- An interesting development in any market is when a vacuum develops following an explosive, extended trend.

- This market activity can occur without any change in underlying fundamentals, though when commercial do get involved things can get rough in a hurry.

- In a bearish vacuum trade, like what was seen in grain and oilseeds Thursday, the tendency is for markets to fall quickly searching out buy orders that might've been left behind.

If you’ve ever been curious what I meant when I talked about vacuum trade, Thursday is a great example. The idea is markets continue to extend existing trends, often dramatically, blowing through all available buy orders (in an uptrend, sell orders in a downtrend) along the way. Then as new buying gets harder to find and sell orders start to trickle in, these same markets begin to fall. However, with no buy orders to slow the descent markets start getting pulled down faster, as if in a vacuum, searching out a price level where buying interest may be waiting. Usually this happens with no change seen in underlying fundamentals, though in those cases when commercial traders add pressure things can get rough.

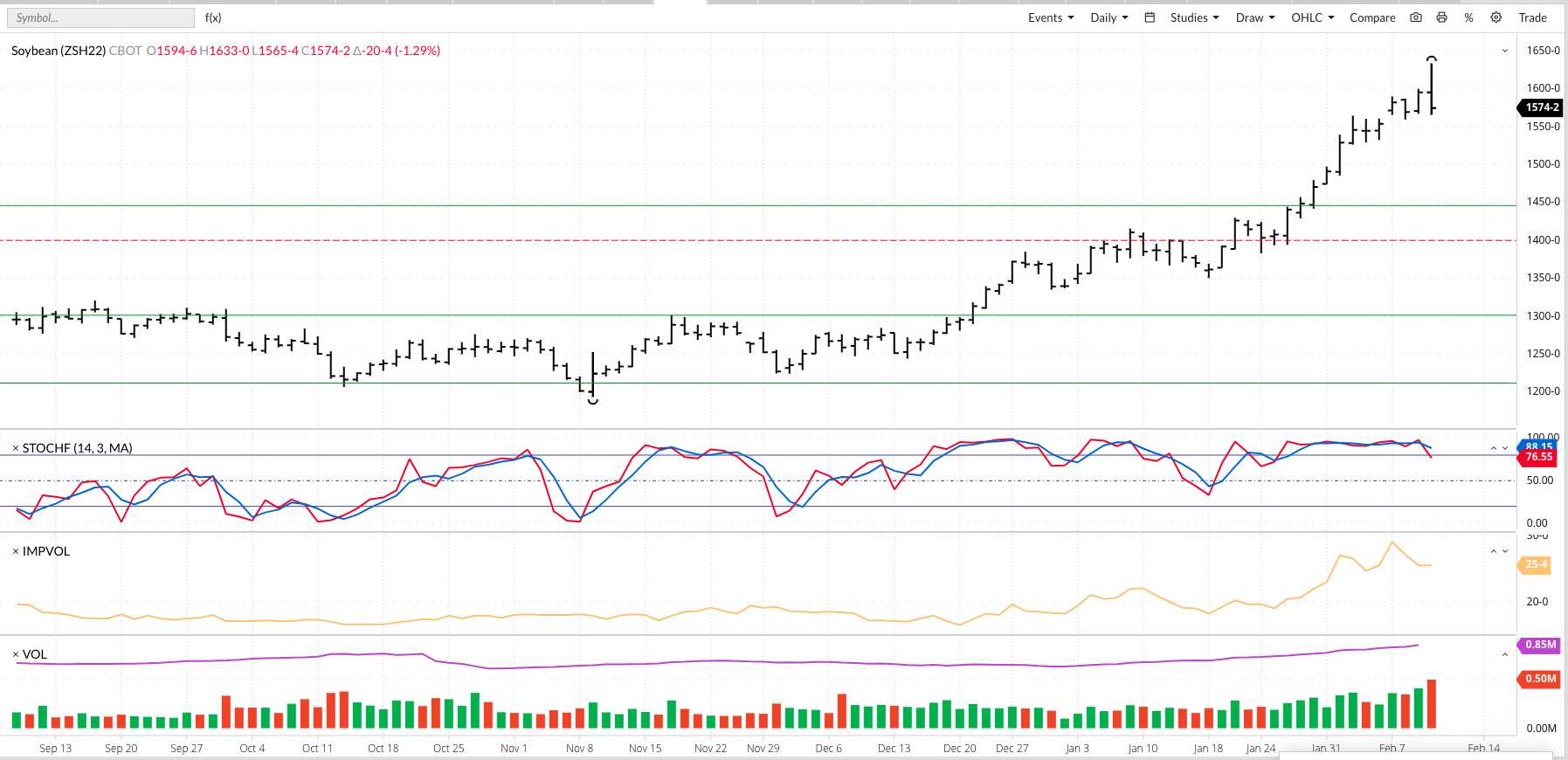

The vacuum in the soybean market resembled a black hole Thursday. The result was bearish key reversals were completed on the old-crop March, May, and July daily charts while new-crop November completed a short-term bearish spike reversal. Additionally, it could be argued the three old-crop issues are in position to complete island top patterns if they see gap lower opens Thursday night. However, like nearly everything else in market analysis, this pattern could be heavily debated. As I’ve talked about of late, besides the strong vacuum that has been building another concern has been on the fundamental side, notably national average basis. We’ve seen the cmdty National Soybean Basis Index ((ZSBAUS.CM) weaken four weeks in a row and working on a fifth (possibly true in more ways than one), coming in Wednesday at 46.6 cents under March futures. But let’s throw the brakes on for a moment. I do not want to come across like a bear leaving its den after winter hibernation. The key fundamental reads of the soybean market, including the NSBI, remain bullish.

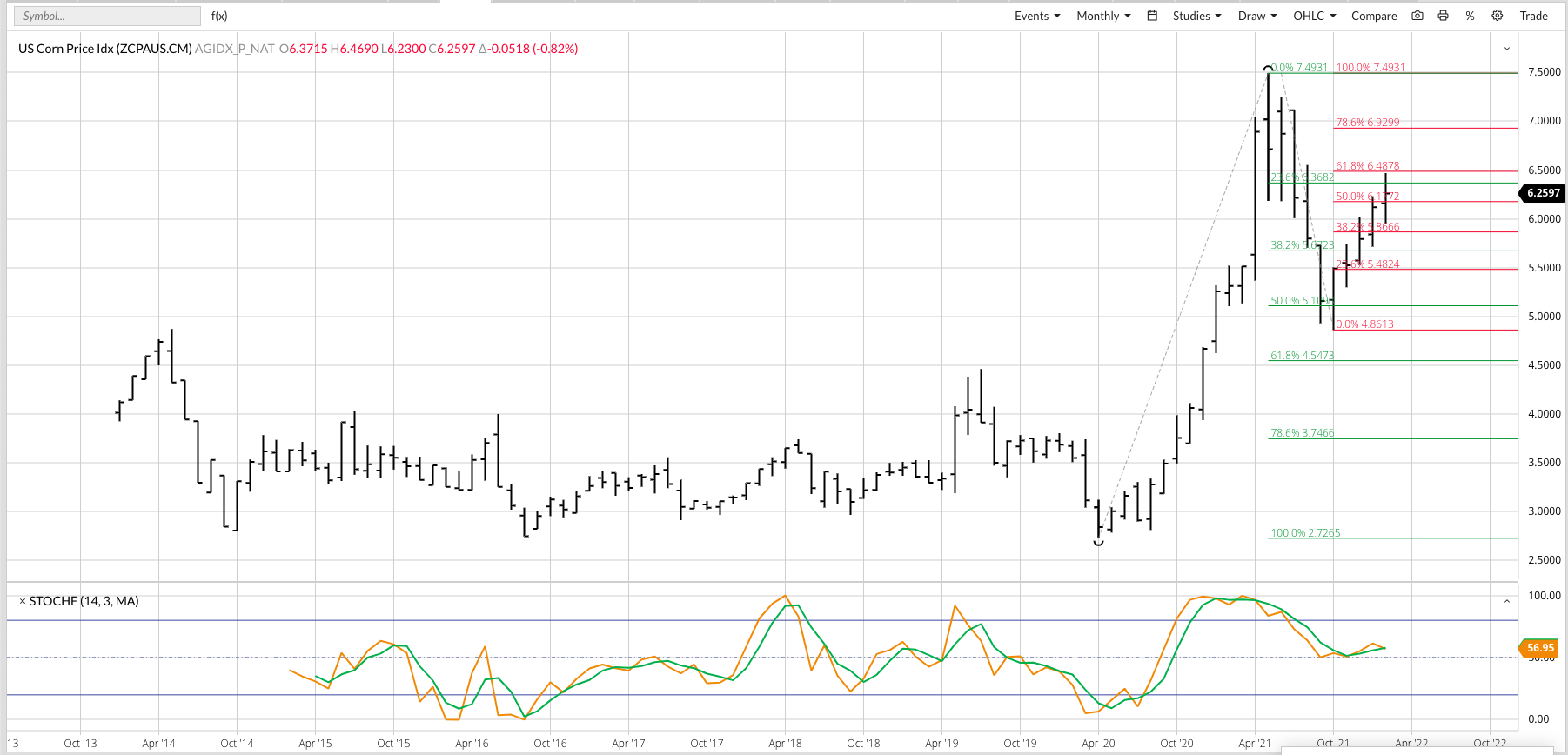

The vacuum in the corn market wasn’t quite as severe as what was seen in soybeans, but it was a vacuum, nonetheless. March climbed to a high of $6.6275, up 16 cents for the day, before falling to a low of $6.3875 and closing 5.0 cents lower for the day. It’s interesting to note preliminary trade volume is showing 335,000 contracts of March changing hands, outdistancing Wednesday’s 320,400 contracts. When the closing bell rang, March had gained 0.5 cent on May, putting the March-May spread at an inverse of 1.25 cents. On the other hand the May-July spread closed unchanged, holding at an inverse of 5.5 cents. This tells us much of Thursday’s selling came from the noncommercial side, though I can’t help but think commercials were selling early in the break as those holding cash continued to sell into the rally. Given the lower close in futures it will be interesting to see what happens with national average basis Thursday afternoon, with the cmdty National Corn Basis Index ((ZCBAUS.CM) calculated at 15.6 cents under March Wednesday. Technically, charts look bearish with the most telling still the long-term topping patterns in both cash (the cmdty National Corn Price Index, (ZCPAUS.CM) and December futures completed last May.

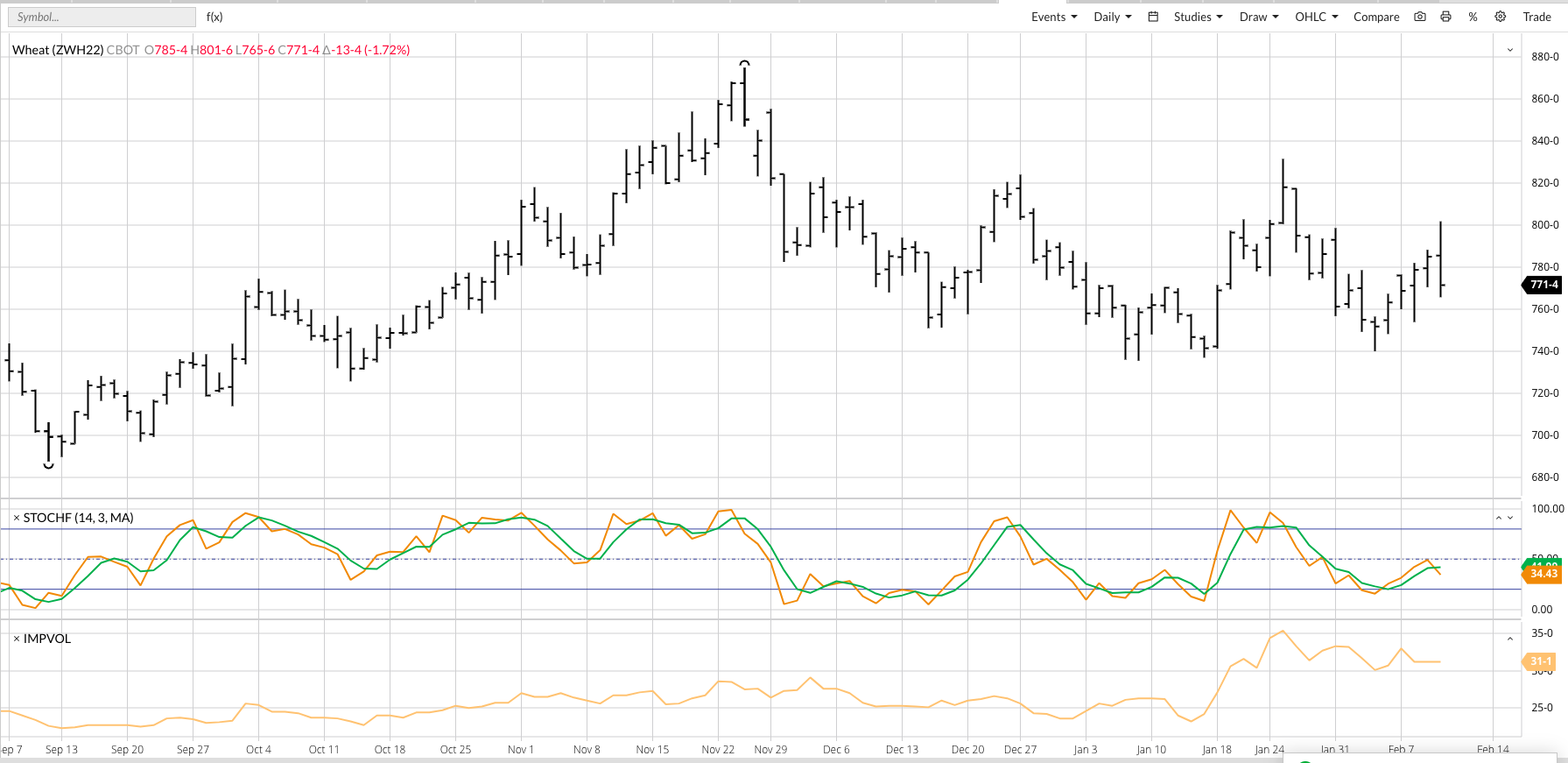

Vacuum trades can be more difficult to find in the wheat sector. After all, it’s wheat, meaning spike rallies and falls seemingly without logic are the norm. Still, a look at Thursday’s activity allows us to at least make the argument vacuums did exist. March Chicago (SRW) gained as much as 16.75 cents, climbing briefly above $8.00, before stalling and falling to a low of $7.6575, down 19.25 cents for the day. Add in March losing 1.25 cents to May and we can clearly see pressure came from both noncommercial and commercial traders. Did something happen along the Ukraine/Russia border to calm tensions? Absolutely not. If we are looking for a why, the market simply ran out of buyers. A similar scene played out in Kansas City (HRW) with the March issue closing 14.0 cents lower and losing 1.0 to May.

/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)