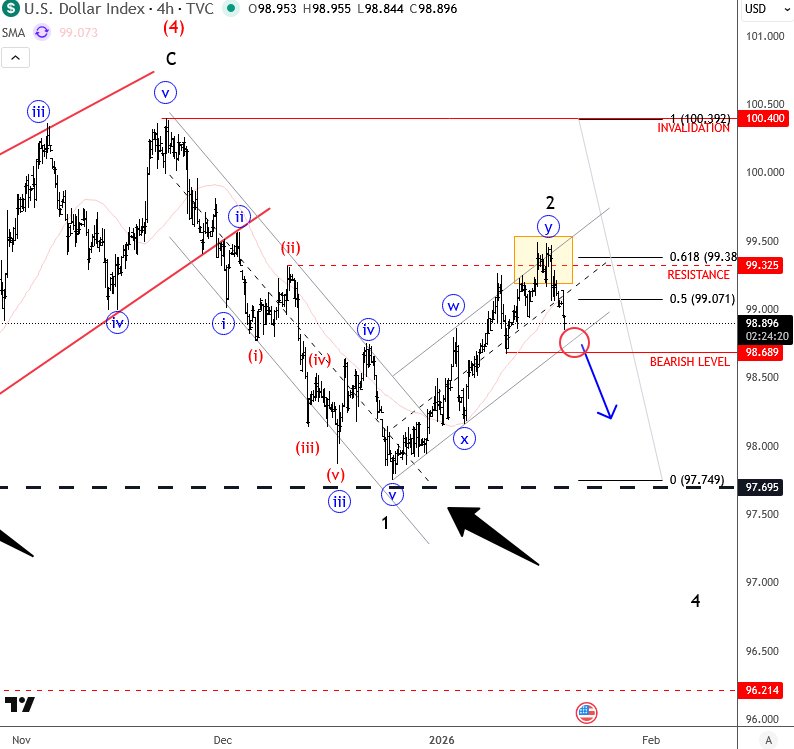

We saw some shakeout in the markets at the start of the week, as Trump imposed fresh tariffs on eight countries that have blocked his plans to acquire Greenland. Metals are trading higher, supported by increased demand for safe havens, while stocks and the US dollar are under pressure. Stocks and the US dollar remain positively correlated, but one of them is likely to give way soon. The US dollar is slowing down across the board, as the Dollar Index (DXY) is attempting to turn lower from the resistance level mentioned and highlighted last week.

For daily analysis like this on Forex, Stocks, Commodities and Crypto - find us here wavetraders.com

It seems that markets are taking the response from European leaders seriously, who apparently are not willing to give up easily on Greenland, and this is clearly evident on the price charts. The USD is coming down aggressively, and if DXY breaks the trendline support, then get ready for some bigger moves ahead. NZD, EUR, and GBP are looking strong vs USD.

Grega