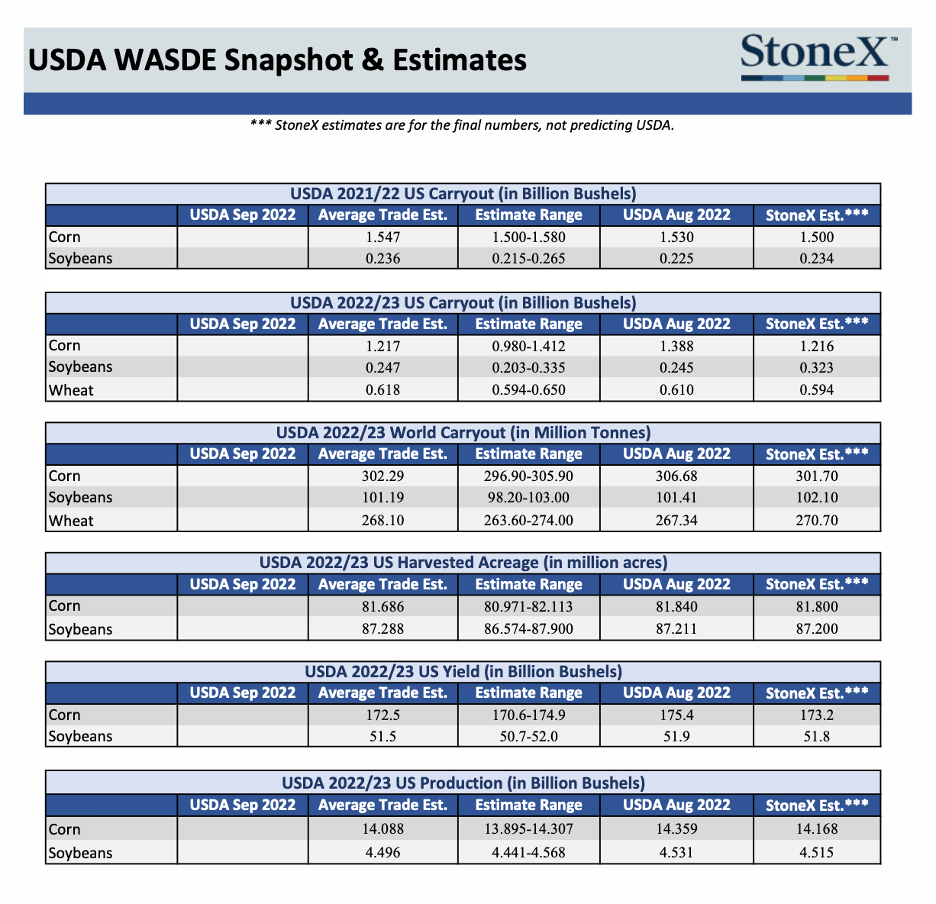

Corn production is likely to be revised lower for the US and Europe in the September WASDE. The average trade guess for US corn yields is around 172.5 bushels per acre, however Pro-Farmer is forecasting final US corn yields at 168.1 bushels per acre.

Note that the Pro-Farmer estimate is 7 bushels per acre lower than the August WASDE expectations. The USDA is not likely to make such a drastic change in their month-over-month estimates. Yet, there is the potential that the USDA surprises on corn yields and prints a number outside the range of expectations.

Additionally, it appears that the USDA has some work to do on the European production estimates. Some private analysts are floating numbers around 50 million metric tons, versus the USDA’s August print of 60 mmt. The original estimate for EU corn production heading into the growing season was for 68.25 mmt. This means that between roughly 12 – 25% of expected EU corn production has evaporated in the drought.

If there is a bright spot, it is soybeans. Brazil is beginning to plant their soybean crop now. All indications are that Brazilian farmers have fertilizer they need to grow a record crop, and they are expected to plant a record number of acres this year. If the weather cooperates, we expect that the unprecedented Brazilian production will put downward pressure on prices.

Overall, given the backdrop of tight global supplies and the wild cards of weather and geopolitics, we believe that upside risks remain. Elevated volatility is all but certain.

The recent expectations for the top grain and oilseed markets for the September 12 WASDE report are:

Source: StoneX

As the market prepares for next week’s report, the price action will likely reflect if the data comes in near the market’s expectations. Data that deviates from forecasts tend to lead to the most volatile response to the USDA’s monthly report. While the WASDE report will impact the path of least resistance of prices, the market’s interpretation and the overall sentiment will drive prices higher or lower early next week.

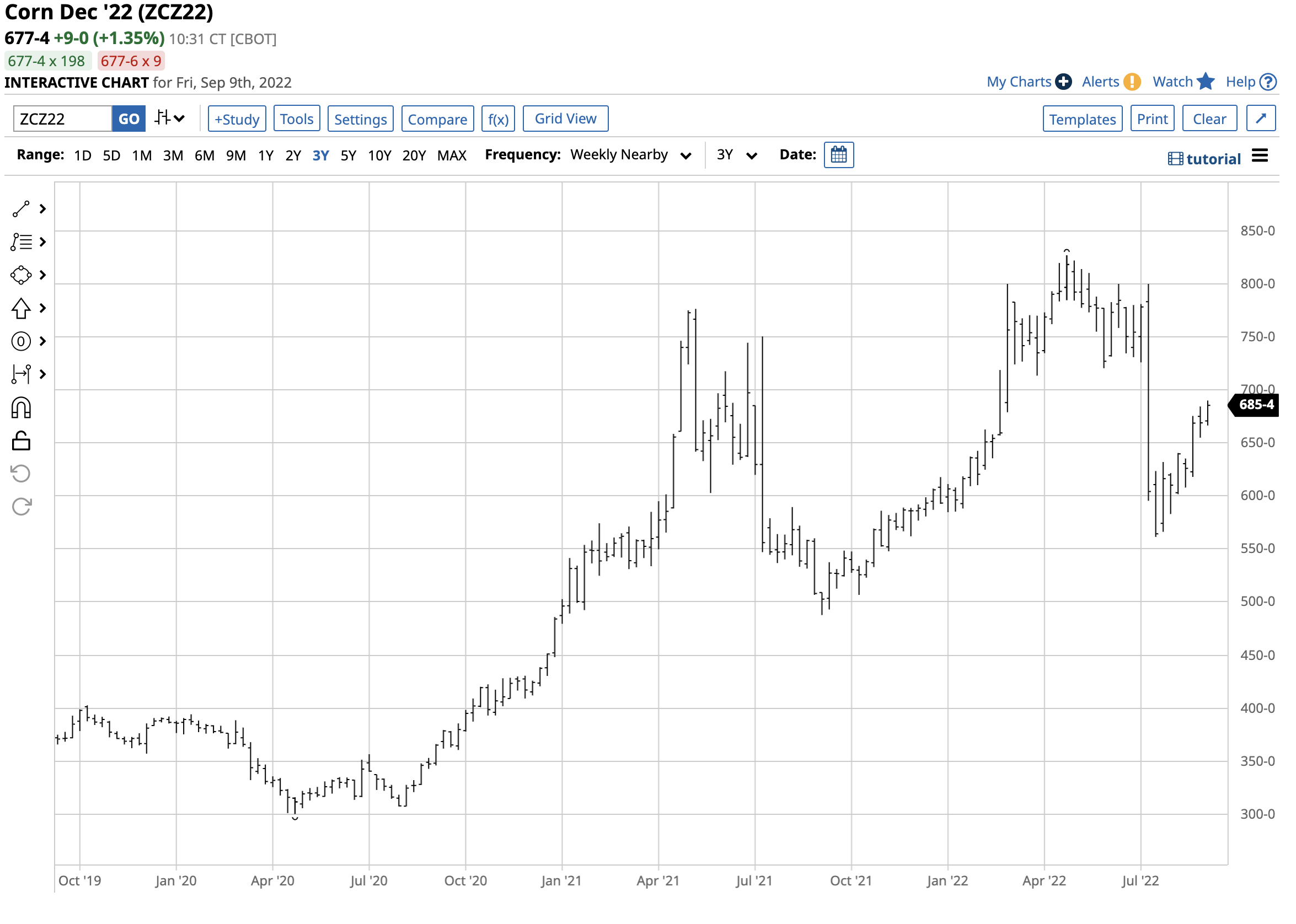

Corn expectations are for a bullish report

Nearby CBOT corn futures reached a high of $8.27 per bushel during the final week of April, rising to only 16.75 cents below the 2012 record peak. After a correction that took the price to a low of $5.6150 in mid-July, corn has made higher lows and higher highs over the past weeks.

The chart highlights the short-term bullish trend in new-crop December corn futures that were trading at the $6.7750 per bushel level on Friday, September 9. The path of least resistance shows that the market’s sentiment is bullish for the corn market going into the September WASDE report.

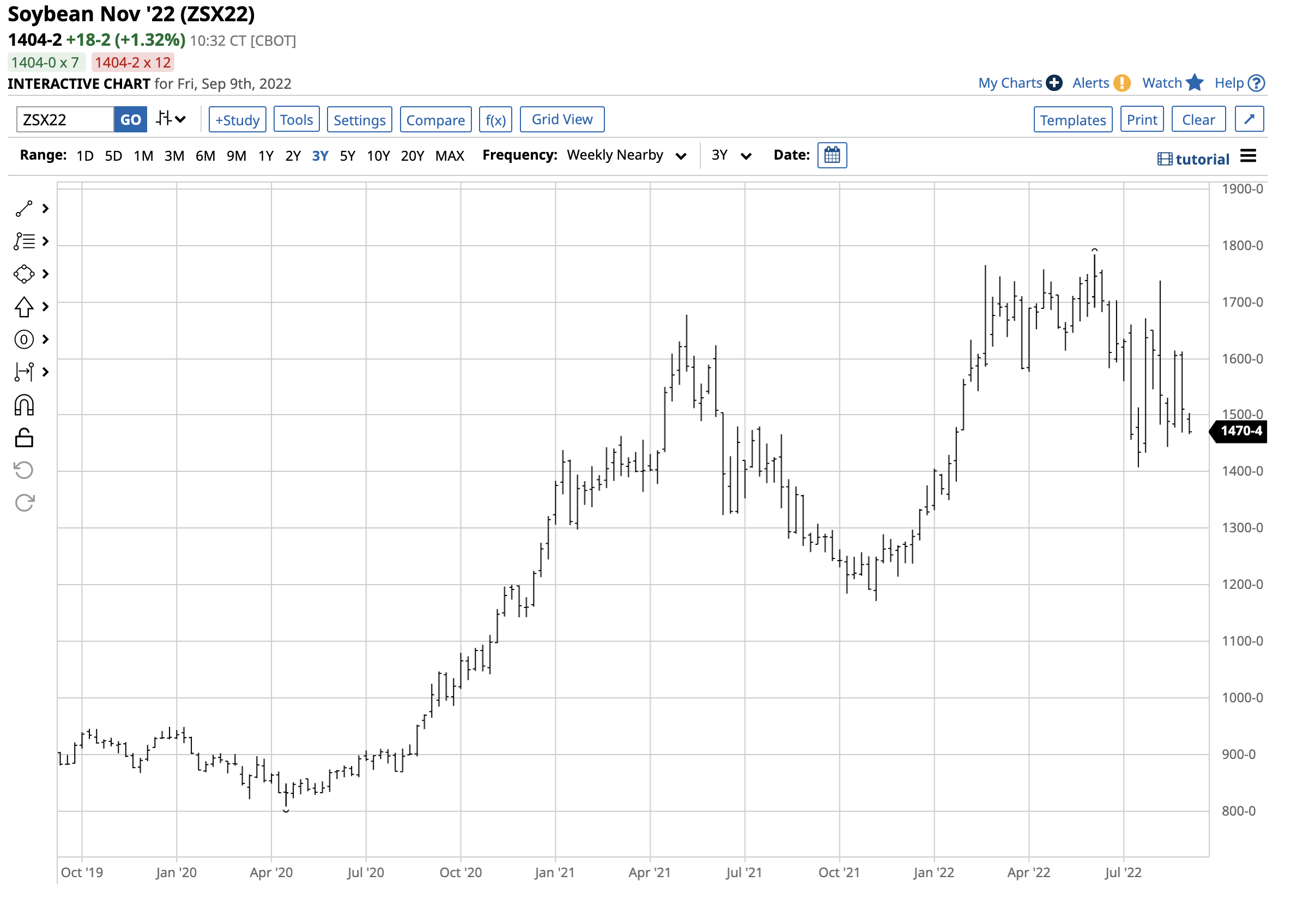

Soybeans are also bullish

The market’s sentiment in the soybean futures arena is less bullish than in corn, but the oilseed futures remain at an elevated level going into the monthly USDA report.

The chart illustrates at just over the $13.75 per bushel level; nearby soybean futures are at multi-year highs. Nearby soybean futures rose to $17.84 in June and fell to around $14 per bushel. The peak was only 10.75 cents below the record 2012 peak. The high in the new-crop November beans were below $16, and the low was below $13 per bushel. The backwardation or nearby premium for soybeans reflects the supply concerns in 2022. At above the $14 per bushel level on September 9, soybeans are elevated but have lagged corn and wheat futures.

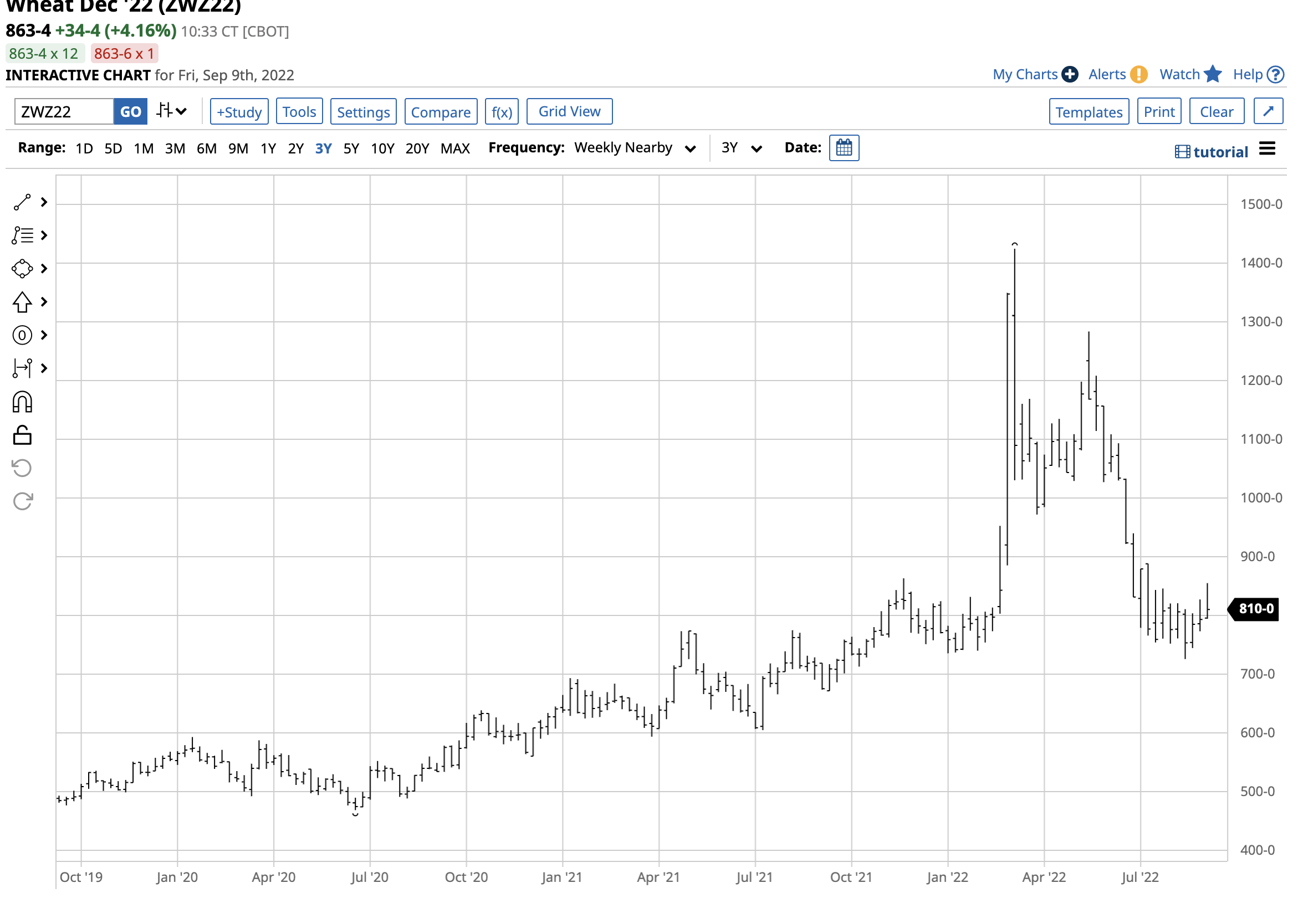

Wheat is a unique case

Nearby CBOT wheat futures rose to $14.2525 per bushel in March, a new all-time high for the soft red winter wheat. Russia is the world’s leading exporter of the primary ingredient in bread, making wheat a unique agricultural commodity in 2022.

The chart shows March’s explosive move in the CBOT wheat futures market. At over $8.60 per bushel on September 9, the futures are at the highest price in a decade since 2012.

The war in Europe’s breadbasket remains the overriding factor for grain and oilseed prices

Russia and Ukraine are Europe’s breadbasket, as both countries are leading corn and wheat producers and exporters. The fertile soils in the countries have been a battlefield throughout the 2022 crop year. Simultaneously, the Black Sea Ports, a critical logistical export hub, has been a war zone. As Jake Hanley said, “Global balance sheets remain tight. The uncertainties surrounding Black Sea grain shipments is adding pressure to an already fragile situation.”

As the war continues, it will profoundly impact the global balance sheets for the grains that feed the world. Moreover, since Russia is a critical energy supplier, sanctions and retaliatory measures have lifted oil, gas, and coal prices, increasing the demand for biofuel. Corn is the leading input in US ethanol, and soybeans are an ingredient in biodiesel. The first major war in Europe since WW II will continue to put upward pressure on prices and underpin them on corrections. Given the tight balance sheets, it could take years for the markets to return to normal reactions to supply and demand fundamentals.

The September 12 WASDE may move the grain and oilseed futures markets, but the sentiment and the events in Ukraine will guide prices over the coming months. The bias remains bullish going into the September WASDE report. We will find out next week if any deviation from market expectations causes a short-term correction or if they support prices at higher levels.

More Grain News from Barchart

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)