/Apple%20logo%20-%20by%20Pexels%20via%20Pixabay.jpg)

Tech behemoth Apple (AAPL) is experiencing a dip in its stock performance ahead of first-quarter results for fiscal 2026, which are set to be reported on Jan. 29. AAPL stock is down by 9% over the past month. However, Goldman Sachs analysts see this as an opportune moment to load up on Apple shares.

Analyst Michael Ng expects iPhone revenue to rise 13% year-over-year (YOY), with shipments increasing 5% during that period, boosted by a 26% surge in China after the company reclaimed its top position in the Chinese smartphone market. Looking ahead, Ng believes that, over the next two years, iPhone sales will benefit from factors such as the new iPhone Fold model and a shift to a biannual iPhone launch cycle.

Given this information, Goldman Sachs has a “Buy” rating and a $320 price target on AAPL stock. Apple also recently snapped a four-day losing streak on Jan. 21, after it was revealed that the firm is developing an artificial intelligence (AI) chatbot and a wearable pin.

About Apple Stock

Apple ranks among the planet’s most dominant corporations, driving breakthroughs in tech, aesthetics, and user-centric devices. Headquartered in Cupertino, California, home to the iconic Infinite Loop campus, the company masterminds an ecosystem fusing hardware, software, and services into intuitive offerings. Apple has a gigantic market capitalization of $3.65 trillion.

Although Apple's overall stock trajectory has been positive, gains have been capped by volatility. Over the past 52 weeks, the stock has gained 11%, while over the past six months AAPL has risen 16%. Following tariff announcements in April 2025, the stock reached a 52-week low of $169.21, but AAPL is now up 47% from that level.

The stock began rising sharply in August after the company announced a new $100 billion commitment to the United States, bringing its U.S. investment to $600 billion over the next four years. The company has already started shipping its U.S.-made servers for AI applications. This development was followed by the launch of the new iPhone 17 lineup, which was then followed by the launch of the refreshed versions of Apple's iPad Pro, Vision Pro headset, and 14-inch MacBook Pro. The performance of AAPL was also bolstered by the company's robust earnings.

Apple’s shares reached a 52-week high of $288.62 in December, but they are now down 14% from that level. In November, Apple reported layoffs to streamline its sales department, while the company has been experiencing leadership changes.

Apple’s price-to-earnings ratio of 33 times is modestly higher than the industry average.

Apple Q4 Earnings Recorded Strong Growth

On Oct. 30, Apple reported strong growth in its fourth-quarter results for fiscal 2025. Total net sales increased 8% YOY to $102.5 billion, surpassing the $101.2 billion that Wall Street analysts had expected. Products continue to make up the bulk of Apple’s topline and increased 5.4% YOY during the quarter to $73.72 billion. Apple’s iPhone sales climbed 6% from the prior-year period to $49.03 billion.

CFO Kevan Parekh revealed that, driven by high consumer satisfaction, the company’s installed base of active devices reached an all-time high across all product categories and geographic segments. Apple’s Q4 EPS increased by 91% from the year-ago value to $1.85, beating the $1.73 per share analyst estimate.

As already stated, Apple is geared to report its Q1 fiscal 2026 results on Jan. 29, after the market closes. Ahead of the results, analysts are bullish about the company’s EPS growth. They expect EPS to climb 10% YOY to $2.65 for Q1. For fiscal 2026, EPS is projected to surge 9% annually to $8.15, followed by 12% growth to $9.10 in the next fiscal year.

What Do Analysts Think About Apple Stock?

Wall Street analysts have been significantly bullish on this tech stalwart. Analysts at Evercore ISI and Citigroup think highly of AAPL stock’s prospects. Evercore ISI analysts added AAPL to its “Tactical Outperform” list, believing the company’s core business will drive its upcoming earnings, expecting iPhone sales to climb 17% YOY. They also reiterated an “Outperform” rating on the stock and maintained a $330 price target, noting that, as sales skewed toward higher-end models in the holiday quarter, Apple’s average selling prices are poised to exceed expectations.

Citi also shares this view and expect sApple’s iPhone business to carry the company through. While analysts maintained a bullish “Buy” rating on Apple stock, they also cut the price target from $330 to $315 because they expect a 50% increase in the company’s DRAM costs this year.

Wedbush analyst Dan Ives thinks 2026 could be a “monumental year” for Apple, reiterating an “Outperform” and a Street-high $350 price target. Ives believes that we will see the company “dive into the deep end of the pool on its AI strategic roadmap” this year.

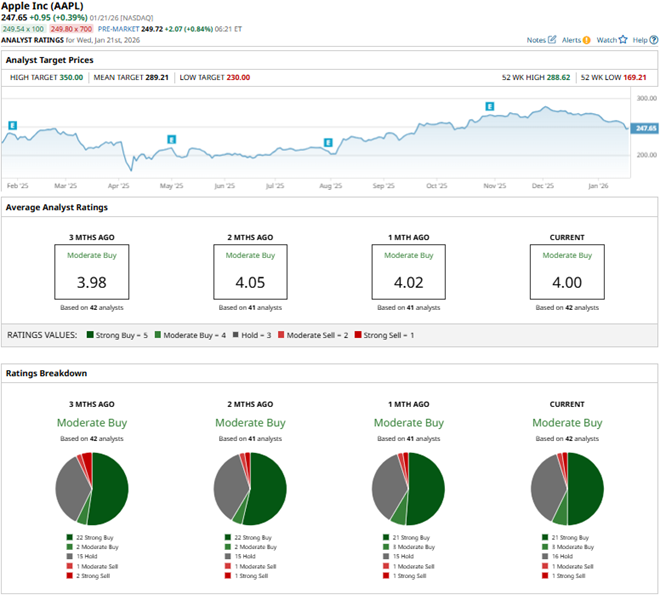

Apple has been in the spotlight on Wall Street for some time now, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 42 analysts rating the stock, 21 analysts have a “Strong Buy,” three analysts suggest a “Moderate Buy,” 16 analysts play it safe with a “Hold” rating, one analyst suggests “Moderate Sell,” and one analyst has a “Strong Sell” rating. The consensus price target of $289.21 represents 17% potential upside from current levels. Meanwhile, the Street-high price target of $350 indicates 41% potential upside from here.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)