AST SpaceMobile (ASTS) shares surged roughly 15% on Friday after the satellite communications company secured a coveted position as a prime contractor on the Missile Defense Agency's SHIELD program.

The indefinite-delivery, indefinite-quantity contract positions the Texas-based firm to compete for future task orders supporting the Trump administration's ambitious “Golden Dome” program. Basically, the Golden Dome aims to provide layered protection against air, missile, space, cyber, and hybrid threats across all operational domains.

The SHIELD program, or Scalable Homeland Innovative Enterprise Layered Defense, indicates a shift toward leveraging commercial space technology for national security applications.

Despite the big news, ASTS stock is taking a beating today and is down over 11% due to competitor Blue Origin announcing a new communications satellite network.

AST SpaceMobile's selection validates a unique approach to building space-based cellular broadband networks accessible directly by standard smartphones for commercial and government use. The company operates nearly 500,000 square feet of manufacturing facilities in the United States, with 95% vertical integration and all major manufacturing processes under domestic control.

Chief Commercial Officer Chris Ivory emphasized that the award recognizes the company's innovative low-Earth-orbit satellite architecture, featuring the largest commercial phased arrays ever deployed.

The contract enables AST SpaceMobile to bid directly on future task orders spanning research, development, engineering, prototyping, and operations of critical missile defense systems.

This development comes as the administration explicitly prioritizes streamlining commercial space sector involvement in national security to maintain American technological superiority.

AST SpaceMobile Is Widening Its Competitive Moat

AST SpaceMobile is positioning itself at the forefront of a potentially massive market opportunity as it transitions from technology demonstration to commercial-scale deployment of its space-based cellular broadband network.

The Texas-based satellite manufacturer successfully launched BlueBird 6 in late December, marking a key milestone as the largest commercial communications array ever deployed in low Earth orbit at nearly 2,400 square feet.

The company's value proposition centers on solving a fundamental connectivity problem affecting billions of people worldwide.

AST SpaceMobile's technology enables standard smartphones to connect directly to satellites when terrestrial towers are unavailable. This capability addresses coverage gaps that plague even developed markets while opening new possibilities in underserved regions globally.

- Management has built an impressive commercial ecosystem with over 50 mobile network operator agreements covering nearly 3 billion subscribers.

- Strategic partnerships include major U.S. carriers AT&T (T) and Verizon (VZ), global players such as Vodafone, and technology giants such as Alphabet (GOOGL) (GOOG).

- The business model revolves around a 50-50 revenue share arrangement with operators for add-on services, positioning AST as a growth engine rather than a cost center for its telecom partners.

ASTS has secured over $1 billion in committed revenue through definitive commercial agreements with partners, including Verizon and Saudi Telecom Group. These contracts typically span five to ten years with commitments heavily weighted toward the front end. Some agreements include significant prepayments, with $175 million received in 2025 alone, which provides validation of the technology's commercial viability.

AST SpaceMobile has also emerged as a credible player in the government sector, recently winning prime contractor status on the Missile Defense Agency's SHIELD program, which supports the aforementioned Golden Dome program.

The company has made substantial progress on funding and manufacturing scale. With over $3.2 billion in pro forma cash and liquidity, management has capital to launch over 100 satellites, well beyond the 45 to 60 satellites targeted for deployment by the end of 2026.

What Is the ASTS Stock Price Target?

Analysts tracking ASTS stock forecast revenue to increase from $57.34 million in 2025 to $3.45 billion in 2029. It is projected to end 2029 with a free cash flow of $770 million, compared to an outflow of $1.1 billion in 2025.

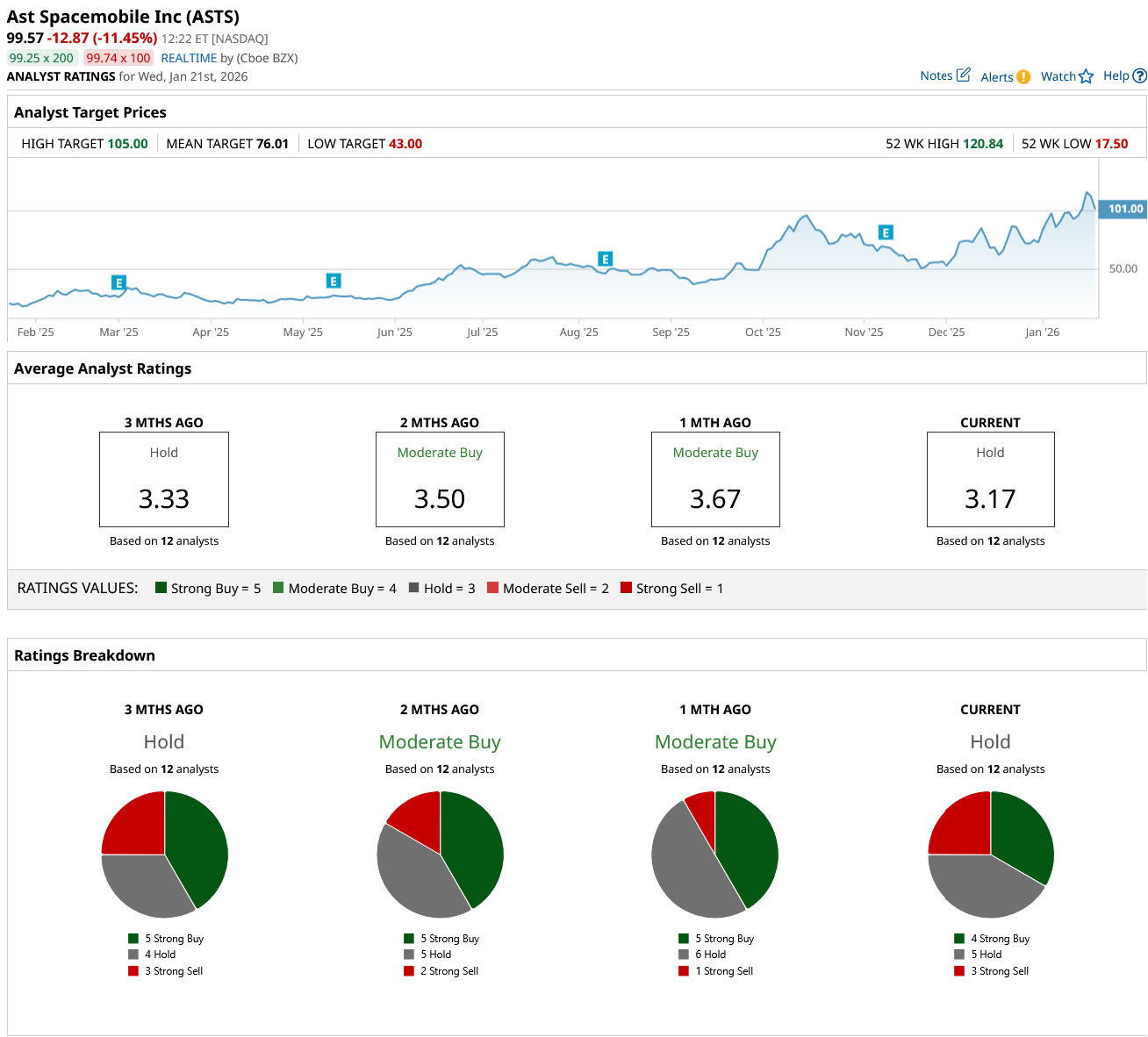

Out of the 12 analysts covering ASTS stock, four recommend “Strong Buy,” five recommend “Hold,” and three recommend “Strong Sell.” The average AST SpaceMobile stock price target is $76, which is below its current target price of $100.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)