Drone makers Aerovironment (AVAV) and Kratos Defense (KTOS) certainly seem to have very bright futures ahead of them, as both have landed major deals from the Pentagon in the last year, both firms have integrated advanced technologies into their products, and drones have become a major part of warfare. Moreover, geopolitical tensions are generally high and rising in much of the world, causing many countries to raise their defense spending meaningfully. And President Donald Trump is asking Congress to increase defense spending by about 50% in fiscal 2027, while Defense Secretary Pete Hegseth is clearly a big fan of drones.

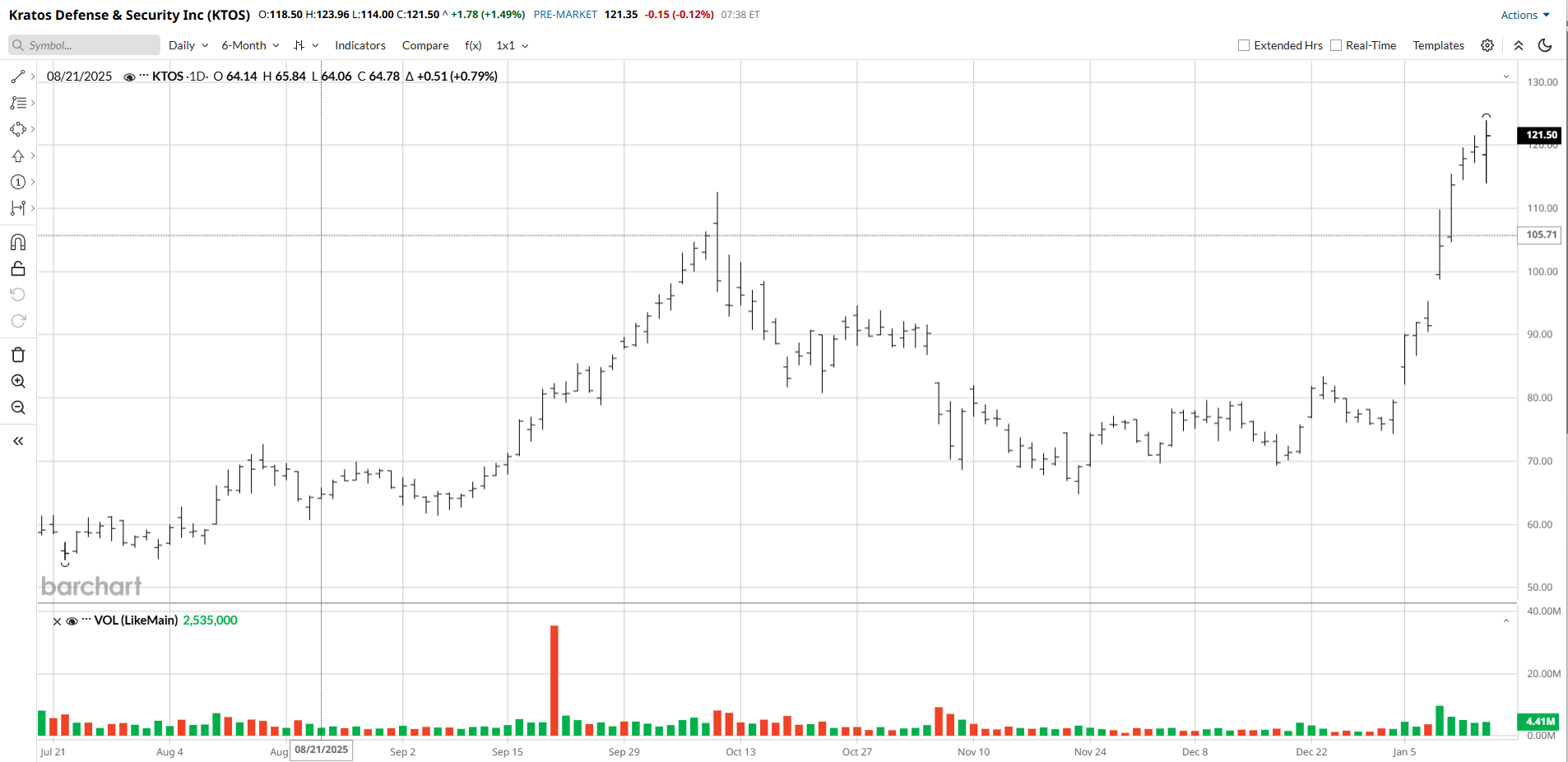

But both AVAV stock and KTOS stock have extremely high valuations, partly due to recent crises that have dominated the headlines in recent weeks.

As the attention paid to these crises ebbs and they are resolved, the shares of both Aerovironment and Kratos could very well retreat meaningfully. As a result, I believe that Cathie Wood’s decision to trim her ETFs’ holdings of AVAV stock and KTOS stock was the right move, and I think that retail investors should follow her lead. Sometimes profit taking is a smart move, and this is one of those times.

About AVAV and KTOS

Both firms are leading makers of military drones. In Aerovironment’s fiscal second quarter which ended on Nov. 1, its revenue advanced 4% versus the same quarter a year earlier to $472.5 million, while its net cash flow sank 50.6% year-over-year to $318.57 million. The name has a forward price-earnings ratio of 110 times and a market capitalization of nearly $19 billion.

In the third quarter, Kratos’ sales dropped 1% versus the same period a year earlier to $347.6 million, but its net income rose 200% year-over-year to $8.7 million. The stock has a forward price-earnings ratio of 220 times and a market capitalization of $21 billion.

AVAV and KTOS Have Made Impressive Deals and Offer Top-Notch Technology

In September, AeroVironment reported that it had received a contract worth nearly $240 million from the Pentagon. The agreement calls for the firm to develop “long-haul space laser communication terminals to an unnamed customer in the next three and a half years.” And the following month, the company noted that it would create anti-electromagnetic spectrum (EMS) products for the Air Force and carry out R&D into anti-EMS initiatives under the terms of a $246 million agreement. What’s more, AVAV recently obtained a deal from the Army involving autonomous technology. Further, in the wake of the company’s acquisition of Blue Halo, it looks well-positioned to facilitate America’s forays into space and the country’s huge, anti-missile initiative, Golden Dome.

As for Kratos, the firm convinced the U.S. Marines to make its Valkyrie drone “a program of record,” and there’s a good chance that Golden Dome will incorporate the company’s satellite offering. Overseas, KTOS is partnering with South Korea’s Korea Aerospace Industries “to develop AI-enabled manned-unmanned teaming systems” in order to allow manned aircraft and unmanned drones to collaborate. And in October, the company obtained a deal that could be worth up to $175 million from the U.S. Navy. Under the agreement, KTOS will provide the branch’s radar with missile defense and “integrated air and missile warfare” capabilities.

Both Are Benefiting From Strong Macro Trends

Trump recently announced that he would ask Congress to approve a $1.5 trillion defense budget for fiscal 2027, which kicks off in October 2026. That would represent a very large increase of about 50% from this year’s spending plan, which is expected to be about $1 trillion. And Defense Secretary Pete Hegseth, who is seeking over 300,000 drones, is clearly a big fan of the aircraft.

Additionally, given the recent conflicts involving Iran, European fears about Russia, and continued worries about China in East Asia among countries in the region, defense spending in many parts of the world is rapidly increasing. Finally, drones have certainly become a major part of warfare in the last few years.

Headlines Appear to Have Boosted Both Names, But the Headlines Will Fade

The crises in Venezuela and Iran appear to have played a role in lifting AVAV and KTOS. Between Jan. 2 – the day before the U.S. invasion of Venzuela which reportedly included the use of drones – and Jan. 14, AVAV stock jumped 49%, while KTOS stock rallied 53%. But the strike on Venezuela is likely already starting to fall off many investors’ radar, and there are signs that America may not strike Iran at all.

The Bottom Line on AVAV Stock and KTOS Stock

Both companies certainly have strong, positive catalysts. But the headlines that propelled their recent gains will soon become less influential, and their valuations are sky-high. Therefore, it would be prudent for investors to emulate Cathie Wood and take some profits on both names.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20and%20chart%20data-by%20Poetra_%20RH%20via%20Shutterstock.jpg)