The Boeing Company (BA) has finally broken a long cycle of financial pain, closing the chapter on nearly seven years of persistent setbacks. The aerospace and defense giant reported quarterly revenue of $23.9 billion, up around 57% year-over-year (YOY), its highest since 2018, marking a decisive inflection driven by operational discipline, higher commercial deliveries, and stronger defense volumes.

This rebound matters because Boeing burned roughly $40 billion between the first quarter of 2019, after the second fatal 737 Max crash, and the third quarter of 2025. Although operational momentum has reinforced this recovery. Boeing delivered 600 aircraft last year, almost double the 2024 total and the strongest delivery count since 2018.

CEO Kelly Ortberg, who returned from retirement in 2024, has confirmed that further production increases remain firmly on the near-term roadmap. He stated that Boeing has set the foundation for a turnaround, supported by record backlogs across commercial aviation, defense, and services.

He also struck a disciplined tone, noting that the company has not fully turned the corner yet but is making measurable, credible progress toward sustained recovery. Against this backdrop, let us discuss how investors could position themselves in Boeing’s shares as the turnaround steadily takes shape.

About Boeing Stock

Based in Arlington, Virginia, Boeing designs and manufactures commercial aircraft, including the 737, 767, 777, and 787. With a market cap of approximately $185.9 billion, the company also builds military aircraft, weapons, and unmanned systems while delivering global services spanning engineering, maintenance, training, and upgrades.

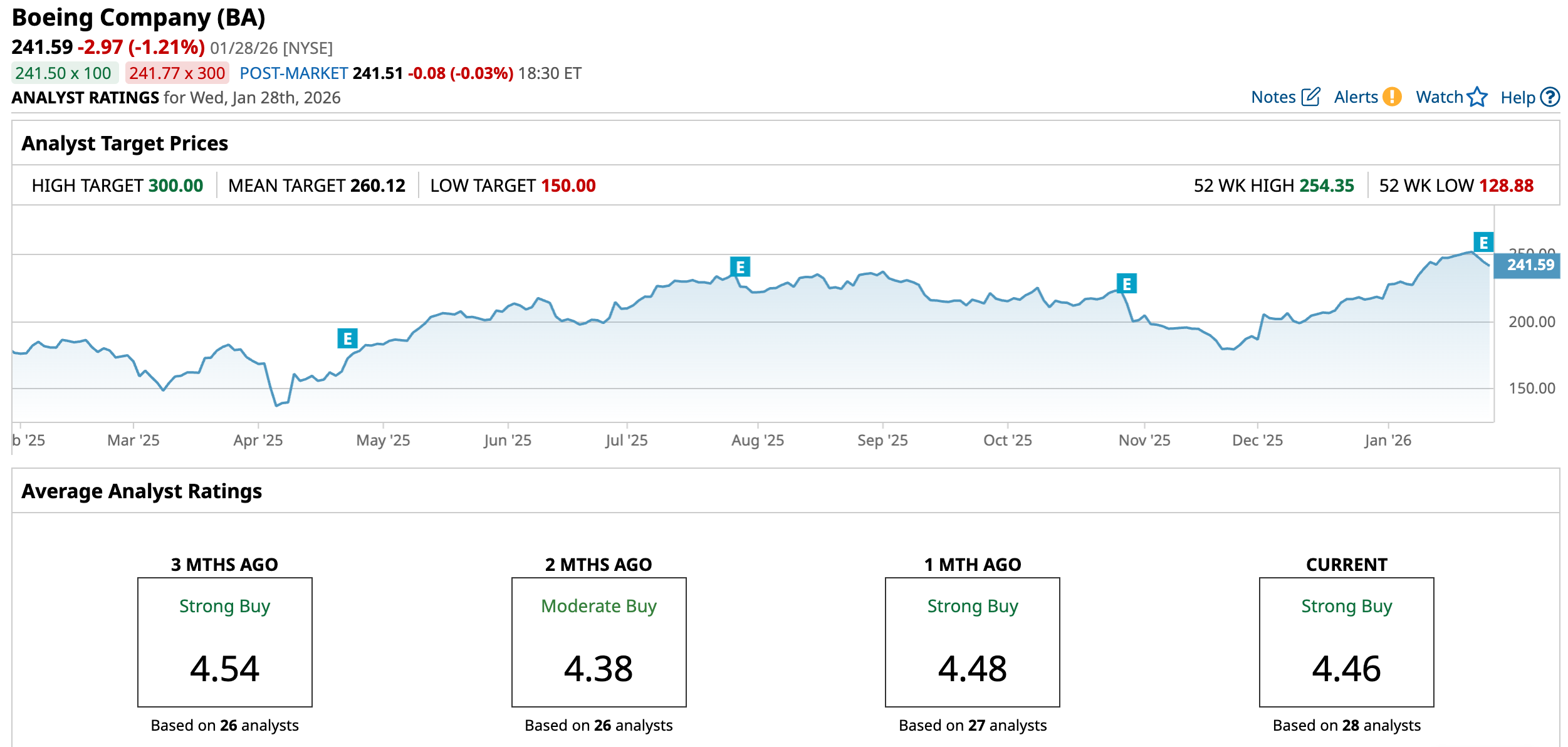

Over the past 52 weeks, BA stock has delivered a gain of nearly 35.9%, reflecting renewed investor confidence as Boeing’s operational and financial narrative is improving. The strength has carried decisively into the current year, with the stock advancing 11.27% year-to-date (YTD) and adding another 11.62% in just the past month alone.

BA stock is currently trading at 95.71 times forward adjusted earnings and 1.96 times sales. The valuation multiples sit well above industry averages, clearly signaling that the market is assigning Boeing a meaningful premium based on recovery expectations and longer-term growth potential.

Boeing Surpasses Q4 Earnings

On Jan. 27, Boeing reported Q4 fiscal 2025 revenue of $23.95 billion, up 57.1% YOY and ahead of the $22.6 billion that analysts had penciled in. Adjusted EPS reached $9.92, reversing a $5.90 loss last year and outperforming analyst expectations of a $0.44 loss per share.

Further, the company reported a profit of $8.2 billion compared with a loss of $3.9 billion in the prior year’s period. The reversal was primarily driven by the sale of its digital aviation business, which generated approximately $9.6 billion in proceeds and materially strengthened the company’s balance sheet.

Cash flow trends further validated the recovery. Operating cash flow reached $1.3 billion during the quarter, while free cash flow stood at $400 million. Moreover, Boeing’s overall order backlog climbed to a record $682 billion during the year.

Moving forward, management projects free cash flow of $1 billion to $3 billion for fiscal 2026. They also emphasized that achieving $10 billion in annual free cash flow is very attainable, with scope to exceed that level over the longer term, contingent on certain factors.

Analysts support the improving outlook. They expect the first-quarter fiscal 2026 loss per share to narrow roughly 49% YOY to -$0.25. For the full fiscal year 2026, EPS is projected to grow 109% to $0.96, followed by a further 253.1% increase in fiscal year 2027 to $3.39.

What Do Analysts Expect for Boeing Stock?

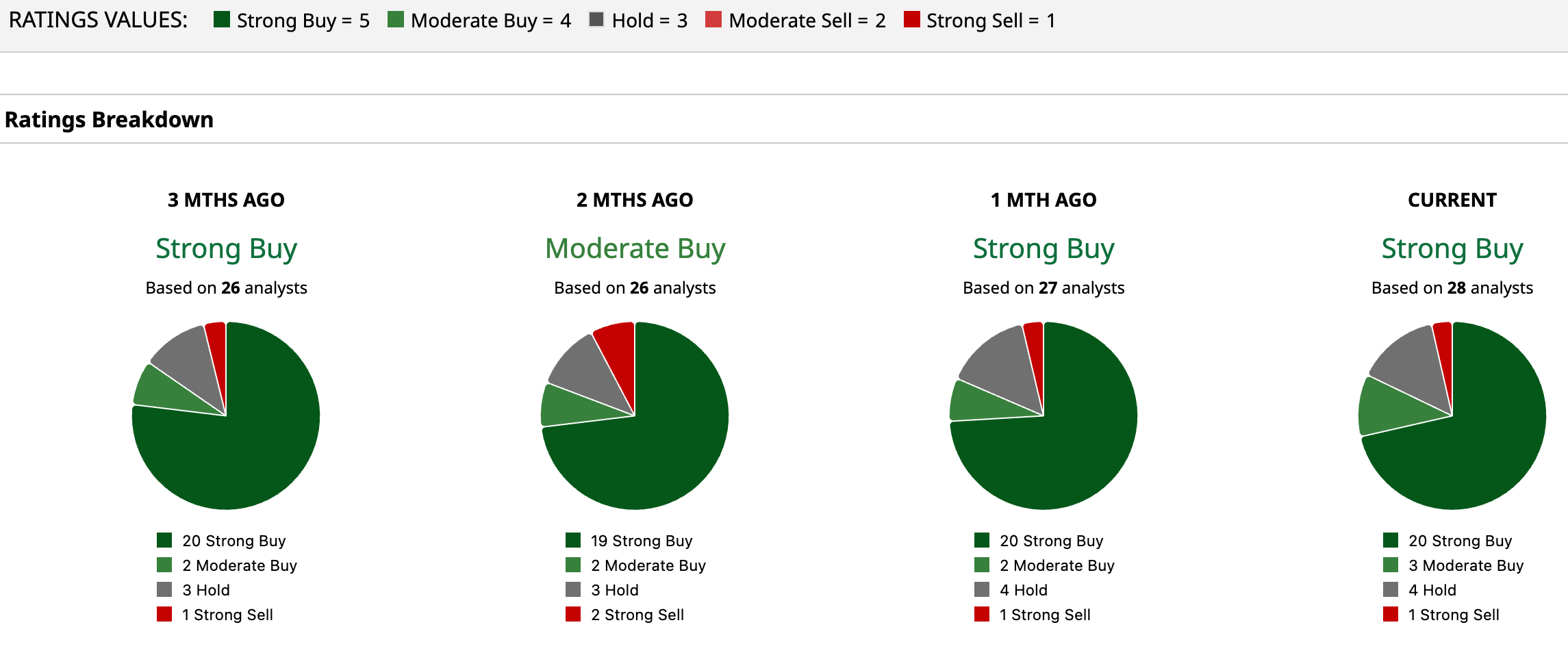

With the operational tide clearly turning, Wall Street has warmed up to Boeing. Its stock is carrying an overall “Strong Buy” rating. Among 28 analysts, 20 rate it “Strong Buy,” three suggest “Moderate Buy,” four recommend “Hold,” while one leans toward a “Strong Sell.”

The average price target of $260.12 implies a gain of 7.7% from current levels. On the optimistic end, the Street-high target of $300 points to nearly 24% upside, reflecting the view that if Boeing executes cleanly, shareholders could enjoy a smooth ascent.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20microchip%20by%20DesignKingBD360%20via%20Shutterstock.jpg)

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)