/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

Microsoft (MSFT) just reported strong quarterly financial results. However, MSFT stock experienced one of its sharpest single-day declines in years. Microsoft shares closed about 10% lower following the second-quarter earnings.

A major reason impacting MSFT stock is investor concern over the company’s rapidly rising capital expenditures (CapEx). As demand for artificial intelligence (AI) capabilities within its cloud ecosystem surges, Microsoft is pouring massive investment into the infrastructure needed to support that growth. Spending on GPUs, CPUs, and data center expansion has accelerated faster than the market anticipated.

This sharp increase in CapEx is making investors nervous, especially at a time when markets are already questioning whether the broader AI boom is becoming overheated. The fear is that companies may be spending aggressively today without clear visibility on how quickly those investments will translate into long-term returns.

Another factor weighing on sentiment is Azure’s growth outlook. While Microsoft’s cloud platform continued to expand at an impressive pace, its growth came in slightly below market expectations in Q2. Management also acknowledged that capacity constraints remain an issue, suggesting that Microsoft may not yet have enough infrastructure in place to fully capture the demand currently in front of it.

The numbers highlight the tension. Microsoft’s Q2 CapEx reached $37.5 billion, up from $34.9 billion in Q1 and nearly 66% higher than a year ago. Meanwhile, Azure and other cloud revenue grew 39% in the quarter, and management is forecasting 37% to 38% growth in Q3. Although Microsoft expects capital spending to ease sequentially next quarter, the overall scale of investment remains a concern.

Still, these pressures appear more short-term than structural. Moreover, Microsoft’s underlying fundamentals remain strong, and the company continues to stand out as one of the top long-term players in both AI and cloud computing.

Is Microsoft Stock a Buy Now?

While Microsoft ramps up spending on AI infrastructure, it continues to execute well, as reflected in its strong revenue growth, rising earnings, and robust free cash flow, which strengthen its ability to invest in long-term opportunities while still returning cash to shareholders.

In the second quarter, Microsoft maintained solid double-digit growth on both the top and bottom lines. Its growth was once again driven by accelerating demand for its cloud and AI solutions, while the company also reported improved operating leverage.

Microsoft’s commercial remaining performance obligation (RPO), essentially a measure of contracted revenue that has not yet been recognized, remained solid. This balance climbed to $625 billion, more than doubling year-over-year. About a quarter of that amount is expected to convert into revenue over the next 12 months, while the longer-term portion grew even faster. Around 45% of the RPO is linked to OpenAI, which may raise concentration risk, but the remaining balance increased by 28% in Q3, showing strong customer demand across Microsoft’s products and services.

Microsoft Cloud revenue reached $51.5 billion, up 26%. Cloud gross margins continue to decline as the company is investing aggressively in AI capacity. Efficiency improvements helped offset some of that pressure.

Within the Intelligent Cloud segment, revenue rose 29% to $32.9 billion. Azure, Microsoft’s flagship cloud platform, grew even faster, with revenue up 39%. Management noted that demand continues to exceed supply.

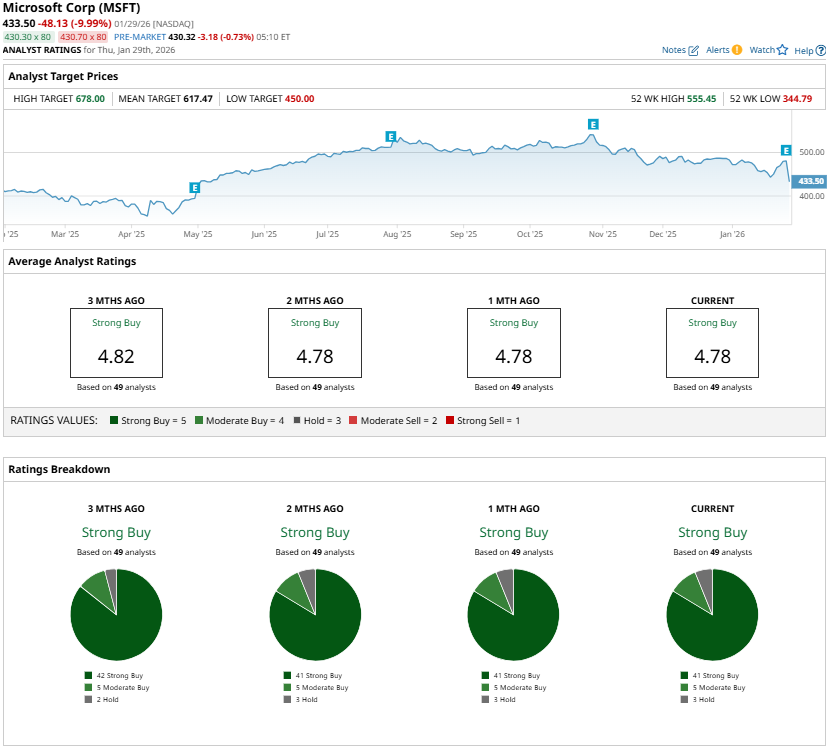

In conclusion, Microsoft’s sharp post-earnings dip appears to be driven more by short-term investor anxiety around surging CapEx and slightly softer Azure growth expectations than by any deterioration in the company’s long-term fundamentals. While heavy AI infrastructure spending may pressure margins in the near term, it also reflects strong demand and Microsoft’s commitment to maintaining leadership in cloud and AI. With robust revenue growth, expanding contracted backlog, and continued Wall Street confidence, the pullback looks less like a trap and more like a potential buying opportunity for long-term investors.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)