/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

Joby Aviation (JOBY) is a company that builds electric air taxis, quiet, all-electric flying vehicles that take off and land vertically (eVTOLs). Designed for city hops, the S4 aircraft carries four passengers plus a pilot up to 150 miles at 200 mph, slashing traffic time with zero emissions. Joby plans on-demand rides via an app, like Uber (UBER), but in the sky, targeting busy urban routes, airports, and events.

Founded in 2009, Joby is headquartered in Santa Cruz, California. It operates mainly in the United States but has partnerships extending to Dubai, Australia, Japan, and the UK.

Joby Stock Slips

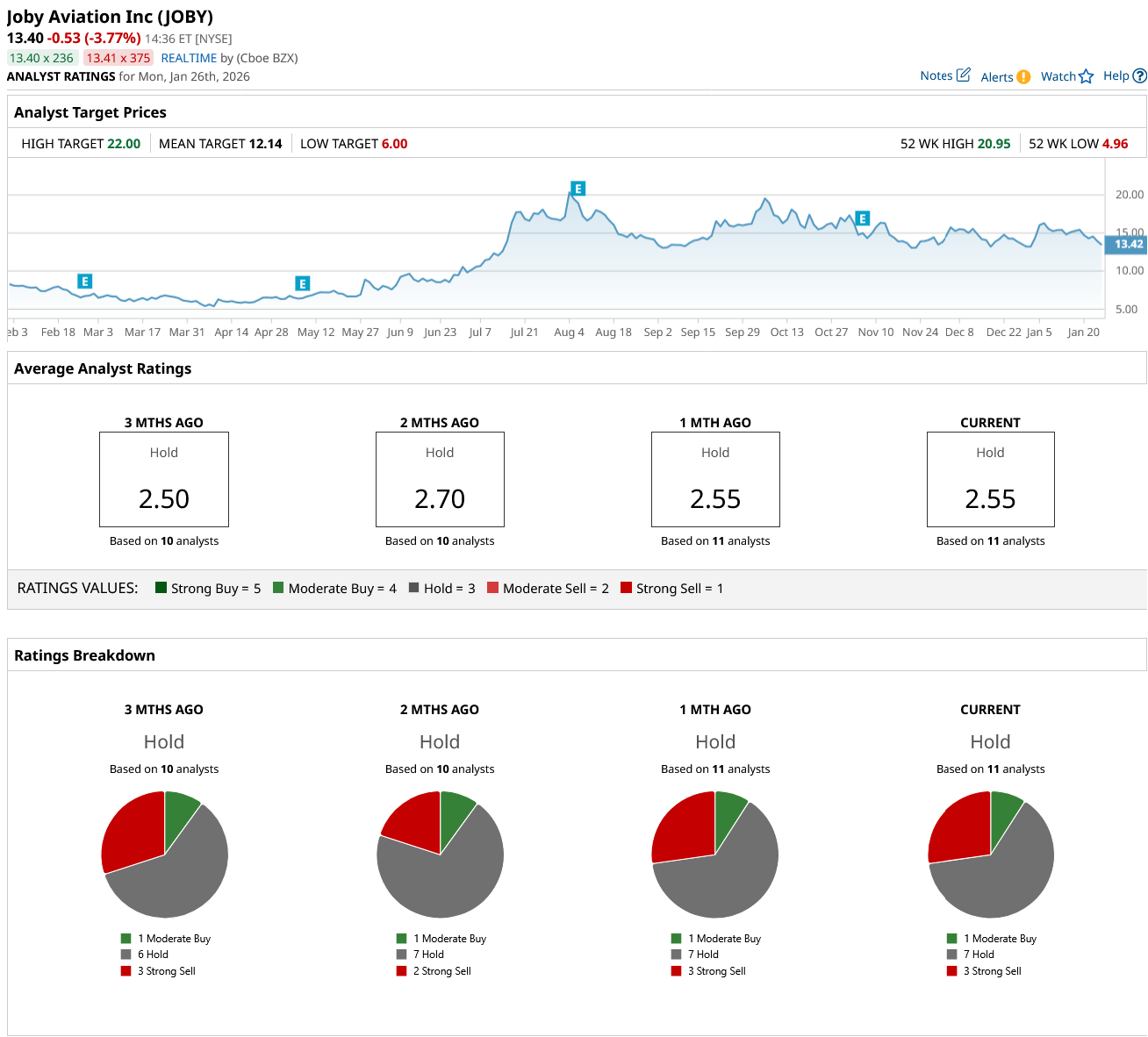

Joby Aviation’s stock has slipped about 4% today while being 36% off its 52-week high of $20.95 set in April 2025, but up 172% from its 52-week lows of roughly $5 set in early July last year. JOBY stock has slipped close to 13% in the last five days and 25% in six months but is up 54% in the past 52 weeks.

On the other hand, the market index Russell 2000 has a modest 16% gain in the same time frame. Joby has a market cap of $12.9 billion and trades below its 50-day moving average of $14.57, reflecting bearish sentiment in the market.

Joby Aviation Results

Joby Aviation reported Q3 revenue of $23 million from Blade urban air mobility ($14 million) and defense/engineering contracts ($9 million). EPS came in at -$0.48, missing expectations of -$0.19 by 152% due to heavy R&D investment and non-cash warrant revaluations inflating losses.

Net loss hit $401 million (up from $144 million YoY), with operating loss at $182 million. R&D expenses rose 18% to $149 million, and SG&A was up 47% to $45 million on team growth and Blade integration. Adjusted EBITDA loss was $133 million. Its cash pile stood strong at $978 million, bolstered by a $576 million equity raise in October.

Joby provided no specific Q4 guidance but highlighted flight-testing progress (600+ flights YTD), Blade carrying 40,000 passengers, and autonomous tech demos. Funds support FAA certification, manufacturing ramp, and 2026 commercial launch targets.

J.P. Morgan’s Short List Q1 2026

J.P. Morgan's equity research team surveyed top analysts to pinpoint 24 high-conviction short ideas across sectors like aviation (JETS), energy (XLE), tech (XLK), and financials (XLF). These picks target overvalued stocks with structural flaws or headwinds, offering hedges against market upside.

JOBY stands out as a prime short due to its lofty valuation, trading at a steep premium to traditional aerospace/defense peers and other pre-revenue cleantech plays. Analysts argue the $12.9 billion enterprise value assumes unrealistically fast eVTOL certification, rapid adoption, and sky-high margins despite multi-year timelines to scaled operations.

Additional targets span consumer (Krispy Kreme (DNUT), Brown-Forman (BF.B)), energy (Imperial Oil (IMO), Transocean (RIG)), financials (SLM (SLM), First Hawaiian (FHB), Lincoln National (LNC)), tech (Skyworks Solutions (SWKS) and Fortinet (FTNT)), and building products (Installed Building Products (IBP)). Picks like Textron (TXT) and Canadian Solar (CSIQ) reflect sector-specific concerns from overvaluation to execution risks.

Should You Sell JOBY Stock?

The bearish short sentiment is further reinforced by other analysts, as indicated by the consensus “Hold” rating with a mean price target of $12.14, representing a 9% downside from the current market price.

JOBY stock has received one “Moderate Buy” rating, seven “Hold” ratings, and three “Strong Sell” ratings from analyst reviews so far.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)