Cathie Wood's ARK Invest has been steadily accumulating shares of Roblox (RBLX), adding to positions across multiple funds, including ARKF (ARKF), ARKK (ARKK), and ARKW (ARKW), as part of a broader portfolio shift toward long-term innovation themes.

The buying activity comes as Wood reduces exposure to mature tech names such as Meta Platforms (META), Palantir Technologies (PLTR), and Roku (ROKU), indicating a shift in its investment approach.

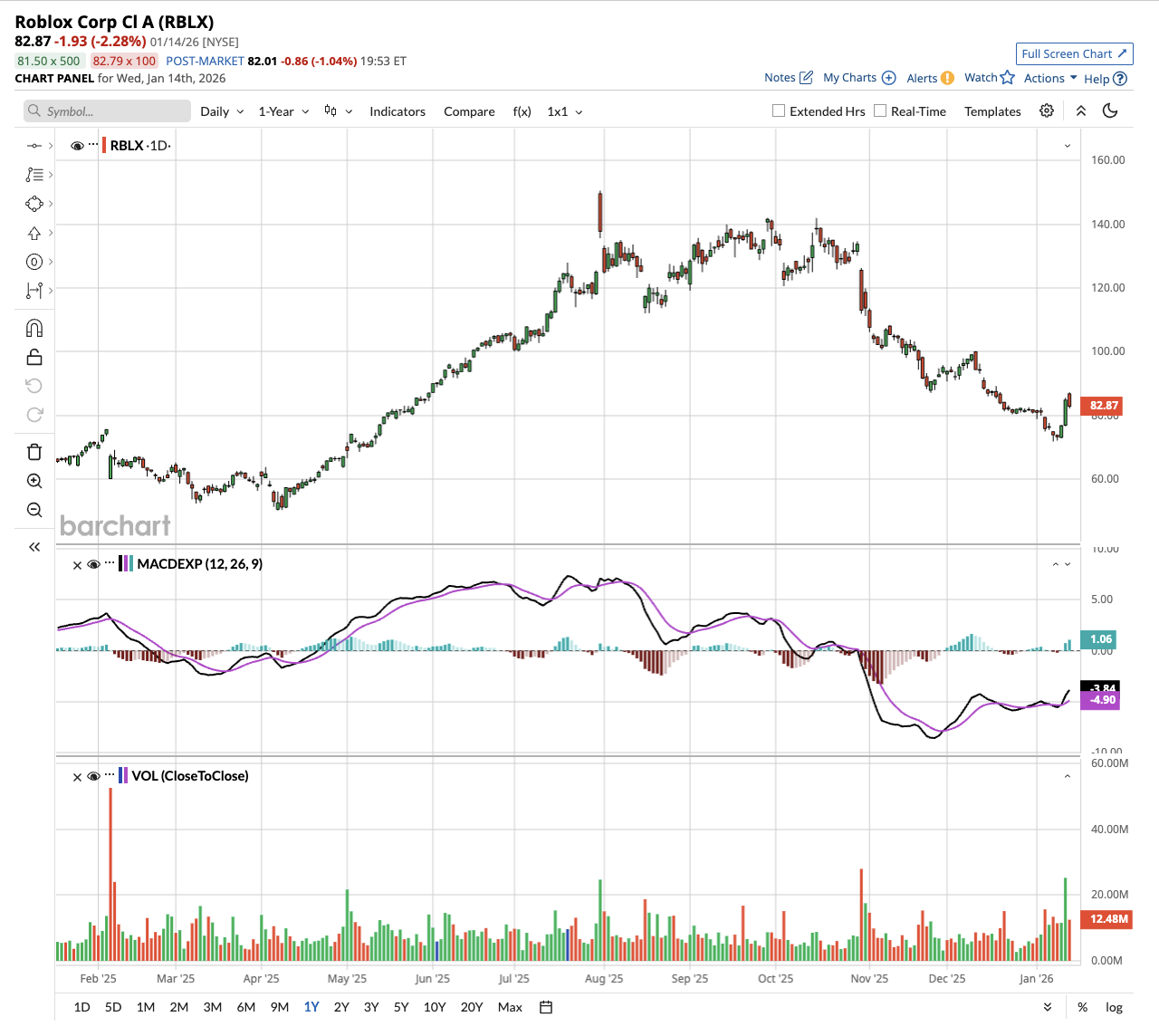

Valued at a market cap of $58 billion, Roblox operates a user-generated gaming platform that has gained significant traction among younger demographics. With millions of daily active users, RBLX stock has surged 33% in the past year but also trades 45% below all-time highs.

Wood's interest appears tied to the platform's potential in the metaverse and digital economy, which are viewed as transformative growth opportunities. The gaming company has focused on expanding its user base beyond children and teenagers while improving monetization through virtual goods and immersive experiences.

Wood's recent portfolio moves show her doubling down on disruptive technologies, including electric aviation, CRISPR gene therapies, and AI-driven healthcare. Her renewed focus on Roblox suggests she sees meaningful upside potential as the platform evolves its business model and captures a larger share of digital entertainment spending.

Is Roblox Stock a Good Buy Right Now?

Roblox's stock remains volatile despite stellar growth in daily active users (DAUs). In Q3, Roblox increased DAUs by 70% year-over-year (YoY) to 151.5 million, while bookings increased 70% to $1.92 billion.

Users aged 13 and older now account for two-thirds of total DAUs, growing 89% annually. International expansion continues to drive momentum, with Asia-Pacific bookings more than doubling. The platform now estimates it captures 3.2% of global gaming revenue, up from 2.3% a year ago.

Management raised developer exchange rates by 8.5%, which will increase annual creator earnings by $95 million. In the first nine months of 2025, total creator payouts surpassed $1 billion. Notably, the top developers averaged $38.5 million, which is exceptional.

The company’s investments in the creator economy will help Roblox maintain platform vitality and attract new content. However, the market reacted negatively to management's cautious commentary about near-term growth prospects.

While Roblox did not provide specific guidance, it highlighted potential headwinds, including difficult YoY comparisons and friction from new safety policies. The company plans to implement facial age estimation technology and stricter communication controls. These regulatory controls could temporarily impact engagement even as management believes the measures support long-term sustainability.

Roblox estimates gross margins to compress from 40% in Q3 to 36.5% in Q4, driven by early production costs for new chip architectures and pricing adjustments to manage supply constraints.

Looking ahead, management expects margins to decline slightly in 2026 due to higher developer payouts, infrastructure investments, and safety initiatives. Roblox estimates it'll spend around $36 billion in capital expenditures in 2025 and 2026. These expenses will be used to build out data center capacity, GPU infrastructure, and support AI features.

What Is the RBLX Stock Price Target?

Analysts tracking RBLX stock forecast revenue to increase from $4.37 billion in 2024 to $12.70 billion in 2029. In this period, its free cash flow is projected to increase from $640 million to $3.28 billion. If RBLX is priced at 30 times forward FCF, which is not too steep, it could surge over 60% over the next three years.

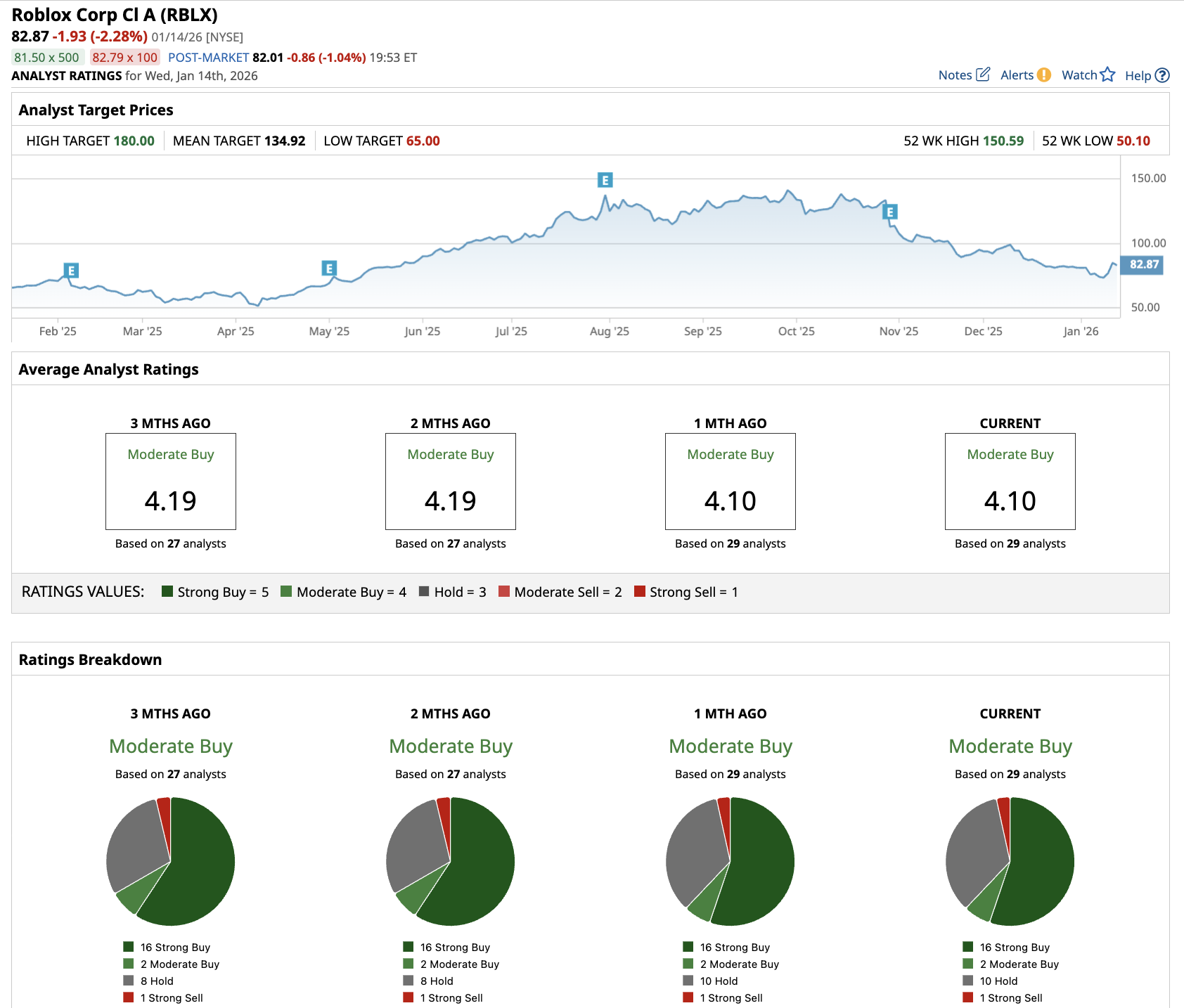

Out of the 29 analysts covering RBLX stock, 16 recommend “Strong Buy,” two recommend “Moderate Buy,” 10 recommend “Hold,” and one recommends “Strong Sell.” The average RBLX stock price target is $135, above the current price of $83.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)