- Although real estate experts claim that housing prices won’t correct significantly (if at all) for a long time, such a notion goes against fundamental realities.

- Homebuyers who were priced out of the market may be looking at much lower prices in the near future, though the circumstances are complicated due to economic concerns.

- Essentially, those who will benefit the most are buyers that are ready to buy in cash or have bulletproof income streams.

For prospective homebuyers dealing with unprecedented frustrations since the start of the COVID-19 pandemic, it’s difficult to contain outbursts of anger. As people gradually became acclimated to the new normal, housing prices went berserk, skyrocketing to one plateau after another. But for the patient folks unwilling to be pressured into the fear of missing out (FOMO), the Federal Reserve provided potential respite.

Following an unprecedented stimulus package totaling nearly $5 trillion, inflation became an inevitable headwind. To control surging prices (which of course are debilitating to an economy), the Fed has committed to removing the monetary punch bowl, instead replacing it with higher interest rate hikes. Under basic economic principles, as borrowing costs increase, demand for acquisitions – particularly large-scale ones like real estate – decrease.

However, buyers have yet to see significant declines in housing prices overall, leading some experts to state that those on the sidelines will likely be waiting for a while before prices depreciate significantly. The most probable outcome, according to this thesis, is that the housing appreciation rate will decline to normal rates of growth.

In other words, real estate prices will stay elevated but from here on out, the acceleration of prices will match that of historical norms since demand is supposedly still strong for housing. The implication, then, is that you should buy before prices rise even more.

Before you do that, though, you should consider the data.

Rising Rates are Fundamentally Deflationary

First, it’s interesting to note that the experts that say housing prices won’t decline for many, many years to come are those involved in the broader real estate industry. Clearly, a conflict of interest exists. Just like you wouldn’t trust the word of a used-car salesperson about a car they’re selling, you should take any ideas about the housing market from sector-related agents, brokers and attorneys with a huge grain of salt.

Second, historical data contradicts the notion that housing prices can continue rising amid the Fed’s commitment to raise benchmark interest rates. It’s just simple free market forces at work. A high and rising yield incentivizes savers, which is inherently deflationary. On the other hand, a low and declining yield incentivizes risk.

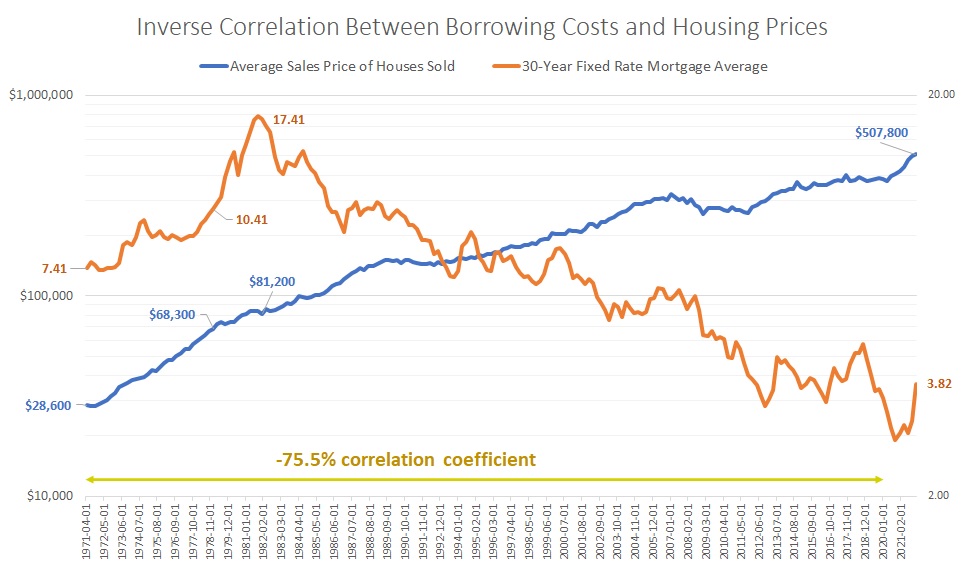

Therefore, we are moving into a risk-off environment, which is not conducive to escalating housing prices. Indeed, between the second quarter of 1971 through Q4 2019, the relationship between 30-year mortgage rates and housing prices registers as an inverse correlation coefficient of 75.5%.

Immediately, some might point to the direct correlation between rising rates and rising prices during the 1970s and early 1980s as evidence that the current housing bull run can continue upward. However, this assessment ignores demographic realities: during this time, baby boomers entered homebuying age.

Also, do note that the direct correlation didn’t last indefinitely. When mortgage rates soared above 10%, the acceleration of housing prices clearly declined. From the early 1980s onward until the COVID-19 pandemic, the intuitive inverse relationship won out: lower rates, higher home prices.

Not a Panacea

Although the prospect of higher rates finally deflating the unreasonable housing bubble might appear to be good news for embattled homebuyers, the shifting grounds isn’t necessarily a panacea. Largely, this is because the average U.S. consumer is in rough shape, having fired much of their ammo during the global health crisis.

Prior to the pandemic, the collective credit card balance of households totaled $930 billion, a staggering record tally. Following the influx of stimulus money, this balance declined to $841 billion, a 10% improvement which isn’t nothing, to be fair. However, consumers would have been better served prioritizing the elimination of this debt.

Instead, many folks apparently gambled their government funds in high-risk ventures like meme stocks and cryptocurrencies. The end result is that they’re facing a high interest-rate environment without realistic prospects of governmental support. Therefore, not everybody will be able to participate in reduced housing prices.

Additionally, the economy faces recession risks as consumers hunker down against dramatically soaring costs of everything from gasoline to groceries. Therefore, we should expect an increase in layoffs. Not surprisingly, companies related to the housing market like Redfin (RDFN) have handed many of their employees pink slips, disproving the notion that real estate is somehow insulated from rising rates.

Indeed, mortgage lenders will probably see the writing on the wall, reducing their loan application acceptance rate to only the most qualified. Therefore, unless you’re a cash buyer or have robust income streams, you might have difficulty picking up the discounts.

An Interesting Conundrum

While the last point might seem like a frustrating full-circle for prospective homebuyers, it’s possible that housing prices could decline sharper than many onlookers anticipate. The reality is that mortgage lenders aren’t stupid. There’s a reason why the real estate industry is unloading risk via layoffs and other downsizing efforts.

They see a recession coming. Under this framework, it’s too risky to conduct business as usual since the slicing and dicing can filter down to many other white-collar industries.

Therefore, the volume of qualified borrowers will, in my opinion, shrink considerably. In order to compensate, housing prices have to come down to match the new paradigm. Typically, though, prices overshoot before they reach equilibrium, which might be good news for buyers who really are qualified.

More Stock Market News from Barchart

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)