/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

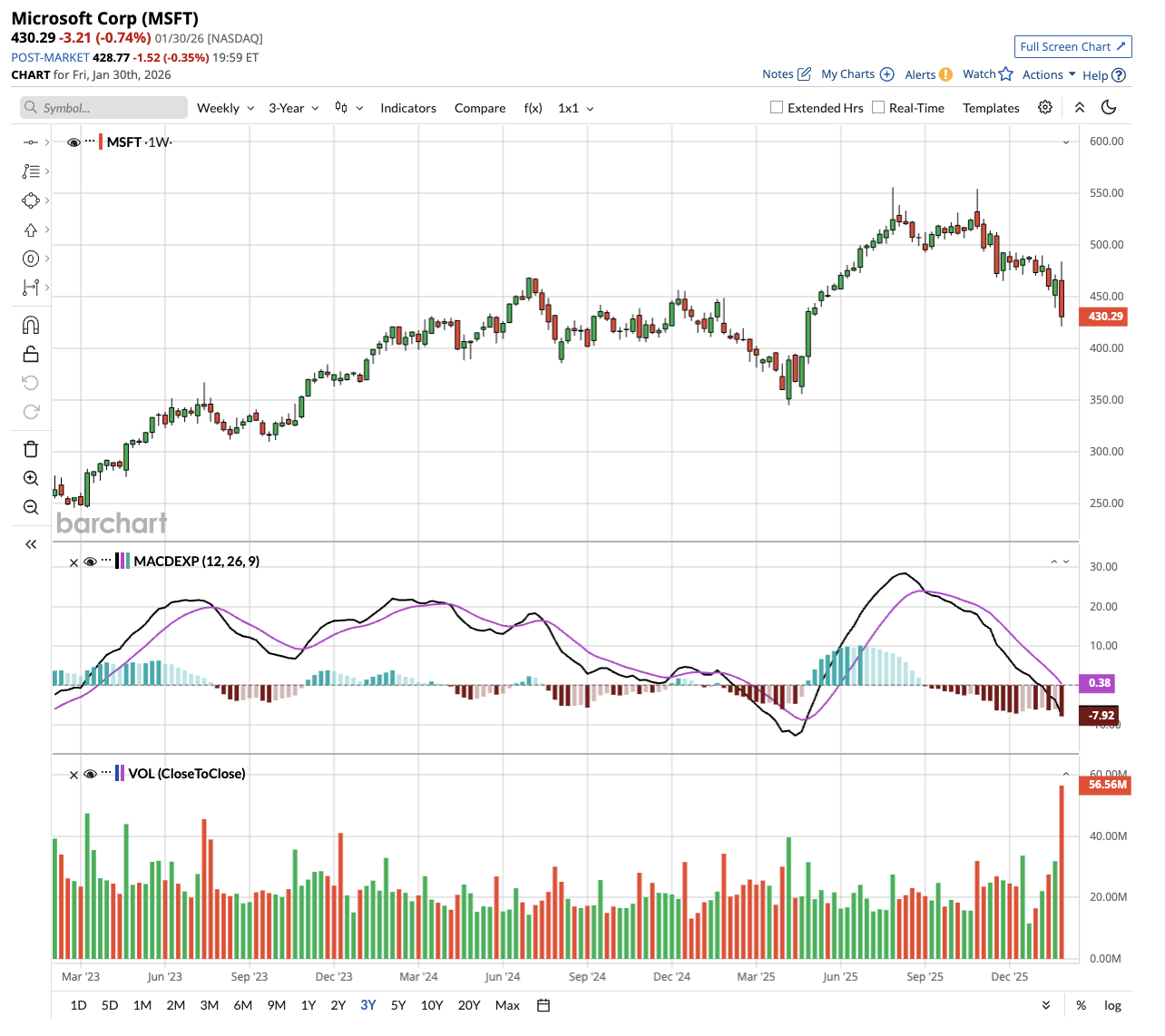

Microsoft (MSFT) just landed a massive $750 million cloud deal with AI search startup Perplexity, but investors aren't exactly celebrating, given MSFT stock tanked 10% following the company's latest earnings report.

According to a Bloomberg report, the Perplexity deal could be a key win for Microsoft's Azure cloud business. The deal allows the AI search company to deploy models from OpenAI, Anthropic, and xAI through Microsoft's Foundry service.

It's a strategic move that diversifies Perplexity's cloud infrastructure beyond its primary partner, Amazon Web Services (AMZN). However, Wall Street's reaction to Microsoft's earnings tells a different story about investor confidence.

The Earnings Miss that Spooked Investors

Microsoft's fiscal second-quarter results on Jan. 29 weren't terrible by any measure.

- Revenue hit $81.27 billion, beating the $80.27 billion consensus.

- Adjusted earnings per share came in at $4.14, topping expectations of $3.97.

- However, Azure cloud revenue growth of 39% fell short of the 39.4% consensus forecast.

- More concerning, guidance for the More Personal Computing segment—which includes Windows—came in at roughly $12.6 billion, well below the $13.7 billion analysts expected.

The market's response was swift and brutal. Shares plunged 10% the following day, the stock's worst single-day performance since March 2020. The selloff erased $357 billion from Microsoft's market cap, leaving it valued at $3.22 trillion.

CFO Amy Hood argued the Azure number could have been higher if Microsoft had allocated more data center capacity to external customers rather than prioritizing internal needs like Microsoft 365 Copilot and GitHub Copilot.

"If I had taken the GPUs that just came online in Q1 and Q2 and allocated them all to Azure, the KPI would have been over 40%," Hood explained during the earnings call.

Microsoft’s Infrastructure Dilemma

Notably, Microsoft spent $37.5 billion on data centers and equipment in the quarter, up 66% from a year ago and above the $34.31 billion analysts expected. CEO Satya Nadella revealed that Microsoft added nearly 1 gigawatt of total capacity during the quarter. But customer demand continues to outpace available supply, creating a delicate balancing act.

The company must juggle incoming capacity between serving Azure customers, powering first-party AI products like Microsoft 365 Copilot, allocating resources to R&D teams, and replacing aging infrastructure.

Ben Reitzes of Melius Research told CNBC there's “an execution issue here with Azure, where they need to literally stand up buildings a little faster.” Alternatively, Bernstein analysts defended Microsoft's approach, arguing management made "a cognizant decision to focus on what is best for the company long term rather than driving the stock up this quarter."

The Copilot Question

UBS analysts raised concerns that Microsoft is prioritizing AI compute capacity for products such as Microsoft 365 Copilot, which hasn't achieved ChatGPT-level success.

- Microsoft disclosed it now has 15 million paid Microsoft 365 Copilot seats—the first time the company has shared this metric.

- While this number is impressive, it pales in comparison to the over 450 million total paid commercial Microsoft 365 seats available.

- The tech behemoth noted that average conversations per Copilot user doubled year-over-year (YOY), and daily active users increased 10-fold.

- Seat additions were up over 160% compared to last year, with major deployments at companies like Publicis, which purchased over 95,000 seats.

Still, UBS analysts wrote that "M365 revenue growth is not accelerating due to Copilot" and questioned whether these capacity investments will pay off.

The OpenAI Elephant in the Room

Microsoft's commercial remaining performance obligation—essentially future contracted revenue—jumped 110% to $625 billion. However, 45% of this backlog comes from OpenAI's $250 billion cloud commitment.

Jefferies analyst Brent Thill voiced concerns on CNBC about whether OpenAI can meet the financial targets required to fulfill its massive commitments to Microsoft and other providers.

CFO Amy Hood defended the concentration, noting the remaining 55%—roughly $350 billion—represents "a breadth of customers across solutions, across Azure, across industries, across geographies" that grew 28%.

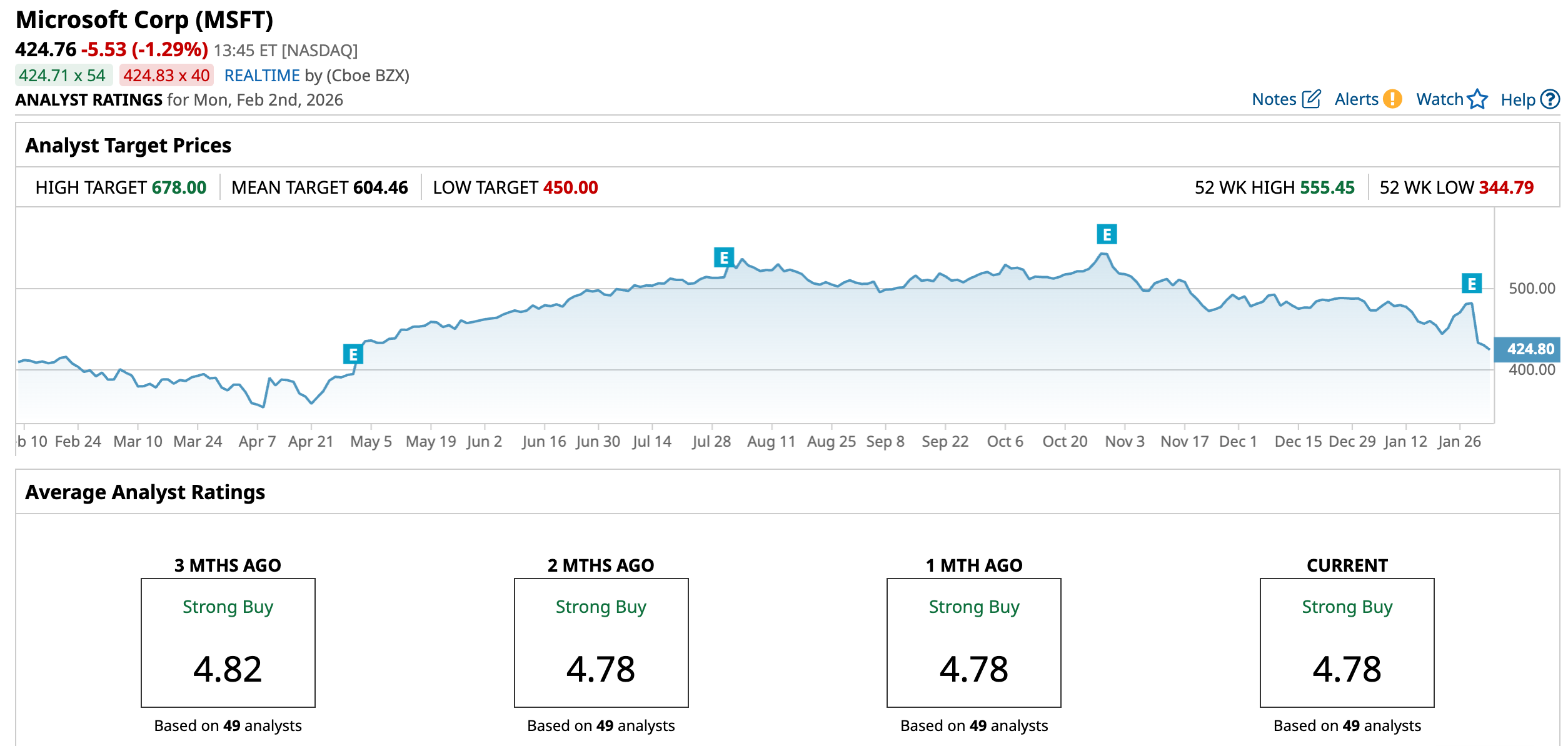

What is the MSFT Stock Price Target?

Microsoft's fundamentals remain strong. The company generated $35.8 billion in operating cash flow, up 60% YOY. Its Microsoft Cloud business surpassed $50 billion in quarterly revenue for the first time, up 26% YOY.

The Perplexity deal shows Azure is winning business from well-funded AI startups. Microsoft now serves over 1,500 Foundry customers using both OpenAI and Anthropic models. The number of customers spending over $1 million quarterly on Foundry grew nearly 80%.

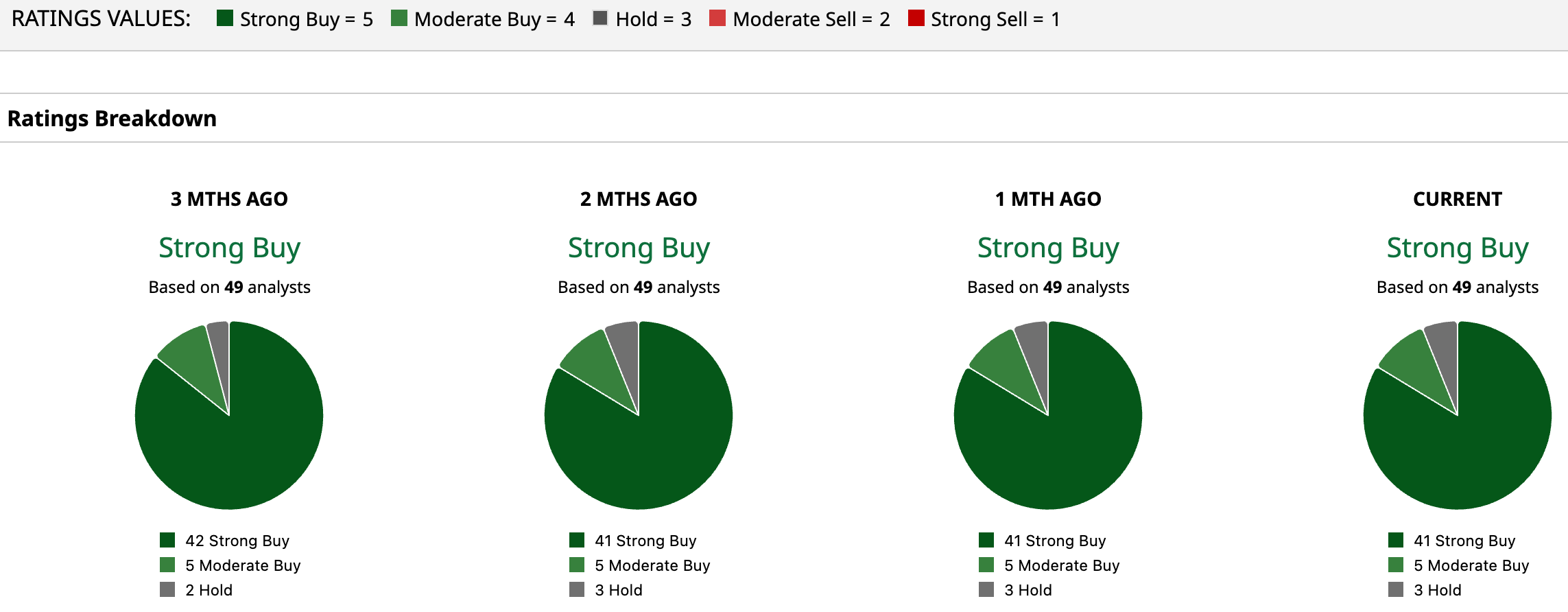

Out of the 49 analysts covering MSFT stock, 41 recommend “Strong Buy”, five recommend “Moderate Buy,” and three recommend “Hold”. The average MSFT stock price target is $604.46, showing 42% from its current price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)