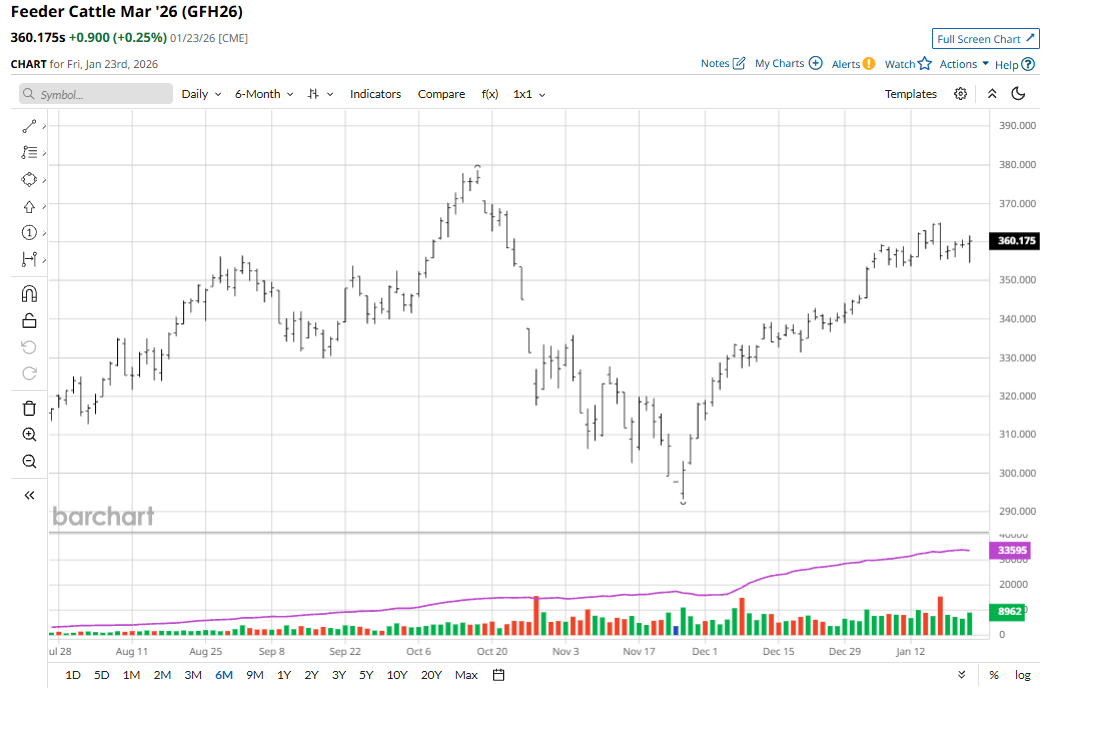

February live cattle (LEG26) on Friday rose $2.525 to $234.90 and for the week were up $2.75. March feeders (GFH26) gained $0.90 to $360.175 and for the week rose $3.725. Friday’s technically bullish weekly high closes in February live cattle and March feeders set the table for some follow-through chart-based buying early this week.

It appears cattle traders were expecting Friday afternoon’s monthly USDA cattle-on-feed (COF) report to lean price-friendly, which it did.

The agency reported that cattle and calves on feed in feedlots with capacity of 1,000 or more head totaled 11.5 million head on Jan. 1. The inventory was 3% below Jan. 1, 2025. The inventory included 7.02 million steers and steer calves, down 3% from the previous year. This group accounted for 61% of the total inventory. Heifers and heifer calves accounted for 4.44 million head, down 3% from 2025. Placements in feedlots during December totaled 1.55 million head, 5% below 2024. Net placements were 1.50 million head.

- Placements of cattle and calves weighing less than 600 pounds were 365,000 head

- 600-699 pounds were 360,000 head

- 700-799 pounds were 355,000 head

- 800-899 pounds were 274,000 head

- 900-999 pounds were 115,000 head

- 1,000 pounds and greater were 85,000 head

Marketings of fed cattle during December totaled 1.77 million head, 2% above 2024. Other disappearance totaled 58,000 head during December, 2% below 2024.

Cash Cattle Prices Remain Resilient Amid Still-Solid Consumer Demand for Beef

Still-very-quiet cash cattle trading late last week saw the USDA report on Friday steers averaging $231.93 and heifers averaging $232.23. Those numbers compare to the prior week’s average cash cattle trade reported by USDA at $232.50.

Retailers continue to anticipate good consumer demand for beef at the meat counter in the coming months, despite still historically high retail beef prices. Consumer confidence remains generally upbeat as recent U.S. economic data does not signal any serious trouble, while the Federal Reserve is likely to lower interest rates this year.

New World Screwworm Remains a Potentially Bearish Uncertainty

The New World Screwworm threat is again in focus and now leans price- bearish, fundamentally, due to the uncertainty of the matter and its potential impact on consumer psychology.

The matter resurfaced in early January when Texas Agriculture Commissioner Sid Miller issued a statement following a confirmation of new active cases of New World Screwworm in the Mexican border state of Tamaulipas. The latest detections bring the total number of reported cases to 16, with 13 cases currently active. The U.S. Department of Agriculture (USDA) has also confirmed that one of the newly reported cases is the northernmost active detection in Mexico, just 197 miles from the Texas border. “Now is the time for Texas producers to stay sharp and be prepared. The Texas Department of Agriculture, working alongside our state and federal partners, is fully engaged in enhanced surveillance, coordination, and response planning. But protecting Texas agriculture starts on the ranch, and we need producers to be our first line of defense,” he said.

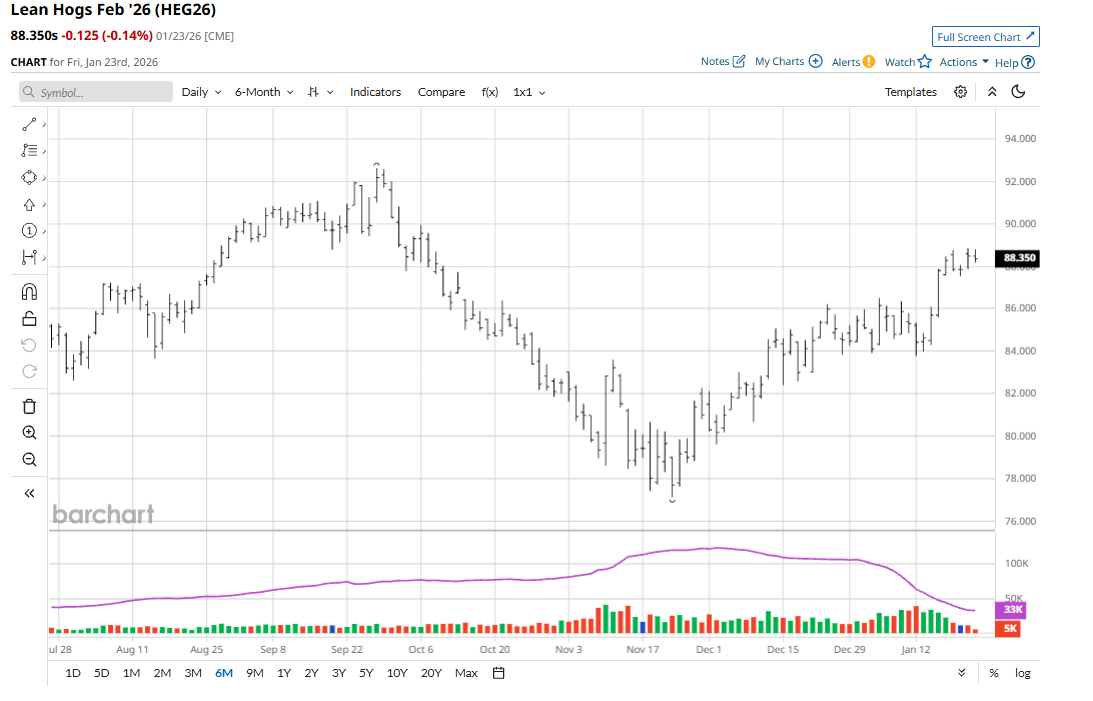

Lean Hog Futures Bulls Continued to Ride Price Uptrend

February lean hog (HEG26) futures on Friday fell 12 1/2 cents to $88.35 and for the week were up 7 1/2 cents. The lean hog futures market paused late last week, with some mild profit taking featured from the shorter-term futures traders, after prices earlier in the week hit a 3.5-month high.

Firmly bullish technicals and increases in the cash hog and CME lean hog index prices recently are helping to push futures prices higher. Hog futures’ premium to the CME lean hog index also remains a positive element for the futures market, suggesting hog traders expect the cash market to continue to improve.

The latest CME lean hog index is up $0.67 to $83.07. Monday’s projected cash index price is up another $0.55 to $83.62. The national direct five-day rolling average cash hog price quote today is $60.71.

Elevated Beef Prices Driving Better Pork Demand

Still historically elevated beef prices at the meat counter are likely to continue to see better substitution demand for pork. Such will likely continue to support the cash hog and lean hog futures markets by at least keeping a floor under prices, if not sustaining the present price uptrends in both markets.

Hog slaughter levels continue above year-ago totals, reflecting solid consumer demand. Given elevated supplies, grocers have likely been ramping up ham purchases ahead of the Easter holiday, which falls early this year. The current landscape leans in favor of a run in futures prices toward the early-autumn 2025 highs in the coming weeks or few months.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)