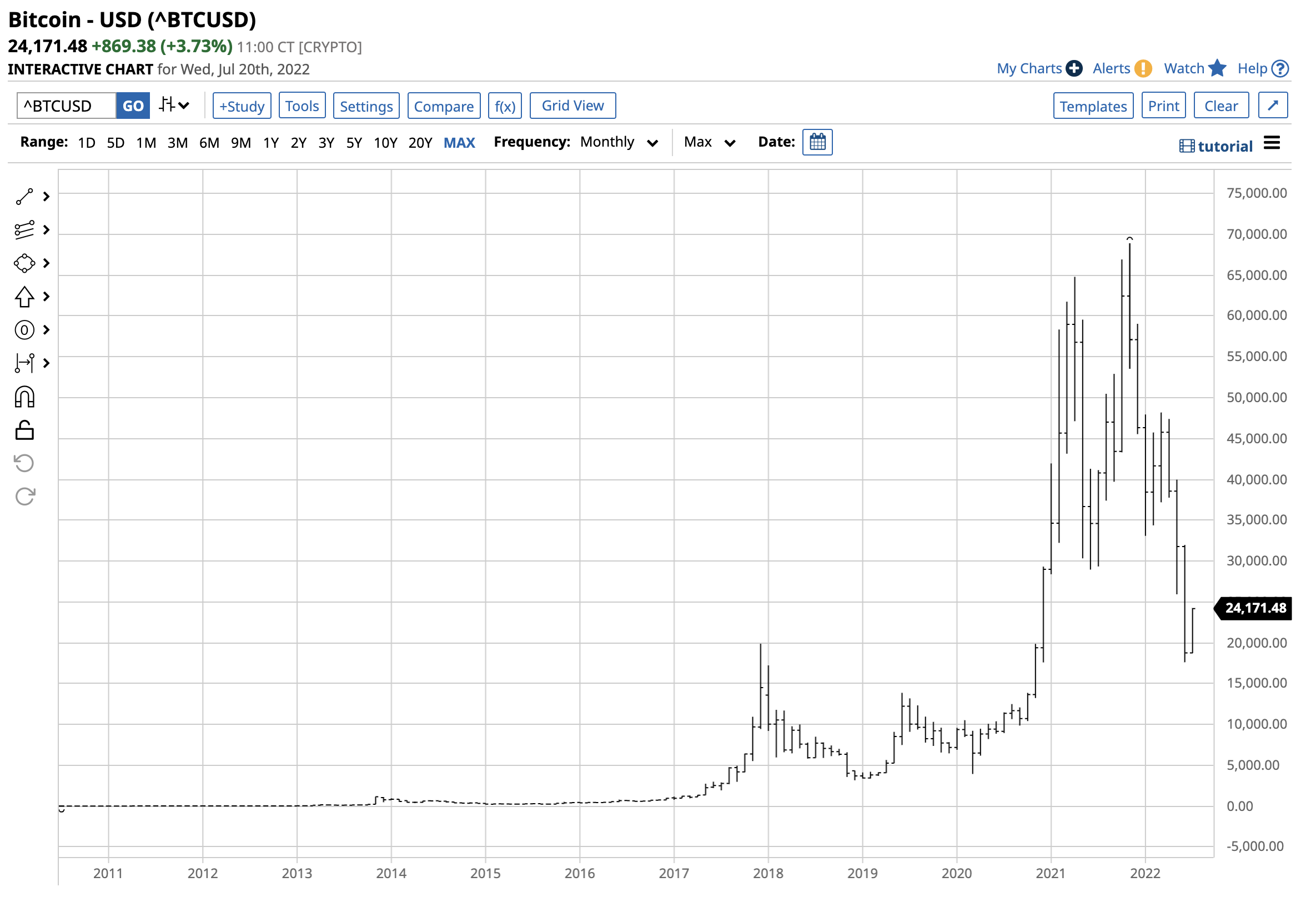

Bitcoin reached $68,906.48 late last year when it put in a bearish key reversal pattern on the daily chart. Since then, the price has made lower highs and lower lows, falling to below $17,620 before recovering to the $24,000 level on July 20. While many crypto devotees were calling for $100,000 Bitcoin in 2021, today, the consensus is that a decline to the $10,000 level is in the cards for the crypto that has 42.1% of the asset class’s market cap. Meanwhile, the total market cap declined from over $3 to just over $1 trillion over the past eight months, with Bitcoin valued at $461 billion.

The implosive price action has caused losses for many late comers and has left a trail of bankruptcies in its path. Cleaning out the weaker crypto-related businesses could be a blessing in disguise for the futures of the currencies that challenge the world’s existing government-controlled exchange instruments and money supply.

A price implosion, but early buyers still have substantial profits

Bitcoin traded at five cents per token twelve years ago in 2010.

The chart highlights at $24,171.48 per token, a $1 investment in the leading cryptocurrency at the 2010 low was worth over $483,000 on July 20. At the high, those 20 tokens had a value of over $1.378 million. While the early buyers still had a substantial profit, they suffered a significant opportunity loss.

Many buyers are on the sidelines waiting for the market to turn

The trend is always your best friend in markets, and it turned decidedly lower on November 21 when Bitcoin and Ethereum put in bearish key reversal patterns on the daily charts.

Any market participant that bought the Bitcoin dip at $60,000, $50,000, $40,000, $30,000, or $25,000 per token ran into a falling knife. Most investors and traders are waiting for a sign that the trend has turned, but as of July 20, the path of least resistance remains lower. Meanwhile, the cryptocurrency news has scared away potential buyers over the past weeks and months.

Bankruptcies abound in the crypto world

Three Arrows Capital (3AC) is currently the leading casualty of the collapse of cryptocurrencies. The fund filed for Chapter 11 protection with losses that could total over $1 billion.

Voyager Digital Ltd., a crypto lending platform, filed for bankruptcy after halting or limiting customer withdrawals. Celsius Network, a crypto trading and loan company, also filed for bankruptcy one month after stopping its customers from withdrawing funds.

While Coinbase (COIN), a leading publicly traded crypto exchange, remains solvent, the shares declined from $429.54 on its listing day to the $77 per share level on July 20. Bitcoin fell 64% from the November 21, 2022, all-time peak, while COIN shares lost over 82% of their value since the April 2021 high.

The issue facing the platforms and cryptocurrency-related businesses is the lack of regulatory oversight. Many customers assumed that the platforms and lenders were cryptocurrency banks, but they did not have the insurance that protects market participants that left balances with the companies. In a recent filing, Coinbase (COIN) disclosed that cryptocurrencies held in custodial accounts were not protected from bankruptcy proceedings, and those balances could be considered assets of the company during Chapter 11 filings.

Volatility can be dangerous, but it creates opportunities

Price variance in the cryptocurrency arena is unprecedented. The rise of Bitcoin from five cents to nearly $69,000 per token and even at over $24,000 on July 20 separates the leading crypto from almost all other asset classes. The incredible rewards have had a magnetic impact on investors and traders looking to turn a few bucks into a life-altering fortune.

Those who came late to the Bitcoin party learned a dangerous lesson that the potential for substantial rewards comes with commensurate risks. Over the past weeks, since mid-June 2022, Bitcoin had traded around the $20,000 per token level, with a low of $17,614.34 on June 20 and a high of $22,706.41 on July 18. The midpoint of $20,160.38 had been the pivot point for the leading cryptocurrency. Bitcoin moved to the highest level since June 13 on July 20, which could be a sign that the bearish trend is ending.

An investment in Bitcoin at the current price is a lot more attractive from a risk-reward perspective than at the November 2021 high. However, the risk remains high for Bitcoin and the other over 20,250 tokens in the highly volatile asset class.

Only invest capital that you are willing to lose

When considering an investment in Bitcoin or any cryptocurrency, the downside risk is zero. There is a potential for investors to wake up one day and find that the value has evaporated, and the capital invested is worthless.

Meanwhile, the past price action suggests that another price surge is possible for the asset class that is an emerging alternative to the traditional currency instruments. Fiat currencies like the dollar, euro, yen, pound, and most others derive value from the full faith and credit of the countries that issue the legal tender. Crypto values come exclusively from the bids to buy and offers to sell in the marketplace. However, governments like China have banned cryptocurrency trading and investing. If other countries follow the Chinese, the asset class will become illegal and an “underground” asset, limiting liquidity and impacting values.

Only invest capital that you are willing to lose in any cryptocurrency. The recent bankruptcies left many investors and traders who believed they had a valuable stash of cryptos holding an empty bag. Any investment in cryptos requires the understanding that 100% of the purchase is at risk. The potential for oversized rewards comes with a price tag of substantial risks. Understanding the risk-reward dynamics is the first and most critical step for anyone considering dipping a toe in the crypto arena at any price level.

More Crypto News from Barchart

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)