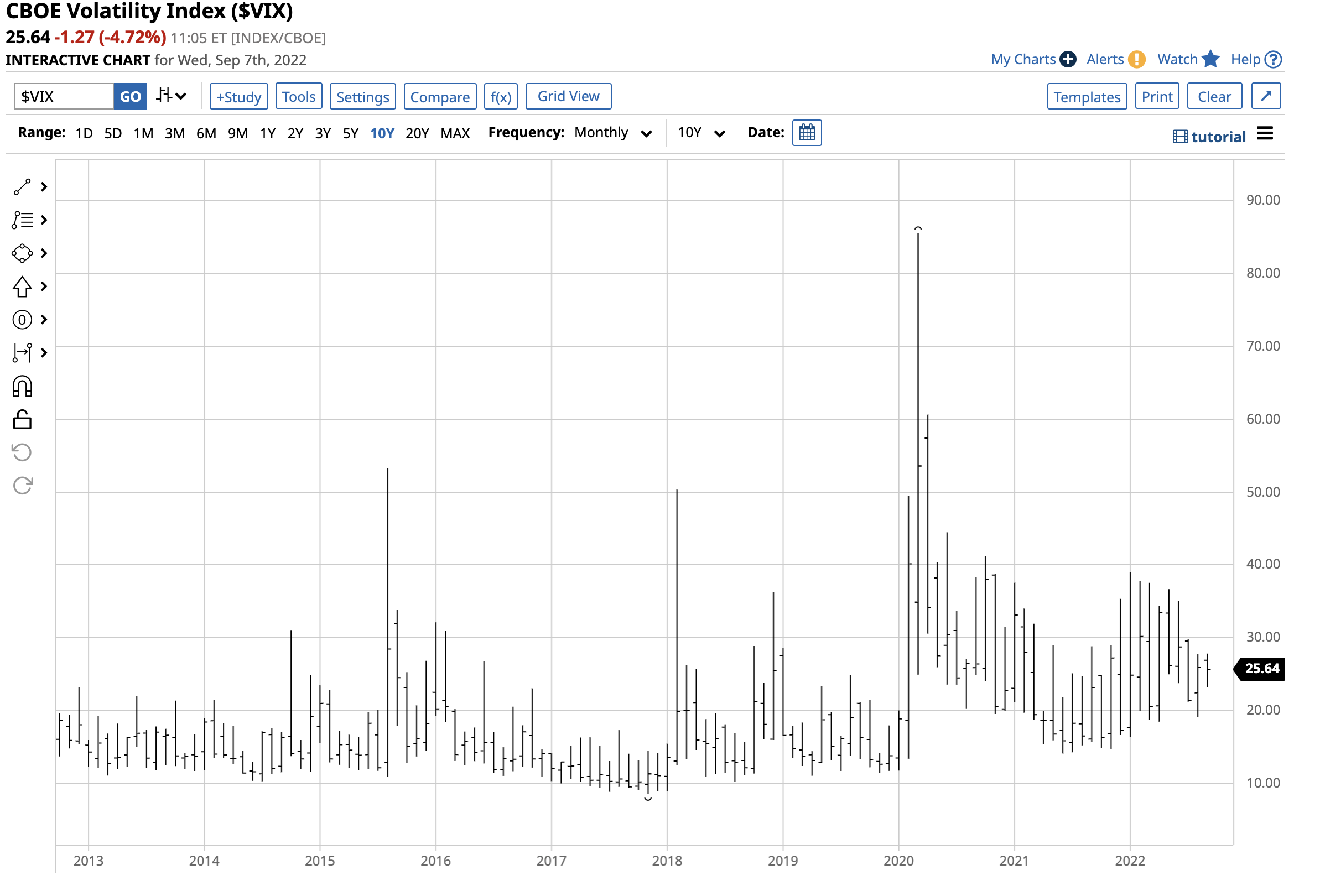

The 2022 summer months were a special and unique occasion as the end of the pandemic ushered in the first vacation season since 2019 as the pandemic hit the US and world like a ton of bricks in early 2020. After two summers of lockdowns, isolation, and fear, the situation relaxed and improved this past summer. Meanwhile, rising geopolitical tensions replaced COVID-19 as the leading threat this year, and inflation continued to spiral out of control. In September 2022, the economic condition that pushed consumer and producer prices higher remains at the highest level in four decades. The US economy faces two quarterly declines, the textbook definition of a recession. The stock market is limping into the fall season, which could spell problems over the coming weeks and months. The VIX index displays an upward bias going into the fall months.

History tells us to be careful in the fall

Throughout history, October has not been a good month for stock market bulls. The stock market crash of 1929 that started the Great Depression occurred in October. Black Monday, the crash of 1987, was on October 9, and the 2008 bearish spike began with the DJIA’s 777.68-point decline on September 29. While the crashes were significant events, many other stock market selloffs occurred during the fall.

Seasonality is a reason for investors and traders to proceed with caution in the stock market over the coming weeks and months.

Economic indicators are not pretty

The global pandemic that began in early 2020 has left a significant legacy on markets across all asset classes. In China, lockdowns continue to weigh on the economy. At the same time, artificially low interest rates and massive government stimulus programs have come at a substantial cost in the US, Europe, and other parts of the world. Inflation has increased to the highest level in over four decades, and declines in economic growth threaten a recession. High prices during an economic slowdown are the textbook definition of stagflation, a condition that central banks and governments have few tools to correct. While increasing interest rates can cause inflation to decline, it also chokes economic growth and turbocharges recessionary pressures.

The bottom line is the stock market faces uncertainty in the fall of 2022, which is not bullish for equity prices.

Geopolitics are dangerous

Markets also reflect the geopolitical landscape. In 2022, turmoil on the world stage has led to a bifurcation between the global nuclear powers. China and Russia forged a “no-limits” alliance before Russian troops stormed into Ukraine, starting the first major European war since WW II. Russia’s relations with the US and the European NATO members have deteriorated to the worst state since the cold war. Moreover, NATO and the US support for Ukraine creates the potential for a widening conflict and is impacting food and energy supplies that flow from Russia and Ukraine to Western Europe.

Chinese relations with the US have also become more than a challenge. Chinese support for Russia and plans to force reunification upon Taiwan threaten peace in the region.

Geopolitics in 2022 is another reason for stock market weakness.

Markets reflect economic and political events- Be careful

The economic and geopolitical landscapes create an almost perfect bearish storm for the stock market at a historically weak time of the year. As liquidity returns to the stock market after the summer vacation season, the potential for downdrafts is elevated. Rising interest rates attract capital away from equities as fixed-income investments offer increased yields. Inflation erodes money’s purchasing power, weighing on savings and increasing costs for companies, weighing on earnings. The geopolitical turmoil increases the potential for sudden shocks that may cause periodic selloffs as capital seeks havens of safety away from the stock market. Be careful in markets, as the current environment has become dangerous for investors and traders.

Buying the VIX index on any dips could be the optimal approach

The S&P 500 index is the most diversified stock market measure. The VIX index measures the prices of put and call options on the stocks in the S&P 500 index. The chief determinant of option prices is implied volatility, or the future price variance the market expects. The VIX tends to rise when stock prices decline as market participants buy options as price insurance.

A rising VIX index is a sign that investors and traders are fearful that selloffs are on the horizon.

The chart of the VIX index shows option prices have increased from the levels seen over the past years. The base levels have moved from 10-15 before the global pandemic to the 20-30 level, indicating that option buyers have paid more for calls and puts, and the potential for downside market volatility has increased.

Stocks tend to fall during the fall season, and the economic and geopolitical factors suggest that the stock market could experience significant selloffs. Hedging stock portfolios for the coming months could be the optimal way to protect nest eggs against downdrafts. Meanwhile, buying VIX-related products on dips could be a way to profit from the historically volatile fall season in 2022.

More Stock Market News from Barchart

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)