/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Tesla (TSLA) designs, builds, and sells electric vehicles (EVs), energy solutions, and solar products. Some of its popular models include the Model 3, Model Y, Cybertruck, and semi-truck. Tesla's Supercharger network spans continents, while Powerwall and Megapack store solar energy for homes and grids. With factories worldwide and a direct-sales model, Tesla is attempting to innovate in autonomy, robotics (Optimus), and AI to redefine transportation and energy.

Founded in 2003, Tesla is headquartered in Austin, Texas, with manufacturing sites in the U.S., China, and Germany, with dealings in over 30 countries.

Tesla Stock Lags

TSLA stock trades 109% above its 52-week low of $214 but down 10% from the $499 high. Shares gained 2.3% over the past five days in a steady climb, fell 8% over the past month amid a recent pullback, rose 35% over six months during a strong recovery, and edged up 8% over 52 weeks in a volatile year.

Compared to the Nasdaq 100's ($NDXT) 19% yearly gain, TSLA outperforms the short-term but lags over one month. The stock sits above its 50-day MA of $442 and 200-day MA of $371, showing bullish momentum fueled by EV sales and robotaxi excitement.

Tesla Results Beat Estimates

Tesla reported Q3 revenue of $28.1 billion, up 12% from last year and beating analyst estimates of $27.7 billion. GAAP EPS was $0.50, down 31% YoY and matching consensus. Automotive revenue grew 6% to $21.2 billion, boosted by energy storage sales. Tesla also achieved record vehicle deliveries of 497,000.

Gross margin dipped to 19.8% (auto at 15.4%), and operating margin fell to 5.8% as expenses rose 50% to $3.4 billion on AI and sales investments. Energy storage shone with 12.5 GWh deployed (up 81% YoY) and $3.4 billion in revenue. Cash flow was strong, but the FSD take rate improved. Net income dropped 37% to $1.4 billion GAAP.

On the deliveries part, Tesla has released its Q4 numbers with 434,000 vehicles produced during the quarter and 418,000 delivered, with a record 14.2 GWh of energy storage products deployed.

The company is also scheduled to release its fourth-quarter results on Jan. 28.

Tesla Launches Driverless Robotaxi

Elon Musk announced on X (formerly Twitter) that Tesla started unsupervised robotaxi rides in Austin, Texas, on Thursday. Videos showed vehicles operating without safety drivers six months after Musk's initial timeline.

Tesla took extra caution for the rollout due to safety stakes, marking a key step toward full autonomy.

Additionally, Barclays analyst Dan Levy has raised their price target to $360 from $350, signaling a downside of nearly 20% while maintaining their “Equalweight” rating on the stock. The analyst also cautioned investors against overestimating the robotaxi narrative while pointing towards Musk’s initial target of 500+ robotaxis by the end of 2025, with 30-50 operational robotaxis currently.

Should You Buy TSLA Stock?

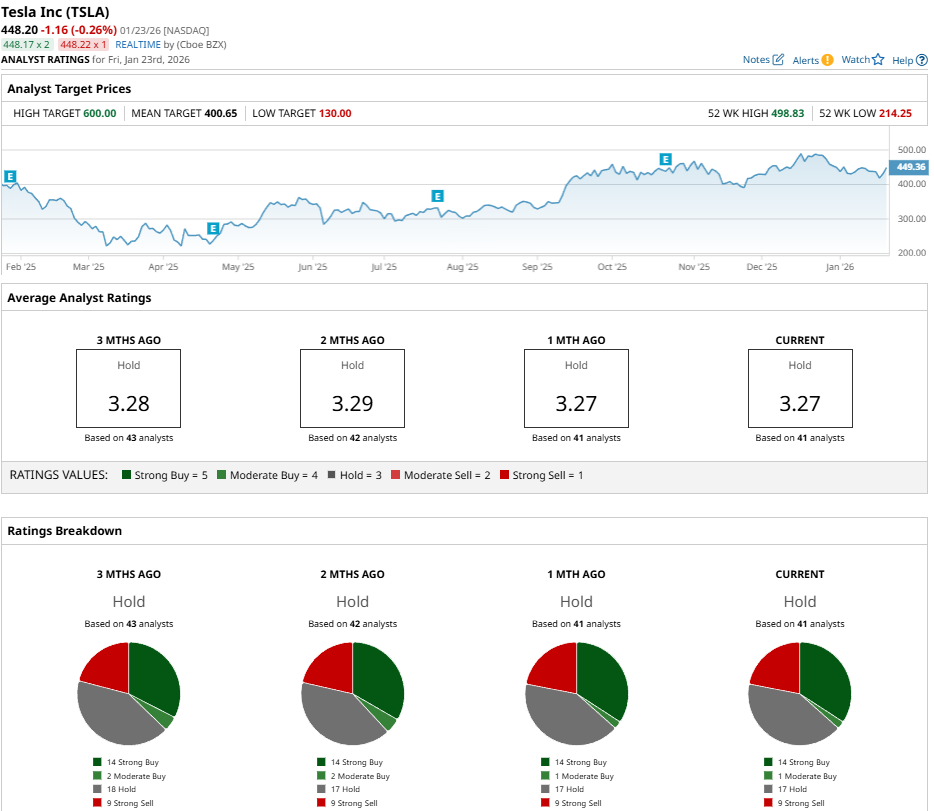

Investors are having a turbulent time with TSLA stock, and analyst estimates suggest the pain will continue with a consensus “Hold” rating and a mean price target of $400.65, reflecting a downside of 10% from the market rate.

The stock has been rated by 41 analysts in total, providing 14 “Strong Buy” ratings, one “Moderate Buy” rating, 17 “Hold” ratings, and nine “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)