/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

“The world has entered the age of electricity,” according to International Energy Agency (IEA) chief Fatih Birol. In a Jan. 19 commentary, Birol wrote that “Oil and gas will still be widely used for many years to come, but the use of electricity is growing twice as fast as overall energy demand.”

That’s why renewable energy is an investment theme that simply isn’t going away, regardless of U.S. policy rollbacks on some “green” initiatives. Birol notes that “renewables are meeting much if not all of the rising demand for electricity, often because they are the most competitive option” – and in markets like India, “Solar is leading the way.”

Likewise, energy analyst Nat Bullard, who co-founded the AI firm Halcyon, reported in his annual update on decarbonization that solar power has tripled its market share in six years to account for 12% of global power generation.

Investment Dollars Pour Into AI

Of course, it’s difficult to discuss surging demand for electricity without addressing one of the primary causes: the ongoing land grab by artificial intelligence (AI) hyperscalers to build data centers. Bullard’s analysis highlights an 80% increase in global data center electricity consumption alone over the past 5 years.

"AI-related US private fixed investment is increasing while all other investment is falling," notes Bullard.

More broadly, the analyst calculates 2025 tech capex as reaching over 2.0% of gross domestic product at its peak – a figure that easily exceeds previous industrialization and technology projects, including interstate highways in 1966 and broadband buildouts in 2000.

And to a large extent, continued growth in AI now hinges on the ability of the energy sector to produce and deliver massive amounts of power.

A Global Growth Story

Masdar, the Emirati-controlled renewable energy company, currently sits at the intersection of both market narratives. The United Arab Emirates has rushed to join the booming data center economy, with facility development and investment high on the kingdom’s agenda.

Abu Dhabi formed a dedicated investment vehicle, MGX, for the purpose of investing in AI – and last October, the fund led a consortium to close the biggest-ever data center acquisition on record. The $40 billion purchase of Aligned Data Centers includes 5 GW of capacity across 50 facilities in the Americas, per Forbes.

That follows on the heels of Abu Dhabi’s May 2025 Stargate UAE announcement, a massive data center collaboration with OpenAI and Oracle (ORCL) that also includes partners like Nvidia (NVDA), Cisco (CSCO), and SoftBank (SFTBY).

Naturally, then, the kingdom is highly interested in the energy to power these endeavors. Masdar CEO Mohamed Jameel Al Ramahi recently told Semafor that he’s “not a big fan” of the Trump administration rolling back renewable energy policies, but his company will likely use the opportunity to invest in struggling U.S. wind and solar power assets.

Masdar, which already owns a 50% stake in California’s solar specialist TerraGen, currently has 45 gigawatts of renewables capacity in its portfolio and 20 more in the pipeline. The company plans to invest $35 billion over the next four years to reach its 2030 target of 100 GW, according to Semafor.

How AI is Accelerating the Energy Transition

Some analysts believe that the outsized power demand from AI could actually accelerate a global shift toward renewable energy sources.

“Renewable energy prices have dropped by more than 90%, and in 2024, 91% of new renewable projects were cheaper than fossil alternatives,” explained Agate Freimane, partner at venture capital firm Norrsken, in recent comments to CNBC.

She continues, “This shift triggers a self-reinforcing cycle: cheaper clean power accelerates electrification, rising electrification boosts demand for storage and grid intelligence, and those upgrades push the cost of clean energy even lower. In this way, it can be argued that AI is accelerating the shift to renewables.”

That pivot toward renewables, in turn, could drive boom times for battery makers. Returning to Bullard’s decarbonization report, he observes that “Germany has replaced baseload with renewables, and it now needs energy storage.”

Already, he reports, “Battery energy storage investment is up by $65 billion in ten years.”

How to Invest in the Age of Electrification

For investors looking to play the long-term upside in renewable energy, there are plenty of options – although solar energy would appear to be one “sweet spot.”

First Solar (FSLR) is one industry leader we’ve highlighted before, while the iShares Global Clean Energy ETF (ICLN) exchange-traded fund (ETF) offers broader exposure, including several non-public companies, wind energy providers, and some geographic diversity that may appeal to those wary of “picking winners.”

Even the most dedicated proponents of renewable energy believe that natural gas (NGH26) will continue to be an important bridge fuel, with research firm Wood Mackenzie predicting it’s going to be part of the power mix as late as 2060. However, trading the “widow maker” directly isn’t for everyone. We’ve previously discussed the merits of turning to pipeline stocks instead; Energy Transfer (ET) is still one of my largest energy holdings, and offers a healthy dividend yield for income-minded investors.

As analyst Nate Bullard writes that “Global gas turbine manufacturing capacity is well below current demand," it’s also worth keeping our prior favorite GE Vernova (GEV) on watch, which doubles as a nuclear energy trade thanks to its collaboration with Hitachi (HTHIY). Another top nuclear pick is Centrus (LEU); small nuclear reactors require a specific type of fuel, which LEU can provide.

And finally, on the topic of battery storage…

EOSE Revisited

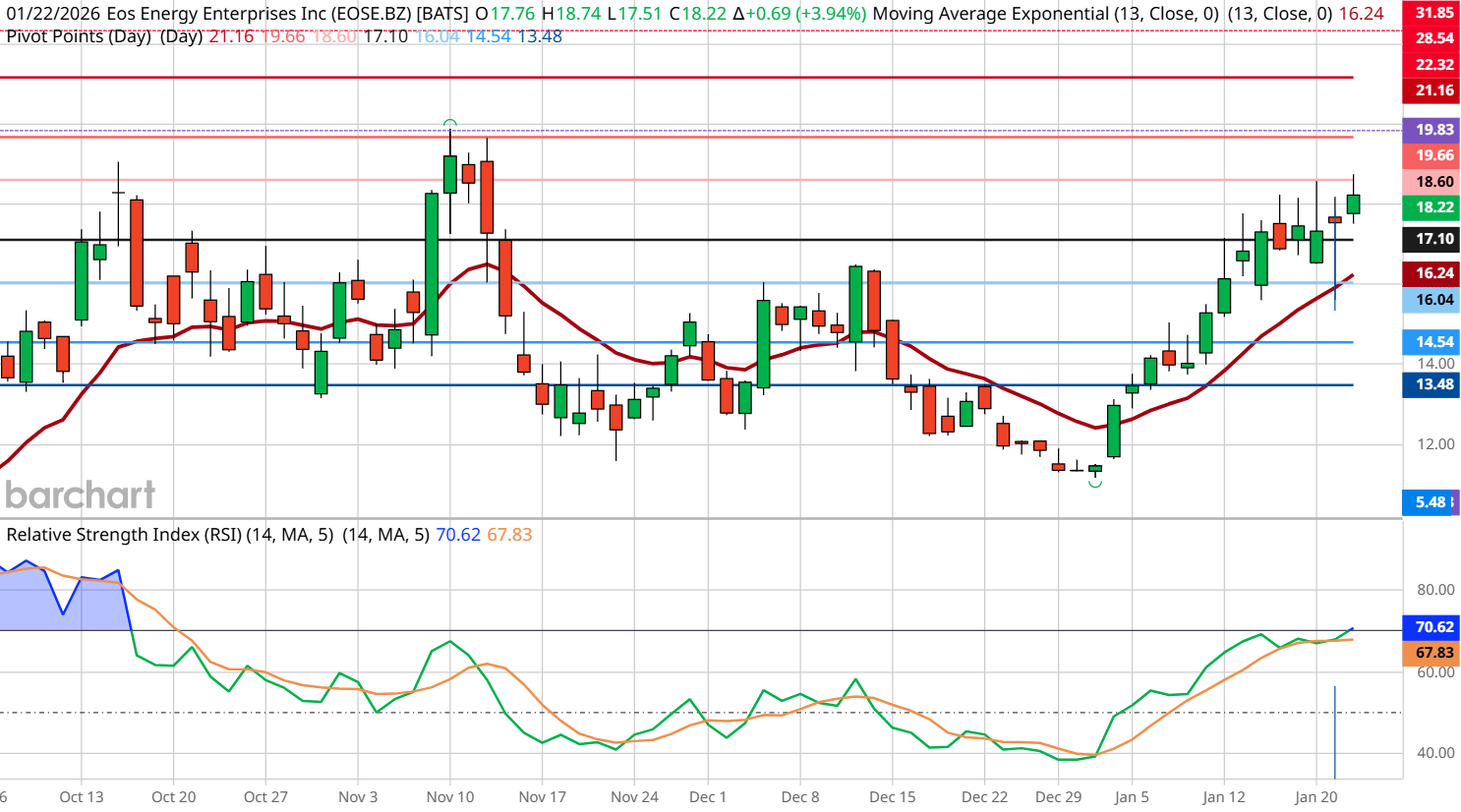

To wrap up, here’s a close look at our favorite renewable pick – the battery storage stock EOS Energy (EOSE), which just presented at Davos this week and recently announced a technical breakthrough in battery storage (full disclosure: I’m long EOSE shares).

EOSE is currently placed 23rd on Barchart’s Top 100 Stocks to Buy. The stock has made 11 new highs over the past month and is set to close higher for four weeks in a row. If this trend continues, it will ultimately challenge the 52-week high at 19.83.

On Wednesday, EOSE survived a critical intraday correction. For perspective, using our 13EMA / Pivots template over 30-minute time periods, the green box shows an oversold RSI positioned at a "V" bottom located at this week's previous low and first pivot support level.

A positive gap-up reaction on Thursday only confirms the bullish sentiment surrounding this stock.

This daily chart better shows the aforementioned highs and lows, and candlestick enthusiasts will note that Wednesday's daily candle could be considered a bullish hammer.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close. Senior Editorial Director Elizabeth Volk contributed additional reporting.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)