/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)

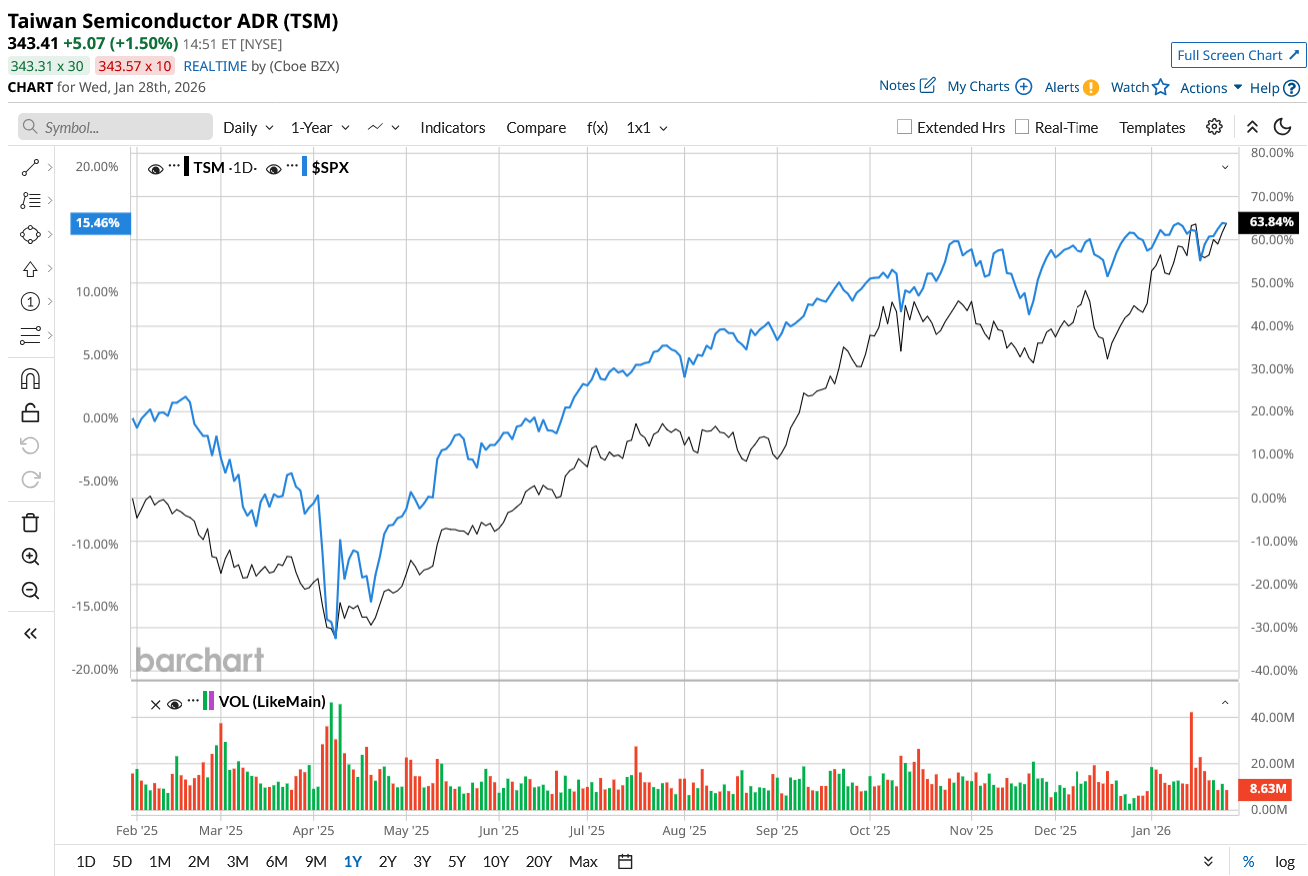

Taiwan Semiconductor Manufacturing Company (TSM), or TSMC, is the world’s largest and most advanced semiconductor foundry. While it does not design chips, it is a major supplier to tech companies, producing cutting-edge chips (such as 3 nm, 5 nm, and lower). TSMC delivered a blowout quarter and strong end to 2025, thanks to strong demand for its cutting-edge technologies and the rapid adoption of AI-based applications. The stock rose 50.7% last year but is now down 3% from its 52-week high of $351.33.

Let’s find out if the stock is a good buy now on the dip.

Advanced Technologies Drive Q4 Performance

In the fourth quarter ended December 2025, TSMC’s revenue increased by 25.5% year-over-year (YoY) to $33.7 billion, driven by strong demand for advanced process technologies. Leading-edge nodes continue to drive TSMC's revenue. In Q4, 3 nm technology accounted for 28% of wafer revenue, with 5 nm and 7 nm accounting for 35% and 14%, respectively. Technologies at 7 nm and below accounted for 77% of wafer revenue in the quarter.

For the full year 2025, 3 nm technology contributed 24% of wafer revenue, with advanced technologies overall accounting for 74%, compared to 69% last year. This shift highlights the company’s increasing reliance on cutting-edge nodes to fuel growth. Profitability improved meaningfully, with gross margin reflecting cost improvement efforts at 62.3%. Diluted earnings also rose 35% in the quarter. TSMC’s high-performance computing (HPC) remained the largest contributor in the quarter, accounting for 55% of total revenue. Smartphone revenue also increased, accounting for 32% of fourth-quarter sales. IoT and automobiles each contributed 5%, with data center enterprise (DCE) accounting for 1%.

For the full year, HPC revenue rose 48% YoY, significantly outpacing other platforms. Smartphones, IoT, and automotive also delivered double-digit growth for the full year, reflecting broad-based recovery outside AI-driven demand.

TSMC Sets Confident Growth Outlook for 2026

TSMC continues to expand its global manufacturing presence. In the U.S., its first Arizona fab has already begun high-volume production, with more fabs under development and growth plans planned to meet substantial multi-year AI demand. The company now has one in production in Japan, with a second fab under construction, and further fabs are being built in Europe.

Aside from outstanding top- and bottom-line growth, TSMC's balance sheet is also robust. It ended the quarter with $98 billion in cash and marketable securities. Despite investing $40.9 billion on capital expenditures, TSMC paid out and increased its dividend.

Looking ahead, TSMC predicts Q1 2026 revenue of $34.6 billion to $35.8 billion, a 38% YoY increase at the midpoint. Gross margins are estimated to range between 63% and 65%.

Management believes that AI is a key driver of long-term growth. TSMC now forecasts AI accelerator revenue growth approaching a mid-to-high 50% compound annual growth rate from 2024 to 2029. Overall, the company expects its long-term revenue to grow at around 25% CAGR over the five-year period starting in 2024, supported by contributions across smartphone, HPC, IoT, and automotive platforms.

The company plans to significantly increase investment in 2026, with capital expenditures projected between $52 billion and $56 billion. TSMC plans to spend 70% to 80% of these expenses on advanced process technologies, with the remainder on specialty technologies and advanced packaging, testing, and mask-making. Despite the higher spending, management expects profitable growth in 2026.

Only a handful of companies globally can manufacture advanced logic chips at scale, and TSMC leads in this, making it a reliable supplier to popular tech giants such as Nvidia (NVDA), AMD (AMD), and Broadcom (AVGO). Furthermore, manufacturing advanced chip fabs requires tens of billions of dollars and years of technical expertise, which leads to high switching costs for its partners.

Overall, TSMC enters 2026 with strong demand visibility, expanding margins, and an aggressive investment plan aimed at capturing long-term growth from AI and advanced computing, while continuing to deliver increasing returns to shareholders. Analysts also expect TSMC’s earnings to increase by 34.4% in 2026, followed by another 26% in 2027. Trading at 23 times forward earnings, TSMC is still a reasonable AI stock to buy now.

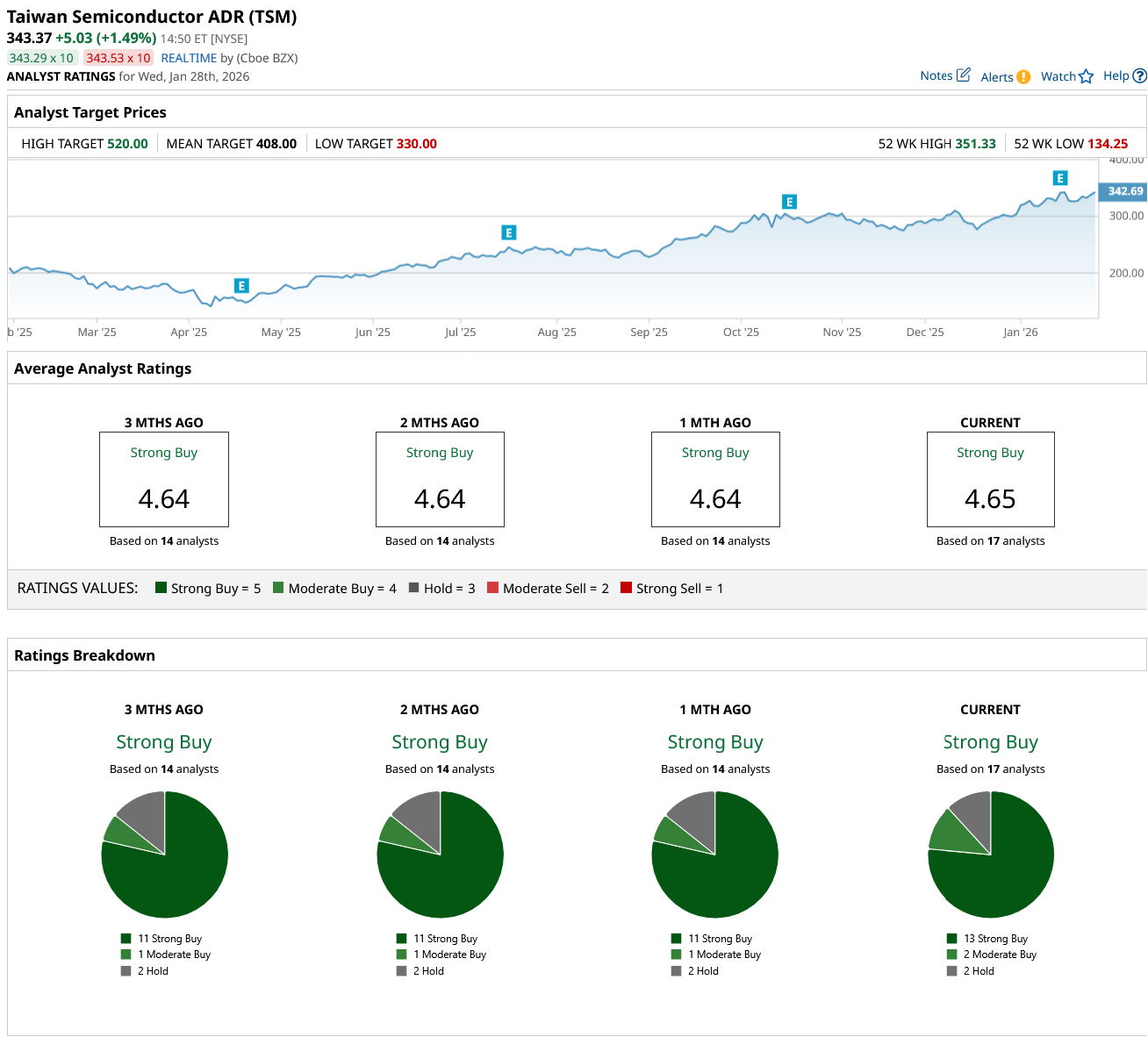

What Does Wall Street Say About TSM Stock?

Overall, Wall Street has a consensus “Strong Buy” rating for TSM stock. Out of the 17 analysts that cover the stock, 13 rate it a “Strong Buy,” two say it is a “Moderate Buy,” and two rate it a “Hold.” Based on the average price target of $408, the stock has an upside potential of 19% from current levels. Plus, its high target price of $520 implies a potential upside of 52% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/McDonald's%20Corp%20arches%20by-%20TonyBaggett%20via%20iStock.jpg)