/Spotify%20logo%20by%20Bastian%20Riccardi%20via%20Unsplash.jpg)

Spotify Technology S.A. (SPOT) has kicked off the new year with a strategic move that’s grabbing investor attention: a fresh round of U.S. subscription price increases across its Premium tiers. Starting February 2026, monthly fees for individual plans will rise to $12.99, as Spotify seeks to bolster revenue, expand monetization, and improve profitability in an increasingly competitive streaming landscape. Despite the announcement, Spotify shares fell nearly 4% on Jan. 15.

The increase follows prior U.S. price hikes in July 2023 and June 2024. The price move also comes as Spotify enters 2026 under new leadership, with co-founder Daniel Ek stepping down as CEO, and co-CEOs Gustav Söderström and Alex Norström taking over.

At the same time, Spotify has faced criticism from some artists. Several have removed their music amid controversy tied to Ek’s investment in a defense technology firm, even as the company expands AI-driven features and grows its podcast and video offerings. So, is it worth buying the stock now?

About Spotify Stock

Spotify is a leading global audio-streaming and media company that offers music and podcasts to users worldwide. The company is based in Luxembourg and has a market cap of around $103.9 billion, reflecting its status as one of the major players in the global streaming industry. Over the years, Spotify has expanded its services beyond music, adding podcasts, audiobooks, and now doubling down on video and audiovisual content.

After years of range-bound and sideways movement following its public offering in 2018, the stock broke into a powerful uptrend in 2024 as investors responded to a turnaround in growth and profitability. In 2025, the momentum continued, with the stock rising as the company reported strong subscriber growth and, for the first time, full-year profitability for the fiscal year 2024, a milestone that sparked fresh investor enthusiasm.

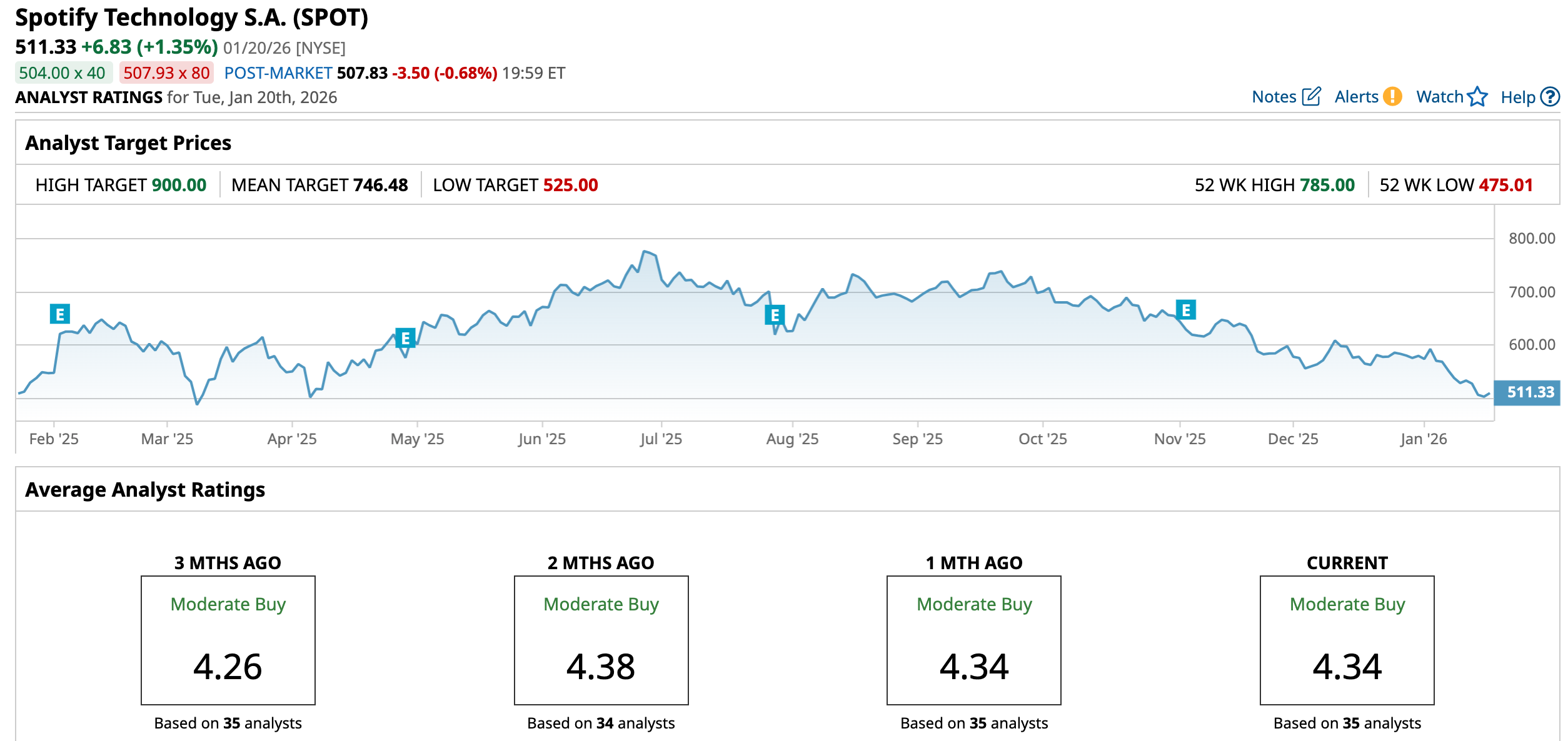

After rallying sharply earlier in the year and reaching a record high of $785 in June 2025, SPOT underwent a broad pullback through the rest of the year, currently down 34.8% from its peak. Over the past 52 weeks, shares have been up 5.31%.

Spotify’s share price weakened late in 2025 as investors became cautious about the company’s growth outlook, and as Spotify moved into 2026, this cautious tone carried over with the stock only up 3.52% over the past five days.

The market reacted to signs of slower revenue growth, while leadership transitions added a degree of uncertainty.

The stock trades at a premium compared to industry peers at 37.49 times forward earnings.

Stable Q3 Performance

In the third quarter of 2025, released on Nov. 4, Spotify delivered a stable set of financial results, while some areas remained challenging. Total revenue for Q3 reached €4.3 billion, representing a 7% increase year-over-year (YOY).

On the user front, Spotify’s monthly active users (MAUs) climbed to about 713 million, up around 11% compared with the same period last year, driven by gains across developed and emerging markets.

Premium subscribers grew to about 281 million, a roughly 12% YOY increase, reflecting continued demand for paid tier offerings. Although premium subscriber growth contributed to higher revenues, ARPU remained relatively flat in constant currency.

The advertising-supported revenue declined 6% YOY, highlighting ongoing execution challenges in that business.

Profitability metrics showed notable improvement. Operating income for Q3 2025 was €582 million, a 28% increase YOY. Gross margin expanded modestly to 31.6%, up from 31.1% a year earlier. Spotify swung from prior-quarter losses to post a net profit of €899 million, or €3.28 per share, well ahead of analyst expectations.

In the quarter, Spotify rolled out around 30 product updates, including “lossless” audio, improved playlist-mixing tools, expanded mobile-free tier capabilities, messaging between users, and enhanced controls. The firm is clearly leaning into a multi-format vision and laying the groundwork for broader content and monetization strategies.

Furthermore, Spotify, for the Q4 2025, expects MAUs to rise to 745 million and premium subscribers to grow to 289 million (implying around 8 million net adds). Revenue guidance for Q4 stands at €4.5 billion, with a targeted gross margin of about 32.9%.

Analysts predict EPS to be around $7.70 for fiscal 2025, up 29.4% YOY, before surging by a solid 74.8% annually to $13.46 in fiscal 2026.

What Do Analysts Expect for Spotify Stock?

Spotify plans to raise prices for its U.S. Premium subscriptions starting in February, a move that UBS views positively for the stock. UBS analyst Batya Levi recently reiterated a “Buy” rating on Spotify with an $800 price target, citing meaningful upside from current levels.

Also, Deutsche Bank reaffirmed its “Buy” rating and $775 price target on Spotify after the company announced U.S. subscription price increases, a move the firm views as supportive of margins. Deutsche Bank believes the new pricing should help ease concerns around rising label-royalty costs and support profitability.

On the other hand, Benchmark lowered its price target on Spotify to $760 from $860 but maintained a “Buy” rating, citing expectations for operational leverage and incremental pricing gains in 2026.

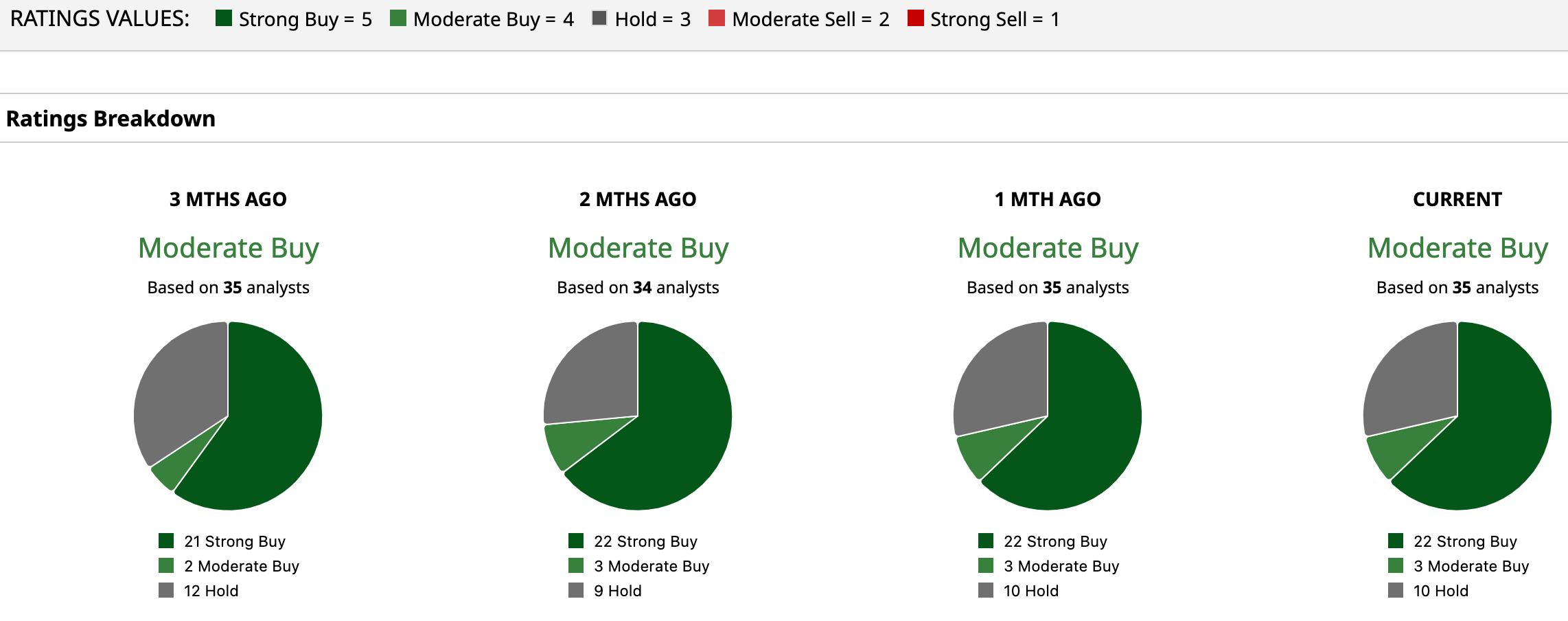

Overall, SPOT has a consensus “Moderate Buy” rating. Of the 35 analysts covering the stock, 22 advise a “Strong Buy,” three suggest a “Moderate Buy,” and the remaining 10 analysts are on the sidelines, giving it a “Hold” rating.

The average analyst price target for SPOT is $746.48, indicating a potential upside of 46%. The Street-high target price of $900 suggests that the stock could rally as much as 76%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)