/Axon%20Enterprise%20Inc%20logo%20with%20buy%20and%20sell-by%20NPS_87%20via%20Shutterstock.jpg)

Axon Enterprise (AXON) is set to release its fourth-quarter 2025 earnings on Feb. 24 amid mounting investor concerns over its lofty valuation. The company, a leader in public safety technology, has seen its stock stumble early in the year, reflecting broader market jitters about high-growth tech firms trading at premium multiples.

Despite this, Axon continues to expand its AI capabilities, highlighted by its November agreement to acquire Carbyne for $625 million. This move integrates cloud-native 911 technology into Axon's ecosystem, uniting devices, real-time communications, and digital evidence management to enhance emergency response.

As AI integration deepens, questions linger: Will Q4 results validate the hype or deliver a valuation reality check? With shares down year-to-date (YTD), earnings could either reignite momentum or amplify doubts.

About Axon Enterprise Stock

Headquartered in Scottsdale, Arizona, Axon Enterprise develops technology and weapons for law enforcement, military, and civilian use. Its products include body-worn cameras, in-car cameras, TASER energy devices, cloud software for evidence management, and emerging AI-driven solutions like drones and real-time operations tools. The company operates in two segments — TASER and Software and Sensors, with the majority of revenue coming from the latter — focusing on hardware and cloud-based systems for digital evidence.

In 2026, AXON stock has declined 14% YTD, lagging the S&P 500's ($SPX) 1.3% gain. This follows a near-10% plunge on Jan. 28 after heavy trading volume of over 1.3 million shares and a 7% plunge on Jan. 29 after volume of 1.5 million shares. In 2025, the stock fell 4%, snapping a nine-year winning streak of positive annual returns and marking its first losing year since 2015. AXON underperformed the S&P 500's roughly 16% advance that year.

Valuation metrics show Axon trading at a trailing price-to-earnings (P/E) ratio of 395, a forward P/E of 430, and a PEG ratio 17.3. Its forward price-to-sales (P/S) ratio stands at 16.3. Compared to the aerospace and defense industry averages, Axon's multiples are significantly higher, indicating stretched valuations relative to peers.

Historically, Axon's P/S has risen from 4 a decade ago to 16 today, reflecting multiple expansion amid rapid growth. The P/E measures price per dollar of earnings, while PEG adjusts for growth. High figures suggest overvaluation, especially with recent earnings misses. Overall, AXON stock appears overvalued, though its AI pivot could justify premiums if it delivers on execution.

What Wall Street Is Looking for in Q4

As Axon approaches its Q4 earnings report, analysts are zeroing in on key metrics to gauge the company's trajectory amid valuation pressures and AI expansion. Consensus estimates peg losses at $0.18 per share, while revenue is expected at $755.29 million, higher than the upper end of guidance of $750 million to $755 million, implying 31% year-over-year (YOY) growth. This follows full-year 2025 revenue projections of $2.74 billion, up 31% from 2024.

Over the past four quarters, Axon's performance against estimates has been volatile, underscoring the scrutiny ahead. In Q3, actual earnings of a $0.23 loss missed the 0.08 estimate. Q2 delivered a beat with 0.85 actual versus 0.08 expected, while Q1 saw losses of $0.12 against an expected loss of $0.04 per share.

Investors should watch for guidance on AI integration, as the Carbyne deal aims to bolster cloud-native 911 tech, uniting Axon's devices with real-time response tools. However, concerns mount over insider selling, with executives offloading shares regularly over the past year and only one purchase by a director.

CEO Patrick Smith sold nearly $6.2 million worth earlier this month through a prearranged 10b5-1 plan, trimming his stake but retaining over 3.1 million shares valued at about $1.5 billion. While such sales are often routine for liquidity or diversification, the pattern — 11 sales by Smith in 18 months totaling over 580,000 shares — raises eyebrows as the stock has been steadily declining.

Defenders argue Smith's substantial ownership indicates his interests are still aligned with the company. That said, persistent selling could fuel bearish sentiment if Q4 disappoints.

What Do Analysts Expect for Axon Enterprise Stock?

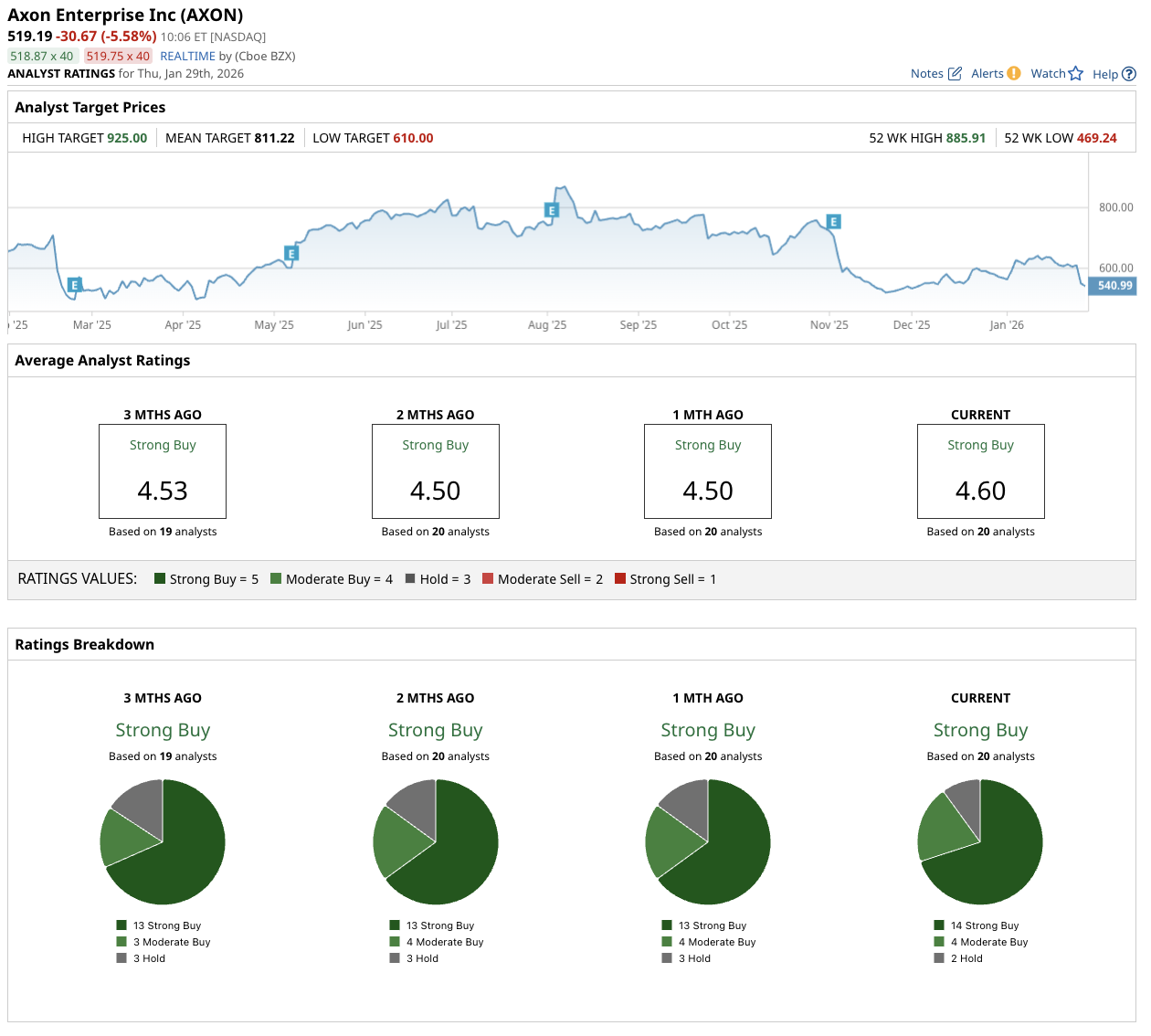

Sentiment toward Axon remains positive, with a consensus "Strong Buy" rating based on coverage from 20 analysts. The breakdown includes 14 "Strong Buy" recommendations, four "Moderate Buy" ratings, and two "Hold" ratings. No downgrades have been noted, but AXON stock's volatility has prompted caution amid high multiples. Consensus has held steady in recent months, buoyed by Axon's AI push despite 2025's underperformance.

The mean price target stands at $811.22, well above the current share price of $485, representing potential upside of 67% from here. This reflects optimism around long-term growth from acquisitions like Carbyne and expanding public safety tech, though realization depends on Q4 execution and market conditions.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)