/Microchip%20Technology%2C%20Inc_%20microchip%20die%20extracted-by%20SweetBunFactory%20via%20iStock.jpg)

Not long ago, Michael Burry became bearish on the AI trade. In fact, he called some of the biggest names frauds, referring to their accounting practices. Morgan Stanley has now come out with a warning: the huge investments in AI could result in higher-than-anticipated depreciation charges over the next few years. Was Burry right all along?

Morgan Stanley points out that many of the hyperscalers, including Oracle (ORCL), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and Meta Platforms (META), were originally involved in asset-light business models. They are only now shifting to infrastructure-heavy operations by setting up AI projects that demand big data centers. Collectively, these companies could face over $680 billion in depreciation charges in the next four years! If investors hadn’t taken Michael Burry’s earlier warnings seriously, they might want to do so now.

Tech Stock #1: Oracle (ORCL)

Oracle is a provider of database software, enterprise resource planning (ERP), customer relationship management (CRM), cloud infrastructure, and similar services. It has a global customer base and is headquartered in Austin, Texas.

ORCL was comfortably outperforming the S&P 500 ($SPX) last year when it touched highs of nearly $350. Since then, it has more than halved, and over the last 12 months, has returned -11.7% versus the S&P 500’s 14.32%. The stock has become an example of how an AI trade can go bad. At one point, it was among the top 10 companies in the U.S. by market cap.

While the stock falling more than 50% is bad, it does give a great entry point for new investors. The stock’s forward P/E of 25.82x is now 17% below its 5-year average. It is also quite close to the forward P/E of the Nasdaq 100 Index, which currently stands at 25.89x.

ORCL is expected to grow its earnings at 35% in 2027 and 49% in 2028. After Morgan Stanley’s revelations, these estimates may be revised downward. Investors can take a wait-and-see approach and wait for those revisions, because the company’s core business is still strong, and it is an integral part of the U.S. government’s AI plans.

Oracle reported its quarterly earnings on Dec 10 and reported an EPS of $2.26 versus expectations of $1.64. The revenue came in short of expectations at $16.06 billion versus Wall Street’s $16.21 billion. This was still a healthy 14% growth. The firm’s remaining performance obligations went up 438% to $523 billion. However, investors will now be looking at this number with skepticism.

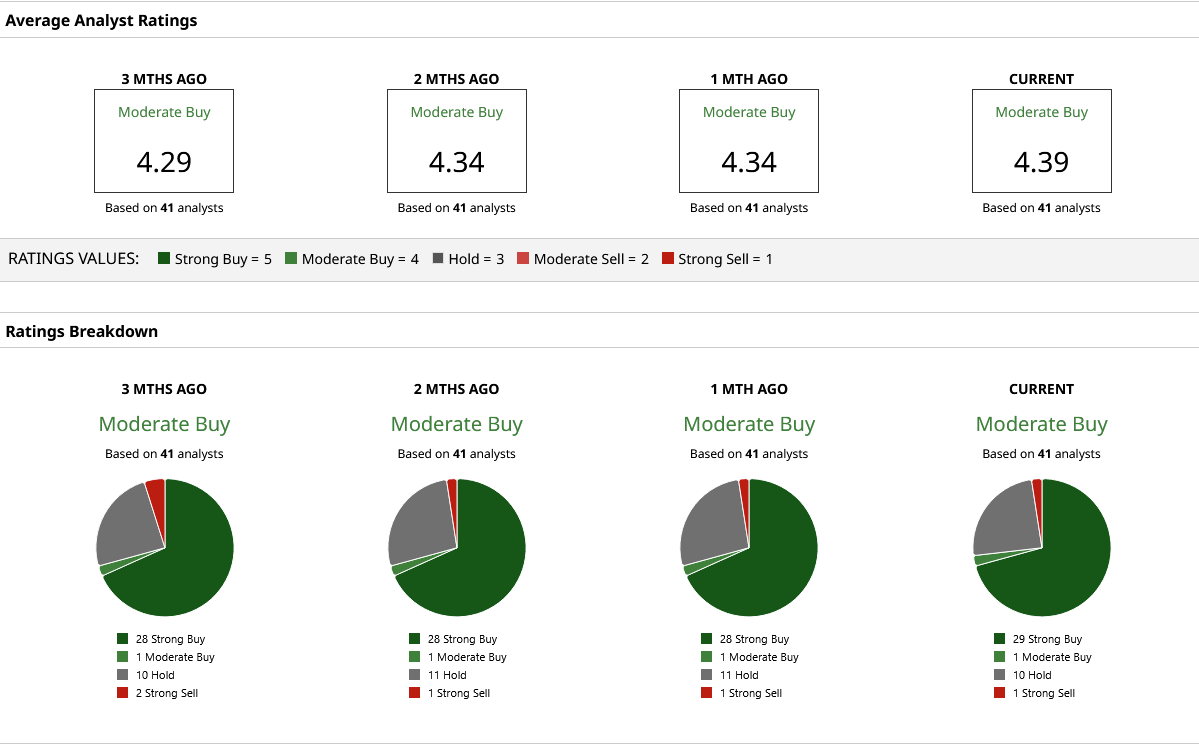

Analysts have mainly been bullish on the stock, but it will be interesting to see how many of them revise their target price downward. In the last two days, Citizens lowered its price target from $342 to $285 while Scotiabank lowered its ORCL target price from $260 to $220. More downgrades could follow in the coming days as the mean Wall Street price target is still quite high at $297.84.

Tech Stock #2: Alphabet (GOOGL)

Alphabet is the parent company of Google and offers products and services like the Google search engine, YouTube, Google Cloud, and Waymo, among others. It is a major player in the AI revolution and is headquartered in Mountain View, California.

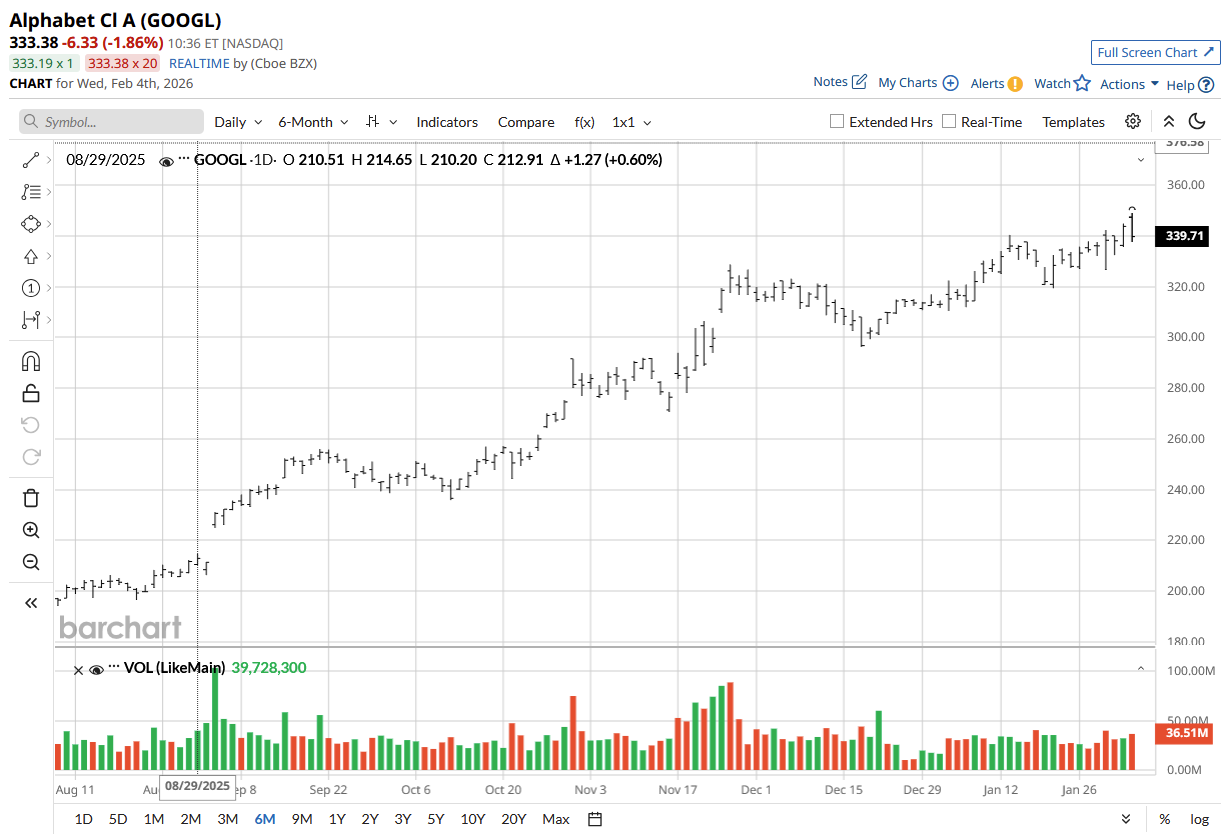

GOOGL was supposed to lose its search engine advantage with the emergence of AI. However, the public is only now waking up to the value that this firm possesses. Over the last one year, it has returned 61.5%, 4.3x the S&P 500 returns.

Alphabet’s one-year performance means the stock is now expensive, as it should be. The company continues to register growth that defies belief. Trading at a forward P/E of 29.23x and a forward price-to-sales of 8.64x when it has historically traded much lower means you’re buying it at an AI premium.

That premium is fully justified when one looks at the earnings report announced on Feb. 4. Let’s leave Wall Street expectations aside for a moment, even though the company comfortably beat them. It is the growth that is staggering. Google Cloud brought in a staggering 48% more revenue than the previous year. Advertising revenue grew at 13.5% YoY, while YouTube ads revenue grew at a slightly less impressive 9%. The company plans to spend somewhere between $175 billion and $185 billion on AI in 2026, almost twice its AI spending in 2025.

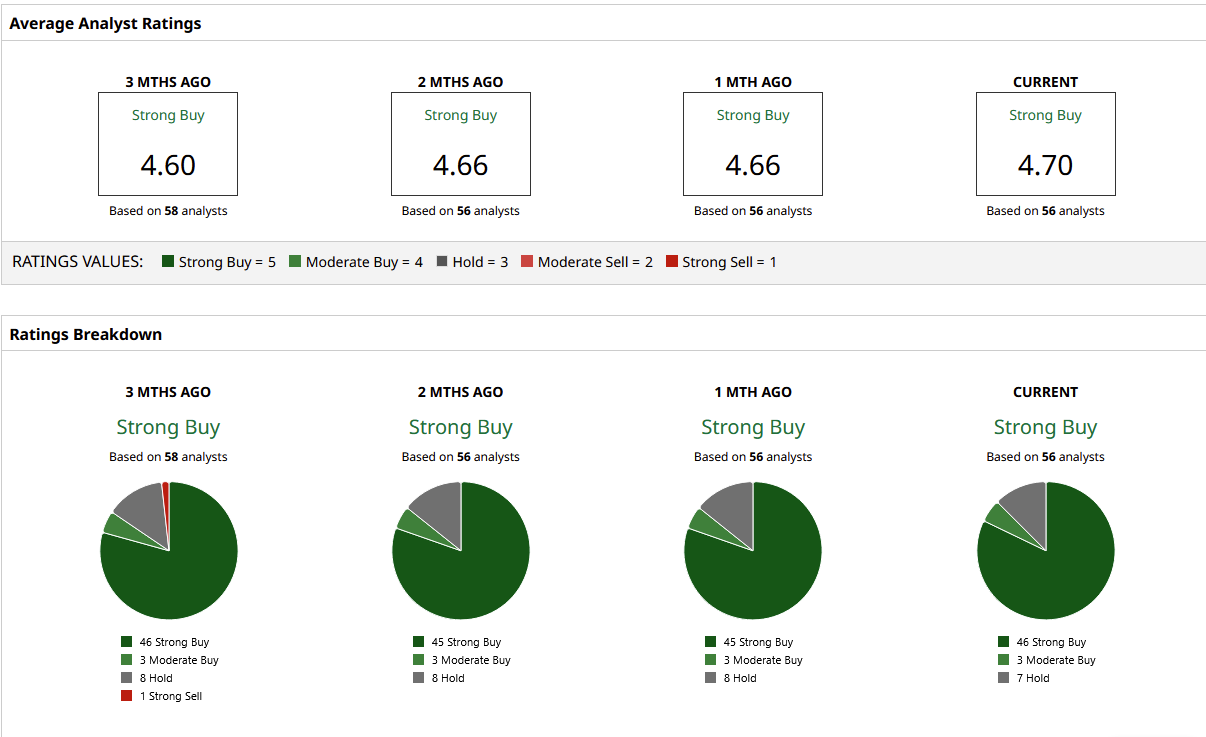

Analysts continue to be bullish on the stock, with 46 “Strong Buy” ratings out of 55 analysts covering the stock. Having said that, it trades quite close to the mean Wall Street price target of $347.68, so investors should carefully review their upside before taking a position in the stock.

Tech Stock #3: Microsoft (MSFT)

Microsoft develops and sells software products like the Windows operating system, MS Office, and cloud services. It also sells laptops and gaming equipment. It was founded by Bill Gates and Paul Allen in 1975 and is headquartered in Redmond, Washington.

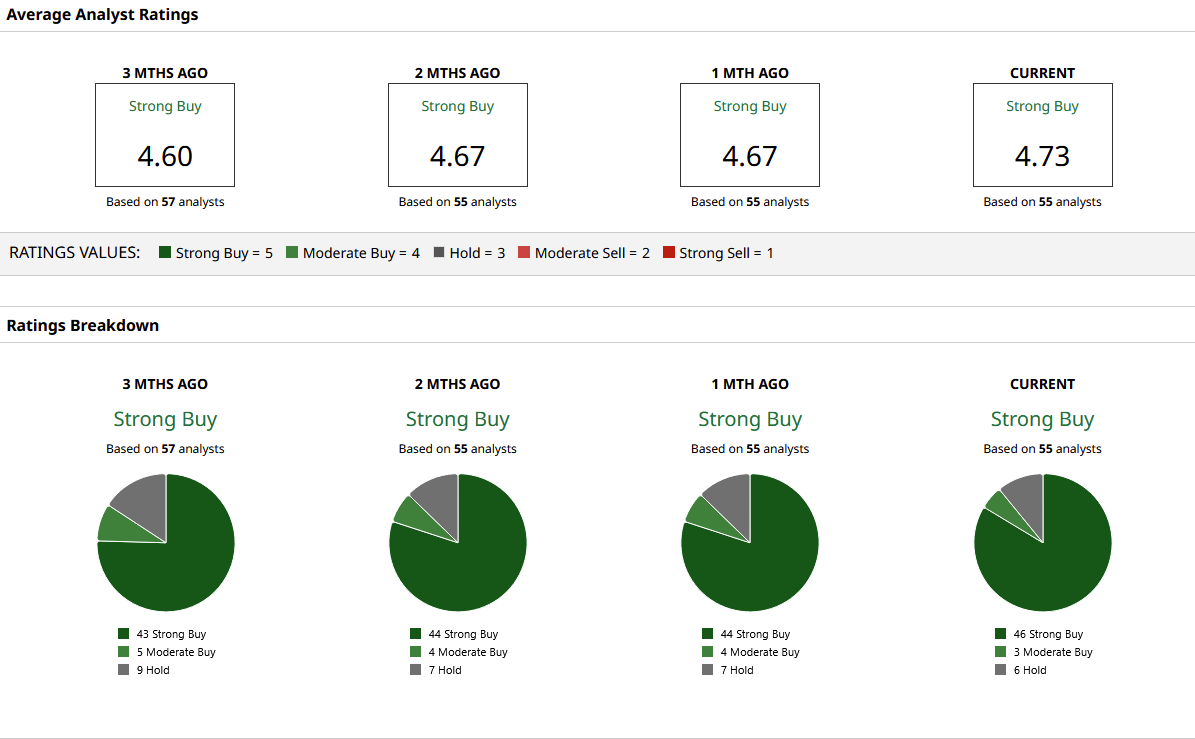

After losing almost 13% in a month, the stock has given back all the gains of the last 12 months. This is particularly shocking for investors who had pinned hopes on MSFT’s investment in OpenAI to bear fruit. There are now significant worries over the company’s AI investments as well as its backlog concentration in OpenAI.

That 45% OpenAI representation in the company’s backlog resulted in a dip that makes the stock attractive. The forward P/E of 24.12x is still 24% cheaper than the five-year average of 31.74x. The price-to-sales offers a 15% discount. The stock is back exactly where it was two years ago. If the AI rally was a bubble, Microsoft's share of it has already burst.

The earnings report on Jan. 28 otherwise contained numerous positives. The EPS of $4.14 comfortably beat Wall Street expectations of $3.97, and the revenue came in exactly a billion dollars above expectations. The revenue guidance of $81.2 billion at the midpoint was quite close to Wall Street expectations of $81.19.

A consensus “Strong Buy” rating is hardly surprising for MSFT stock, and the price targets suggest there is still considerable upside. The mean target price of $602.57 offers 45% upside, though one can expect some downward revisions in the coming days.

Tech Stock #4: Meta (META)

Meta owns popular social media platforms Facebook, WhatsApp, Instagram, Messenger, and Threads. The company is also involved in augmented and virtual reality projects. It is headquartered in Menlo Park, California.

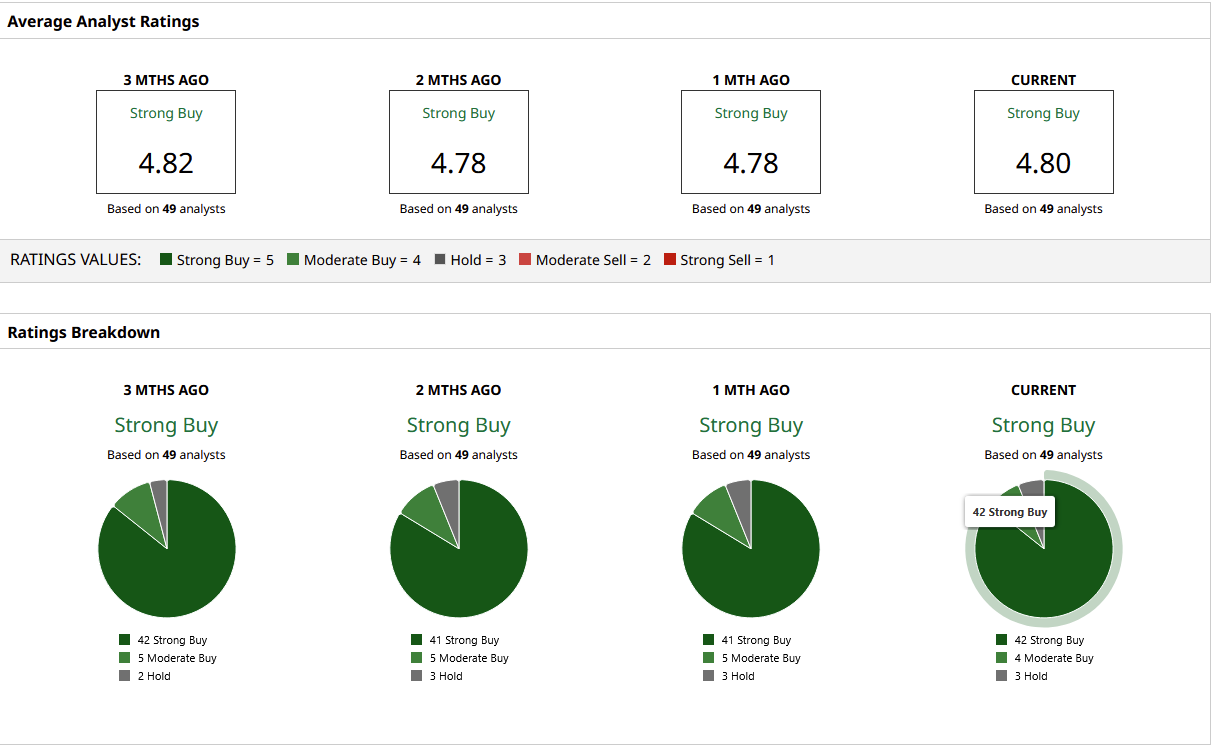

META stock has returned -4.4% in the last year, underperforming the S&P 500’s 14.3% returns during the same period.

Meta was one of the few companies that were able to monetize their AI ventures very early through improved advertising. However, things have calmed down for some time now, and the stock is trading at a forward P/E of 22.62x, below the Nasdaq 100 Index’s forward P/E of 25.89x and quite close to its historic 5-year average as well. It is therefore not a bad time to bet on the company’s ventures, especially the use of AI in smart glasses, which could take off if the execution is right.

META was up 10% after announcing its earnings report on Jan. 28. The company topped estimates and provided guidance well above Wall Street expectations. Earlier in January, the company laid off over 1,000 people from its virtual reality-related projects to switch resources to smart glasses. Investors may want to keep track of those developments as they could significantly change the way we use technology, especially smartphones, and open a massive growth avenue for the company.

Analysts are bullish on META stock, with Freedom Capital raising its price target on the stock from $800 to $825. Interestingly, other analysts are even more bullish, with the average price target of $862 offering 29% upside from here on.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)