/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

2025 could not have gone any better for satellite communications company AST SpaceMobile (ASTS). ASTS stock is up almost 250% on a year-to-date (YTD) basis, and now it's ending the year on another high, quite literally. On Dec. 24, the Texas-based company revealed the successful launch of the Bluebird 6 into orbit. With this, Bluebird 6 becomes the largest commercial communications array to be deployed in low Earth orbit. Notably, Bluebird 6 is built to transmit 4G and 5G cellular broadband directly to ordinary, unmodified smartphones from space. This means that no special satellite phone or extra hardware is needed, a game-changer for internet connectivity in remote or underserved areas.

On top of that, with an array of over 2,400 square feet, Bluebird 6 is over three times larger than the arrays on the earlier BlueBird satellites. A larger array implies a higher usable bandwidth and capacity, resulting in stronger signals, greater coverage area, and more users served. Further, with an aim to deliver 10 times the capacity of previous satellites, the Bluebird 6 expects to offer higher peak speeds and more simultaneous connections. This launch also keeps AST SpaceMobile on track to launch 45 to 60 satellites by the end of 2026.

So, 2025 is ending with a bang for ASTS stock. However, does the stock stack up as a reliable investment option in 2026? Let's find out.

Unprofitability Remains a Concern

Notwithstanding all the recent exciting developments and the initiatives that the company is working on to bring about a different paradigm in communications, AST SpaceMobile remains an unprofitable enterprise. In fact, since its founding, the company has not returned a profit. Over the last six quarters, losses have also come in narrower than estimates on just a single occasion.

This was the case in the most recent quarter as well, with both revenue missing estimates and losses coming in wider. Yet, revenues multiplied to $14.7 million in Q3 2025 from just $1.1 million in the year-ago period. Gateway deliveries and hitting certain U.S. government milestones were the primary drivers of this sharp uptick. Moreover, although losses narrowed to $0.45 per share from $1.10 in the previous year, the metric was way above the Street's estimate of a loss of $0.21 per share. Further, this marked yet another quarter of bottom-line misses from the company.

News on the cash flow front did not provide much cause for optimism either, as net cash used in operating activities for the nine months ended Sept. 30, 2025 widened to $136.5 million from $97.7 million in the prior year. However, with AST SpaceMobile closing the quarter with a cash balance of $1.2 billion, the firm was much above its short-term debt levels.

Valuations-wise, ASTS stock is trading at bubble levels. At a price-to-sales ratio of over 5,000, AST's multiple is completely out of touch with the industry average.

Does the Future Justify the Valuation?

AST SpaceMobile's valuations may look heady, but its timeline-specific milestones for the future give shareholders a clearer picture of the direction the company is heading toward. Notably, by the close of Q3, AST had Bluebird 8 through Bluebird 19 at different build stages, and the company still expects to finish the microns needed for 40 satellites by early 2026. Management has talked about hitting a cadence of six satellites a month by year-end 2025, a target that looks more realistic now. Testing also keeps moving forward even with just a handful of satellites in orbit.

Further, spectrum has seen some big wins in recent months. That will matter a lot for where AST SpaceMobile ends up competitively. Earlier this year, the company picked up global priority rights to 60 MHz of S-band spectrum through an ITU filing for $65 million. Those rights cover the 1980–2010 MHz and 2170–2200 MHz bands for mobile satellite services worldwide, subject to country-by-country nods.

On the partnership front, AST locked in a 10-year deal with Saudi Arabia's stc group that spans the kingdom and other MENA markets. The pact includes building three gateways in Saudi Arabia and a network operations center in Riyadh. stc is putting in $175 million upfront and committing to meaningful ongoing revenue. Separately, AST also teamed up with India's Vi to bring direct-to-device satellite coverage to the Indian market.

That said, real hurdles are still in the way, beyond the obvious profitability and valuation questions. Production-scale satellites haven't launched yet, so true continuous direct-to-device service won't start until 2026 at the earliest. Until there's enough coverage for reliable connections, recurring revenue remains off the table. Competition is heating up, too, especially from Starlink's aggressive push. Heavy reliance on a few big partners could create concentration risk down the line as well.

Analyst Opinions on ASTS Stock

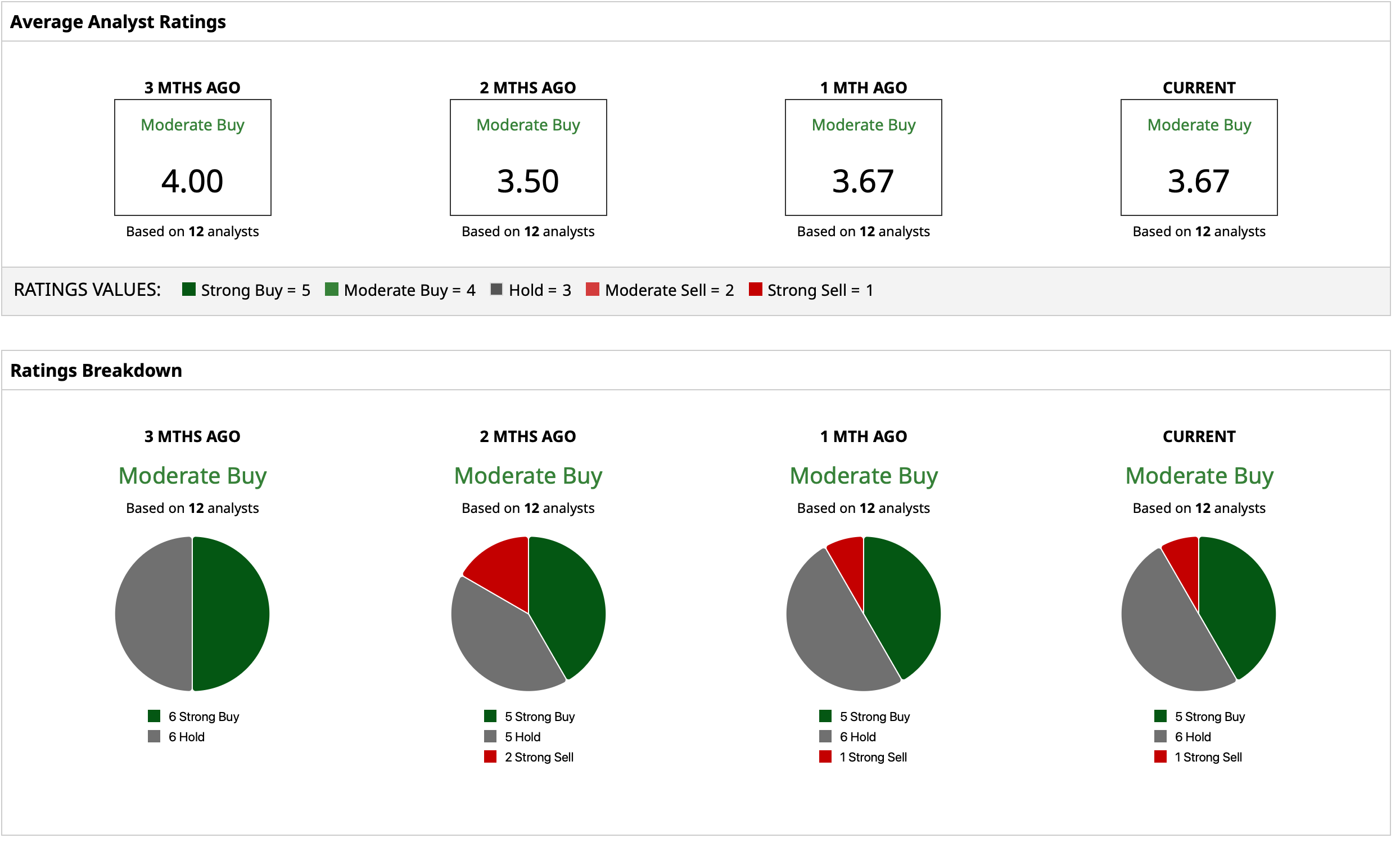

Overall, Wall Street analysts remain cautiously optimistic about the ASTS stock with a “Moderate Buy” consensus rating and a mean price target of $73.23. The high target price of $95 indicates upside potential of about 20% from current levels. Out of 12 analysts covering the stock, five have a “Strong Buy” rating, six have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)