Southwest Airlines (LUV) has delivered one of its strongest market moments in decades. On Thursday, Jan. 29, its stock surged 18.7% to close at $48.50, a four-year high, following the release of the company’s fiscal 2025 Q4 results. The move marked its biggest single-day percentage gain since 1978 and its strongest close since Nov. 2021.

The rally did not come out of nowhere. Over the past two years, Southwest has systematically dismantled the practices that once defined it. The airline ended open boarding, began charging for checked bags for the first time, and rolled out basic economy fares, replacing long-held quirks with decisions designed to lift revenue.

That reset reached a turning point this week. Southwest officially closed the book on 54 years of open seating and moved to assigned seats, introducing paid options for preferred locations and extra legroom. This gives the airline clearer pricing power and a more predictable revenue stream.

CEO Bob Jordan recently confirmed the airline is also exploring airport lounges. At the same time, executives remain focused on cutting costs and tightening the operation as new revenue streams come online.

Management expects profits to at least quadruple in 2026, well ahead of analyst forecasts, as bag fees, seat assignments, and other changes finally reshape a half-century-old business model into one built for sustained earnings growth.

About Southwest Airlines Stock

Based in Dallas, Texas, Southwest Airlines is one of the world’s most recognized carriers, serving 117 airports across 11 countries. With a market cap brushing $25.1 billion, the airline flies a single-type Boeing 737 fleet, keeping operations simple while maintaining a broad domestic and near-international reach.

The stock’s recent performance mirrors the operational clarity. Over the past 52 weeks, Southwest’s shares have jumped 56%. In the last three months, they gained 63%, and just in the past month alone, investors pushed the stock up 19%, showing that the market is steadily buying into the airline’s transformation.

Even after the rally, valuation remains modest. LUV stock is currently trading at 14.13 times forward adjusted earnings and 0.82 times sales. Both sit below the industry averages and their own five-year average multiples, suggesting an attractive entry point for investors looking for upside without overpaying.

Shareholders are also collecting income along the way. The company pays an annual dividend of $0.72 per share, translating to a 1.48% yield. Its most recent $0.18 per share payment went out on Jan. 16 to shareholders of record as of Dec. 26, 2025, reinforcing financial stability.

A Closer Look at Southwest Airlines’ Q4 Earnings

On Wednesday, Jan. 28, Southwest opened the books on its fourth-quarter 2025 results. Revenue reached $7.44 billion, up 7.4% from a year earlier. It fell just short of the $7.51 billion analysts expected, but not by enough to derail the bigger picture.

Capacity grew 5.8% year-over-year (YoY) even as the fleet count stayed roughly flat, squeezing more output from the same assets. That efficiency translated into EBIT of $386 million. Cost control held firm, too, with CASM excluding fuel rising just 0.8% YoY, despite flying less capacity than originally planned.

Earnings reflected that balance. Adjusted EPS climbed 3.6% to $0.58, landing exactly where Wall Street expected. The balance sheet added reassurance as Southwest closed 2025 with $3.2 billion in cash and cash equivalents, supported by a $1.5 billion revolving credit line, leaving the airline well positioned to keep pushing its reset.

Management sounds increasingly confident in the payoff. Executives say the impact of initiatives launched in 2025 is now clear, and they expect meaningful margin expansion and strong earnings growth this year.

For Q1, Southwest’s management forecasts revenue per seat mile growth of 9.5%, alongside adjusted earnings of at least $0.45. Looking further out to the full fiscal year, they expect to earn a minimum of $4 per share on an adjusted basis. Capacity growth of 2% to 3% nearly doubles last year’s pace but remains measured.

Analysts also see the earnings curve bending sharply upward. Wall Street is forecasting Q1 fiscal 2026 EPS growth of 446.2% YoY to $0.45. Full-year 2026 EPS is expected to jump 260.2% to $3.35, with another 36.1% increase penciled in for 2027 to $4.56.

What Do Analysts Expect for LUV Stock?

Wall Street’s caution reflects a company still in transition. While Southwest’s strategic reset is gaining traction, analysts remain divided on how quickly the changes will translate into durable, long-term margins.

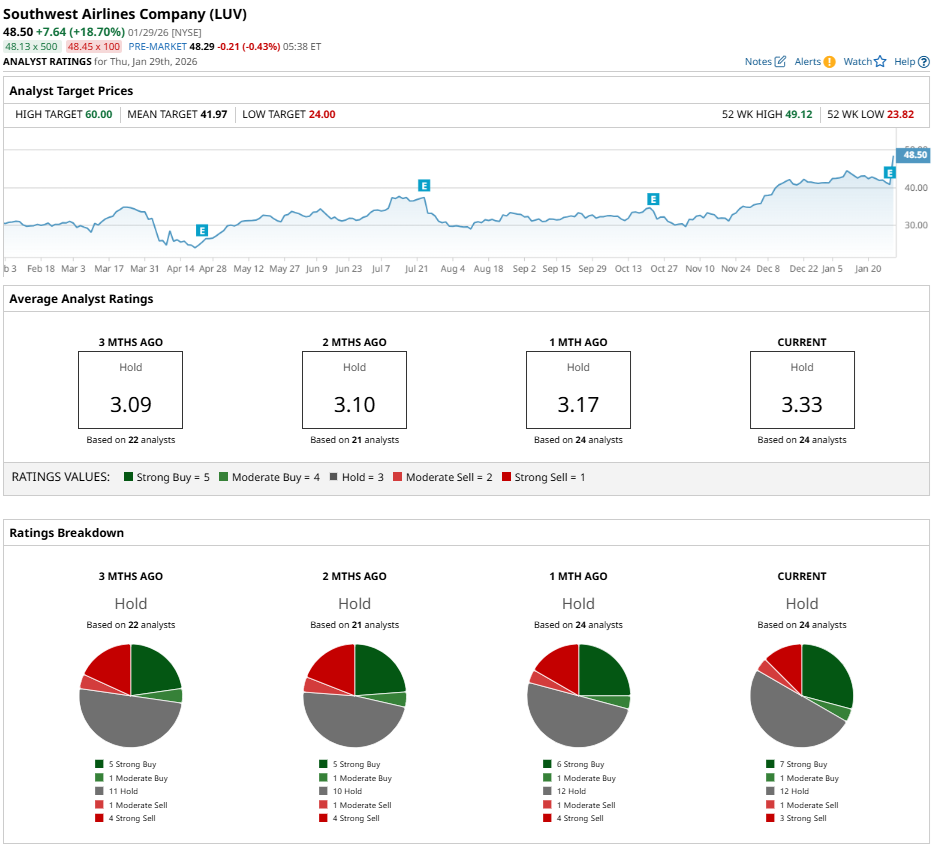

As a result, LUV stock carries a consensus rating of “Hold,” with opinions spread across the spectrum. Of the 24 analysts covering the stock, seven rate it “Strong Buy,” one suggests “Moderate Buy,” 12 call for “Hold,” one recommends “Moderate Sell,” and three remain firmly in the “Strong Sell” camp.

That restraint also shows up in the price targets. LUV stock is already trading above its average price target of $41.97, indicating near-term optimism is largely priced in. Still, the Street-high target of $60 implies roughly 23.7% upside from current levels, leaving room for gains if execution continues to improve.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)