/Apple%20products%20arranged%20on%20desk%20by%20tashka2000%20via%20iStock.jpg)

Apple (AAPL) stock is inching down on Jan. 30, as rising memory costs temper enthusiasm about future gains despite record revenue on staggering iPhone demand in fiscal Q1. But a senior JPMorgan analyst, Samik Chatterjee, believes AAPL is worth buying on the dip since it’s trading at a discount by historic norms.

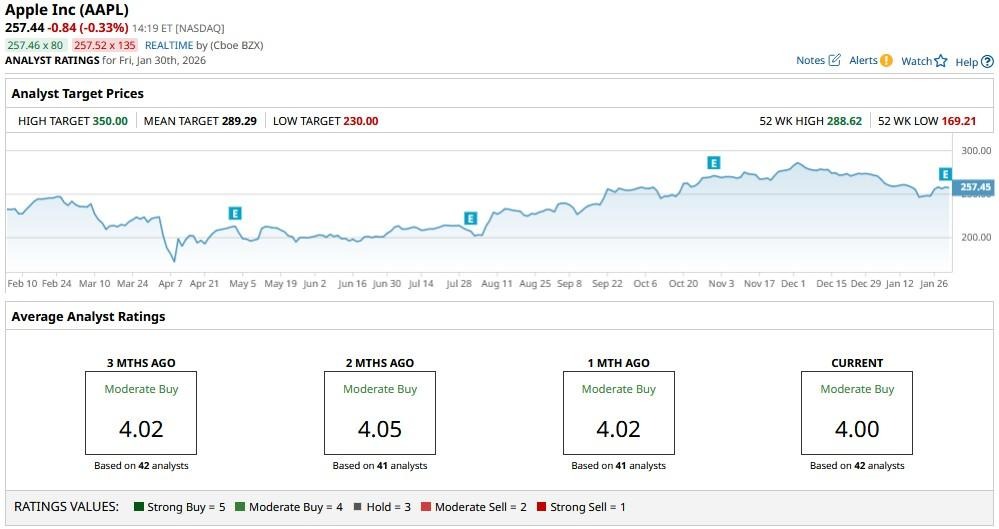

At the time of writing, Apple shares are up some 50% versus their 52-week low.

Why JPMorgan Is Bullish on Apple Stock

In his research note, Chatterjee argued higher memory costs are unlikely to significantly hurt Apple margins as the titan has favorable long-term contracts with its suppliers.

Moreover, AAPL stock is currently trading at a forward price-to-earnings (P/E) ratio of about 31x, which is lower than its multiple during previous super cycles.

As investors factor in a multi-year artificial intelligence (AI) upgrade cycle, the company’s share price could push notably higher from here, he told clients.

Chatterjee maintains a “Buy” rating on the iPhone maker, with a price target of $315, indicating potential upside of nearly 24% from here.

AI and Hardware Rollouts to Drive AAPL Shares Higher

According to Chatterjee, Apple’s multi-year partnership with Google to integrate Gemini into its ecosystem, and its plans of a Siri revamp could reverse recent weakness in its services unit.

All in all, he’s convinced that the company has multiple levers it can pull to drive sustainable growth over the long-term.

Note that there have been rumors of a foldable iPhone scheduled for launch by the end of this year, which could boost average selling prices (ASPs) and — by extension — AAPL share prices further in 2026.

According to Barchart, options traders also seem to believe that Apple’s rally isn’t out of juice just yet, given the upper price on contracts expiring mid-April is set at about $275 currently.

What’s the Consensus Rating on Apple?

While not as bullish as JPMorgan, other Wall Street firms continue to recommend sticking with Apple as well.

The consensus rating on AAPL shares sits at “Moderate Buy” currently, with the mean price target of about $289 indicating potential upside of nearly 14% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)