/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

Nancy Pelosi, representative for California's 11th District and former Speaker of the House, is still one of the most influential voices in the Democratic Party. She's also a very successful investor. Recently, she has loosened her purse strings to make some new notable stock purchases. This includes tech titans such as Apple (AAPL) and Alphabet (GOOG) (GOOGL). Yet, the most notable one was of Nvidia (NVDA). But what makes owning one of the hottest stocks on Wall Street a noteworthy affair for Pelosi? It's because Pelosi's case with the shares of the chip giant has been one of missed opportunity, even though, on a net basis, the trade has still been profitable for her.

Pelosi & Nvidia: A Tale of Could Have Been (For Pelosi)

Nancy Pelosi and, to some extent, her husband Paul, are (in)famously regarded as very savvy stock pickers. While in some quarters, she has been accused of insider trading; regardless, her punts over the years have made her a lot of wealth. However, her journey with Nvidia has been topsy-turvy.

First, she invested in the stock by purchasing 50 call options on June 3, 2021. Pelosi eventually owned 25,000 shares of the company, thanks to a 4-for-1 stock split and some more buying. However, this all came to nothing, as mounting public pressure and accusations of exercising calls on the stock before the contentious CHIPS Act led to Pelosi and her husband reporting losses of about $341,000 on the trade. Consequently, if they had held the shares until today, their position would have been worth more than $20 million.

Not one to give up on the world's most valuable company, Pelosi again purchased 50 call options on the stock with a strike price of $120, for a value between $1 million and $5 million. Pelosi's luck with the stock shone again as Nvidia announced an even higher 10-for-1 stock split in June 2024, with Pelosi, along with her husband, now owning more than 50,000 shares of the company, of which they sold 10,000 to lock in some gains.

This continued in 2025, with them buying another 50 call options on the stock in January while selling 20,000 shares in December. They ended the year by buying 50 call options on the stock again, converting them into 5,000 shares on Jan. 16, 2026.

Overall, it is estimated that her total holding value of Nvidia shares stands between $45 million and $50 million, with a profit between $15 million and $20 million.

Notably, with a market cap of $4.5 trillion, the NVDA stock is up 49% over the past year.

Owning Nvidia Is a No-Brainer

Pelosi's missteps (forced or otherwise) notwithstanding, the case for owning NVDA stock remains as strong as ever, despite emerging challenges from Google's TPUs.

As highlighted in my most recent piece about the company, Nvidia's robust ecosystem makes it difficult for consumers to switch to other chip players once they are inside it.

This has led to the company reporting financials that are the envy of many, marked by stupendous growth and a rock-solid balance sheet.

Nvidia's performance over the last decade has been nothing short of explosive, with revenue and earnings growing at compound annual rates of 44.06% and 66.66%, respectively. The latest numbers from Q3 2025 make it clear that this momentum hasn't slowed down one bit under Jensen Huang's leadership.

The company turned in another standout quarter, topping both revenue and earnings forecasts while keeping year-over-year (YoY) growth above 50% across the board.

Revenue hit $57.1 billion, up 62% from the same quarter a year ago. EPS climbed 60% to $1.30, beating the $1.26 consensus estimate. The data center segment, which remains the biggest driver, grew 66% to $51.2 billion.

Cash flow remained very strong. Operating cash flow increased to $23.8 billion from $17.6 billion in the prior year, and free cash flow rose 65% to $22.1 billion. Nvidia closed the quarter with $60.6 billion in cash, short-term debt below $1 billion, and long-term debt of $7.5 billion, meaning cash was more than eight times the long-term debt level.

For the December quarter, the company guided to revenue around $65 billion, which would translate to roughly 65.4% YoY growth.

Analyst Opinion on NVDA Stock

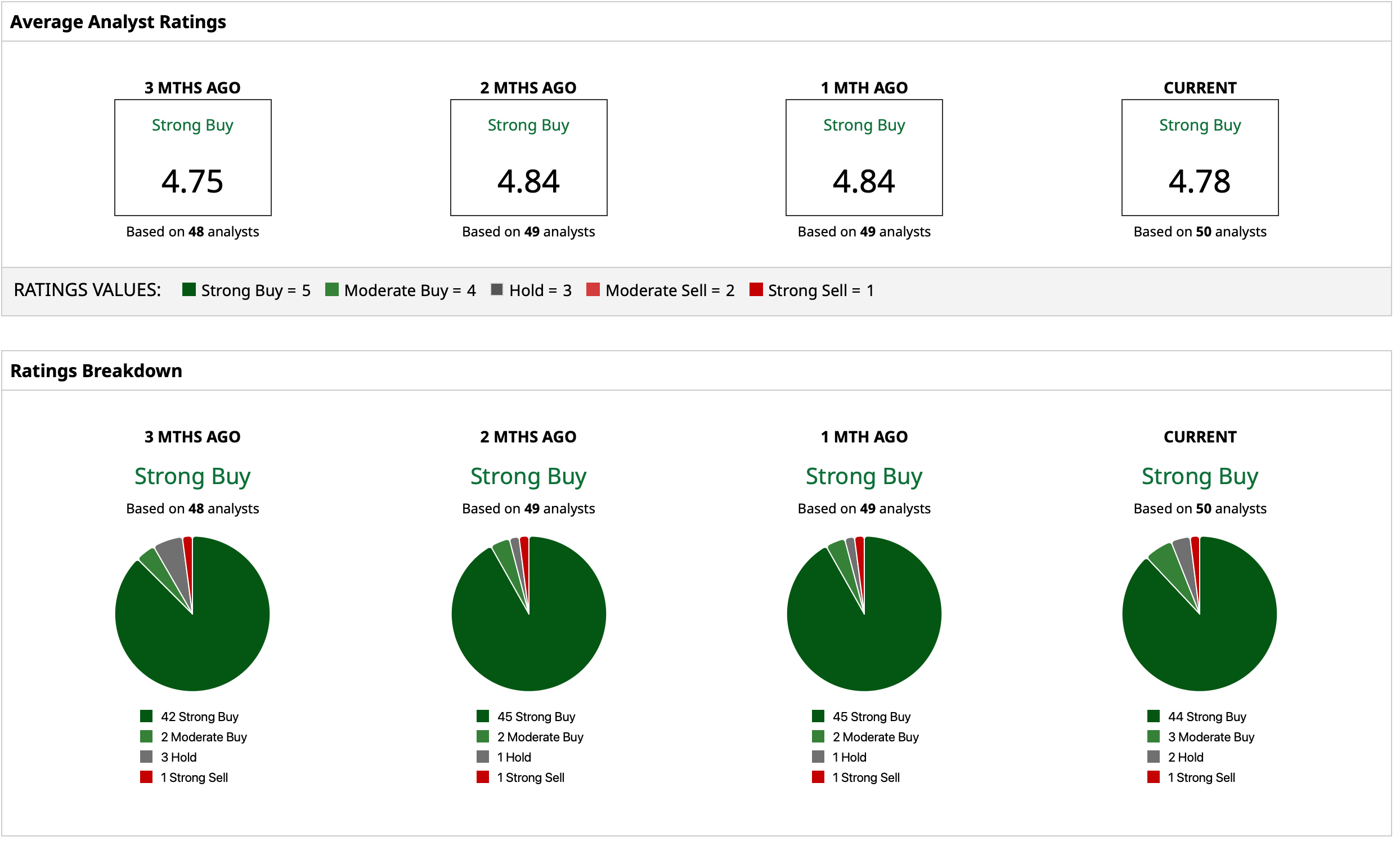

Thus, analysts have attributed a rating of “Strong Buy” for the NVDA stock, with a mean target price of $254.81. This indicates an upside potential of about 35% from current levels. Out of 50 analysts covering the stock, 44 have a “Strong Buy” rating, three have a “Moderate Buy” rating, two have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)