/Applied%20Materials%20Inc_%20campus%20sign-by%20Sundry%20Photography%20via%20iStock.jpg)

Applied Materials (AMAT) has been on a solid upward trajectory, with its stock rising about 72.4% over the past six months and reaching a new high. This strong performance reflects growing investor confidence in the company’s ability to capitalize on the accelerating adoption of artificial intelligence (AI). The ongoing investments in AI are driving demand for advanced semiconductor manufacturing equipment, supporting its financials and share price.

AMAT is one of the world’s leading suppliers of wafer fabrication equipment and plays a critical role across the semiconductor value chain. Its tools are essential for producing chips used in AI workloads and data center servers, as well as in consumer electronics, automobiles, and a wide range of industrial applications. As chipmakers expand capacity to support increasingly complex and power-intensive computing needs, Applied Materials has emerged as a key beneficiary of this investment cycle.

Despite facing headwinds over the past year from changes in trade regulations that have reduced its addressable market in China, the company has continued to deliver solid growth. Fiscal 2025 marked Applied Materials’ sixth consecutive year of expansion, driven largely by robust AI-related demand. Further, the company invested in new capabilities, enhanced its product portfolio, and streamlined its organizational structure, positioning itself to capture future opportunities more effectively.

Looking ahead to 2026, Applied Materials appears well-positioned to benefit from the expansion of AI-driven computing. As chipmakers invest heavily to meet rising performance and efficiency requirements, demand for advanced wafer fabrication equipment should remain robust, supporting Applied Materials’ growth. However, valuation concerns could limit the upside potential.

What Investors Should Watch in 2026 for Applied Materials

As the pace of large-scale AI adoption accelerates, the semiconductor industry is entering a period of heightened investment in AI-computing infrastructure. This trend is expected to be a major driver of growth for Applied Materials in 2026, as demand rises for advanced semiconductors and the wafer fabrication equipment needed to produce them.

Applied Materials is positioned to benefit from ongoing AI spending thanks to its product strategy, which focuses on inflection-point innovation. The company has consistently developed technologies aligned with the highest-value segments of semiconductor manufacturing, and it is poised to continue this trend in 2026.

AI data center expansion is driving strong demand for leading-edge foundry logic, DRAM, and high-bandwidth memory (HBM). Applied Materials already holds strong positions in these segments, and its new product roadmap should help capitalize on demand and translate into sustained growth for the company over the next year.

AMAT has also been working closely with customers to understand longer-term demand expectations and align its supply chain and production capacity accordingly, thereby enhancing efficiency.

Despite this favorable setup, investors should be aware of potential near-term margin pressure. While top line could continue to improve, the company’s bottom line may face headwinds, particularly in the first half of the year. Margins are likely to remain under pressure until production volumes increase enough to absorb fixed costs and support greater efficiency.

Overall, the semiconductor equipment market is expected to accelerate in the second half of 2026, driven by AI-related investments in advanced logic and memory technologies. For Applied Materials, this should translate into strong demand for its most products and services. However, margin compression could still pose a risk to earnings growth, especially in the early part of the year.

The Bottom Line for AMAT Stock

Applied Materials appears well-positioned to benefit from the AI-driven investment cycle. However, despite this favorable industry backdrop, the stock’s valuation is a concern. Applied Materials is currently trading at a forward price-to-earnings of 33.3 times, which appears elevated relative to the company’s projected earnings growth. Analysts expect its bottom line to increase by 1.2% in fiscal 2026 and by about 20% in fiscal 2027.

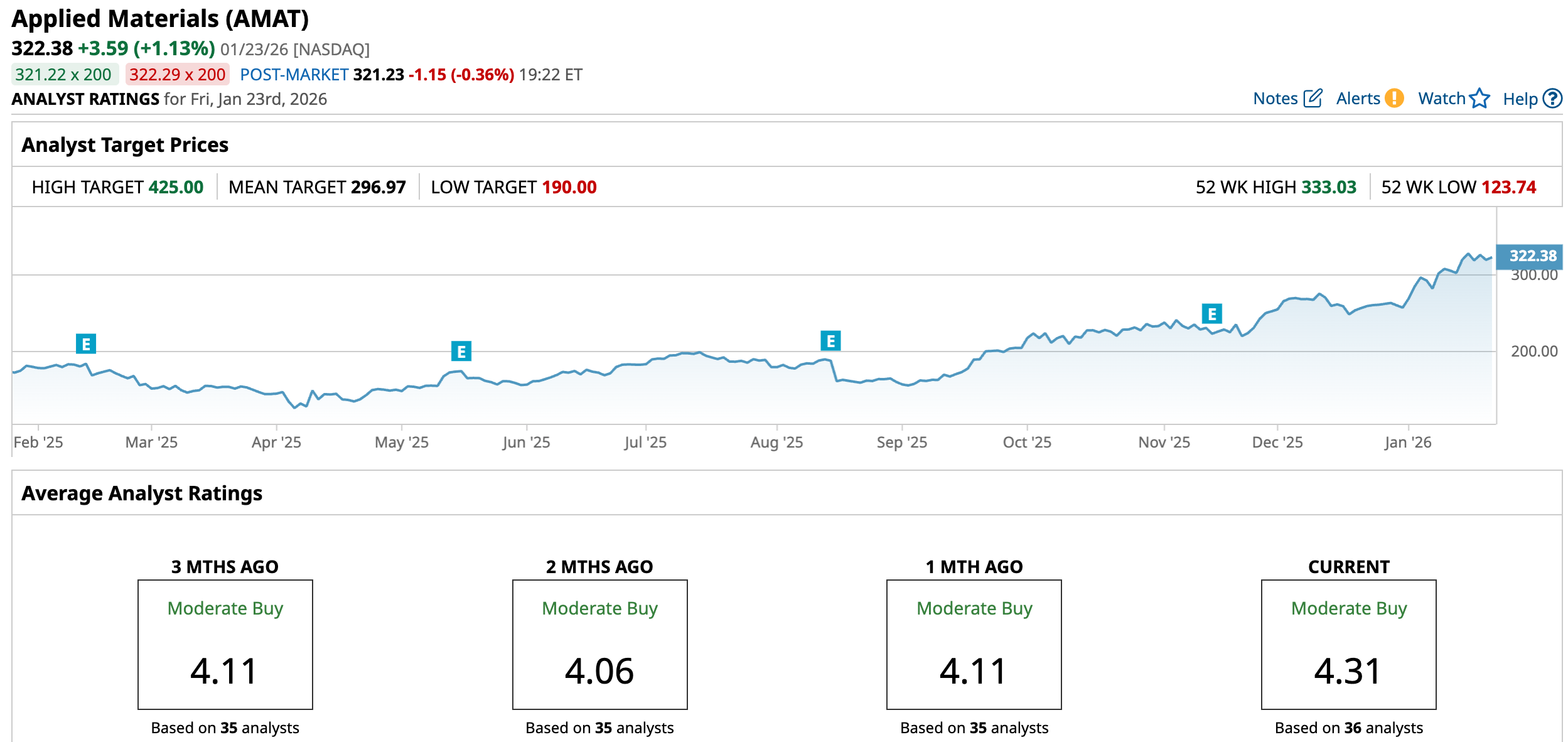

For now, Wall Street sentiment remains cautiously optimistic. Analysts have maintained a “Moderate Buy” consensus rating on Applied Materials.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)