Texas-based Occidental Petroleum Corporation (OXY) is a globally diversified energy company with operations spanning the United States, the Middle East, and North Africa. It ranks among the largest oil and gas producers in the U.S., with significant positions in the Permian and DJ basins, as well as offshore in the Gulf of America. The company’s midstream and marketing segment supports the transportation and commercialization of its production, while its subsidiary, Oxy Low Carbon Ventures, focuses on developing technologies and business models aimed at lowering emissions alongside energy development.

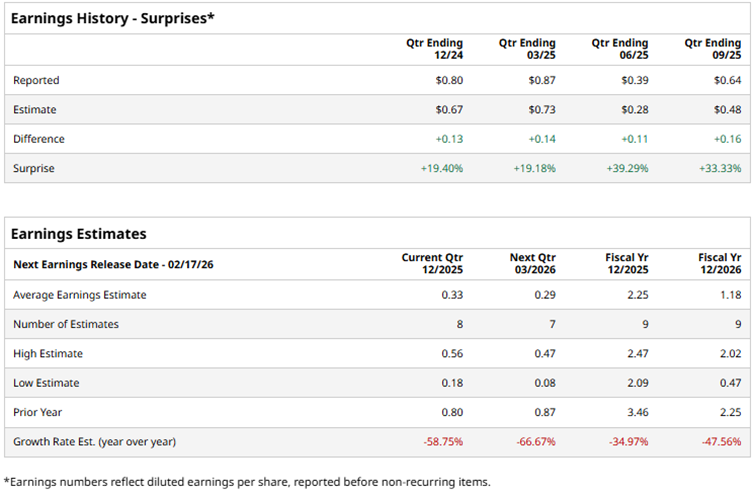

Currently valued at a market capitalization of approximately $42.1 billion, the energy giant is gearing up to lift the curtains on its fiscal 2025 fourth-quarter earnings on Feb. 19, 2026. And ahead of this event, Wall Street is projecting a steep 58.8% year-over-year drop in Q4 earnings to $0.33 per share. Still, the company enters the results with credibility, having beaten analysts’ bottom-line estimates in each of the past four quarters.

Looking beyond the quarter, the earnings outlook remains muted. For fiscal 2025, Occidental’s EPS is forecast at $2.25, marking a 35% drop from the previous year, before falling another 47.6% to $1.18 in 2026.

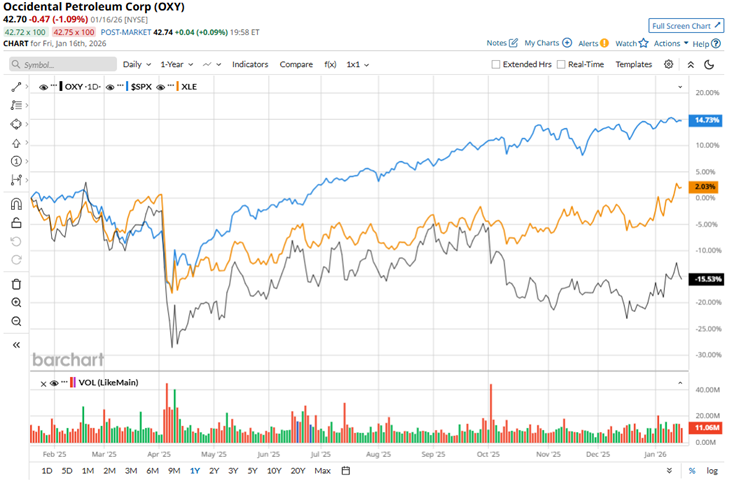

Occidental had a rough ride in 2025, with its shares plunging about 18.4%. That performance pales in comparison to the broader S&P 500 Index ($SPX), which surged 16.9%, and even trails the Energy Select Sector SPDR Fund (XLE), which posted a modest 2.3% gain over the same period.

The company released its third-quarter earnings results in November last year, delivering a mixed performance. Revenue came in at $6.6 billion, down from $7.1 billion a year earlier and slightly below Wall Street’s estimate of $6.8 billion. On an adjusted basis, earnings per share dropped sharply to $0.64 from $1.00 in the prior-year period, yet still managed to beat analysts’ expectations by an impressive 33.3%. Meanwhile, total average production topped the upper end of guidance at 1,465 thousand barrels of oil equivalent per day (Mboed), highlighting strong operational execution.

Overall, Wall Street remains relatively cautious on Occidental Petroleum, reflected in its consensus “Hold” rating. Among the 25 analysts covering the stock, sentiment is mixed. Four recommend a “Strong Buy,” one calls it a “Moderate Buy,” a larger group of 16 sits on the sidelines with a “Hold,” while four take a more bearish stance with a “Strong Sell.”

Despite this tepid outlook, the average price target of $49.08 suggests potential upside of roughly 15% from current trading levels, indicating that some analysts still see room for gains ahead.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)