The Bitwise Cryptocurrency Industry Innovators ETF product (BITQ) holds shares in many cryptocurrency-related leading companies trading in the stock market. BITQ is a kind of Bitcoin soup or stew as it owns miners, platforms, lenders, and other businesses whose profits rise and fall with crypto prices.

The crypto winter began on November 10, 2021, and lasted through June 20, when Bitcoin and Ethereum reached lows. BITQ followed the two top tokens over the period.

Bitcoin and Ethereum have recovered since the June lows

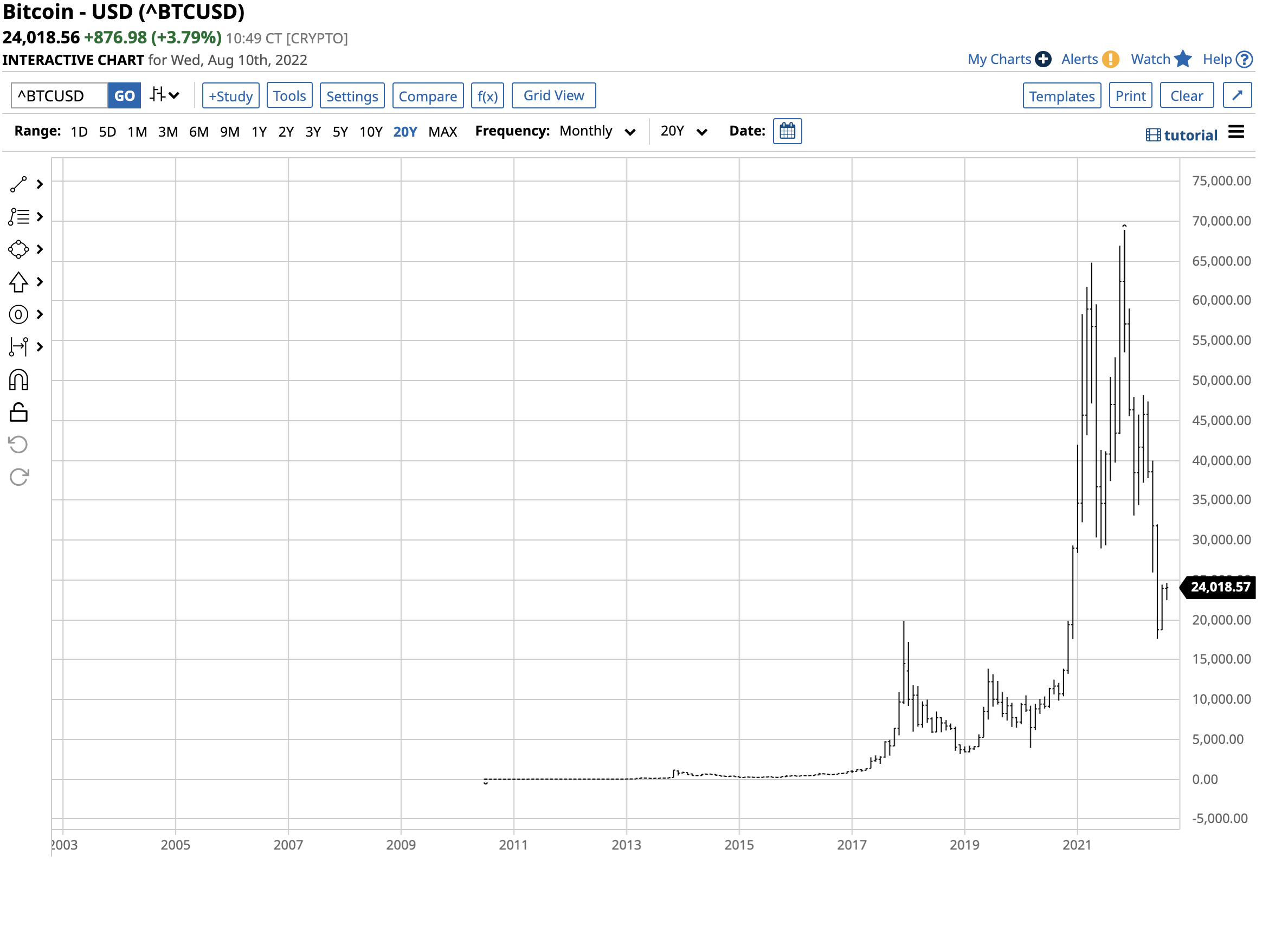

Bitcoin’s decline from $68,906.48 on November 10, 2021, to $17,614.34 on June 20 took the leading cryptocurrency 74.4% lower.

The chart shows Bitcoin made lower highs and lower lows from late 2021 through June 2022. Over the past weeks, the leading cryptocurrency has made higher lows, and higher highs as a recovery is underway.

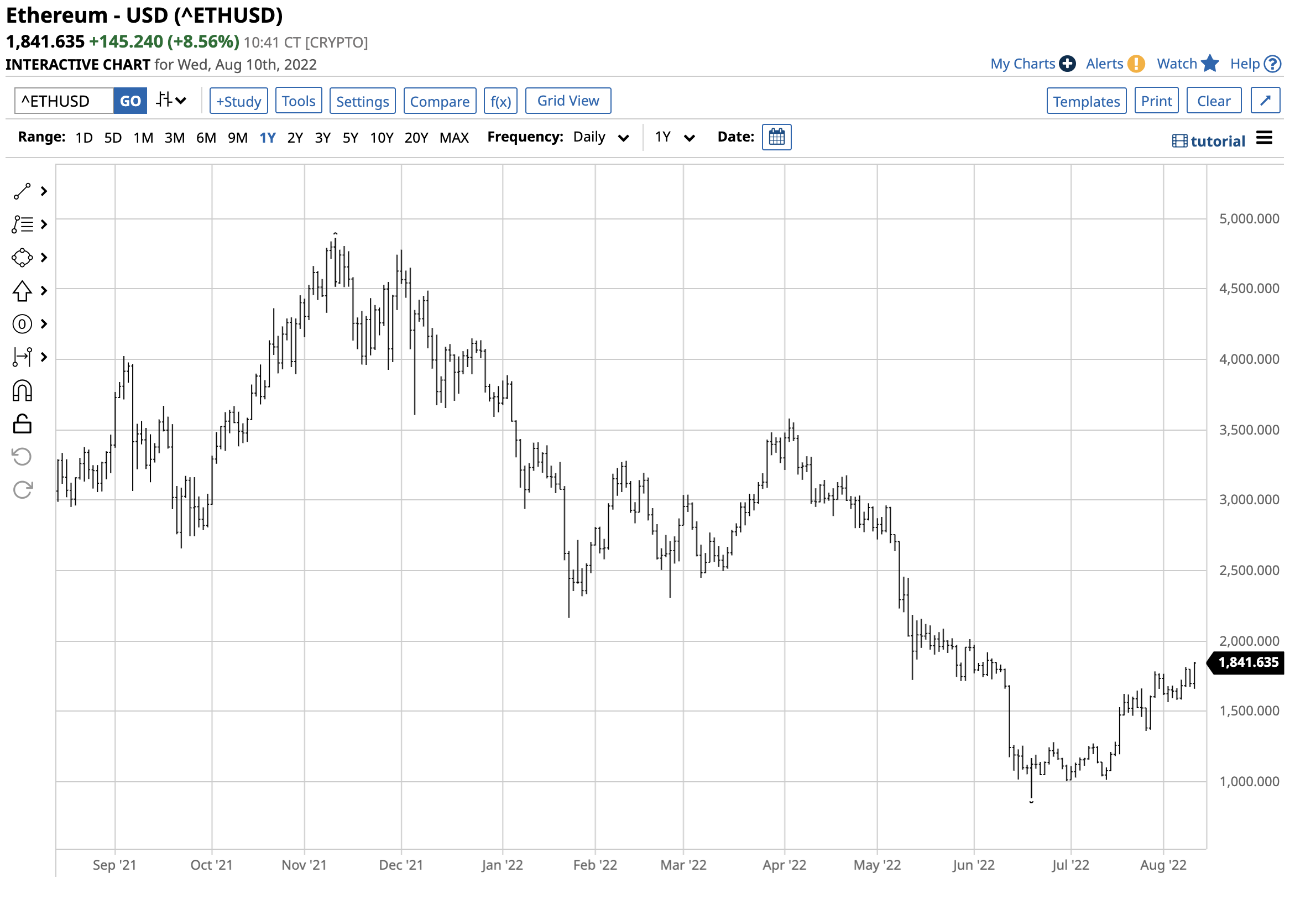

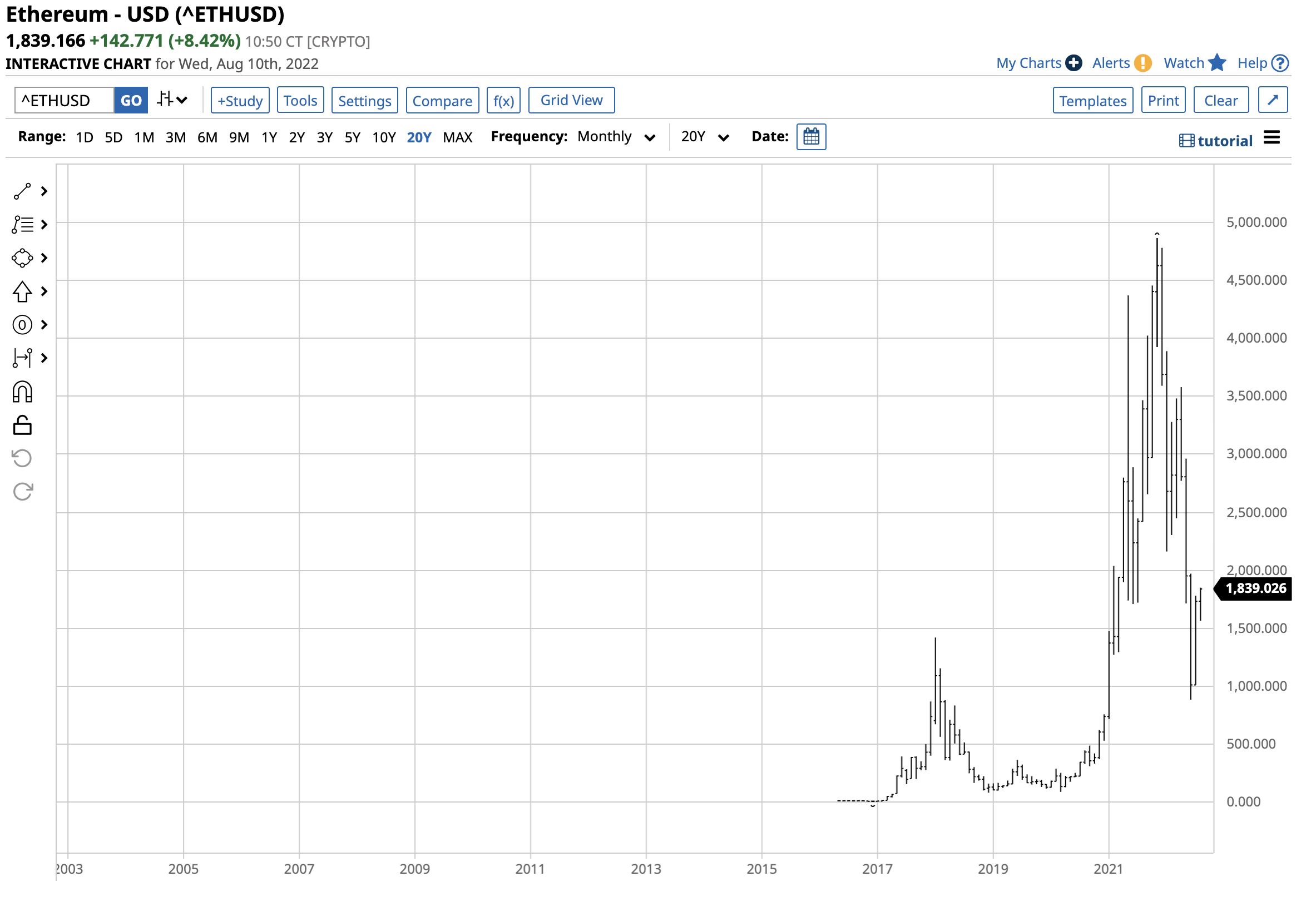

Ethereum, the second-leading crypto, did even worse during the crypto winter and has outperformed Bitcoin during the recovery.

Ethereum fell from $4,865.426 to $883.159 during the same period, an 81.8% decline. The price was nearly double the level at the June 20 low as Ethereum has made higher lows and higher highs over the past weeks.

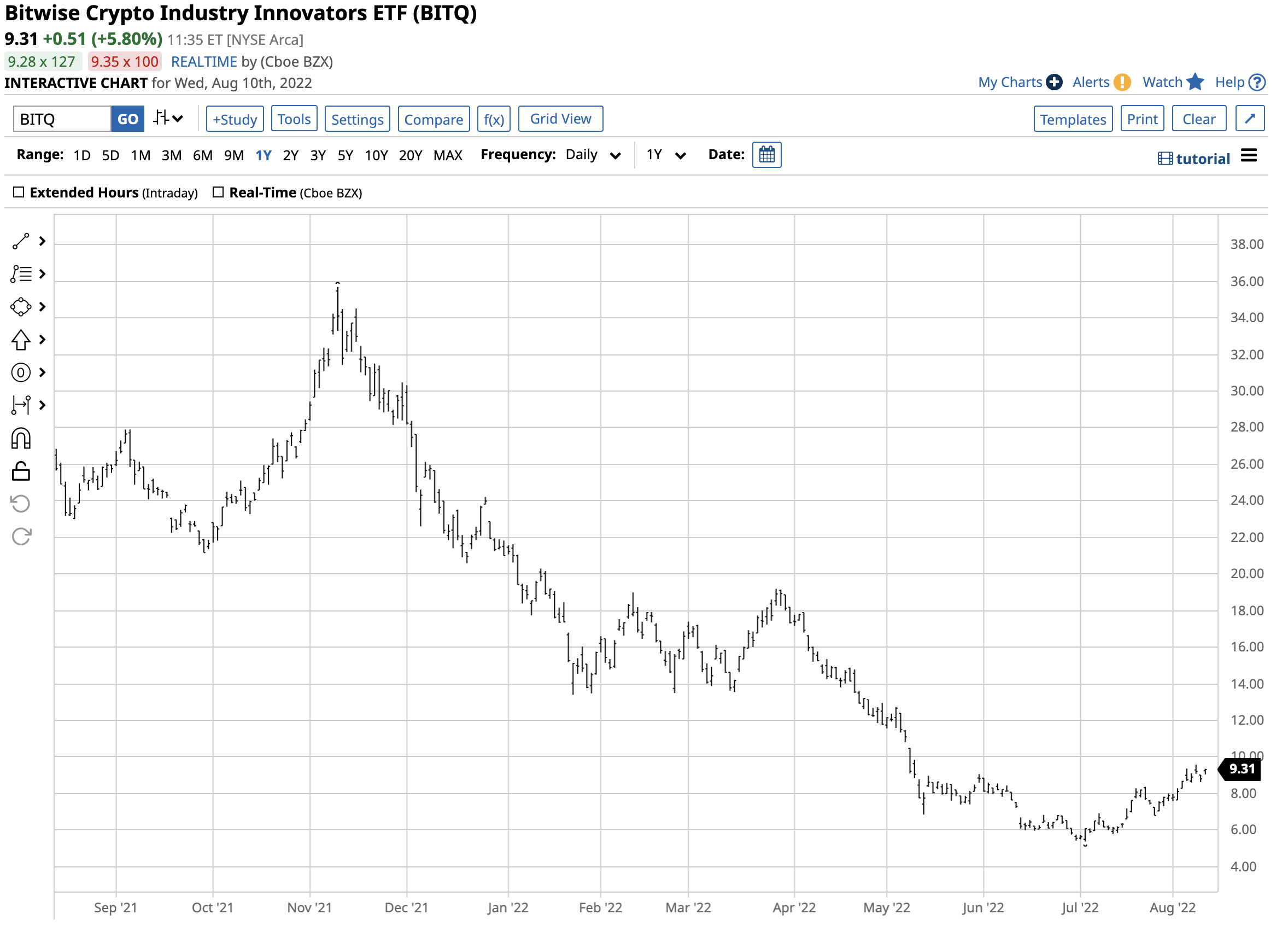

BITQ followed like an obedient puppy

The Bitwise Crypto Industry Innovators ETF product (BITQ) peaked the day before Bitcoin and Ethereum reached record highs and reversed to the downside.

The chart highlights the decline from $35.68 on November 9, 2021, to a low of $5.39 per share on July 5, 2022, an 84.9% drop. At the $9.31 level on August 10, the BITQ ETF recovered 72.7% from the early July low.

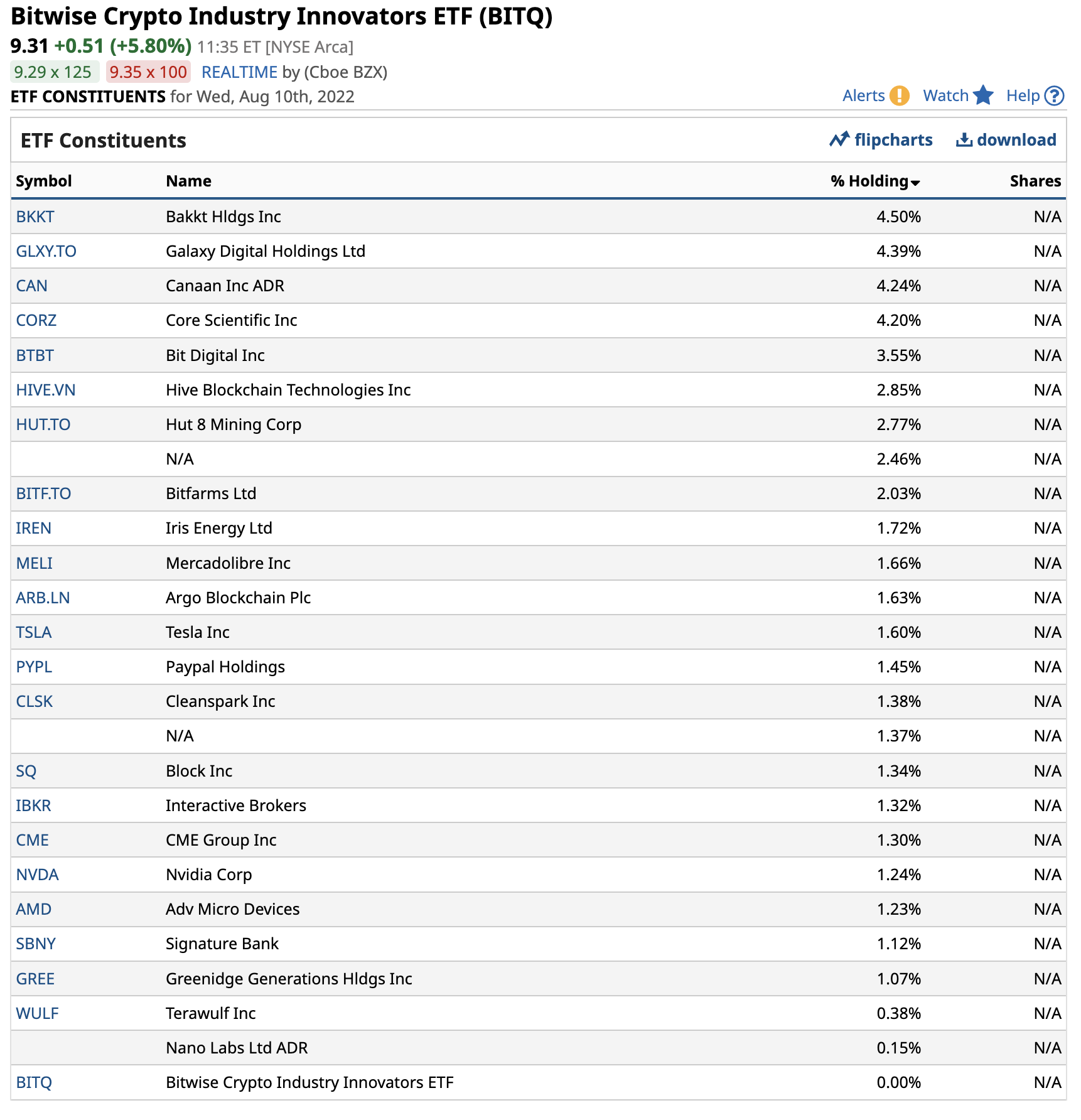

The top holdings in Bitcoin soup

At $9.31, the BITQ ETF had $78.93 million in assets under management. BITQ trades an average of 156,720 shares daily and charges a 0.85% management fee. The top holdings of the ETF include:

BITQ’s administrators invest in companies they believe lead the “rapidly emerging crypto economy.”

A cleansing in the asset class

The crypto winter caused lots of financial stress. Latecomers who purchased tokens in late 2021 when Bitcoin, Ethereum, and many other of the constantly increasing number of cryptocurrencies were moving towards the record high and the asset class’s market cap moved above the $3 trillion level saw the value of their investments evaporate. Meanwhile, some leveraged companies and a hedge fund have filed for Chapter 11 protection. Voyager and Celsius, two crypto lending platforms, went bankrupt, and the 3AC hedge fund went bust. 3AC had managed about $10 billion before leverage caused its capital to disappear along with its founders.

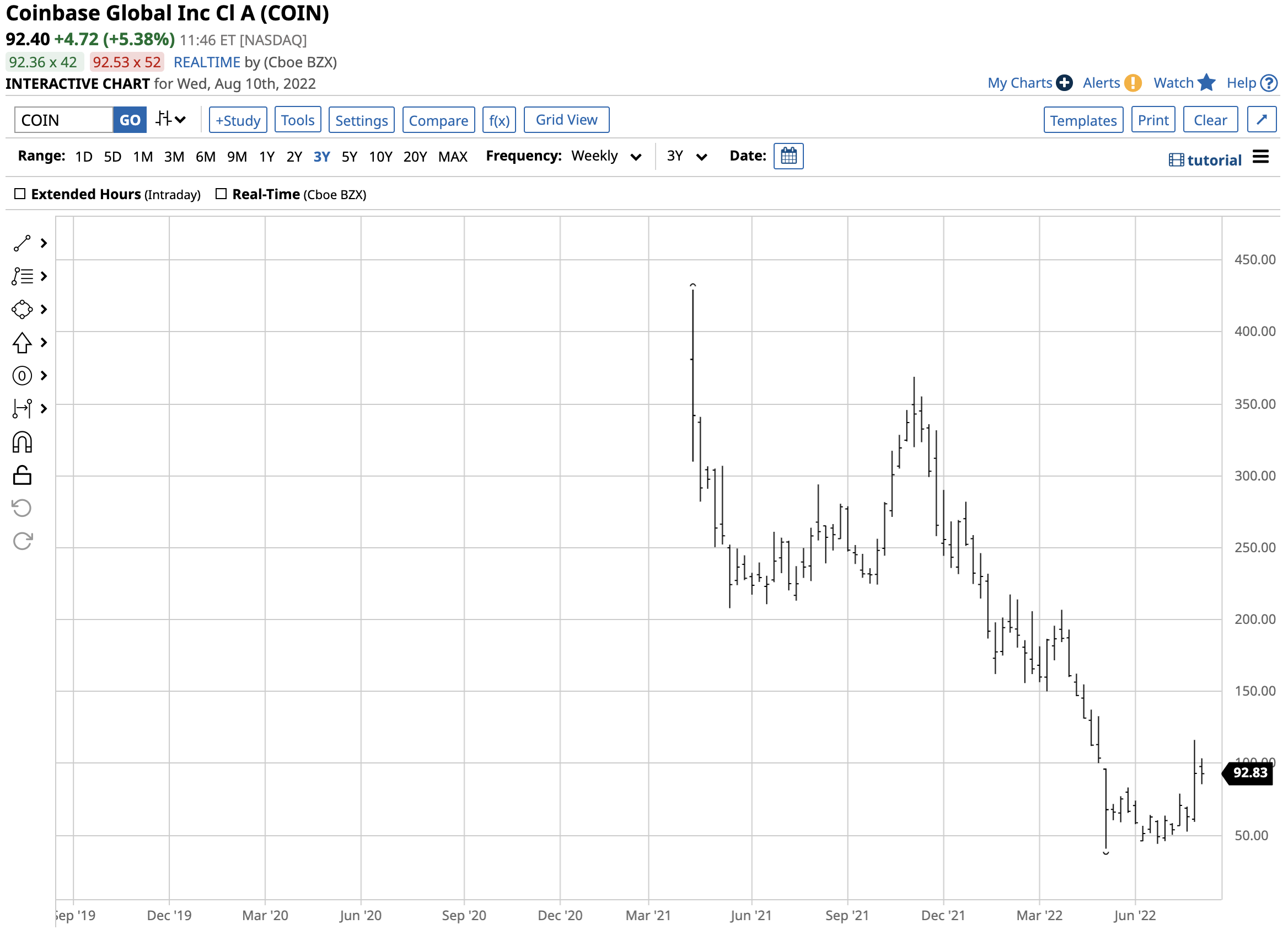

Severe market corrections can serve as a cleansing, forcing out the weaker and highly leveraged players. Shares in Coinbase (COIN), a leading publicly traded crypto platform, moved steadily lower since the April 2021 NASDAQ listing.

The chart shows the decline from $429.54 on the listing day to a low of $40.83 in early May 2022. Famed short seller Jim Chanos sold the stock short at much higher levels as he felt the shares were “tremendously overvalued,” and fee compression in the crypto market did not support a recovery. Meanwhile, after reaching a low of nearly one-tenth of the April 2021 high, COIN shares turned around and were at $92.40 per share on August 10. The recovery in cryptos helped push the shares high, but a partnership with investment giant Blackrock (BLK) turbocharged the COIN recovery. BLK has a market cap of over $105.5 billion.

The upside potential is exciting if history repeats

The crypto winter sent Bitcoin 74.4% lower, and Ethereum plunged 81.8%. The declines caused bankruptcies and left even the most committed cryptocurrency supporters licking their financial wounds. However, the corrections were nothing new for the volatile asset class.

The long-term Bitcoin chart illustrates the decline from the December 2017 $19,862 high to $3,158.10 in December 2018. Over the period, Bitcoin dropped over 84%.

Ethereum fell from $1,419.975 in January 2018 to $82.408 in December 2018 or 94.2%. The percentage losses during the recent crypto winter were smaller than in 2018.

Volatility can be a nightmare for passive investors, but it is a paradise of opportunities for nimble traders with their fingers on the pulse of markets. Trend-following in the crypto arena has been the optimal approach, given the explosive rallies and implosive corrections. If the asset class is on the verge of another explosive move higher, BITQ could be the optimal approach for market participants seeking exposure without owning the tokens.

More Crypto News from Barchart

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)