With the war between Russia and Ukraine at Europe’s doorstep and NATO’s support for Ukraine, it is no surprise that the European economy is suffering. The euro currency has been working toward parity against the US dollar, a level not seen since 2002.

The dollar index’s rise reflects the dollar’s strength against other reserve currencies, but it masks the significant change in the global economy in 2022. Vladimir Lenin, the first Soviet leader, said, “There are decades where nothing happens, and there are weeks when decades happen.” In 2022, the geopolitical events have been so dramatic that we may look back at the period as months where centuries occurred.

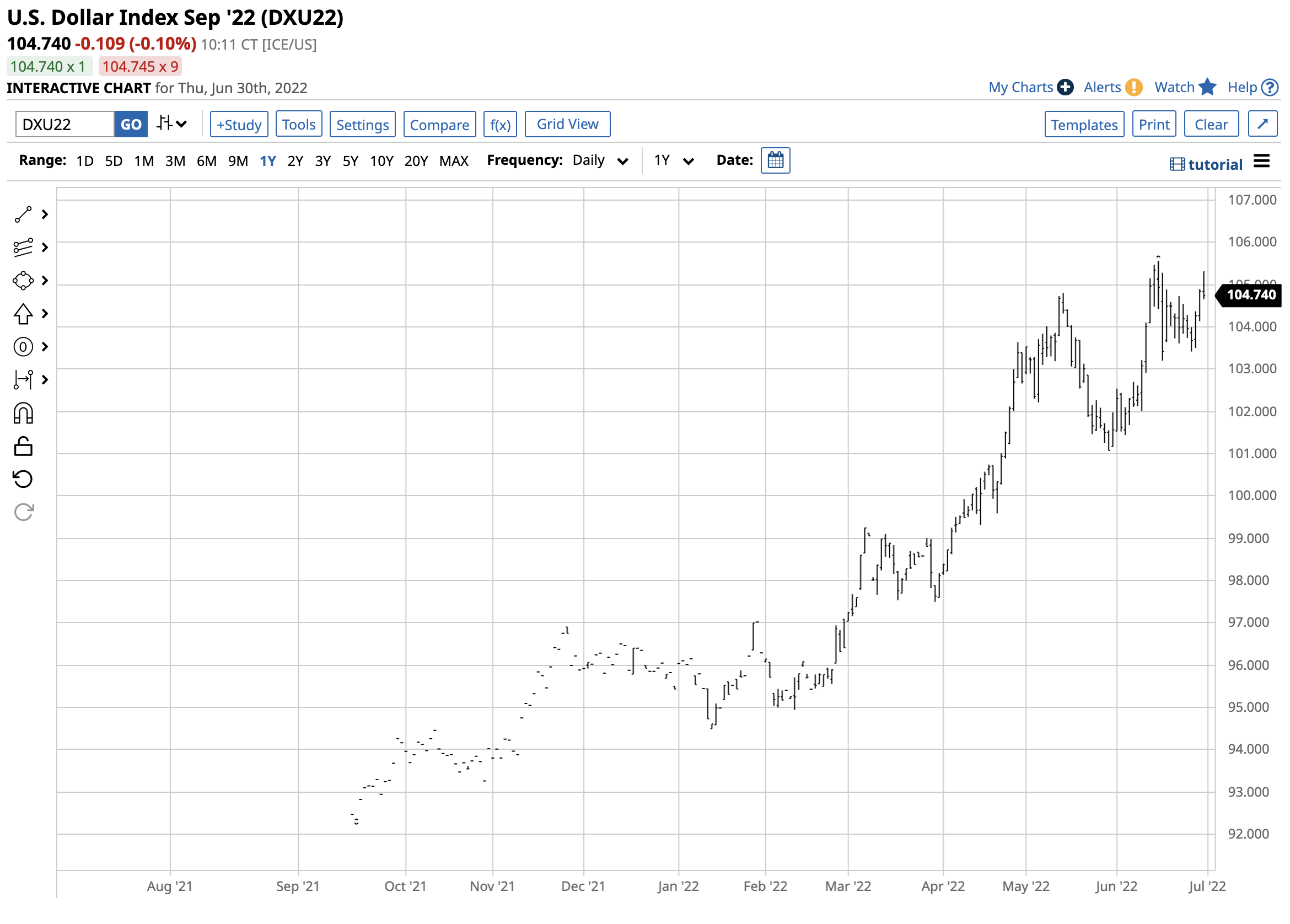

The bullish trend in the dollar index continues

The latest bullish leg in the continuous US dollar index futures contract began in January 2021 when it found a bottom at the 89.165 level.

The chart highlights the move from 89.165 to the most recent 105.565 high, an 18.54% rise in eighteen months.

Meanwhile, the long-term chart shows the dollar index’s bull market dates back to the April 2008 71.05 low. Since then, the US dollar has made higher lows and higher highs as the dollar have gained against the other world reserve currencies. The latest leg higher came as inflationary pressures mounted, causing the central bank to tighten monetary policy. Interest rate differentials are one of the primary factors for the path of least resistance of one reserve currency against the others.

An early February handshake changed the global landscape

On February 4, 2022, at the Beijing Olympics opening ceremonies, Russian President Putin and Chinese leader Xi shook hands on a “no-limits” alliance. Russian troops stormed into Ukraine when the games ended, starting the first major European war since WW II.

Russia considers Ukraine Western Russia, while the US and NATO support sovereignty as an independent Eastern European country. Meanwhile, as the war rages on, China is watching the developments closely as they have a similar position on Taiwan.

The bottom line is that the Beijing handshake set the stage for significant geopolitical bifurcation as countries pick sides and tensions mount.

Bifurcation impacts the worldwide economy

The political divisions will have a substantial impact on the global economy. Sanctions in Russia and Russian retaliation affect the flow of energy and other commodities worldwide. Moreover, a growing number of neutral countries are seeking NATO membership, including Sweden and Finland, that border the Russian Federation.

NATO members continue to supply Ukraine with arms and monetary support, and Russia is limiting energy flows to “unfriendly” countries dependent on Russian oil and gas. Moreover, Russia and Ukraine are Europe’s breadbasket, which will likely impact worldwide food supplies, causing shortages and record-high prices.

All the currencies in the dollar index belong to countries allied against Russian aggression. Meanwhile, the BRICS countries, including Brazil, Russia, India, China, and South Africa, are not objecting to President Putin’s expansionary aspirations. Brazil is South America’s leading economy and a leading commodity producer. India is the world’s second-most populous country with the world’s sixth-leading economy. South Africa is a top raw material producer.

China looks to increase its sphere of influence

In late June, at the virtual BRICS summit, Chinese President Xi said, “to politicize the global economy and turn it into one’s tool or weapon, and willfully impose sanctions by using one’s primary position in the international financial and monetary systems will only end up hurting one’s own interests as well as those of others and inflict suffering on everyone.” The Russian leader said trade between the Russian Federation and the BRICS countries increased by 38% to reach $45 billion in the first quarter of 2022.

China has been working to gain influence with the BRICS countries, along with efforts to bring Mexico, Saudi Arabia, and Turkey into the fold. While the dollar index reflects one part of the global currency market, an expanding alliance including these countries could challenge the West militarily and economically.

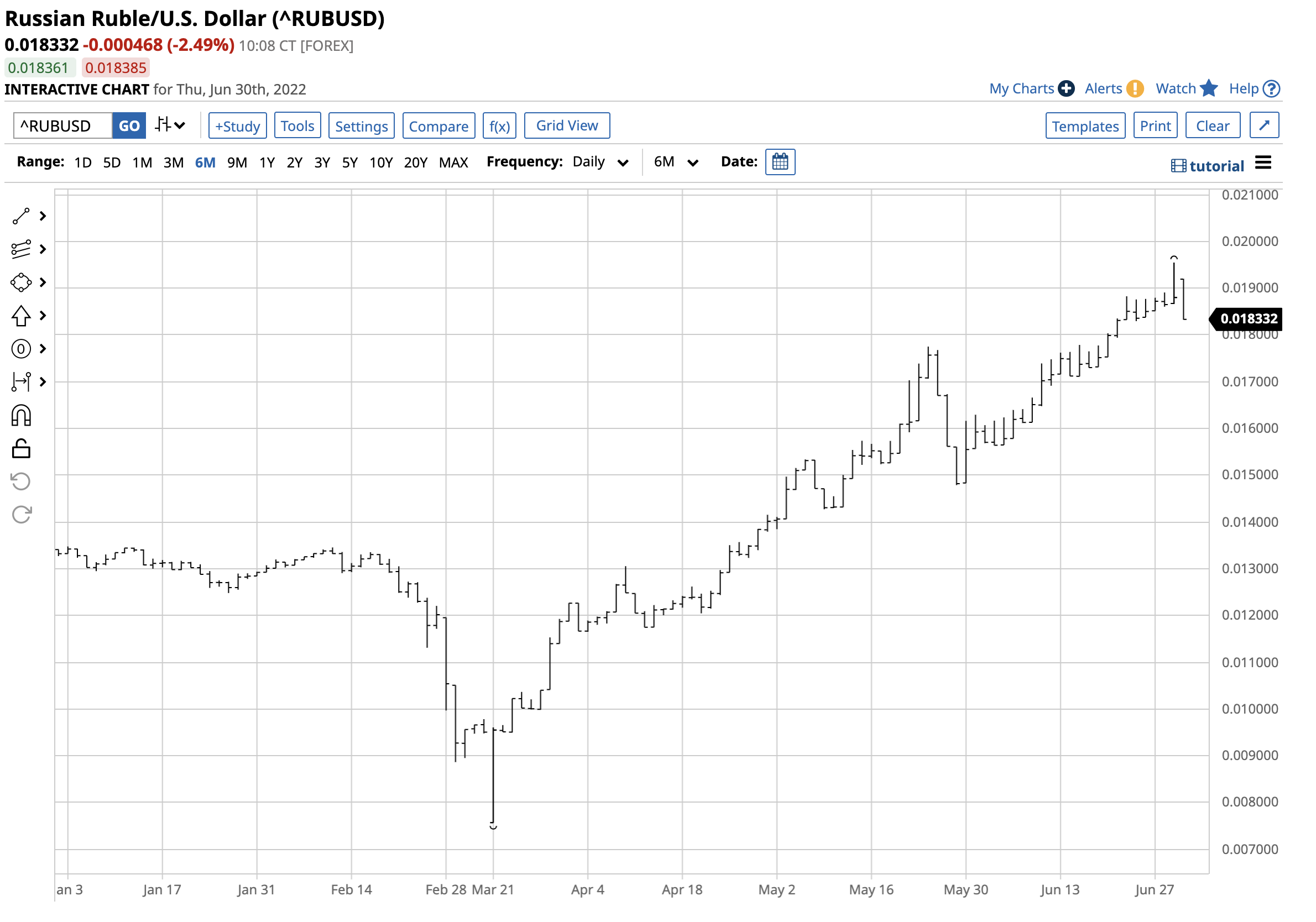

The move in the Russian rouble says the dollar index could be losing its status

Sanctions on Russia have not caused a collapse in the Russian economy based on the price action in the Russian rouble. Russia decided to back its currency with gold, declaring that 5,000 roubles are exchangeable for one gram of gold. The Russian rouble reached a low on March 21. On that day, the US dollar index traded to a low of 98.

The chart shows that at 104.740 on June 30, the dollar index moved 6.9% higher.

Meanwhile, the currency relationship between the US and Russian currencies moved from $0.00757 on March 21 to $0.018332 on June 30, an over 142% gain over the period.

The dollar may be the best performing fiat currency in the western reserve currency alliance, but the move in the rouble and a growing coalition expanding Russia and China’s “no-limits” support is a sign that the dollar index is not global but a bifurcated currency instrument with declining significance in a very turbulent world.

More Forex News from Barchart

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)