The overall commodities asset class declined by 6.27% in Q2 2022 but was still 8.74% above the level at the end of 2021. Meanwhile, a composite of live and feeder cattle and lean hog futures prices rose 3.31% from April 1 through June 30, 2022. Within the sector, the feeders and lean hogs rose by over 7%, while fat or live cattle prices slid by just under 5%.

Over the first six months of 2022, the meat sector was 10.96% higher than at the end of 2021.

Live cattle futures edged lower in Q1 and declined in Q2

Nearby live cattle futures fell by 4.88% in Q2 and were 5.10% lower over the first six months of 2022.

The chart highlights the steady to weak price action in the live cattle futures arena over the past six months. Live cattle futures came out of the gate with a rally on July 1, 2022. After settling at the $1.32575 per pound level on June 30, the August futures contract was above $1.3450 on the first day of Q3.

The feeder cattle futures rallied in Q2 after a Q1 loss

The nearby feeder cattle futures rose 7.56% in Q2, erasing the loss from Q1. The feeders were 4.03% higher over the first half of 2022.

The chart shows the bullish price action in nearby feeder cattle futures. The August contract settled at $1.7360 per pound on June 30. Corn futures edged 0.67% lower in Q2, which supported the feeders as corn is an input in raising the animals. The August feeders were higher at the $1.7450 level on July 1.

The bullish price action in hogs continued after a substantial gain in Q1

Pork demand remains robust, pushing nearby lean hog futures 7.25% higher in Q2. Over the first six months of 2022, lean hogs led the animal protein sector higher with a 33.94% gain.

Lean hog futures moved higher in Q1 and Q2 as the meat markets moved into the peak demand season that began in late May. Expiring July futures settled at $1.09125 on June 30, with the August futures at the $1.0210 level. The August futures were higher at near $1.03 per pound on July 1.

Inflation causes higher input costs

Inflationary pressures continue to underpin all commodity prices, and meats are no exception. Grains are the primary ingredient in animal feeds. In Q2, a composite of the grain sector moved 3.46% lower, but it was 14.65% higher over the first half of this year. Energy, another input factor, was 6.77% higher in Q2 and moved 43.86% above the level at the end of 2021. Labor, financing, and other expenses also increased, making total production costs rise. Higher input prices lead to higher meat prices.

In Q3 and Q4, the meat markets will move past the peak demand season during the summer months. Meat prices tend to move lower in September and October, but 2022 is anything but an ordinary year.

Pork is a less expensive alternative for consumers- The live cattle-lean hog spread shows that pork is more popular in the current environment

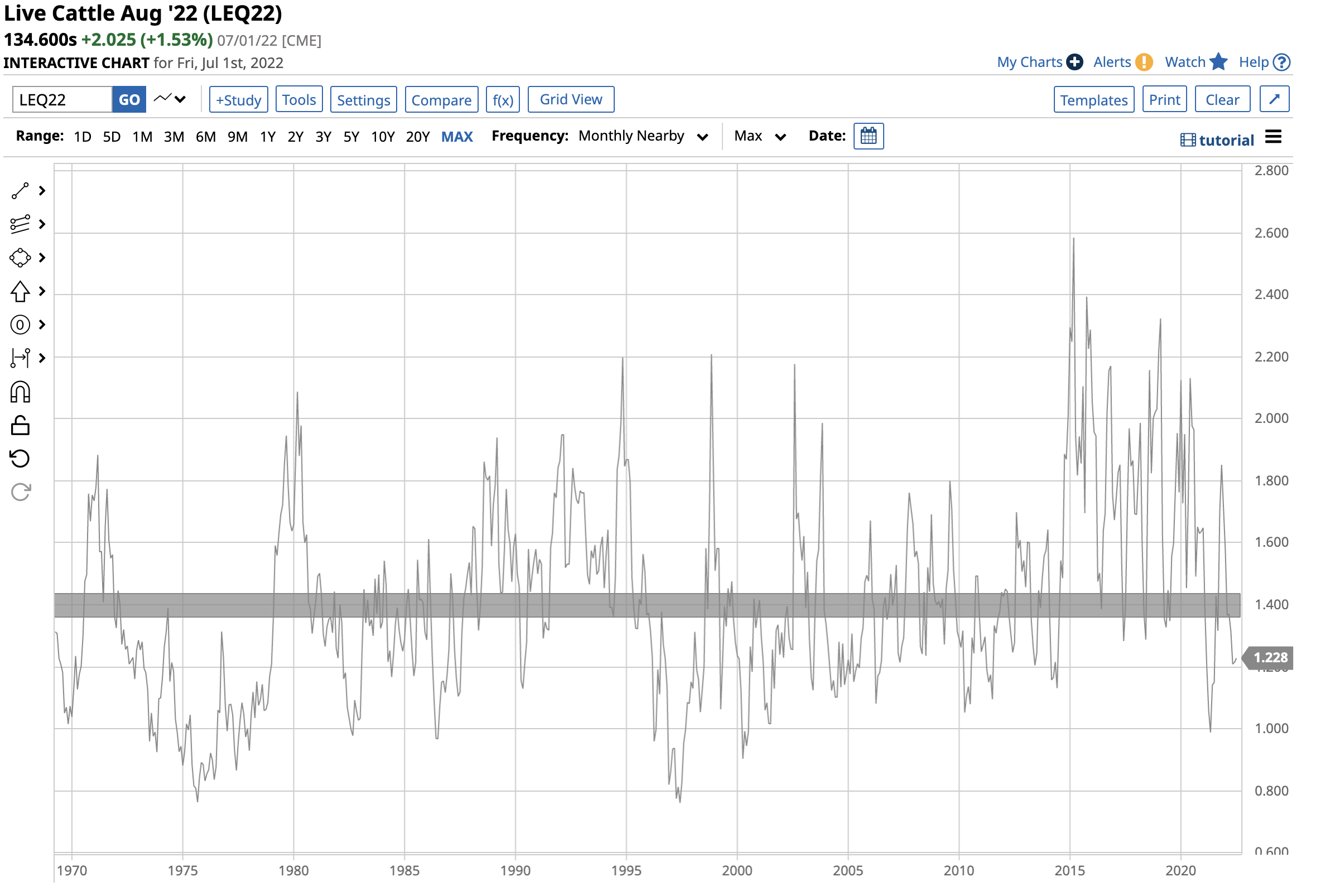

Pork has outperformed beef in 2022 as the nominal price of hogs is lower than cattle. Consumers facing rising energy and other costs watch their pennies, making pork more attractive than beef for dinner tables. Meanwhile, pork is historically expensive compared to beef at the current prices. August cattle and hog futures prices settled at $1.32575 and $1.0210 per pound on June 30, 2022. The long-term average for the live cattle versus lean hog futures spread is around the 1.4 pounds of pork in each pound of beef level.

The chart dating back to the late 1960s ({LEQ22}/{HEQ22}) shows the long-term average at the 1.4:1 level. Based on the August closing prices at the end of Q2, it stood at 1.2985:1, below the average, making pork historically expensive compared to beef. Meanwhile, the lower nominal price supports pork as consumers look to save money on their grocery baskets.

As we move into the second half of 2022, grain and energy prices will influence the meat futures markets. The price action on July 1 could be a sign that higher prices are on the horizon, but meats could run into selling later this summer as the market faces the end of the peak grilling season.

More Livestock News from Barchart

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)