Live Nation Entertainment, Inc. (LYV) is a leading live entertainment company that promotes and produces live music events, operates entertainment venues, manages ticketing services, and generates sponsorship and advertising revenue worldwide. Live Nation is headquartered in Beverly Hills, California and has a market cap of around $34.3 billion.

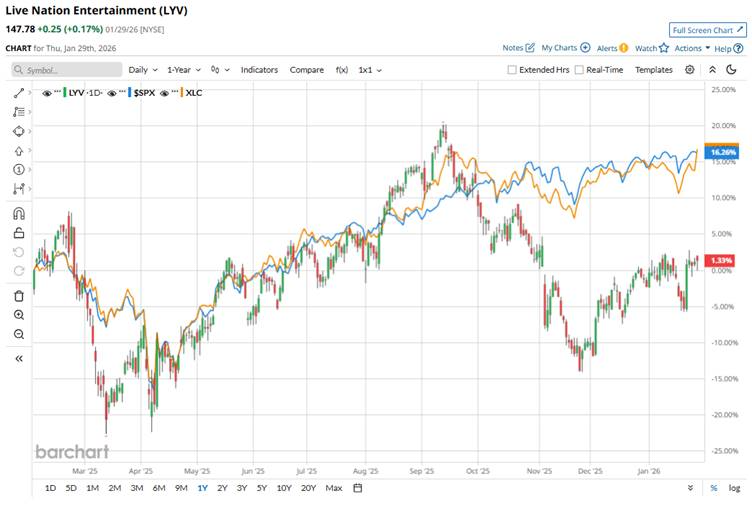

The stock has significantly underperformed the broader market over the past year. LYV has soared 3.7% over the past 52 weeks and again 3.7% on a YTD basis, compared with the S&P 500 Index’s ($SPX) 15.4% surge over the past year and 1.8% returns on a YTD basis.

Narrowing the focus, LYV has also lagged behind the Communication Services Select Sector SPDR ETF Fund’s (XLC) 17.6% surge over the past year and 1.8% gains this year.

Live Nation Entertainment’s stock has risen due to strong underlying demand for live concerts and events, robust ticket sales growth, and optimistic outlooks on live entertainment trends. However, LYV has underperformed the broader market because of earnings misses, cost pressures from expanded operations, and regulatory and macroeconomic headwinds that make discretionary spending stocks more volatile.

For the full fiscal 2025, analysts expect LYV to report a loss per share of $0.19, deteriorating 106.9% year-over-year. It has surpassed the Street’s bottom-line estimates in two of the past four quarters, while missing on the other two occasions.

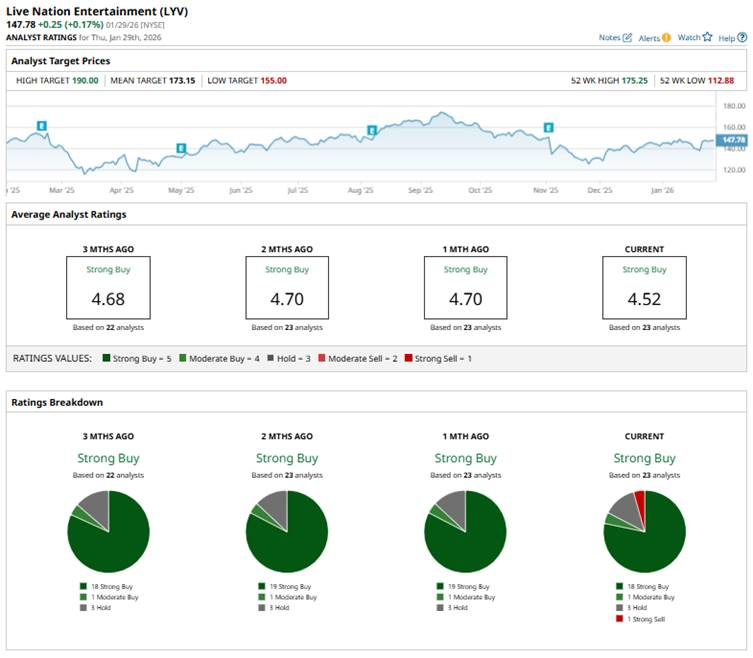

The stock has a consensus “Strong Buy” rating overall. Of the 23 analysts covering the stock, opinions include 18 “Strong Buy” ratings, one “Moderate Buy,” three “Holds,” and one “Strong Sell.”

This configuration is less bullish than one month ago, when 19 analysts gave “Strong Buy” recommendations, and there were no “Strong Sell” ratings.

This month, Bernstein SocGen reiterated an “Outperform” rating on Live Nation with a $185 price target, citing a faster-filling touring pipeline.

Live Nation’s mean price target of $173.15 suggests a 17.2% upside potential. Meanwhile, the Street-high target of $190 represents a notable 28.6% premium to current price levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)