/A%20close-up%20of%20an%20Amazon%20Zoox%20vehicle%20by%20Michael%20Vi%20%20via%20Shutterstock.jpg)

Earnings season is kicking off in a big way. The S&P 500 ($SPX) recently cleared the 7,000 mark on AI-driven optimism and rate-cut hopes, and that momentum has traders hunting for the next breakout. However, the pullback has begun as President Trump's choice for Federal Reserve chair has injected fresh market volatility, refocusing investors on interest-rate-sensitive names and macro risks.

Meanwhile, smaller social media plays, like Trump Media (DJT) and Joyy (JOYY), have seen surging volume as meme-style momentum chases headlines and speculation. Against that noisy, fast-moving backdrop, Reddit (RDDT) stands out. The company will report fourth-quarter and full-year 2025 results after the close on Thursday, Feb. 5, a date already buzzing among traders hunting actionable alpha.

Without further ado, let's see what we need to know about upcoming earnings.

Reddit Strong User Growth and Engagement Trends

Reddit is an online social news aggregation and discussion platform organized around user-created communities or “subreddits.” It’s unique for its highly engaged user base and dual revenue model: the company monetizes through targeted digital advertising and, increasingly, enterprise data-licensing services selling anonymized user and content data to AI and marketing partners.

Reddit’s audience expansion has been incredible lately. By the end of Q3 2025, the platform reported 116 million daily active unique visitors and 50.2 million logged-in users, up sharply from 2024. This huge growth was driven by major global events, trending market activity, and content partnerships with Google’s (GOOG) (GOOGL) Gemini and OpenAI. Not only that, but the company is now also broadening monetization through Reddit Premium, improved advertising tools, and new AI features.

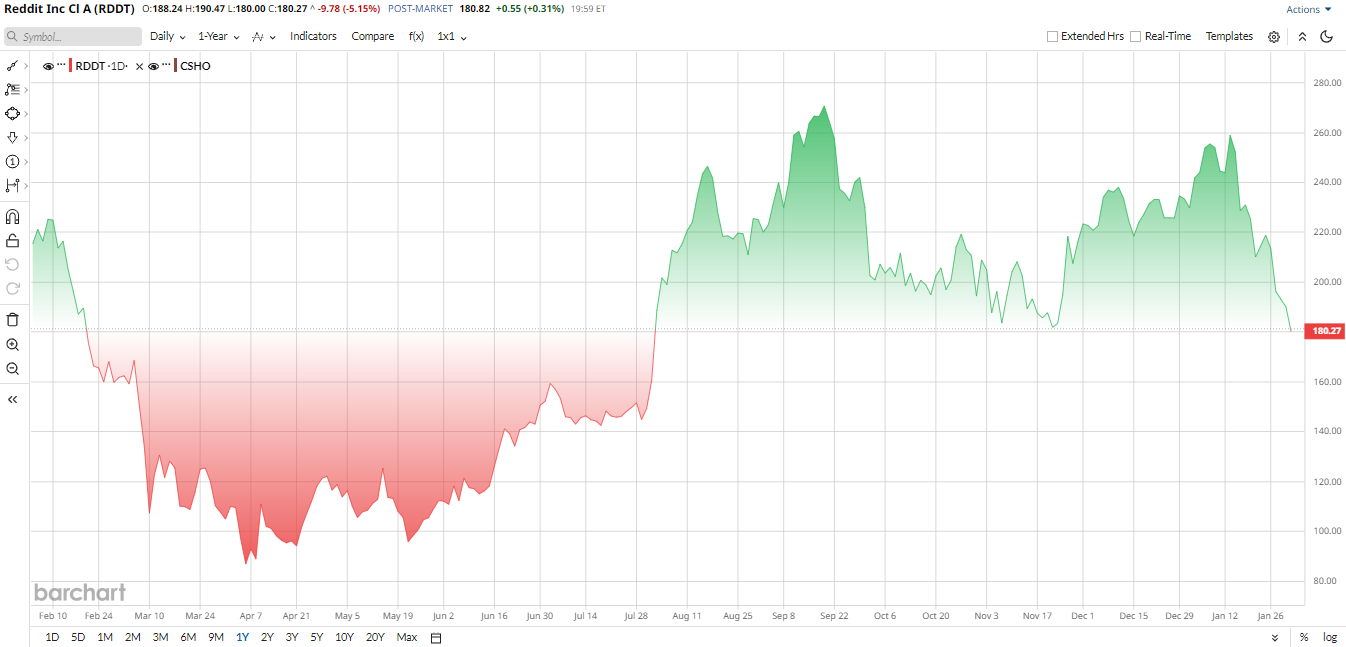

After going public in late 2024, RDDT stock had a banner year. In 2025, it climbed roughly 40%, driven by strong revenue growth of about 68% year-over-year (YoY) in Q3 and excitement around its AI/data licensing story. However, the stock has since cooled off in 2026, down 21% year-to-date (YTD), indicating profit-taking after the earlier rally.

Even with the pullback, Reddit appears richly valued. Its trailing P/E is around 111×, far above the Internet Content & Information industry average of roughly 32×. Likewise, its price/sales and EV/sales ratios are in the high teens or 20s, well above typical tech peers. Even on a PEG basis of 1.36, Reddit is not cheap. Analysts have already baked high growth into the stock.

What to Expect From the Upcoming Report

So Reddit's earnings report is almost here, and Wall Street expects continued strength in the upcoming quarter. Analysts forecast about $665.8 million in revenue and roughly $0.96 in EPS. That follows Q3’s strong beat with 68% revenue growth YoY.

If we look back at the past, management has given no formal Q4 guidance, but CFO Andrew Vollero has signaled ongoing double-digit growth and a ramp in data licensing. Investors will be watching for any commentary on ad spend trends, user engagement metrics, and costs. A solid beat-and-raise on these lines could reinforce the stock’s premium valuation, whereas any weakness, e.g., slower ad growth or higher expenses, would likely pressure the shares.

Options traders are bracing for a sizable move. As of now, the 30-day implied volatility on RDDT was about 81.7% with calls at 82.9% and puts at 80.4%, implying an expected post-earnings swing on the order of 20%. The put-call implied volatility ratio of 0.97 is near neutral, indicating a balanced bias between bullish and bearish contracts.

In simple language, the options market shows elevated caution, so investors are clearly expecting high volatility around the Feb. 5 report.

Reddit’s Enterprise Deals Signal Growth

Reddit has been courting other new business agreements before the earnings release. For instance, Emplifi will connect to the Reddit enterprise API, and Invoca will connect Reddit ads data into its analytics package. These deals demonstrate how Reddit is monetizing its massive user base and advertising resources into some of the best data offerings. Nevertheless, analysts believe that no serious short-term change will be caused by such deals; the concentration remains on the Feb. 5 earnings announcement.

One analyst notes that Reddit’s “key short-term catalysts remain execution on ad monetization, data licensing traction, and any update around the Google traffic lawsuit.” In other words, management’s guidance on ad revenue, user metrics, and licensing will matter much more than the new partnerships.

What Analysts Are Saying About RDDT Stock?

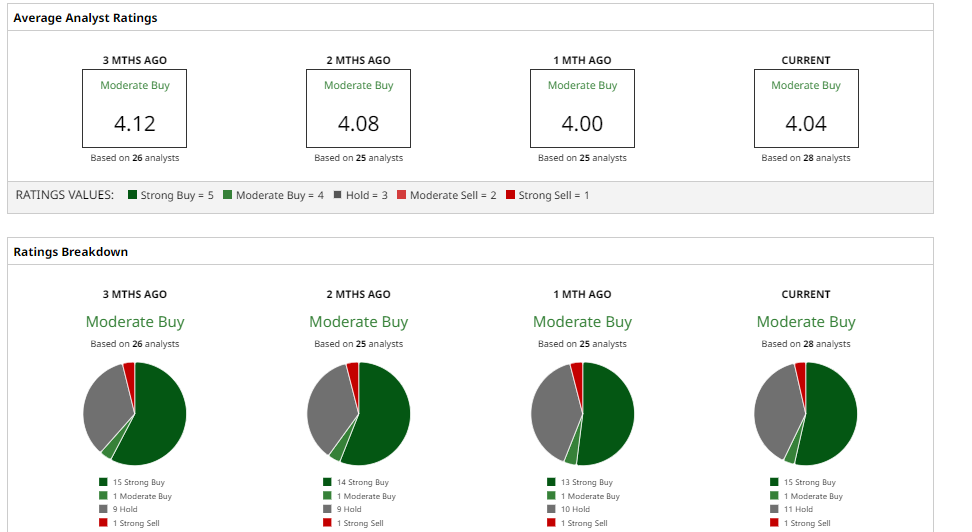

On Wall Street, analysts generally remain bullish on RDDT's prospects. Morgan Stanley recently reiterated an “Overweight” rating on RDDT stock and raised its one-year price target to $250, citing “durable growth.”

Goldman Sachs lifted its target to $238 while keeping a “Neutral” rating on optimism about better ad targeting and personalization. Citigroup raised its target to $265 with a “Buy” rating. Other recent targets include Deutsche Bank at $285 and Evercore at $320.

Overall, the consensus is a “Moderate Buy” with an average target around $249, which suggests more than 37% upside potential from current prices.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/ServiceNow%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)