Apple (AAPL) stock is down 6% in the last week and is off over 1.8% in the past month. As a result, its valuation is looking particularly interesting. Now there are attractive option income plays using covered calls and/or cash-secured puts in AAPL stock.

Analysts now project that revenue will rise almost 7% from Q2 to $88.73 billion in Q3. Moreover, the average Q3 earnings per share (EPS) forecast is $1.26, up from $1.20 last quarter.

In fact, based on the average forecast of 43 analysts is for $6.10 in EPS for the year ending Sept. 2022, putting the stock today at 26x earnings ($160.10 per share on Aug. 31). For 2023, the multiple falls to 24.8x.

This is below its average P/E multiple for the past four years of 30.8x according to Morningstar. This implies that there is a basis to believe AAPL stock has room to move higher, although not necessarily dramatically higher.

This means the stock could tread water or move higher over the near term. As a result, there are good potential income opportunities by shorting out-of-the-money (OTM) covered calls and/or OTM cash-secured puts. Here are a few examples.

Shorting OTM AAPL Calls and Puts for Income

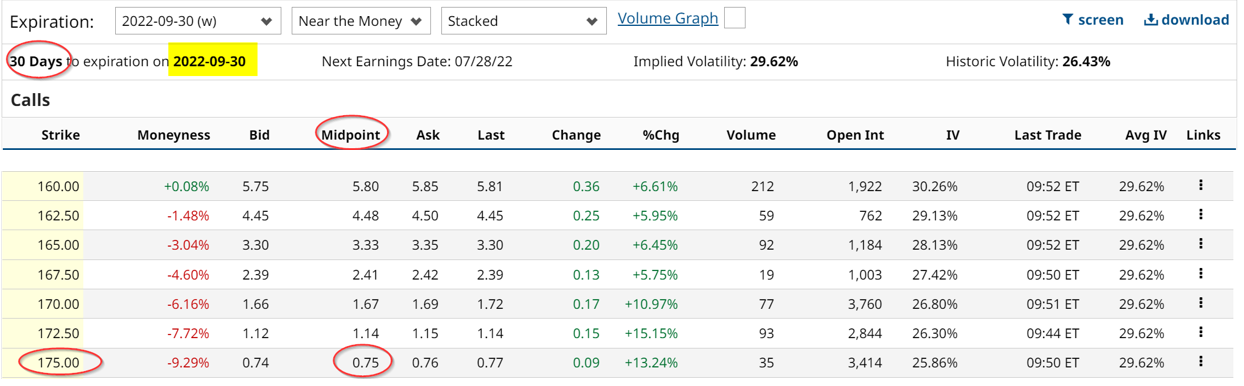

The table below from Barchart shows the call options chain for calls expiring Sept. 30, which is 30 days from now. The $175 strike price, which is almost 10% above today's price of $159.33, offers a premium of 75 cents per call option contract.

This means that the investor who buys 100 shares for $15,933 and then sells 1 call option contract will receive $75 immediately. That represents a yield of 0.47%, or almost one-half of one percent for a one-month obligation to sell shares at $175.00. That works out to an annual return of 5.64%, if it can be repeated each month.

In addition, assuming the stock closes at $175 or higher by Sept. 30, the investor would receive a 9.8% capital gain, for a total return of 10.27% in one month. That is a very attractive income opportunity.

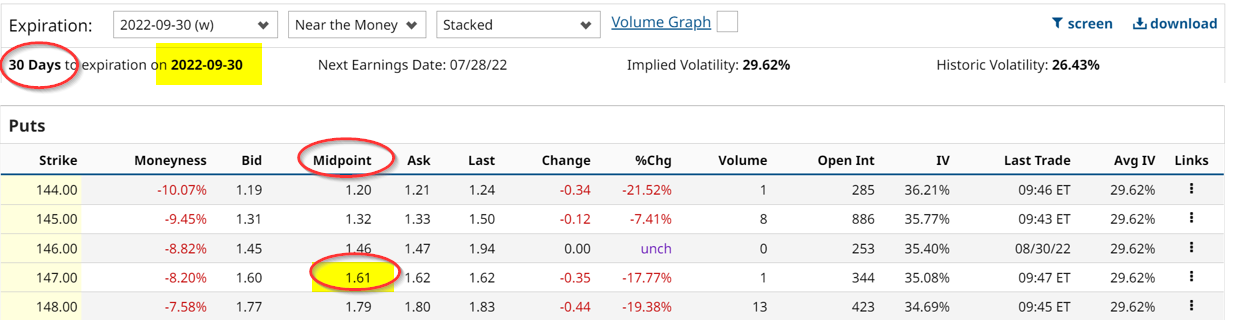

Another way to play this is to short OTM cash-secured puts. For example, the put option chain below shows that the $147 strike price offers a premium of $1.16 per put contract.

Here is what this means. An investor puts up $14,700 in cash with a brokerage firm in order to secure the potential purchase of 100 APPL shares at $147.00 per share. This is over 7.7% below today's price.

In return, after selling the $147 strike price put at $1.61, the investor immediately receives $161 for this one-month obligation. That works out to a 1.0% yield on the potential $147 purchase price, and a 12% annual yield.

That is even more attractive a potential income opportunity for investors than the covered call play. However, there is no potential capital gain possibility as there is with the covered call play.

Bottom line: AAPL stock looks attractive here and there are two good option income opportunities for enterprising investors.

More Stock Market News from Barchart

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

/Pfizer%20Inc_%20logo%20sign-by%20JHVEPhoto%20via%20iStock.jpg)