/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)

Cisco Systems (CSCO) reported positive free cash flow (FCF) for the latest quarter ending Jan. 24, 2026, albeit lower than last year. Nevertheless, its FCF margin is still strong, and despite higher capex, management's guidance was for higher earnings.

As a result, analysts have higher target prices for CSCO stock. For example, Yahoo! Finance now reports that the average of 26 analysts' price targets is $87.86. That's 14% higher than today's price.

CSCO is trading at $76.87, down from a recent peak of $86.78 on Feb. 9, just before the Feb. 11 earnings release.

Based on its strong FCF and FCF margins, despite higher AI-related investments and capital expenditures (capex), Cisco Systems' stock has good upside. This article will show why and a conservative way to play CSCO.

Strong FCF and Guidance

Cisco reported that its fiscal Q2 revenue (ending Jan. 24, 2026) was up 10.3% to $15.3 billion, and earnings per share (EPS) rose faster, +11%.

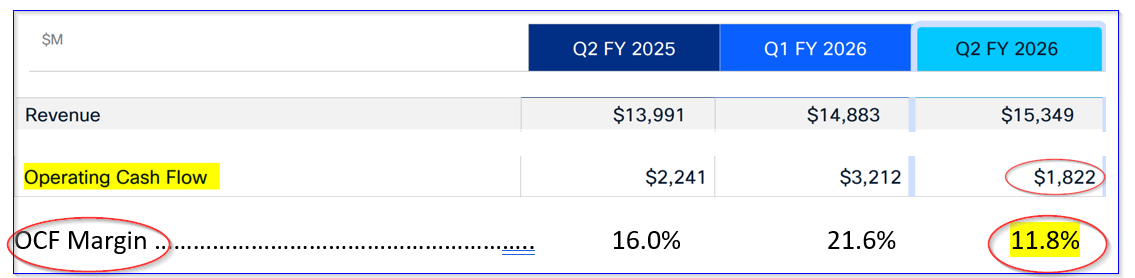

However, its operating cash flow (OCF), which includes all cash flow before capital expenditures (capex), was down from $2.24 billion last year to $1.82 billion.

Nevertheless, that still represented 11.8% of its quarterly revenue, albeit lower than last year's 16 OCF margin and 21.% in the prior quarter. This can be seen on page 17 of its slide deck:

However, after higher capex spending, its Q2 FCF was $1.539 billion (10.0% of revenue) compared to $2.03 billion last year (14.5% FCF margin), according to Stock Analysis.

Moreover, over the trailing 12 months (TTM), its FCF was still strong ($12.24 billion), representing 20.73% of TTM revenue. That was down less from the prior year's 23.6% FCF margin.

As a result, based on management's higher revenue forecasts for this year, we can expect that FCF could be higher over the next 12 months (NTM).

Projecting FCF Using Revenue Forecasts

For example, management guided that this year it expects revenue to range between $61.2 billion and $61.7 billion (see page 4 of its earnings release). The midpoint of $61.45 billion is 8.5% higher than last year's $56.65 billion revenue.

In fact, analysts' forecasts are higher. Seeking Alpha shows that 19 analysts project $61.56 billion for the year ending July 2026, and $64.93 billion for the following fiscal year. That implies that over the next 12 months (NTM) revenue could rise to $63.245 billion, up 11.64% over FY 2025.

As a result, if we assume that Cisco Systems could maintain around 21% FCF margin (slightly higher than its TTM 20.73% margin), FCF could rise to almost $13.3 billion:

$63.245 billion NTM revenue x 0.21 = $13.28 billion NTM FCF

That would be over $1 billion higher than its LTM FCF of $12.24 billion, or +8.5%.

As a result, CSCO's value over the next 12 months (NTM) could be higher. Here's why.

Price Targets (PTs) for CSCO Stock

Right now, Cisco's stock has a market capitalization of $302.456 billion, according to Yahoo! Finance. As a result, its FCF yield on a trailing 12-month (TTM) basis is just over 4%:

$12.24b TTM FCF / $302.456 b mkt cap = 0.0405 = 4.05% FCF yield

Assuming its FCF yield improves to 4.0% over the next 12 months, the market value could rise to $332 billion:

$13.28 NTM FCF / 0.04 = $332 billion NTM mkt cap

That's $30 billion higher than todays mkt cap or about 10% higher.

In other words, even before share buybacks, which have been strong at Cisco, its price target (PT) is 10% higher:

$76.87 x 1.10 = $84.56 PT (i.e., +10%)

That is even lower than Yahoo! Finance's survey PT of $87.86, and Barchart's mean survey PT of $87.15 per share. Moreover, 18 analysts surveyed by AnaChart.com, which tracks recent analyst write-ups, show an average PT of $98.23. These surveys average $91.06, or +18.5% higher.

The bottom line is that CSCO stock could be worth between 10% to 18.5% more than today's price.

One way to conservatively play this is to sell short out-of-the-money (OTM) put options in one-month expiration periods. That way, an investor can get paid while setting a potential lower buy-in point.

Shorting 1-Month OTM CSCO Puts

For example, look at the March 20, 2026, expiration period. It shows that the $72.50 strike price put, over 5% lower than today's price, has a midpoint premium of $0.87 per put contract.

That means a short-seller can make $87 immediately after securing $7,250 with their brokerage firm and placing a “Sell to Open” trade order for this contract.

That represents a one-month yield of 1.20% (i.e., $87/$7,250). The worst that can happen is CSCO falls to $72.50 or lower, and the collateral is used to buy 100 shares at that price.

This could result in an unrealized capital loss. But the breakeven point is $71.63 (i.e., $72.50-$0.87), which is 6.8% lower than today's price. So, it provides a good potential entry point.

Moreover, less risk-averse investors could use the premium to help buy longer-dated in-the-money (ITM) CSCO call options. That way, they can gain upside in CSCO stock that is potentially greater than buying CSCO shares. I have discussed this in other articles.

The bottom line is that Cisco Systems' stock looks cheap here, and shorting OTM puts and buying ITM calls are conservative ways to play CSCO.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)