/Unitedhealth%20Group%20Inc%20HQ%20photo-by%20jetcityimage%20via%20iStock.jpg)

UnitedHealth Group (UNH) is one of the largest U.S. health insurers, operating through UnitedHealthcare for insurance coverage and Optum for health services, technology, pharmacy benefits, and data analytics. The company serves around 150 million people worldwide, offering employer-sponsored insuarance, Medicare, Medicaid, and individual plans alongside Optum's clinics, surgical centers, and digital tools to improve care delivery, affordability, and outcomes.

Founded in 1977, the company is headquartered in Eden Prairie, Minnesota. UnitedHealth primarily operates in the United States but also extends services to other countries via Optum's global network.

What to Know About UnitedHealth Stock

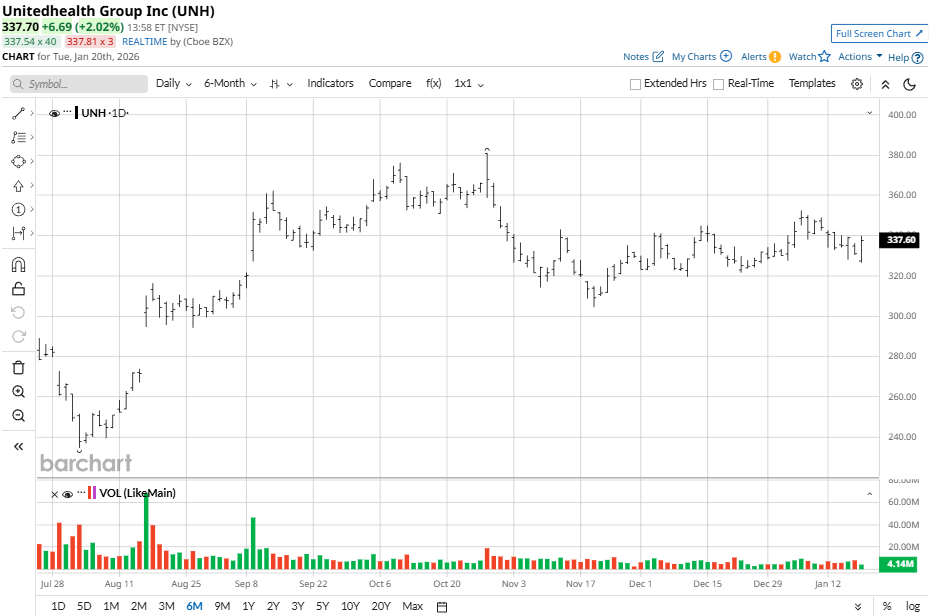

UNH stock is down 44% from its 52-week high of $606.36 but up 47% from the $234.60 low, pressured by Medicare Advantage costs and earnings misses in 2025. Recent performance shows a 3% gain for the past five days, a 5% gain for the past one month, and a nearly 6% loss over the past three months. UNH stock is also up 4.5% year-to-date (YTD) but down 35% for the past 52 weeks.

Facing sectoral headwinds, UNH has sharply underperformed the S&P 500 ($SPX), which is up 13% for the past 52-week period.

UnitedHealth Reports Q3 Results

UnitedHealth Group reported its third-quarter 2025 results on Oct. 28. During the period, the company saw revenue of $113.2 billion, up 12% year-over-year (YOY) and slightly beating analyst estimates. Adjusted EPS reached $2.92 as well, surpassing consensus forecasts of $2.75. Growth stemmed from Optum expansion and Medicare Advantage, with “domestic membership expansion of over 780,000 lives” YTD, as noted by CFO Wayne DeVeydt in the earnings call.

The medical care ratio held at 89.9% with net margin at 2.1%. Operating cash flow also doubled net income to $5.9 billion while UnitedHealthcare's revenues grew amid reimbursement pressures. Optum Insight came in flat YOY at $4.9 billion. Optum Health focused on value-based care (VBC) with 85% high-risk member engagement and 10% membership shrink planned for 2026.

UnitedHealth did not provide explicit Q4 guidance, but the company affirmed its full-year 2025 outlook with V28 Medicare headwinds offset by repricing, benefit design, and Optum investments.

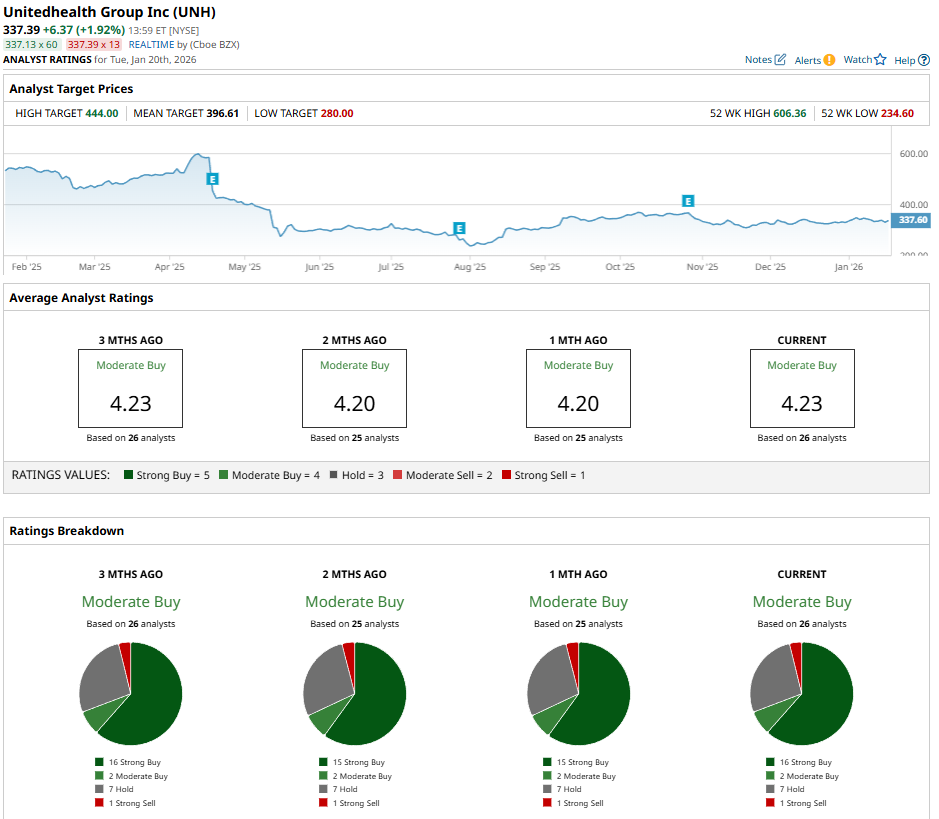

What Do Analysts Think of UNH Stock?

UnitedHealth is set to release its Q4 results on Jan. 27, and analysts expect the company to report an EPS of $2.09, signaling a significant 69% decline from $ 6.81 reported the previous year. Furthermore, analysts expect the downward momentum to continue with a 12% slip in Q1 2026.

On the other hand, analysts still have a bullish take on the UNH stock with a “Moderate Buy” consensus rating and a mean price target of $396.61. That reflects potential upside of 15% from the current market rate.

UNH stock has been rated 26 times by analysts as tracked by Barchart. UnitedHealth Group sports 16 ”Strong Buy” ratings, two “Moderate Buy” ratings, seven “Hold” ratings, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)