/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

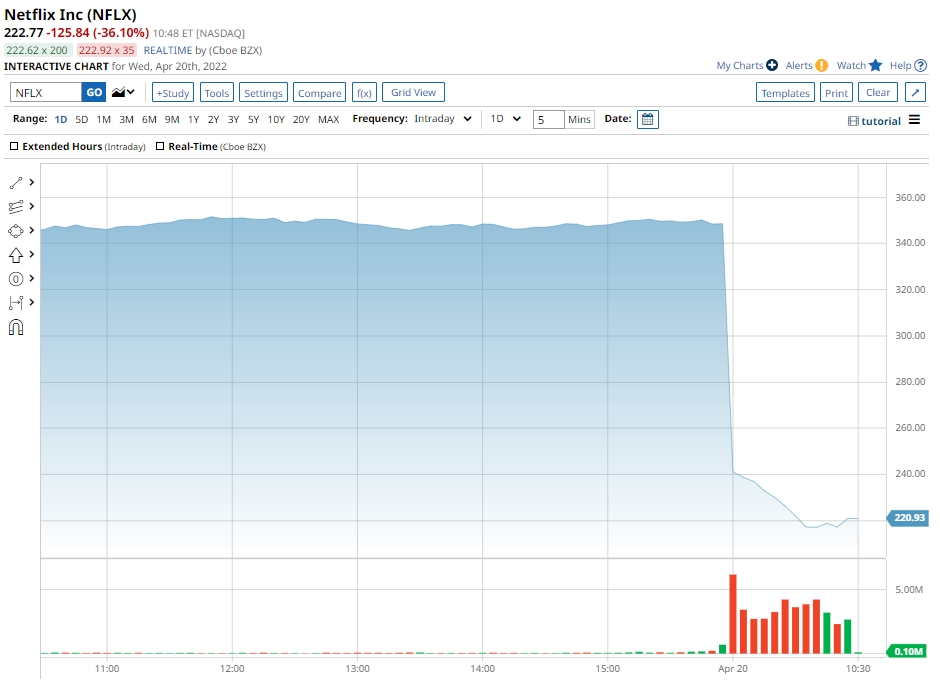

It’s a rough day for Netflix (NFLX). The granddaddy of streaming services stocks is down more than 35% this morning after the company’s disastrous earnings report, in which it reported its first contraction in years and warned the worst is yet to come.

Netflix announced that its customer base fell by 200,000 subscribers in the first quarter of 2022. It was the first time Netflix reported a net loss in subscribers in a decade.

Netflix further announced that it expects to lose 2 million more subscribers in the second quarter.

“Our revenue growth has slowed considerably,” the company said in a letter to shareholders. “Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration — when including the large number of households sharing accounts — combined with competition, is creating revenue growth headwinds.”

For the quarter, Netflix reported revenue of $7.87 billion, just missing the $7.93 billion that analysts projected. Earnings per share came in at $3.53, which was better than the $2.89 EPS that analysts projected.

The drop in subscribers was unexpected and unpredicted. Netflix had guided it expected to add 2.5 million net subscribers during the quarter, while analysts had projected the number would be 2.7 million. A year ago in the first quarter, Netflix added nearly 4 million paid subscribers.

That’s why Netflix stock fell by more than 25% in after-hours trading on Tuesday, when the company issued its earnings report. Those losses accelerated this morning to 35%.

At this point, Netflix has lost more than 62% of its value since Jan. 1.

“All good growth stories eventually come to an end,” Stifel analyst Scott Devitt said in a research note.

In order to stem the tide, Netflix is considering rolling out programs that limit subscribers’ ability to share accounts with different passwords and is also considering a subscription service supported by advertising.

“In addition to our 222 million paying households, we estimate that Netflix is being shared with over 100 million additional households,” the company said in a letter to shareholders.

Another critical issue is competition with competitors like Disney (DIS), Alphabet’s (GOOG, GOOGL) YouTube, Amazon (AMZN) Prime Video, Hulu and HBOMax, among others.

“While our U.S. television viewing share, for example, has been steady to up according to Nielsen, we want to grow that share faster,” Netflix told investors. “higher view share is an indicator of higher satisfaction, which supports higher retention and revenue.”

Netflix is also trying new ways to bring in subscribers, including adding video games at no additional charge last year.

Analysts, however, are roundly lowering their price targets and/or downgrading NFLX stock as they adjust to the company’s lowered expectations. A sampling:

- Atlantic Equities analyst Hamilton Farber downgraded Netflix from overweight to neutral, and set a price target at $280.

- Devitt, the Stifel analyst, downgraded Netflix from buy to hold, and lowered his price target from $460 to $300.

- Wells Fargo analyst Steven Cahall downgraded Netflix stock from overweight to equal weight.

- Evercore ISI analyst Mark Mahaney lowered his firm’s price target from $525 to $300.

- Baird analyst William Power dropped his firm’s price target on Netflix stock from $420 to $260, but maintained a neutral rating. He said the company’s new strategy to monetize password sharing and use an ad-supported model has long-term potential, but also carries risks.

- Truist analyst Matthew Thorton dropped his price target for NFLX from $409 to $300 while maintaining a hold rating. He said the company’s Q1 subscription numbers and Q2 guidance “surprised to the downside.”

- Credit Suisse analyst Douglas Mitchelson dropped his price target from $450 to $350, while maintaining a neutral rating on NFLX stock.

- Bank of America analyst Nat Schindler downgraded NFLX stock all the way from buy to underperform, and cut the price target from $605 to $300. He said he believes it will take time for Netflix to return to growth.

As of this writing, Patrick Sanders had a long position in AMZN stock. He did not have a position in any other of the aforementioned securities.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)