Implied volatility is shooting higher which could mean it’s a good time to be on look lookout for Iron Condor trades.

An iron condor aims to profit from a drop in implied volatility, with the stock staying within an expected range.

When implied volatility is high, the wider the expected range becomes.

The maximum profit for an iron condor is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

Traders should have a neutral outlook on the stock and ideally look to enter when the stock has a high implied volatility percentile.

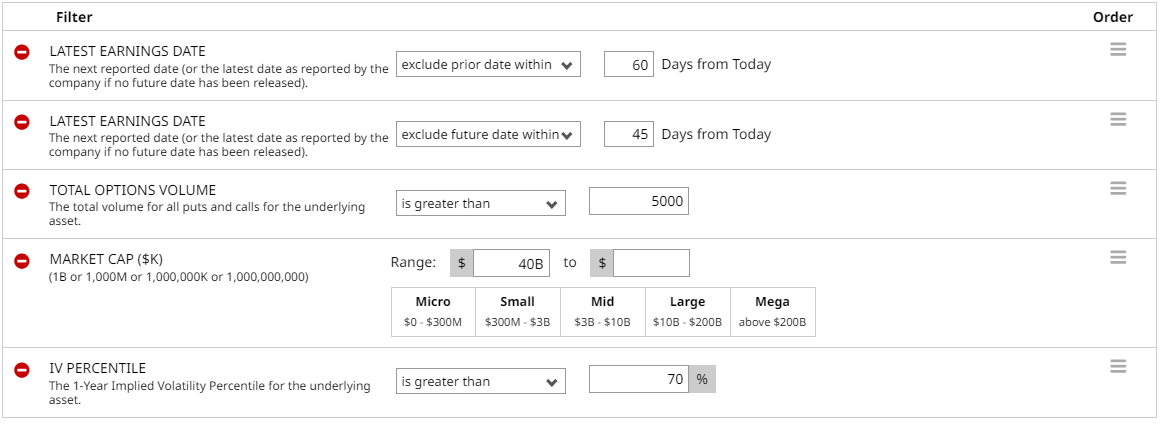

First, let’s look for stocks with a high implied volatility percentile, that are not due to report earnings until late January.

To do this, go to the Barchart Stock Screener and use the following filters:

This screener gives the following results, sorted by implied volatility percentile:

We can see that some stocks have both a high IV Percentile and IV Rank, so let’s use some of those in our Iron Condor Screener.

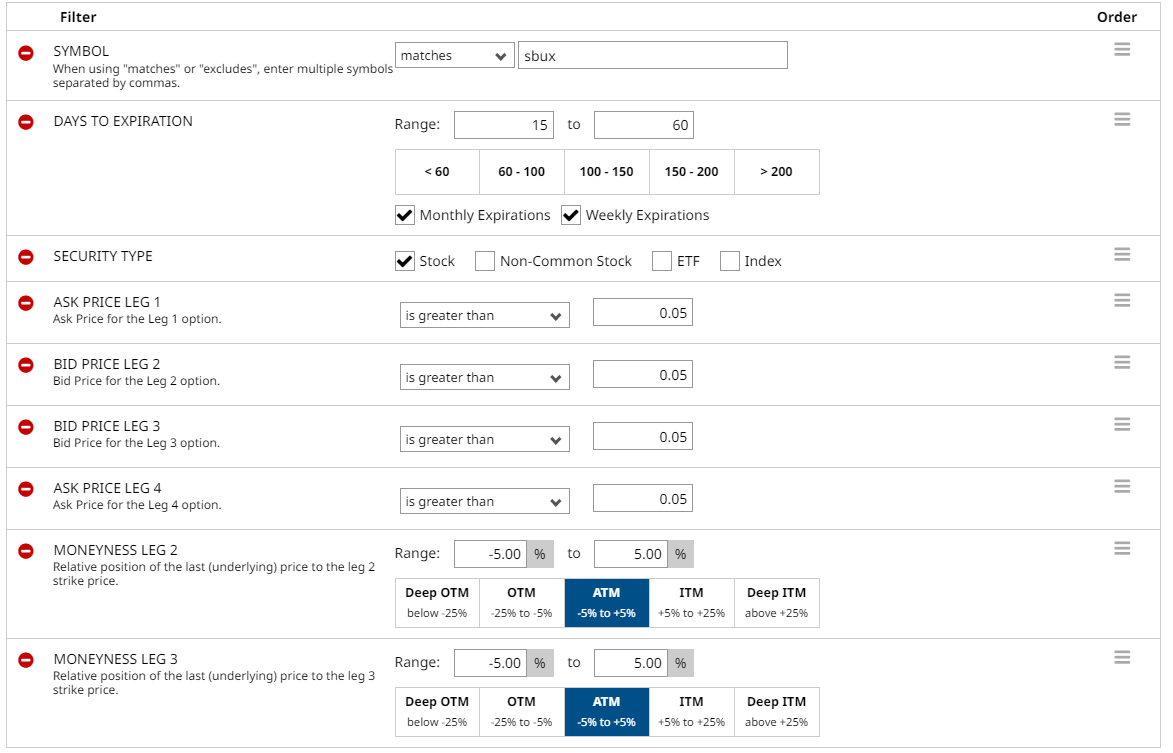

Here are the filters:

And these are the results:

SBUX Iron Condors

Let’s take a look at the first line item, an iron condor on Starbucks (SBUX).

Using the September 23 expiry, the trade would involve selling the 81 put and buying the 74 put. Then on the calls, selling the 88 call and buying the 95 call.

The price for the condor is $1.95 which means the trader would receive $195 into their account. The maximum risk is $505 for a total profit potential of 38.61% with a probability of 56.4%.

The profit zone ranges between 79.05 and 89.95. This can be calculated by taking the short strikes and adding or subtracting the premium received.

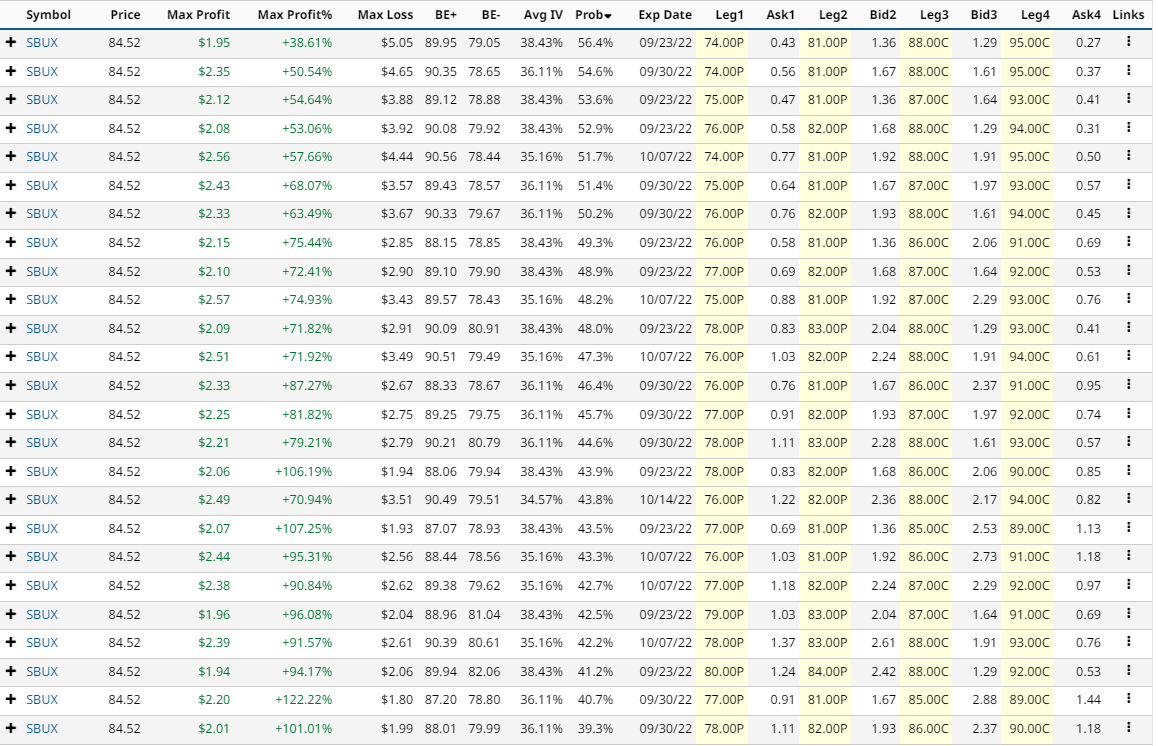

AMZN Iron Condors

Amazon (AMZN) was another stock on our high implied volatility screener. Here are the iron condor screener results for AMZN:

Let’s look at the first line item using the September 23 expiry. The trade involves selling the 121 put and buying the 110 put. Then on the calls, selling the 132 call and buying the 143 call.

The price for the condor is $3.60 which means the trader would receive $360 into their account. The maximum risk is $740 for a total profit potential of 48.65% with a probability of 55.5%.

The profit zone ranges between 117.40 and 135.60. This can be calculated by taking the short strikes and adding or subtracting the premium received.

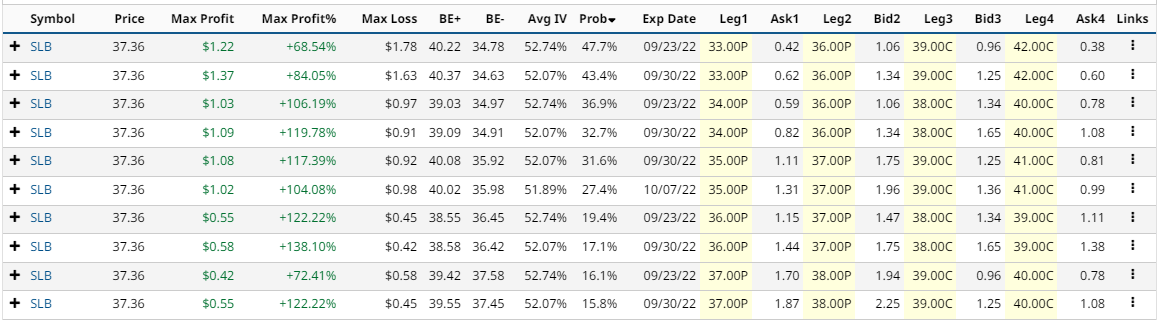

SLB Iron Condors

Schlumberger (SLB) is another stock with both a high IV Percentile and IV Rank from our initial screener.

This screener only gives less results, but the filters can be tweaked to find more ideas.

The first example uses the September 23 expiry and involves selling the 36 put and buying the 33 put. Then on the calls, selling the 39 call and buying the 42 call.

The price for the condor is $1.22 which means the trader would receive $122 into their account. The maximum risk is $178 for a total profit potential of 68.54% with a probability of 47.7%.

The profit zone ranges between 34.78 and 40.22.

Mitigating Risk

Thankfully, iron condors are risk defined trades, so they have some build in risk management. Position sizing is crucial to ensure that minimal damage is done if the trade suffers a full loss.

One way to set a stop loss for an iron condor is closing the trade if the loss is greater than 1.5 times the premium received.

Iron condors can also contain early assignment risk, so be mindful of that if the stock breaks through the short strike and its getting close to expiry.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in some of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, September 6, 2022.

More Stock Market News from Barchart

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)