These 3 well-known tech stocks are simply too cheap. Their forecast earnings growth is still strong and the stocks have low P/E ratios - well below their historical averages. The market has pummeled them too much. We also discuss some call option strategies with them. The three stocks are:

- Microsoft (MSFT) - This global software company's earnings are still forecast to grow over 15% to the year ending June 30, 2023, but the stock is inexpensive at just 23.6x earnings with a 1.0% dividend yield.

- Micro Focus Int'l Plc (MFGP) - This enterprise software company is very inexpensive right now trading at just 2.8 times EPS for the year ending Oct. 2022 and 3x the year to Oct. 2023. Moreover, given its 6.94% yield, the stock is likely to move higher over the next 12 months.

- Oracle (ORCL) - Earnings at this cloud platform and software company are forecast to rise 12.3% in 2023, putting ORCL stock on a cheap forward multiple of just 11.8x earnings. With its buybacks and a dividend yield of 1.86%, ORCL stock is too cheap to ignore.

Let's take a look at these tech stocks.

Microsoft (MSFT)

Microsoft has been hit hard along with other large-cap tech stocks. As of June 17 at $249.22, MSFT stock is down 25.9% year-to-date from $336.82, where it ended in 2021. Moreover, it’s down 28.9% from its peak of $343.11 on Nov. 19, 2021.

But MSFT’s earnings are forecast to rise by 15.5% this year (ending June 30, 2022) to $9.30 per share, up from $8.05 in 2021. Moreover, next year’s earnings will be up another 15.5% to $10.74.

Therefore, MSFT stock is trading for just 22.7 times earnings. That is well below its historical 5-year forward P/E average of 27.96x, according to Morningstar.

Moreover, Microsoft’s buyback and dividend program rose by 25%. It spent $12.5 billion on dividends and share repurchases. At this pace, it could spend $50 billion per year or 2.76% of its market cap on return of capital. That will act as a significant catalyst helping to push MSFT higher over the next year.

Analysts project its 12-month price target will be $353.67, up 42.8%. One way to play this is to buy MSFT call options three months forward.

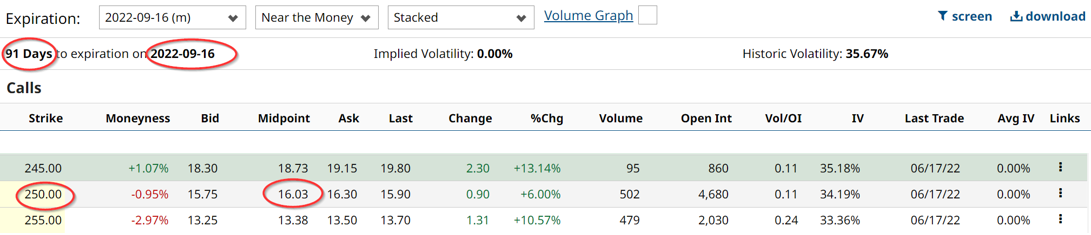

For example, this Barchart option table above shows that the Sept. 16 calls at-the-money price of $250 trades for $16.03. This means you can gain 15 times leverage for your money since the price of MSFT at $247.65 is over 15 times the premium price of $16.03.

If you hold this call until expiration the price of MSFT has to rise to $266.03 or 7.42% higher than its price today of $247.65. That seems like a pretty good bet, given how low MSFT is valued today and its price target of $353 per share.

Micro Focus Int'l Plc (MFGP)

Micro Focus is an international enterprise software company based in the UK and is one of the world’s largest enterprise software companies.

Its revenue fell in the year to Oct. 31, 2021, to $2.9 billion, down from $3 billion. But analysts project a higher EPS at $1.47 per share vs. $1.44 for the October 2022 year.

2023 earnings are forecast to dip slightly to $1.38. As a result, MFGP has a very low price-to-earnings (P/E) multiple of just 2.84x for the Oct. 2022 year and 3x for October 2023.

Moreover, it pays two dividends a year, most of which come in the final dividend. But it seems to average about 28 cents to 29 cents annually. That gives MFGP stock a high 6.8% dividend yield at today’s price of $4.22 as of June 17.

Oracle (ORCL)

Oracle is very cheap. Earnings at this cloud platform and software company are forecast to rise 12.3% to $5.93 per share in 2023.

That makes ORCL stock, at $67.72 on June 17, cheap at just 13x earnings. That is well below its 15x average forward multiple in the last 5 years, according to Morningstar.

Oracle's recent fiscal Q4 earnings showed revenue up 5%. This was mostly from cloud services and support, up 19% YOY. Its non-GAAP EPS was $4.9, also up 5% YOY.

So far there is no downturn in earnings on the horizon. Analysts are still very positive about its future earnings forecasts.

Oracle spent $674 million in its fiscal Q4 on share buybacks, according to Seeking Alpha. That works out to an annualized rate of $2.7 billion or 1.58% of its $171 billion market valuation.

Combined with its dividend yield of 1.84%, this means shareholders get a total yield of 3.44%. Analysts surveyed by TipRanks expect it will rise 29% to $88.71 over the next 12 months.

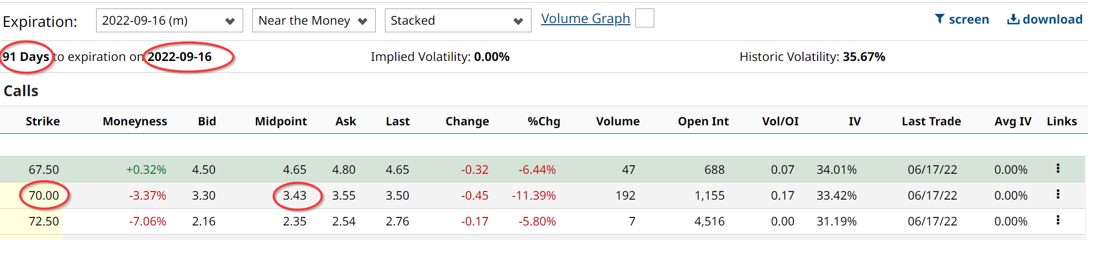

One way to play this is with a 3 month forward call option that trades for just $3.43.

The table above shows that the midpoint price of the Sept. 16 $70 call price is just $3.43. This gives the investor a leverage factor of almost 20 times the stock price of $67.72 today.

So, if you hold the calls until expiration (which most people won't) the stock has to rise to $73.43, or 8.43% more. That seems like a pretty good bet given that its price target is $88.71 from analysts.

The call price could easily move higher depending on the volatility of the underlying stock as well as the cost and time value of money (and vice versa). Given its yield, buybacks, earnings growth, and analysts' target price, this seems to be a good point to go long these calls.

More Stock Market News from Barchart

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)