/Video%20game%20controllers%20by%20TheXomil%20via%20Pixabay.jpg)

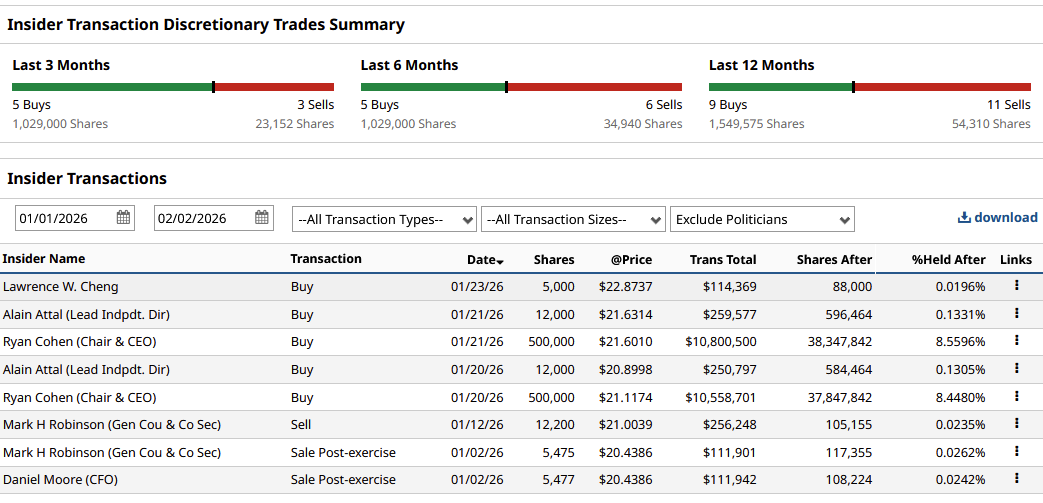

GameStop (GME) stock is experiencing an uptick in volume, and the share price is appreciating accordingly. As is the case with every GameStop rally, it is attracting significant retail trader interest. Fueling this sentiment further, Lawrence Cheng, a director at GameStop, added 5,000 more shares to his holding last week at a price of $22.87. He now holds 88,000 shares in the company.

The trading isn’t just limited to insiders. Michael Burry, in a Substack post early last week, disclosed he was buying the stock. Burry played down the meme-stock sentiment and instead said he was buying it as a long-term value play. He insisted that he believes in CEO Ryan Cohen, likes the governance, and believes in the strategy.

On Jan. 30, Cohen announced he is eyeing a big acquisition but did not clarify whether he will sell the company’s Bitcoin (BTCUSD) holding. In short, GameStop investors can look forward to an eventful few weeks.

About GameStop Stock

GameStop operates retail stores selling video games. It is the world’s largest specialty retailer in this domain and is headquartered in Grapevine, Texas. The company now also operates in collectibles and has a trade-in program where individuals can exchange used video games for cash or store credit.

In the last 12 months, GME hasn’t delivered any significant returns. However, staying true to its reputation, the stock has been volatile. During the same time, the VanEck Video Gaming and eSports ETF (ESPO) has returned 16%.

While the company’s retail business model seems fundamentally flawed in this day and age, its capital structure continues to be strong. It holds $8.83 billion in cash against total debt of $4.39 billion. From a business point of view, the company doesn’t seem to be going anywhere, and its forward earnings growth stands at -18%. This is one reason why any mention of an acquisition or insiders buying fuels speculation about what the company is going to do next, especially with its cash pile. The existing business isn't growing, so investors want to see something new they can bet on.

GameStop Continues Its Struggle With Digital Pivot

GME announced its Q3 earnings on Dec. 3, 2025. Revenue of $821 million fell far short of Wall Street expectations of $987 million. Interestingly, net income of $77.1 million was a significant increase over last year’s $17.4 million. This didn’t stop the stock selloff, though, for the very simple reason that a shrinking topline shows the retailer is struggling with its digital transformation strategy.

The lack of revenue growth is troubling because the company has already put significant efforts into its e-commerce platform, but it isn’t yet bearing any fruit. It expanded its website to offer collectibles and merchandise but continues to struggle in the same way as giants like Sony and Microsoft (MSFT) do in a soft gaming market. Users still flock to Amazon (AMZN) to fulfill their gaming needs, a trend that GameStop has been unsuccessful in changing.

How Are Insiders Trading GameStop Stock

Lawrence Cheng isn’t the only one buying the stock so far this year. CEO Ryan Cohen bought 500,000 shares totaling $10.5 million on Jan. 20, taking his total holding to 37.8 million shares. One day later, he doubled down and added another 500,000 shares. Director Alain Attal has also added 24,000 shares to his holding in January, so Lawrence Cheng’s trade just continues the trend of insider buying in the stock. Something big may be cooking in GME stock in 2026, but we’ll have to wait to find out.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)