/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Despite the constant chorus around diversification, mega-cap stocks continue to anchor market psychology. HSBC Holdings plc (HSBC) has leaned into that reality, urging investors to stay aggressively pro-risk as scale and earnings visibility continue to win. Recently, the global banking powerhouse said it is almost at maximum overweight in equities, while also overweight in high-yield credit, emerging-market debt, and gold.

The bank downplayed geopolitics as a secondary concern, arguing that U.S. rates, rate volatility, and near-term growth expectations remain the true market drivers. It also cautioned that fourth-quarter S&P 500 Index ($SPX) earnings expectations are “still way too low,” recommending a rotation away from rate-sensitive, high-beta sectors and back into mega caps. This rotation places Amazon (AMZN) firmly at center stage.

As one of the market’s most influential hyperscalers, Amazon sits at the intersection of consumer demand, cloud infrastructure, and artificial intelligence (AI). The company has even raised its 2026 capital expenditure forecast to $125 billion from $118 billion, the highest among mega caps, reflecting surging AI and cloud demand.

Analysts now project Amazon's growth of more than 17% in 2026 to over $146 billion. For investors aligned with HSBC’s strategy, Amazon increasingly reads as a long-term compounder rather than a short-term trade.

About Amazon Stock

The Seattle, Washington-based Amazon has evolved far beyond an online retailer. With a market cap of nearly $2.6 trillion, it sells nearly everything, delivers at unmatched speed, streams content, and builds devices. Behind the scenes, Amazon Web Services (AWS) powers vast portions of the internet through cloud and AI services.

Over the past six months, the stock has gained 3.6%. In the last three months, it is up 3.9%. Over just the past five trading sessions, shares have climbed another 2.14%, reflecting renewed confidence ahead of major earnings catalysts.

Coming to valuation, AMZN stock is currently trading at 31.02 times forward adjusted earnings and 3.63 times sales. Both metrics sit well above industry averages, signaling a premium multiple that investors appear willing to pay for scale, growth visibility, and expanding AI-driven profit pools.

Amazon Surpasses Q3 Earnings

Amazon’s shares surged more than 9.6% on Thursday, Oct. 30, 2025, a day after the company unveiled its Q3 2025 results that beat expectations. Revenue grew 13.4% year-over-year (YOY) to $180.17 billion, exceeding analyst estimates of $177.8 billion. EPS rose 36.4% from the year-ago period to $1.95, topping analyst forecasts of $1.57.

The real engine of upside remained AWS. Cloud revenue accelerated 20.2% during the quarter, outpacing expectations of 18.1%. Operating income marginally rose YOY to $17.4 million, while net income advanced 38.2% to $21.2 billion.

CEO Andy Jassy underscored the shift, stating that AWS is “growing at a pace we haven’t seen since 2022,” driven by surging AI demand. The demand continues to reshape Amazon’s capital priorities and strengthens its long-term competitive positioning in cloud and enterprise services.

The strategic pivot is already translating into concrete action across Amazon’s AI stack. The company has launched Q, an enterprise-focused chatbot, and Bedrock, a generative AI platform for cloud customers, while commissioning its $11 billion Project Rainier data center built exclusively to run models from Anthropic’s Claude.

Looking forward, Amazon’s management has guided fourth-quarter 2025 revenue between $206 billion and $213 billion, with operating income expected to range from $21 billion to $26 billion.

The e-commerce giant is scheduled to release its Q4 2025 results on Thursday, Feb. 5, after market close. Analysts expect quarterly EPS growth of 6.5% YOY to $1.98. For full-year 2025, EPS is projected to jump 29.8% to $7.18, followed by another 10% increase in fiscal 2026 to $7.90.

What Do Analysts Expect for Amazon Stock?

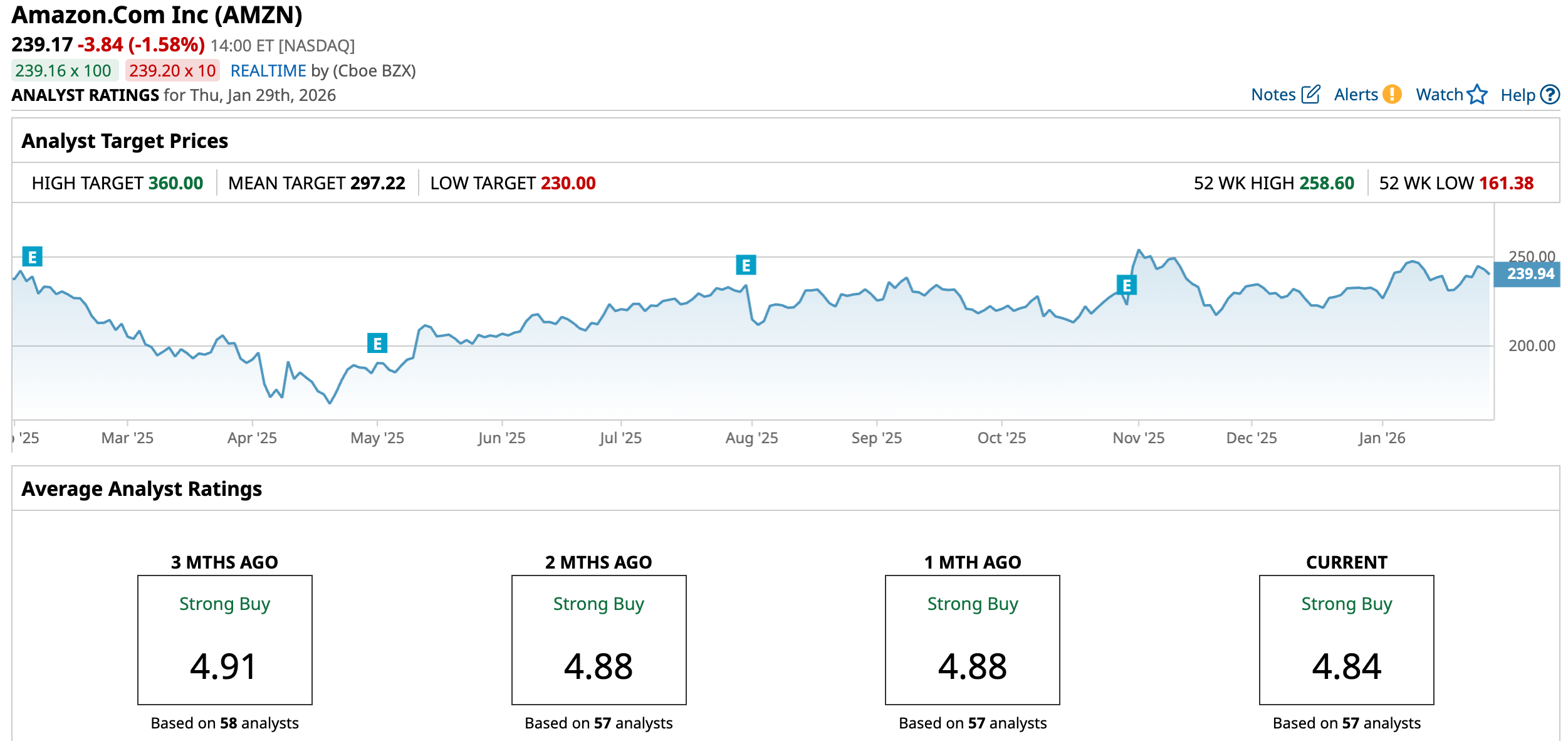

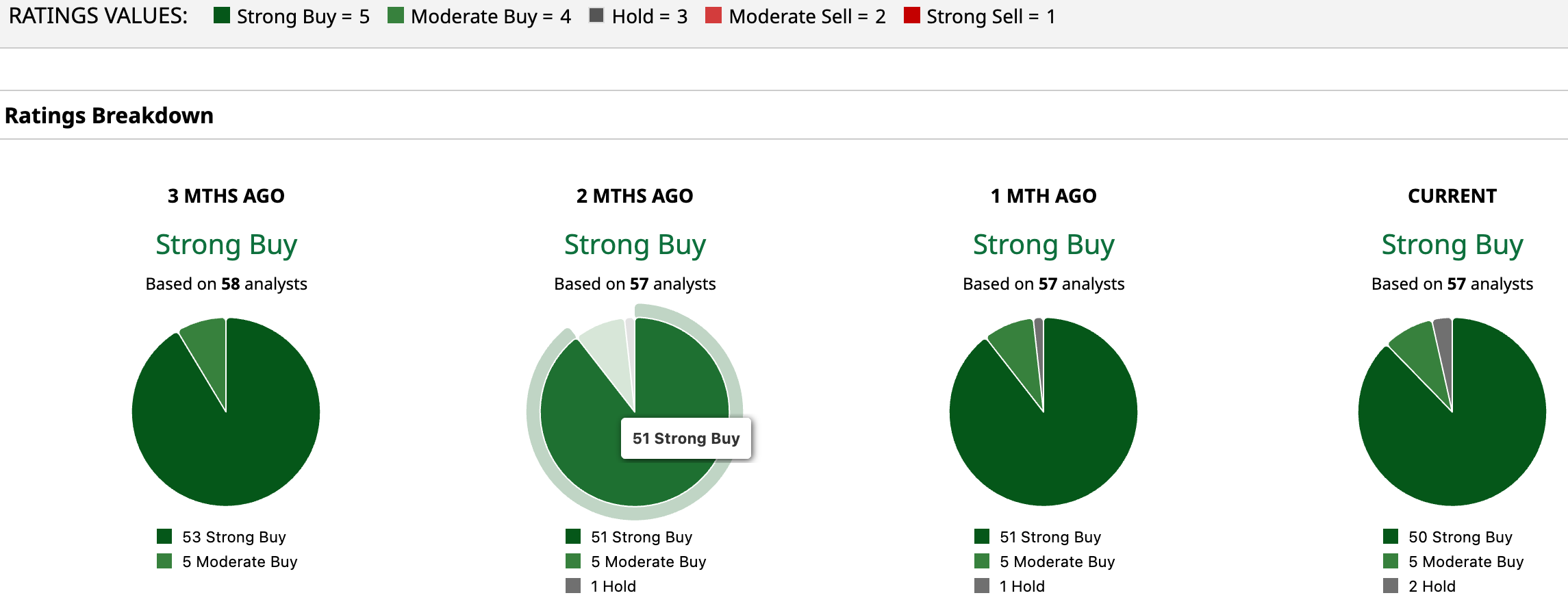

Wall Street’s conviction around Amazon has left little room for ambiguity. Analysts continue to coalesce around a bullish outlook, assigning the stock an overall rating of “Strong Buy.” Among 57 analysts covering the stock, 50 rate it “Strong Buy,” five suggest “Moderate Buy,” and only two call for “Hold.”

The average price target of $297.22 represents potential upside of 24.3%. Meanwhile, the Street-high target of $360 points to a gain of 50.5% from current levels, highlighting expectations that sustained earnings momentum and aggressive investment could continue to re-rate the stock higher.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)